Following is the first part of the full text of finance minister Pranab Mukherjee's speech while tabling the Union budget for the financial year 2011-12 in the Lok Sabha today.

Following is the first part of the full text of finance minister Pranab Mukherjee's speech made in the Lok Sabha today while tabling the Union budget for the financial year 2011-12:

Madam Speaker,

I rise to present the Union Budget for 2011-12.

We are reaching the end of a remarkable fiscal year. In a globalised world with its share of uncertainties and rapid changes, this year brought us some opportunities and many challenges as we moved ahead with steady steps on the chosen path of fiscal consolidation and high economic growth.

Our growth in 2010-11 has been swift and broad-based. The economy is back to its pre-crisis growth trajectory. While agriculture has shown a rebound, industry is regaining its earlier momentum. Services sector continues its near double digit run. Fiscal consolidation has been impressive. This year has also seen significant progress in those critical institutional reforms that would set the pace for double-digit growth in the near future.

While we succeeded in making good progress in addressing many areas of our concern, we could have done better in some others. The total food inflation declined from 20.2% in February 2010 to less than half at 9.3% in January 2011, but it still remains a concern. In the medium term perspective, our three priorities of sustaining a high growth trajectory; making development more inclusive, and improving our institutions, public delivery and governance practices remain relevant. These would continue to engage the Indian policy-planners for some time. However, there are some manifestations of these challenges that need urgent attention in the short term.

Though we have regained the pre-crisis growth momentum, there is a need to effect adjustments in the composition of growth on demand and supply side. We have to ensure that along with private consumption, the revival in private investment is sustained and matches pre-crisis growth rates at the earliest. This requires a stronger fiscal consolidation to enlarge the resource space for private enterprise and addressing some policy constraints. We also have to improve the supply response of agriculture to the expanding domestic demand. Determined measures on both these issues will help address the structural concerns on inflation management. It will also ensure a more stable macroeconomic environment for continued high growth.

The UPA Government has significantly scaled up the flow of resources to rural areas to give a more inclusive thrust to the development process. The impact is visible in the new dynamism of our rural economy. It has helped India navigate itself rapidly out of the quagmire of global economic slowdown. Yet, there is much that still needs to be done, especially in rural India. We have to reconcile legitimate environmental concerns with necessary developmental needs. Above all, there is the 'challenge of growing aspiration' of a young India.

To address these concerns, I do not foresee resources being a major constraint, at least not in the medium term. However, the implementation gaps, leakages from public programmes and the quality of our outcomes are a serious challenge.

Certain events in the past few months may have created an impression of drift in governance and a gap in public accountability. Even as the Government is engaged in addressing specific concerns emanating from some of these events in the larger public interest and in upholding the rule of law, such an impression is misplaced. We have to seize in these developments the opportunity to improve our regulatory standards and administrative practices. Corruption is a problem that we have to fight collectively.

In a complex and rapidly evolving economy, the Government cannot profess to be the sole repository of all knowledge. Indeed, in a democratic polity, it stands to benefit from inputs from colleagues on both sides of the House. They must lend their voice and expertise to influence public policy in the wider national interest. In some areas, good results depend on coordinated efforts of the Centre and the State Governments and in some others, on favourable external developments.

I see the Budget for 2011-12 as a transition towards a more transparent and result-oriented economic management system in India. We are taking major steps in simplifying and placing the administrative procedures concerning taxation, trade and tariffs and social transfers on electronic interface, free of discretion and bureaucratic delays. This will set the tone for a newer, vibrant and more efficient economy.

At times the biggest reforms are not the ones that make headline, but the ones concerned with the details of governance, which affect the everyday life of aam aadmi. In preparing this year's Budget, I have been deeply conscious of this fact. I am grateful for the able guidance of the Hon'ble Prime Minister and the strong support lent by UPA Chairperson Smt Sonia Gandhi in my endeavour. I would now begin with a brief overview of the economy.

Overview of the Economy

On last Friday, I laid on the table of the House the Economic Survey 2010-11, which gives a detailed analysis of the economic situation of the country over the past 12 months. The Gross Domestic Product (GDP) of India is estimated to have grown at 8.6% in 2010-11 in real terms. In 2010-11agriculture is estimated to have grown at 5.4%, industry at 8.1% and services at 9.6%. All three sectors are contributing to the consolidation of growth. More importantly, the economy has shown remarkable resilience to both external and domestic shocks.

Our principal concern this year has been the continued high food prices. Inflation surfaced in two distinct episodes. At the beginning of the year, food inflation was high for some cereals, sugar and pulses. Towards the second half, while prices of these items moderated and even recorded negative rates of inflation, there was spurt in prices of onion, milk, poultry and some vegetables. Of late prices of onion have crashed in wholesale markets and we have had to remove the ban on their exports.

Despite improvement in the availability of most food items, consumers were denied the benefit of seasonal fall in prices normally seen in winter months. These developments revealed shortcomings in distribution and marketing systems, which are getting accentuated due to growing demand for these food items with rising income levels. The huge differences between wholesale and retail prices and between markets in different parts of the country are just not acceptable. These are at the expense of remunerative prices for farmers and competitive prices for consumers.

Monetary policy stance in 2010-11, while being supportive of fiscal policy, has succeeded in keeping core inflation in check. As the transmission lag in monetary policy tends to be long, I expect the measures already taken by the RBI to further moderate inflation in coming months.

The developments on India's external sector in the current year have been encouraging. Even as the recovery in developed countries is gradually taking root, our trade performance has improved. Exports have grown at 29.4% to reach US $184.6 billion, while imports at US $273.6 billion have recorded a growth of 17.6% during April-January 2010-11, over the corresponding period last year. The current account deficit is around the 2009-10 level and poses some concerns because of the composition of its financing.

Policy making in a globalised world has to take into account the likely international developments. To realise the desired outcomes, it is important that there is convergence in expectations of our investors, entrepreneurs and consumers on the macroeconomic prospects of the economy. Against this backdrop, the Indian economy is expected to grow at 9% with an outside band of +/- 0.25% in 2011-12. I expect the average inflation to be lower next year and the current account deficit smaller and better managed with higher domestic savings rate and stable capital flows. While, like last year, I seek the blessings of Lord Indra to bestow on us timely and bountiful monsoons, I would pray to Goddess Lakshmi as well. I think it is a good strategy to diversify one's risks.

Sustaining Growth

In my last Budget, I had started rolling back the fiscal stimulus implemented over 2008-09 and 2009-10 to mitigate the impact of the global financial crisis on economic slowdown in India. In the course of the year, I have moved further on that path. I believe that a part of the current recovery must be stored away to build future resilience. Indeed, a counter cyclical fiscal policy is our best insurance against external shocks and localised domestic factors.

Fiscal Consolidation

The experience with Fiscal Responsibility and Budget Management Act, 2003, (FRBM Act) at Centre and the corresponding Acts at State level show that statutory fiscal consolidation targets have a positive effect on macroeconomic management of the economy. In the course of the year the Central Government would introduce an amendment to the FRBM Act, laying down the fiscal road map for the next five years.

The Thirteenth Finance Commission has worked out a fiscal consolidation road map for States requiring them to eliminate revenue deficit and achieve a fiscal deficit of 3% of their respective Gross State Domestic Product latest by 2014-15. It has also recommended a combined States' debt target of 24.3% of GDP to be reached during this period. The States are required to amend or enact their FRBM Acts to conform to these recommendations.

The Government has been in the process of setting up an independent Debt Management Office in the Finance Ministry. A Middle Office is already operational. As a next step, I propose to introduce the Public Debt Management Agency of India Bill in the next financial year.

Tax Reforms

The introduction of the Direct Taxes Code (DTC) and the proposed Goods and Services Tax (GST) will mark a watershed. These reforms will result in moderation of rates, simplification of laws and better compliance.

As Hon'ble Members are aware, the Direct Taxes Code Bill was introduced in Parliament in August 2010. After receiving the report of the Standing Committee, we shall be able to finalise the Code for its enactment during 2011-12. This has been a pioneering effort in participative legislation. The Code is proposed to be effective from April 1, 2012, to allow taxpayers, practitioners and administrators to fully understand the legislation and adjust to the revised procedures.

Unlike DTC, decisions on the GST have to be taken in concert with the States with whom our dialogue has made considerable progress in the last four years. Areas of divergence have been narrowed. As a step towards the roll-out of GST, I propose to introduce the Constitution Amendment Bill in this session of Parliament. Work is also underway on drafting of the model legislation for the Central and State GST.

Among the other steps that are being taken for the introduction of GST is the establishment of a strong IT infrastructure. We have made significant progress on the GST Network (GSTN). The key business processes of registration, returns and payments are in advanced stages of finalisation. The National Securities Depository Limited (NSDL) has been selected as technology partner for incubating the National Information Utility that will establish and operate the IT backbone for GST. By June 2011, NSDL will set up a pilot portal in collaboration with eleven States prior to its roll-out across the country.

Expenditure Reforms

The effective management of public expenditure is an integral part of the fiscal consolidation process. Expenditure has to be oriented towards the production of public goods and services. The extant classification of public expenditure between plan, non-plan, revenue and capital spending needs to be revisited. This is necessary as one recognises the importance of service sector and the knowledge economy for our development. A Committee under Dr C Rangarajan has been set up by the Planning Commission to look into these issues.

Subsidies

During the year 2010-11, the Nutrient Based Subsidy (NBS) policy was successfully implemented for all fertilisers except urea. The policy has been well received by all stakeholders, and the availability of fertilisers has improved. The extension of the NBS regime to cover urea is under active consideration of the Government.

The Government provides subsidies, notably on fuel and food grains, to enable the common man to have access to these basic necessities at affordable prices. A significant proportion of subsidised fuel does not reach the targeted beneficiaries and there is large-scale diversion of subsidised kerosene oil. A recent tragic event has highlighted this practice. We have deliberated for long the modalities of implementing such subsidies. The debate now has to make way for decision. To ensure greater efficiency, cost effectiveness and better delivery for both kerosene and fertilisers, the Government will move towards direct transfer of cash subsidy to people living below poverty line in a phased manner.

A task force headed by Shri Nandan Nilekani has been set up to work out the modalities for the proposed system of direct transfer of subsidy for kerosene, LPG and fertilisers. The interim report of the task force is expected by June 2011. The system will be in place by March 2012.

People's Ownership of PSUs

The Government's programme to broadbase the ownership of Central Public Sector Undertakings (CPSUs) has received an overwhelming response. The six public issues of CPSUs in the current financial year have attracted around 50 lakh retail investors.

As against a target of Rs40,000 crore, the Government will raise about Rs22,144 crore from disinvestment in 2010-11. A higher than anticipated realisation in non-tax revenues has led us to reschedule some of the divestment issues planned for the current year. I intend to maintain the momentum on disinvestment in 2011-12 by raising Rs40,000 crore. Let me reiterate here that the Government is committed to retain at least 51% ownership and management control of the CPSUs, as stated earlier in my Budget speech for 2009-10.

Investment Environment

Foreign Direct Investment

To make the FDI policy more user-friendly, all prior regulations and guidelines have been consolidated into one comprehensive document, which is reviewed every six months. The last review has been released in September 2010. This has been done with the specific intent of enhancing clarity and predictability of our FDI policy to foreign investors. Discussions are underway to further liberalise the FDI policy.

Foreign Institutional Investors

Currently, only FIIs and sub-accounts registered with the SEBI and NRIs are allowed to invest in mutual fund schemes. To liberalise the portfolio investment route, it has been decided to permit SEBI-registered Mutual Funds to accept subscriptions from foreign investors who meet the KYC requirements for equity schemes. This would enable Indian Mutual Funds to have direct access to foreign investors and widen the class of foreign investors in Indian equity market.

To enhance the flow of funds to the infrastructure sector, the FII limit for investment in corporate bonds, with residual maturity of over five years, issued by companies in infrastructure sector is being raised by an additional limit of US $20 billion taking the limit to US $25 billion. This will raise the total limit available to the FIIs for investment in corporate bonds to US $40 billion. Since most of the infrastructure companies are organised in the form of SPVs, FIIs would also be permitted to invest in unlisted bonds with a minimum lock-in period of three years. However, the FIIs will be allowed to trade amongst themselves during the lock-in period.

Financial Sector Legislative Initiatives

The financial sector reforms initiated during the early 1990s have borne good results for the Indian economy. The UPA Government is committed to take this process further. Accordingly, I propose to move the following legislations in the financial sector:

(i) The Insurance Laws (Amendment) Bill, 2008;

(ii) The Life Insurance Corporation (Amendment) Bill, 2009;

(iii) The revised Pension Fund Regulatory and Development Authority Bill, first introduced in 2005;

(iv) Banking Laws Amendment Bill, 2011;

(v) Bill on Factoring and Assignment of Receivables;

(vi) The State Bank of India (Subsidiary Banks Laws) Amendment Bill, 2009; and

(vii) Bill to amend RDBFI Act 1993 and SARFAESI Act 2002.

In my last Budget speech, I had announced that Reserve Bank of India would consider giving some additional banking licences to private-sector players. Accordingly, RBI issued a discussion paper in August, 2010, inviting feedback from the public. RBI has proposed some amendments in the Banking Regulation Act. I propose to bring suitable legislative amendments in this regard in this session. RBI is planning to issue the guidelines for banking licences before the close of this financial year.

Public Sector Bank Recapitalisation

During the year 2010-11, the Government is providing a sum of Rs20,157 crore for infusion in the Public Sector Banks to maintain Tier I Capital to Risk Weighted Asset Ratio (CRAR) at 8% and increase government equity in some banks to 58%. I propose to provide a sum of Rs6,000 crore for the year 2011-12 to enable Public Sector Banks to maintain a minimum Tier I CRAR at 8%.

Recapitalisation of Regional Rural Banks

As a part of financial strengthening of Regional Rural Banks, an amount of Rs350 crore was given to these banks during this year. I propose to provide Rs500 crore during 2011-12 to enable them to maintain a CRAR of at least 9% as on March 31, 2012.

Micro Finance Institutions

The Micro Finance Institutions (MFIs) have emerged as an important means of financial inclusion. Creation of a dedicated fund for providing equity to smaller MFIs would help them maintain growth and achieve scale and efficiency in operations. I propose to create in the course of the year, "India Microfinance Equity Fund" of Rs100 crore with SIDBI. To empower women and promote their Self Help Groups (SHGs), I propose to create a "Women's SHG's Development Fund" with a corpus of Rs500 crore. The Committee set up by RBI to look into issues relating to micro finance sector in India has submitted its report. The Government is considering putting in place appropriate framework to protect the interests of small borrowers.

Rural Infrastructure Development Fund

The Rural Infrastructure Development Fund (RIDF) is an important instrument for routing bank funds for financing rural infrastructure. This is popular among State Governments. I propose to raise the corpus of RIDF XVII to Rs18,000 crore in 2011-12 from Rs16,000 crore in the current year. The additional allocation would be dedicated to creation of warehousing facilities.

Micro, Small and Medium Enterprises

Micro and Small enterprises play a crucial role in furthering the objective of equitable and inclusive growth. Last year, Rs4,000 crore was provided to SIDBI for refinancing incremental lending by banks to these enterprises. For the year 2011-12, I propose to provide Rs5,000 crore to SIDBI for the same purpose out of the shortfall of banks on priority sector lending targets.

Handloom weavers have been facing economic stress. Consequently, many of them have not been able to repay debts to handloom weaver cooperative societies which have become financially unviable. I propose to provide Rs3,000 crore to NABARD, in phases, for these cooperative societies. The initiative would benefit 15,000 cooperative societies and about 3 lakh handloom weavers. The details of the scheme would be worked out by the Ministry of Textiles in consultation with Planning Commission.

I am happy to report that the outstanding loans to minority communities which stood at 13% of total priority sector lending at the end of last year have increased to 13.6% in the current year. I have directed the Public Sector Banks to achieve the target of 15% at the earliest.

Housing Sector Finance

To further stimulate growth in housing sector, I am liberalising the existing scheme of interest subvention of 1% on housing loans by extending it to housing loan up to Rs15 lakh where the cost of the house does not exceed Rs25 lakh from the present limit of Rs 10 lakh and Rs20 lakh, respectively.

On account of increase in prices of residential properties in urban areas, I propose to enhance the existing housing loan limit from Rs20 lakh to Rs25 lakh for dwelling units under priority sector lending.

To provide housing finance to targeted groups in rural areas at competitive rates, I propose to enhance the provision under Rural Housing Fund to Rs3,000 crore from the existing Rs2,000 crore.

Credit enablement of Economically Weaker Sections (EWS) and LIG households is a serious challenge. To address this issue, I propose to create a Mortgage Risk Guarantee Fund under Rajiv Awas Yojana. This would guarantee housing loans taken by EWS and LIG households and enhance their credit worthiness.

To prevent frauds in loan cases involving multiple lending from different banks on the same immovable property, the Government has facilitated setting up of Central Electronic Registry under the SARFAESI Act, 2002. This Registry will become operational by March 31, 2011.

Financial Sector Legislative Reforms Commission

In pursuance of the announcement made in Budget 2010-11, the Government has set up a Financial Sector Legislative Reforms Commission under the Chair of Justice BN Srikrishna. It would rewrite and streamline the financial sector laws, rules and regulations and bring them in harmony with the requirements of a modern financial sector. The Commission will complete its work in 24 months.

The Companies Bill introduced in Parliament in 2009 has been received from the Parliamentary Standing Committee. The proposed bill will be introduced in the Lok Sabha in the current session.

Agriculture

Agriculture development is central to our growth strategy. Measures taken during the current year have started attracting private investment in agriculture and agro-processing activities. This process has to be deepened further.

In the Budget for 2010-11, I had delineated a four-pronged strategy covering agricultural production, reduction in wastage of produce, credit support to farmers and a thrust to the food processing sector. These initiatives have started showing results but there are other issues in our food economy that require attention. The recent spurt in food prices was driven by increase in the prices of items like fruits and vegetables, milk, meat, poultry and fish, which account for more than 70% of the WPI basket for primary food items. Removal of production and distribution bottlenecks for these items will be the focus of my attention this year. I propose to make allocations for these schemes under the ongoing Rashtriya Krishi Vikas Yojana (RKVY) for an early take-off. The total allocation of RKVY is being increased from Rs6,755 crore in 2010-11 to Rs7,860 crore in 2011-12.

Bringing Green Revolution to Eastern Region

The Green Revolution in Eastern Region is waiting to happen. To realise the potential of the region, last year's initiative will be continued in 2011-12 with a further allocation of Rs400 crore. The programme would target the improvement in the rice based cropping system of Assam, West Bengal, Orissa, Bihar, Jharkhand, Eastern Uttar Pradesh and Chhattisgarh.

Integrated Development of 60,000 pulses villages in rainfed areas

Government's initiative on pulses has received a positive response from the farmers. As per the second advance estimates, a record production of 165 lakh tonnes of pulses is expected this year as against 147 lakh tonnes last year. While consolidating these gains, we must strive to attain self-sufficiency in production of pulses within next three years. I propose to provide an amount of Rs300 crore to promote 60,000 pulses villages in rainfed areas for increasing crop productivity and strengthening market linkages.

Promotion of Oil Palm

The domestic production of edible oil meets only about 50% demand. The gap in supply is met through imports, which are often at high prices due to the quantum of our requirement. Our recent interventions and good rains are expected to result in a higher oilseeds production of 278 lakh tonnes in 2010-11 as against 249 lakh tonnes in 2009-10. To achieve a major breakthrough, we have to pay special attention to oil palm as it is one of the most efficient oil crops. I propose to provide an amount of Rs300 crore to bring 60,000 hectares under oil palm plantation, by integrating the farmers with the markets. The initiative will yield about 3 lakh metric tonnes of palm oil annually in 5 years.

Initiative on Vegetable Clusters

The growing demand for vegetables has to be met by a robust increase in the productivity and market linkage. An efficient supply chain, to provide quality vegetables at competitive prices, will have to be established. I propose to provide an amount of Rs300 crore for implementation of vegetable initiative to set in motion a virtuous cycle of higher production and incomes for the farmers. To begin with, this programme will be launched near major urban centres.

Nutri-cereals

While we ensure food for all, we must also promote balanced nutrition. Bajra, jowar, ragi and other millets are highly nutritious and are known to possess several medicinal properties. The availability and consumption of these Nutri-cereals is, however, low and has been steadily declining over recent years. A provision of Rs300 crore is being made to promote higher production of these cereals, upgrade their processing technologies and create awareness regarding their health benefits. This initiative would provide market-linked production support to ten lakh millet farmers in the arid and semi-arid regions of the country. The programme would be taken up in 1000 compact blocks covering about 25,000 villages. This will help improve nutritional security and increase feed and fodder supply for livestock.

National Mission for Protein Supplements

The consumption of foods rich in animal protein and other nutrients has risen of late, with demand growing faster than production. The National Mission for Protein Supplements is being launched in 2011-12 with an allocation of Rs300 crore. It will take up activities to promote animal based protein production through livestock development, dairy farming, piggery, goat rearing and fisheries in selected blocks.

Accelerated Fodder Development Programme

Adequate availability of fodder is essential for sustained production of milk. It is necessary to accelerate the production of fodder through intensive promotion of technologies to ensure its availability throughout the year. I propose to provide Rs300 crore for Accelerated Fodder Development Programme which will benefit farmers in 25,000 villages.

Hon'ble Members may be curious as to why all these new initiatives are being launched with an allocation of Rs300 crore. Well, the number 3 happens to be my lucky number!

National Mission for Sustainable Agriculture

While the need to maximise crop yields to meet the growing demand for food grains is critical, we have to sustain agricultural productivity in the long run. There has been deterioration in soil health due to removal of crop residues and indiscriminate use of chemical fertilisers, aided by distorted prices.

To address these issues, the Government proposes to promote organic farming methods, combining modern technology with traditional farming practices like green manuring, biological pest control and weed management.

Agriculture Credit

To get the best from their land, farmers need access to affordable credit. Banks have been consistently meeting the targets set for agriculture credit flow in the past few years. For the year 2011-12, I am raising the target of credit flow to the farmers from Rs3,75,000 crore this year to Rs4,75,000 crore in 2011-12. Banks have been asked to step up direct lending for agriculture and credit to small and marginal farmers.

The existing interest subvention scheme of providing short-term crop loans to farmers at 7% interest will be continued during 2011-12. In the last budget, I had provided an additional 2% interest subvention to those farmers who repay their crop loans on time. The response to this scheme has been good. In order to provide further incentive to these farmers, I propose to enhance the additional subvention to 3% in 2011-12. Thus, the effective rate of interest for such farmers will be 4% per annum.

In view of the enhanced target for flow of agriculture credit, I propose to strengthen NABARD's capital base by infusing Rs3000 crore, in a phased manner, as Government equity. This would raise its paid-up capital to Rs5,000 crore. To enable NABARD to refinance the short-term crop loans of the cooperative credit institutions and RRBs at concessional rates, I propose a contribution of Rs10,000 crore to NABARD's Short-term Rural Credit Fund for 2011-12 from the shortfall in priority sector lending by Scheduled Commercial Banks.

Mega Food Parks

Despite growing production of vegetables and fruits, their availability is inadequate due to bottlenecks in retailing capacity. An estimated 40% of the fruit and vegetable production in India goes waste due to lack of storage, cold chain and transport infrastructure. To address these issues, the Eleventh Plan target for number of Mega Food Parks was set at 30. So far, 15 such parks have been sanctioned. During 2011-12, approval is being given to set up 15 more Mega Food Parks.

Storage Capacity and Cold Chains

The years 2008 to 2010 saw very high levels of foodgrain procurement. On January 1, 2011, the foodgrain stock in Central pool reached 470 lakh metric tonnes, 2.7 times higher than 174 lakh metric tonnes on January 1, 2007. The storage capacity for such large quantities requires augmentation. Process to create new storage capacity of 150 lakh metric tonnes through private entrepreneurs and warehousing corporations has been fast tracked. Decision to create 20 lakh metric tonnes of storage capacity under Public Entrepreneurs Guarantee (PEG) Scheme through modern silos has been taken. While we will be able to add about 2.6 lakh tonnes of capacity by March 2011, based on existing sanctions, the addition will reach 40 lakh tonnes by March 2012. During 2010-11, another 24 lakh metric tonnes of storage capacity has been created under the Rural Godown Scheme.

Investment in cold storage projects is now gaining momentum. During this year, 24 cold storage projects with a capacity of 1.4 lakh metric tonnes have been sanctioned under National Horticulture Mission. In addition, 107 cold storage projects with a capacity of over 5 lakh metric tonnes have been approved by the National Horticulture Board.

To attract investment in this sector, henceforth, capital investment in the creation of modern storage capacity will be eligible for viability gap funding scheme of the Finance Ministry. It is also proposed to recognise cold chains and post-harvest storage as an infrastructure sub-sector.

Agriculture Produce Marketing Act

The recent episode of inflation in vegetables and fruits has exposed serious flaws in our supply chains. The government regulated mandis sometimes prevent retailers from integrating their enterprises with the farmers. There is need for the State Governments to review and enforce a reformed Agriculture Produce Marketing Act urgently.

Infrastructure and Industry

Infrastructure is critical for our development. For 2011-12, an allocation of over Rs2,14,000 crore is being made for this sector, which is 23.3% higher than current year. This amounts to 48.5% of the Gross Budgetary Support to plan expenditure.

Our experience with PPP model for creation of public sector assets in the country has been good. We have recently launched the National Capacity Building Programme to enhance capacities of public functionaries in identifying, conceptualising, structuring and managing PPPs. It is our endeavour to come up with a comprehensive policy that can be used by the Centre and the State Governments in further developing public-private partnerships.

Government established India Infrastructure Finance Company Limited (IIFCL) to provide long-term financial assistance to infrastructure projects. It is expected to achieve a cumulative disbursement target of Rs20,000 crore by March 31, 2011, and Rs25,000 crore by March 31, 2012. The take out financing scheme announced in the Budget 2009-10 has been implemented and seven projects have been sanctioned with a debt of Rs1,500 crore. Another Rs5,000 crore will be sanctioned during 2011-12.

In order to give a boost to infrastructure development in railways, ports, housing and highways development, I propose to allow tax free bonds of Rs30,000 crore to be issued by various Government undertakings in the year 2011-12. This includes Indian Railway Finance Corporation Rs10,000 crore, National Highway Authority of India Rs10,000 crore, HUDCO Rs5,000 crore and Ports Rs5,000 crore.

To attract foreign funds for the infrastructure financing, I propose to create Special Vehicles in the form of notified infrastructure debt funds. I will come to the details in Part B of my speech.

National Manufacturing Policy

For sustained growth of GDP and productive employment for younger generation, it is imperative that the growth in manufacturing sector picks up. We expect to take the share of manufacturing in GDP from about 16% to 25% over a period of ten years. Government will come out with a manufacturing policy, which will bring down the compliance burden on the industry through self-regulation and help make Indian industry globally competitive.

To address the need for greater transparency and accountability in procurement policy and allocation, pricing and utilisation of natural resources, the Government has set up two committees. The recommendations will be available within three months.

A Group of Ministers has been set up to consider all issues relating to reconciliation of environmental concerns emanating from various departmental activities including those related to infrastructure and mining. This Group will also suggest changes in the existing statutes, rules, regulations and guidelines and make its recommendations in a time bound manner.

The Indian automobile market is the second fastest growing in the world and has shown nearly 30% growth this year. World over, substantial investments are being made in the field of hybrid and electric mobility. To provide green and clean transportation for the masses, National Mission for Hybrid and Electric Vehicles will be launched in collaboration with all stakeholders.

The funding of 15,260 modern low floor and semi-low floor buses under JNNURM, besides adding to passenger comfort, has transformed the urban transport across India. In 2011-12, Delhi Metro Phase-III and Mumbai Metro Line III are proposed to be taken up. The ongoing Metro projects of Bengaluru, Kolkata and Chennai will be provided financial assistance for speedy implementation.

Investment in fertilizer sector is capital intensive and is considered high risk. It is proposed to include capital investment in fertiliser production as an infrastructure sub-sector.

Exports

The Task Force on Transactions Cost set up by the Department of Commerce to identify and suggest ways to achieve improvement in efficiency of our export processes has completed its work. Twenty-one suggestions made by the Task Force have already been implemented. Action on remaining two will be taken in next few months. This will mitigate transactions cost by about Rs2,100 crore.

To quicken the clearance of the cargo by Customs authorities and further modernise the Customs administration, I propose to introduce self-assessment in Customs. Under this, importers and exporters will themselves assess their duty liabilities while filing their declarations in the EDI system. The Department will verify such assessments on a selective system-driven basis.

There have been considerable difficulties in the sanction of refunds relating to tax paid on services used for export of goods. I propose to shortly introduce a scheme for the refund of these taxes on the lines of drawback of duties in a far more simplified and expeditious manner. A new scheme is also being introduced by which units in SEZs will be able to obtain tax-free receipt of services wholly consumed within the zone and get their refunds in a much easier manner.

Mega clusters have large employment and export potential. I propose to extend the Mega Cluster Scheme for development of leather products. Seven mega leather clusters would be set up during the year 2011-12. I also propose to include Jodhpur for the development of a handicraft mega cluster.

Black Money

The generation and circulation of black money is an area of serious concern. To deal with this problem effectively, Government has put into operation a five-fold strategy which consists of Joining the global crusade against 'black money'; Creating an appropriate legislative framework; Setting up institutions for dealing with illicit funds; Developing systems for implementation; and Imparting skills to the manpower for effective action.

We secured Membership of the Financial Action Task Force (FATF) in June last year. This is an important initiative of G20 for anti-money laundering. We have also joined the Task Force on Financial Integrity and Economic Development, Eurasian Group (EAG) and Global Forum on Transparency and Exchange of Information for Tax Purposes.

During the year, we have concluded discussions for 11 Tax Information Exchange Agreements (TIEAs) and 13 new Double Taxation Avoidance Agreements (DTAAs) along with revision of provisions of 10 existing DTAAs. To effectively handle the increase in tax information exchange and transfer pricing issues, Foreign Tax Division of CBDT has been strengthened. A dedicated Cell for exchange of information is being set up to work on this agenda.

The amendment in our Money Laundering Legislation in 2009 has significantly increased its scope and application. The number of cases registered under this law has increased from 50 between 2005 to 2008 to over 1200 by January this year. The strength of the Enforcement Directorate has been increased three-fold to deal effectively with the increased workload.

The Ministry of Finance has commissioned a study on unaccounted income and wealth held within and outside our country. It would suggest methods to tax and repatriate this illicit money.

Trafficking in narcotic drugs is also a contributor to the generation of black money. To strengthen controls over prevention of trafficking and improve the management of narcotic drugs and psychotropic substances, I propose to announce a comprehensive national policy in the near future.

Strengthening Inclusion

The UPA Government has engineered a major directional change in public policy by its focus on inclusive development. Creation of legal entitlements for an individual's right to work has added to resilience and dynamism in our rural economy. The right to information and the right to education are effective tools of empowerment for removing social imbalances. The country has carried for long enough the burden of hunger and malnutrition. After detailed consultations with all stakeholders including State Governments, we are close to the finalisation of National Food Security Bill (NFSB) which will be introduced in Parliament during the course of this year. The proposed allocation of Rs1,60,887 crore for social sector in 2011-12 is an increase of 17% over current year. It amounts to 36.4% of the total plan allocation.

Bharat Nirman

The UPA Government's flagship programmes have been the principal instrument for implementing its agenda for inclusive development. For the year 2011-12, Bharat Nirman, which includes Pradhan Mantri Gram Sadak Yojna (PMGSY), Accelerated Irrigation Benefit Programme, Rajiv Gandhi Grameen Vidyutikaran Yojna, Indira Awas Yojna, National Rural Drinking Water Programme and Rural telephony have together been allocated Rs58,000 crore. This is an increase of Rs10,000 crore from the current year. A plan has been finalised to provide Rural Broadband Connectivity to all 2,50,000 Panchayats in the country in three years.

MGNREGA

In pursuance of my earlier budget announcement to provide a real wage of Rs100 per day, the Government has decided to index the wage rates notified under the MGNREGA to the Consumer Price Index for Agricultural Labour. The enhanced wage rates have been notified by the Ministry of Rural Development on January 14, 2011. It has resulted in significant enhancement of wages for the beneficiaries across the country.

The Anganwadi workers and Anganwadi helpers are the backbone of Integrated Child Development Services Scheme. I am happy to announce an increase in the remuneration of Anganwadi workers from Rs1,500 per month to Rs3,000 per month and for Anganwadi helpers from Rs750 per month to Rs1,500 per month. This will be effective from April 1, 2011. Around 22 lakh Anganwadi workers and helpers will benefit from the increase.

Scheduled Castes and Tribal Sub-plan

In the Budget for 2011-12, for the first time, specific allocations are being earmarked towards Scheduled Castes Sub-plan and Tribal Sub-plan. These will be shown in the Budget of the relevant Ministries and Departments under separate minor heads of account. Further, I propose to increase the Budget allocation for primitive tribal groups from Rs185 crore in 2010-11 to Rs244 crore in 2011-12.

Education

Our "demographic dividend" of a relatively younger population compared to developed countries is as much of an opportunity as it is a challenge. Over 70% of Indians will be of working age in 2025. In this context, universalising access to secondary education, increasing the percentage of our scholars in higher education and providing skill training is necessary. For education, I propose an allocation of Rs52,057 crore, which is an increase of 24% over the current year.

Sarva Shiksha Abhiyan

The existing operational norms of Sarva Shiksha Abhiyan have been revised to implement the right of children to free and compulsory education which has come into force with effect from April 1, 2010. For the year 2011-12, I propose to allocate Rs21,000 crore which is 40% higher than Rs15,000 crore allocated in the Budget for 2010-11. A revised Centrally Sponsored Scheme "Vocationalisation of Secondary Education" will be implemented from 2011-12 to improve the employability of our youth.

Empowerment flows from Education. While the Scheduled Castes and Scheduled Tribes had access to post matric scholarships, there was so far a lack of pre matric scholarship scheme. In 2011-12, I propose to introduce a scholarship scheme for needy students belonging to the Scheduled Castes and Scheduled Tribes studying in classes ninth and tenth. It would benefit about 40 lakh Scheduled Caste and Scheduled Tribe students.

National Knowledge Network

Approved in March 2010, the National Knowledge Network (NKN) will link 1500 Institutes of Higher Learning and Research through an optical fibre backbone. During the current year, 190 Institutes will be connected to NKN. Since the core will be ready by March 2011, the connectivity to all 1500 institutions will be provided by March 2012.

Innovations

To move beyond the formal R&D paradigm, a National Innovation Council under Shri Sam Pitroda has been set up to prepare a roadmap for innovations in India. The process of setting up State Innovation Councils in each State and Sectoral Innovation Councils aligned to Central Ministries is underway.

The Government has been providing special grants to recognise excellence in universities and academic institutions. In the course of 2011-12, I propose to provide:

— Rs50 crore each to upcoming centres of Aligarh Muslim University at Murshidabad in West Bengal and Malappuram in Kerala;

— Rs100 crore as one-time grant to the Kerala Veterinary and Animal Sciences University at Pookode, Kerala;

— Rs10 crore each for setting up Kolkata and Allahabad Centres of Mahatma Gandhi Antarrashtriya Hindi Vishwavidyalaya, Wardha;

— Rs200 crore as one-time grant to IIT, Kharagpur;

— Rs20 crore for Rajiv Gandhi National Institute of Youth Development, Sriperumbudur, Tamil Nadu

— Rs20 crore for IIM, Kolkata, to set up its Financial Research and Trading Laboratory;

— Rs200 crore for Maulana Azad Education Foundation;

— Rs10 crore for Centre for Development Economics and Ratan Tata Library, Delhi School of Economics, Delhi; and

— Rs10 crore for Madras School of Economics.

Skill Development

I am happy to inform the House that National Skill Development Council (NSDC) is well on course to achieve its mandate of creation of 15 crore skilled workforce two years ahead of 2022, the stipulated target year. It has already sanctioned 26 projects with a total funding of Rs658 crore. These projects alone are expected to create more than 4 crore skilled workforce over the next ten years. In the current year, skill training has so far been provided to 20,000 persons. Of these, 75% have found placements. I will provide an additional Rs500 crore to the National Skill Development Fund during the next year.

National celebrations of 150th Birth Anniversary of Gurudev Rabindranath Tagore will commence from May 7, 2011, in New Delhi. Important events will be held in several countries in Europe, America and Asia. A series of events are also proposed to be organised under the aegis of joint India-Bangladesh Celebrations Committee. An international award with prize money of Rs1 crore is being instituted for promoting values of Universal Brotherhood in the memory of Gurudev Rabindranath Tagore.

Health

For health, I propose to step up the plan allocations in 2011-12 by 20% to Rs26,760 crore. The Rashtriya Swasthya Bima Yojana has emerged as an effective instrument for providing a basic health cover to poor and marginal workers. It is now being extended to MGNREGA beneficiaries, beedi workers and others. In 2011-12, I propose to further extend this scheme to cover unorganised sector workers in hazardous mining and associated industries like slate and slate pencil, dolomite, mica and asbestos etc.

Financial Inclusion

In my last budget speech I had advised Banks to provide banking facilities to habitations having a population of over 2000 by March, 2012. The Banks have identified about 73,000 such habitations for providing banking facilities using appropriate technologies. A multi-media campaign, "Swabhimaan", has been launched to inform, educate and motivate people to open bank accounts. During this year, banks will cover 20,000 villages. Remaining will be covered during 2011-12.

Unorganised sector

I had announced a co-contributory pension scheme "Swavalamban" in the Budget 2010-11. This scheme has been welcomed by the workers in unorganised sector. Over 4 lakh applications have already been received. On the basis of the feedback received, I am relaxing the exit norms whereby a subscriber under Swavalamban will be allowed exit at the age of 50 years instead of 60 years, or a minimum tenure of 20 years, whichever is later. I also propose to extend the benefit of Government contribution from three to five years for all subscribers of Swavalamban who enrol during 2010-11 and 2011-12. An estimated 20 lakh beneficiaries will join the scheme by March 2012.

Under the on-going Indira Gandhi National Old Age Pension Scheme for BPL beneficiaries, the eligibility for pension is proposed to be reduced from 65 years at present to 60 years. Further, for those who are 80 years and above, the pension amount is being raised from Rs200 at present to Rs500 per month.

Environment and Climate Change

Forests

Protection and regeneration of forests has great ecological, economic and social value. Our Government has launched an ambitious ten-year Green India mission. I propose to allocate Rs200 crore from the National Clean Energy Fund to begin its implementation in 2011-12.

Environmental Management

Environmental pollution has emerged as a serious public health concern across the country. I propose to allocate Rs200 crore from the National Clean Energy Fund as Centre's contribution in 2011-12 for launching environmental remediation programmes.

Cleaning of Rivers and Lakes

A number of projects under the National Ganga River Basin Authority have been approved in 2010-11. This momentum will be further stepped up. There are many rivers and lakes of cultural and historical significance that need to be cleaned. In the course of the year 2011-12, I propose to provide a special allocation of Rs200 crore for the clean-up of some important lakes and rivers other than the Ganga.

Some Other Initiatives

In order to boost development in the North Eastern Region and Special Category States, the allocation for special assistance has been almost doubled to Rs8,000 crore for 2011-12. Out of this, Rs5,400 crore has been allocated as untied Special Central Assistance.

The Government's special support to Jammu & Kashmir is anchored in Rs28,000 crore Prime Minister's Reconstruction Plan. In addition, for the current year, about Rs8,000 crore has been provided for the State's development needs. A Task Force to assess infrastructure needs that can be addressed within a time horizon of 24 months for Ladakh and Jammu regions of the State has recommended projects amounting to Rs416 crore and Rs497 crore, respectively. I am providing Rs100 crore for Ladakh and Rs150 crore for Jammu for these identified projects in 2011-12.

To give a boost to the development of backward regions, the allocation under the Backward Regions Grant Fund has been increased from Rs7,300 crore to Rs9,890 crore amounting to an increase of over 35%.

To address problems related to Left Wing Extremism affected districts, an Integrated Action Plan (IAP) for 60 selected tribal and backward districts has been launched in December 2010. The scheme is being implemented with 100% block grant of Rs25 crore and Rs30 crore per district during the years 2010-11 and 2011-12, respectively. The allocated funds are placed at the disposal of the district level committees who in consultation with local MPs will have the flexibility to spend the amount on development schemes as per the local needs.

In recognition of the sacrifices made by Central Paramilitary Forces engaged in tackling Left Wing Extremism, a lump sum ex-gratia compensation of Rs9 lakh for 100% disability will now be granted to personnel of the Defence and paramilitary forces who are discharged from service on medical grounds on account of disability attributable to or aggravated in government service. For personnel with disability ranging from 20 to 99%, a proportionate amount would be given.

In the Budget 2011-12, a provision of Rs1,64,415 crore has been made for Defence services which include Rs69,199 crore for capital expenditure. Needless to say, any further requirement for the country's defence would be met.

In order to speed up delivery of justice, the Plan provision for Department of Justice for 2011-12 has been increased three-fold to Rs1,000 crore. The enhanced provision will help in building judicial infrastructure and the project on E-courts.

Census 2011

The 15th Census in the country is being conducted from 9th February. It is the largest administrative exercise in the country providing statistical data on different socio-economic parameters of population.

In response to the overwhelming demand for enumeration of castes other than Scheduled Castes and Scheduled Tribes in Census 2011, it has been decided to canvass 'caste' as a separate time bound exercise. This exercise will start in June 2011 and will be completed by 30th September 2011.

Improving Governance

I now turn to some important measures being taken for improving governance.

UID Mission

The UID Mission has taken off and Aadhaar numbers are being generated in large numbers. So far 20 lakh Aadhaar numbers have been given and from 1st October 2011, ten lakh numbers will be generated per day. The stage is now set for realising the potential of Aadhaar for improving service delivery, accountability and transparency in governance of various schemes.

IT Initiatives

The backbone of an efficient tax administration is a robust IT infrastructure and its deployment for enhanced taxpayer services. Towards this objective, both the Central Boards of Direct Taxes (CBDT) and Excise and Customs (CBEC) have put in place the following measures:

— The on-line preparation and e-filing of income tax returns, e-payment of taxes through 32 agency banks, ECS facility for electronic clearing of refunds directly in taxpayers' bank accounts and electronic filing of TDS returns are now available throughout the country. These measures have empowered taxpayers to meet their tax obligations without visiting an income tax office.

— The Centralized Processing Centre (CPC) at Bengaluru has increased its daily processing capacity from 20,000 to 1.5 lakh returns in 2010-11. This project has won a Gold Award for e-Governance in 2011. Two more CPCs will become operational in Manesar and Pune by May 2011 and a fourth CPC will come up in Kolkata in 2011-12.

— With the completion of its IT Consolidation Project, CBEC can now centrally host its key applications in Customs, Central Excise and Service Tax. The Customs EDI system now covers 92 locations across the country. CBEC's e-Commerce portal ICEGATE, has also been conferred a Gold Award for e-Governance.

— The 'Sevottam' concept has been adopted by both Boards. The three pilot projects of Aaykar Seva Kendras (ASKs) under CBDT have come of age. CBDT will commission eight more such centres this year. In 2011-12, another fifty ASKs will be set up across the country. CBEC has also launched a similar initiative and four of their pilot projects have been commissioned.

— The electronic filing of Tax Deduction at Source (TDS) statements has stabilized. The Board shall soon notify a category of salaried taxpayers who will not be required to file a return of income as their tax liability has been discharged by their employer through deduction at source.

— CBDT will provide a separate web-based facility to enable a direct, stand-alone interface for taxpayers with the Income Tax Department so that they can report and track the resolution of their refunds and credit for prepaid taxes.

Mission Mode Projects for computerization of Commercial Taxes in States that I announced in my last Budget will allow States to align with the roll out of GST. Funds have been released for 31 projects received from the States and Union Territories. Most of the States and UTs have already enabled the facility of dealers making electronic payments. A number of States have already started accepting Electronic Tax Returns and issuing forms required for inter-state trade.

With the development of the economy, the need to review the provisions of the Indian Stamp Act, 1899, has been felt over the years. I propose to introduce a Bill shortly to amend the Indian Stamp Act.

Five years ago, we took an initiative to introduce a modern and people-friendly e-stamping facility in the country. Only six States have introduced this system so far. I propose to launch a new scheme with an outlay of Rs300 crore to provide assistance to States to modernise their stamp and registration administration and roll out e-stamping in all the districts in the next three years.

I propose to introduce a new simplified return form 'Sugam' to reduce the compliance burden of small taxpayers who fall within the scope of presumptive taxation.

The increase in scope of cases admitted by the Settlement Commissions has provided relief to several taxpayers. This has also increased the workload of the Commission. To fast track the disposal of cases, three more Benches of the Commission are being set up.

Substantial amounts of revenue in both direct and indirect taxes remain locked up in appeals at different levels. Both Boards also invest substantial effort and money in litigation with their employees. In keeping with the National Litigation Policy, several steps have been initiated in 2010-11 for reducing litigation and focusing attention on high revenue cases. Instructions have been issued raising limit of tax effects below which tax disputes will not be pursued by Government in higher Courts of Appeal. These measures would enhance productivity of resources employed in raising revenue.

Corruption

A Group of Ministers has been constituted to consider measures for tackling corruption. The Group has been tasked with addressing issues relating to State funding of elections, speedier processing of corruption cases of public servants, transparency in public procurement and contracts, discretionary powers of Central ministers and competitive system for exploiting natural resources. The Group will make its recommendations in a time bound manner.

Performance Monitoring and Evaluation System

Pursuant to the recommendations of Second Administrative Reforms Commission, the Government has set up a Performance Monitoring and Evaluation System (PMES) to assess the effectiveness of Government departments in their mandated functions. It involves preparation of a Results Framework Document (RFD) by each department, highlighting its objectives and priorities for the financial year and achievements against pre-specified targets at the end of the year. This document would be available for public information on the departmental websites. In the first phase, 62 departments have been covered under PMES.

TAGUP

In pursuance of the announcement made in the Budget 2010-11, I had set up a Technology Advisory Group for Unique Projects (TAGUP). The Group has submitted its report and its recommendations have been accepted in principle. The modalities of implementation are being worked out.

Indian Rupee now has a new symbol which has been notified for use by the Central and State Governments, business entities and the general public. A new series of coins carrying this symbol will be issued shortly. The Government has approached Unicode Standards Authority for inclusion of the symbol in international standards.

Part II of the finance minister's speech follows. Click here

![submenu-img]() Meet IIT-JEE topper with AIR 1, son of government school teachers, he went on to pursue...

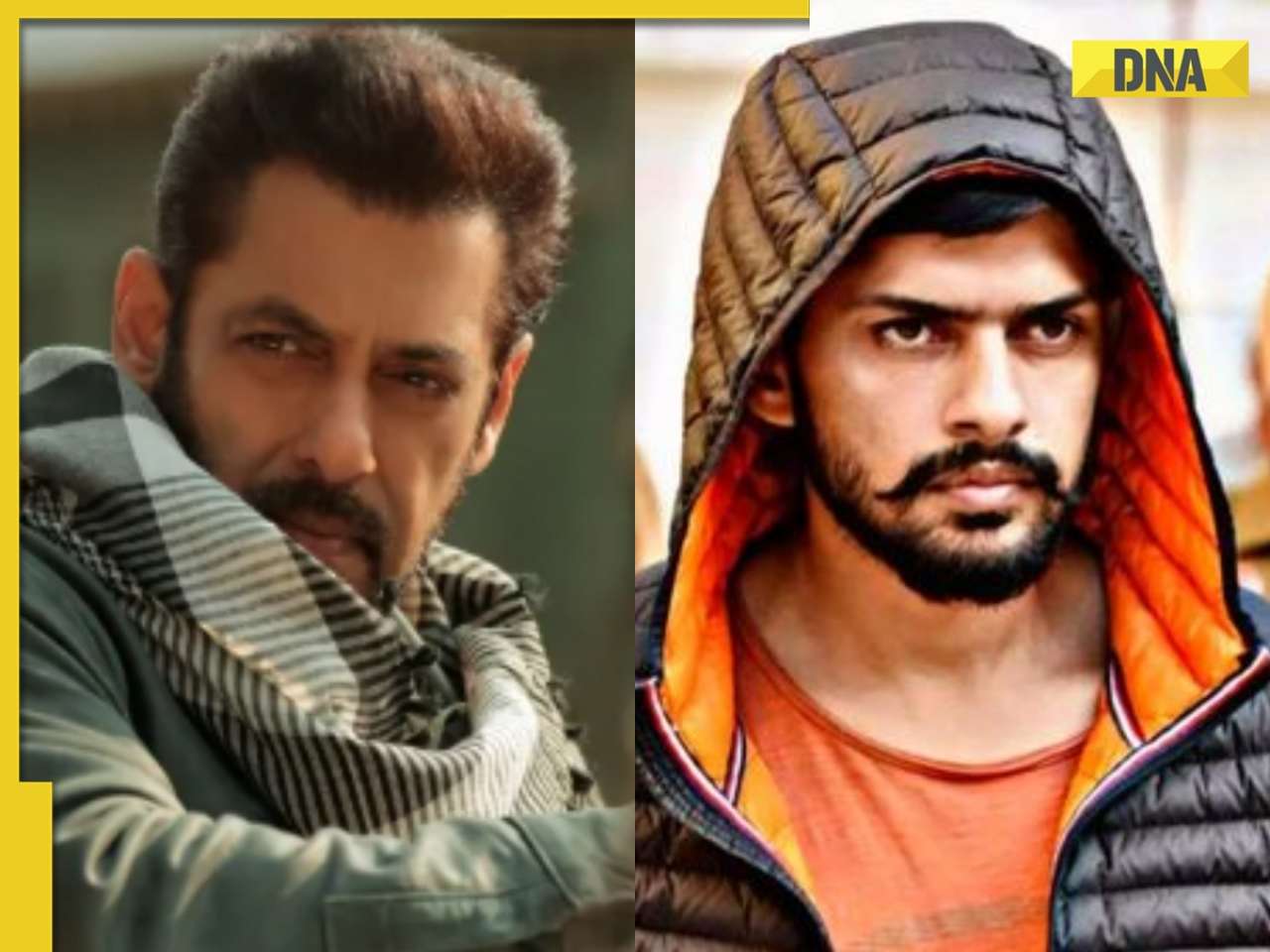

Meet IIT-JEE topper with AIR 1, son of government school teachers, he went on to pursue...![submenu-img]() Salman Khan house firing case: One more Lawrence Bishnoi gang member arrested by Mumbai Police

Salman Khan house firing case: One more Lawrence Bishnoi gang member arrested by Mumbai Police ![submenu-img]() Mukesh Ambani to host Anant-Radhika's second pre-wedding function: Trip to start from Italy with 800 guests and end in..

Mukesh Ambani to host Anant-Radhika's second pre-wedding function: Trip to start from Italy with 800 guests and end in..![submenu-img]() Driver caught on camera running over female toll plaza staff on Delhi-Meerut expressway, watch video

Driver caught on camera running over female toll plaza staff on Delhi-Meerut expressway, watch video![submenu-img]() 'If you come and do something here...': EAM S Jaishankar on India's 'message' against terrorism

'If you come and do something here...': EAM S Jaishankar on India's 'message' against terrorism![submenu-img]() Meet IIT-JEE topper with AIR 1, son of government school teachers, he went on to pursue...

Meet IIT-JEE topper with AIR 1, son of government school teachers, he went on to pursue...![submenu-img]() TN 11th Result 2024: TNDGE Tamil Nadu HSE (+1) result declared, direct link here

TN 11th Result 2024: TNDGE Tamil Nadu HSE (+1) result declared, direct link here![submenu-img]() Meet doctor who cracked UPSC exam with AIR 9 but didn’t became IAS due to…

Meet doctor who cracked UPSC exam with AIR 9 but didn’t became IAS due to…![submenu-img]() TN 11th Result 2024 to be declared today; know how to check

TN 11th Result 2024 to be declared today; know how to check![submenu-img]() Meet man who worked as coolie, studied from railway's WiFi, then cracked UPSC exam to become IAS, secured AIR...

Meet man who worked as coolie, studied from railway's WiFi, then cracked UPSC exam to become IAS, secured AIR...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...

Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...![submenu-img]() Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses

Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses![submenu-img]() Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...

Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...![submenu-img]() In pics: Ram Charan gets mobbed by fans during his visit to Pithapuram for ‘indirect campaign’ for uncle Pawan Kalyan

In pics: Ram Charan gets mobbed by fans during his visit to Pithapuram for ‘indirect campaign’ for uncle Pawan Kalyan![submenu-img]() Streaming This Week: Yodha, Aavesham, Murder In Mahim, Undekhi season 3, latest OTT releases to binge-watch

Streaming This Week: Yodha, Aavesham, Murder In Mahim, Undekhi season 3, latest OTT releases to binge-watch![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Salman Khan house firing case: One more Lawrence Bishnoi gang member arrested by Mumbai Police

Salman Khan house firing case: One more Lawrence Bishnoi gang member arrested by Mumbai Police ![submenu-img]() Meet actress, who got rejected for her looks, had no hit for 15 years; later beat Alia, Deepika, Katrina at box office

Meet actress, who got rejected for her looks, had no hit for 15 years; later beat Alia, Deepika, Katrina at box office![submenu-img]() Abdu Rozik breaks silence on his wedding announcement being called ‘publicity stunt’: ‘The whole world is…’

Abdu Rozik breaks silence on his wedding announcement being called ‘publicity stunt’: ‘The whole world is…’![submenu-img]() Meet actress who made debut with Salman Khan, had super flop career, then got TB, now lives in chawl, runs..

Meet actress who made debut with Salman Khan, had super flop career, then got TB, now lives in chawl, runs..![submenu-img]() Meet actress who worked with Naseeruddin Shah, sister of popular models, is now getting trolled on social media for..

Meet actress who worked with Naseeruddin Shah, sister of popular models, is now getting trolled on social media for..![submenu-img]() Driver caught on camera running over female toll plaza staff on Delhi-Meerut expressway, watch video

Driver caught on camera running over female toll plaza staff on Delhi-Meerut expressway, watch video![submenu-img]() Delhi man takes 200 flights in 110 days, steals lakhs worth of jewelry from passengers

Delhi man takes 200 flights in 110 days, steals lakhs worth of jewelry from passengers![submenu-img]() Viral video: Man makes paratha with 'diesel', internet reacts

Viral video: Man makes paratha with 'diesel', internet reacts![submenu-img]() Viral video of 'black jalebi' leaves internet in shock; netizens say 'hey bhagwan...'

Viral video of 'black jalebi' leaves internet in shock; netizens say 'hey bhagwan...'![submenu-img]() Real-life Bambi and Thumper? Adorable deer and rabbit video melts hearts online

Real-life Bambi and Thumper? Adorable deer and rabbit video melts hearts online

)

)

)

)

)

)