How about some white chocolate mocha or caramel macchiato? Not really little-known names, but when they take pride in belonging to one of the largest coffee chains in the world, the urgency to try them out runs high.

At a time when every international brand is trying to gain a foothold in Bangalore, American giant Starbucks is expected to jostle with the likes of homegrown Cafe Coffee Day, and imports like Costa Coffee, Barista, Gloria Jeans and Coffee Bean &Tea Leaf; in a market where drinking kaapi has been a centuries-old tradition.

After opening 15 outlets in New Delhi and Mumbai, the chain is now eyeing a crowded coffee market, where other than the ubiquitous cafes, traditional long-standing outlets like MTR, India Coffee House and Vidyarthi Bhavan dot the landscape.

Armed with a pricing that is upwards of Rs110 for a 273 ml glass of coffee (minus taxes), with variations that can go beyond Rs200 for a larger container; the US giant looks confident of luring its clientele in a migrant-rich, expat-dominated city, with set of globetrotters who would have tasted the brand abroad.

“We don’t believe in waging a price war to win customers,” says Avani Saglani Davda, CEO of Tata Starbucks. Her mantra is simple—one coffee, one customer, one store at a time.

An outlet too many

Brand consultants feel that despite the clutter in the market, Starbucks will be able to carve out its own niche, simply on the basis of its image. “Starbucks stands out from the rest. Everyone who has heard of it, wants to try it out,” explains Prashant Agarwal, joint MD of retail consultancy Wazir Advisors.

Though the pricing is on the steeper side, experts believe, consumers wouldn’t mind paying to savour a global brand. “The analogy lies in the contention that people have no problems paying for a Baskin Robbins or a California Pizza; even when cheaper alternatives are aplenty,” says an expert, adding that the customer profile for a Starbucks will be distinctly different from those who frequent stores for a quick filter kaapi.

Many customers are aware that the actual price of the coffee in any cafe is just 15-20 per cent of the overall price printed on the menu, say experts, with the balance accounting mainly for real estate, marketing, human resources, and overhead expenditure.

“But still enough, customers do pay since drinking coffee at a Starbucks is not out of necessity, but as part of their lifestyle where hanging out at such a place is considered cool,” argues Devangshu Dutta, CEO of consultancy Third Eyesight.

Coffee’s cool

Yes, the coolness factor does weigh in. For instance, techie Anirudh Gupta, who has frequented Starbucks in the US and is now awaiting its arrival in Bangalore, has this to say, “Abroad, people grab a coffee and head out to work. Here a cafe is more of a place to hang out with friends, or relax while working on the laptop. With Starbucks, the takeaway bit may become popular in India as well.”

Brand consultant Harish Bijoor believes the entry of Starbucks will lead to a caste system of brands in the cafe culture, “where Starbucks might end up being the Brahmin.” Moreover, alongside the brand image goes the underlying premise that a product belonging to a global chain will be better, along with great ambiance and service, adds Dutta. “Therefore, a much awaited debut in Bangalore will definitely draw in customers,” says Bijoor.

What happens to CCD?

Since the market is huge, the potential for new and existing players is equal. A study carried out by Bijoor reveals that going by the consumption trend, India at present requires 7,450 cafes. “There are 2,650 as of now. So the demand-supply gap is huge,” explains Bijoor.

And in Bangalore, which remains a Cafe Coffee Day bastion, the entry of a US player is not really a threat. “The entry of a new player won’t throttle. There is room for all,” asserts K Ramakrishnan, president, marketing, Cafe Coffee Day.

Ramakrishnan feels that the chain has the necessary wherewithal, including its menu revision to include non-coffee drinks; and its formats like lounge, square, cafe and kiosk to cater to a mix of customers. And with 200 outlets across the city, “we are ever ready to service all types of customers with products that are sold across all price points,” contends Ramakrishnan.

Thus if Starbucks has its international image, Cafe Coffee Day has its numbers, feels Bijoor. “CCD has done a great job in capturing all the key locations in Bangalore. Finding the right locations will not be easy for Starbucks,” he predicts.

But experts feel that to ensure their top positions, cafe chains will have to provide customers with the same quality and service consistently across all their locations. According to Dutta, if there is any issue with the quality or service, “it can impact customer base.”

And, it will be the customers who will decide the fate of this brewing war.

![submenu-img]() BMW i5 M60 xDrive launched in India, all-electric sedan priced at Rs 11950000

BMW i5 M60 xDrive launched in India, all-electric sedan priced at Rs 11950000![submenu-img]() This superstar was arrested several times by age 17, thrown out of home, once had just Rs 250, now worth Rs 6600 crore

This superstar was arrested several times by age 17, thrown out of home, once had just Rs 250, now worth Rs 6600 crore![submenu-img]() Meet Reliance’s highest paid employee, gets over Rs 240000000 salary, he is Mukesh Ambani’s…

Meet Reliance’s highest paid employee, gets over Rs 240000000 salary, he is Mukesh Ambani’s… ![submenu-img]() Meet lesser-known relative of Mukesh Ambani, Anil Ambani, has worked with BCCI, he is married to...

Meet lesser-known relative of Mukesh Ambani, Anil Ambani, has worked with BCCI, he is married to...![submenu-img]() Made in just Rs 95,000, this film was a superhit, but destroyed lead actress' career, saw controversy over bold scenes

Made in just Rs 95,000, this film was a superhit, but destroyed lead actress' career, saw controversy over bold scenes![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

Actors who died due to cosmetic surgeries![submenu-img]() See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol

See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol ![submenu-img]() In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi

In pics: Salman Khan, Alia Bhatt, Rekha, Neetu Kapoor attend grand premiere of Sanjay Leela Bhansali's Heeramandi![submenu-img]() Streaming This Week: Crakk, Tillu Square, Ranneeti, Dil Dosti Dilemma, latest OTT releases to binge-watch

Streaming This Week: Crakk, Tillu Square, Ranneeti, Dil Dosti Dilemma, latest OTT releases to binge-watch![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() DNA Explainer: What is India's stand amid Iran-Israel conflict?

DNA Explainer: What is India's stand amid Iran-Israel conflict?![submenu-img]() This superstar was arrested several times by age 17, thrown out of home, once had just Rs 250, now worth Rs 6600 crore

This superstar was arrested several times by age 17, thrown out of home, once had just Rs 250, now worth Rs 6600 crore![submenu-img]() Made in just Rs 95,000, this film was a superhit, but destroyed lead actress' career, saw controversy over bold scenes

Made in just Rs 95,000, this film was a superhit, but destroyed lead actress' career, saw controversy over bold scenes![submenu-img]() Meet 72-year-old who earns Rs 280 cr per film, Asia's highest-paid actor, bigger than Shah Rukh, Salman, Akshay, Prabhas

Meet 72-year-old who earns Rs 280 cr per film, Asia's highest-paid actor, bigger than Shah Rukh, Salman, Akshay, Prabhas![submenu-img]() This star, who once lived in chawl, worked as tailor, later gave four Rs 200-crore films; he's now worth...

This star, who once lived in chawl, worked as tailor, later gave four Rs 200-crore films; he's now worth...![submenu-img]() Tamil star Prasanna reveals why he chose series Ranneeti for Hindi debut: 'Getting into Bollywood is not...'

Tamil star Prasanna reveals why he chose series Ranneeti for Hindi debut: 'Getting into Bollywood is not...'![submenu-img]() IPL 2024: Virat Kohli, Rajat Patidar fifties and disciplined bowling help RCB beat Sunrisers Hyderabad by 35 runs

IPL 2024: Virat Kohli, Rajat Patidar fifties and disciplined bowling help RCB beat Sunrisers Hyderabad by 35 runs![submenu-img]() 'This is the problem in India...': Wasim Akram's blunt take on fans booing Mumbai Indians skipper Hardik Pandya

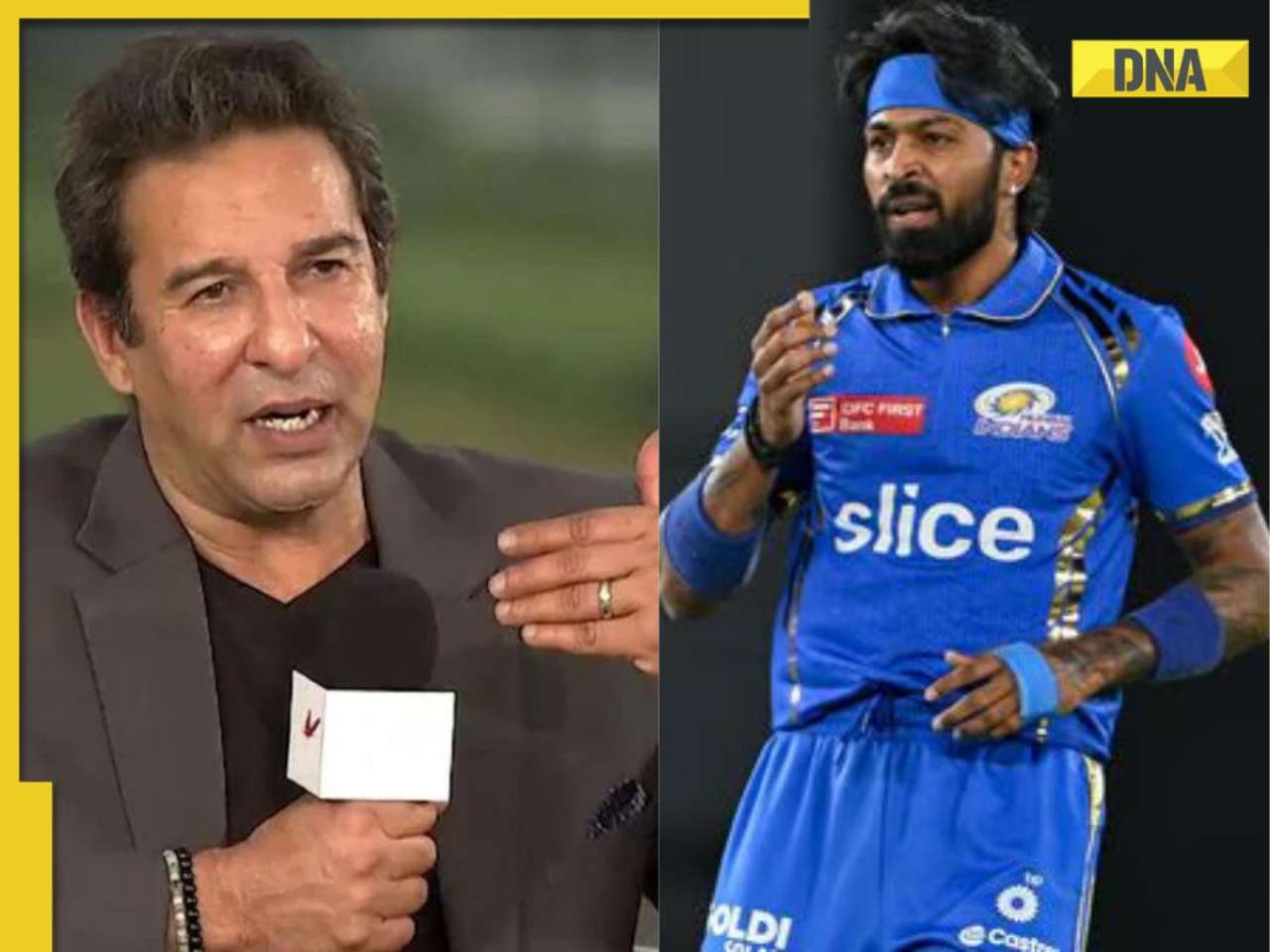

'This is the problem in India...': Wasim Akram's blunt take on fans booing Mumbai Indians skipper Hardik Pandya![submenu-img]() KKR vs PBKS, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

KKR vs PBKS, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() KKR vs PBKS IPL 2024 Dream11 prediction: Fantasy cricket tips for Kolkata Knight Riders vs Punjab Kings

KKR vs PBKS IPL 2024 Dream11 prediction: Fantasy cricket tips for Kolkata Knight Riders vs Punjab Kings![submenu-img]() IPL 2024: KKR star Rinku Singh finally gets another bat from Virat Kohli after breaking previous one - Watch

IPL 2024: KKR star Rinku Singh finally gets another bat from Virat Kohli after breaking previous one - Watch![submenu-img]() Viral video: Teacher's cute way to capture happy student faces melts internet, watch

Viral video: Teacher's cute way to capture happy student faces melts internet, watch![submenu-img]() Woman attends online meeting on scooter while stuck in traffic, video goes viral

Woman attends online meeting on scooter while stuck in traffic, video goes viral![submenu-img]() Viral video: Pilot proposes to flight attendant girlfriend before takeoff, internet hearts it

Viral video: Pilot proposes to flight attendant girlfriend before takeoff, internet hearts it![submenu-img]() Pakistani teen receives life-saving heart transplant from Indian donor, details here

Pakistani teen receives life-saving heart transplant from Indian donor, details here![submenu-img]() Viral video: Truck driver's innovative solution to beat the heat impresses internet, watch

Viral video: Truck driver's innovative solution to beat the heat impresses internet, watch

)

)

)

)

)

)

)