State Bank of India might soon start the process of integrating its remaining associates, beginning with two large ones.

After merging State Bank of Saurashtra, India's largest lender State Bank of India might soon start the process of integrating its remaining associates, beginning with two large ones -- State Bank of Patiala and State Bank of Hyderabad.

According to the roadmap set by State Bank, all its associates will merge with the parent entity "as quickly as possible" to make SBI one of the top 25-30 banks in the world.

With the return of the Congress-led UPA to power, without the crutches of the Left and other difficult allies, SBI expects banking reforms to move forward, a top SBI source said.

"The merger-process of State Bank of Saurashtra has already happened and the roadmap is to complete the consolidation process in the shortest possible period," the source said, adding that it could begin with State Bank of Patiala and State Bank of Hyderabad.

Once the new Government extends permission for mergers, the process could happen in the immediate future, the source said. "It will be more feasible now," the source said.

The Patiala and Hyderabad subsidiaries, which are wholly owned by the parent bank, had clocked impressive results in the last financial year. These two subsidiaries are quite large and SBH is now virtually of the size of Canara Bank.

While SBP reported a net profit of Rs 531.54 crore in 2008-09, against Rs 413.73 crore in 2007-08, SBH's net profit in the last fiscal stood at Rs 616 crore as compared to Rs 557 crore in the previous one.

SBP has a branch network of 750 branches while SBH has 1,014. SBI's associate banks have a combined branch strength of around 5,000 and a total business of around Rs 4 lakh crore.

The merger of all associates of State Bank with itself will take the combined entities' balance sheet to above Rs 8 lakh crore. This will help the Indian banking giant to join the league of global financial powerhouses.

In order to speed up the merger process, SBI appointed its former DMD, Bharti Rao, as adviser last year.

Bharti Rao is understood to have visited all associate banks to start work on the merger process, another source in the bank said.

"The SBI management had put the merger proposals on hold in the last few months only to wait till the new Government takes shape. Now, with a pro-reform Government set to take charge, SBI has plans to put the process (on the fast track)," the source said.

![submenu-img]() MS Dhoni steps out to cast his vote for Lok Sabha polls in Ranchi, crowd goes crazy - Watch

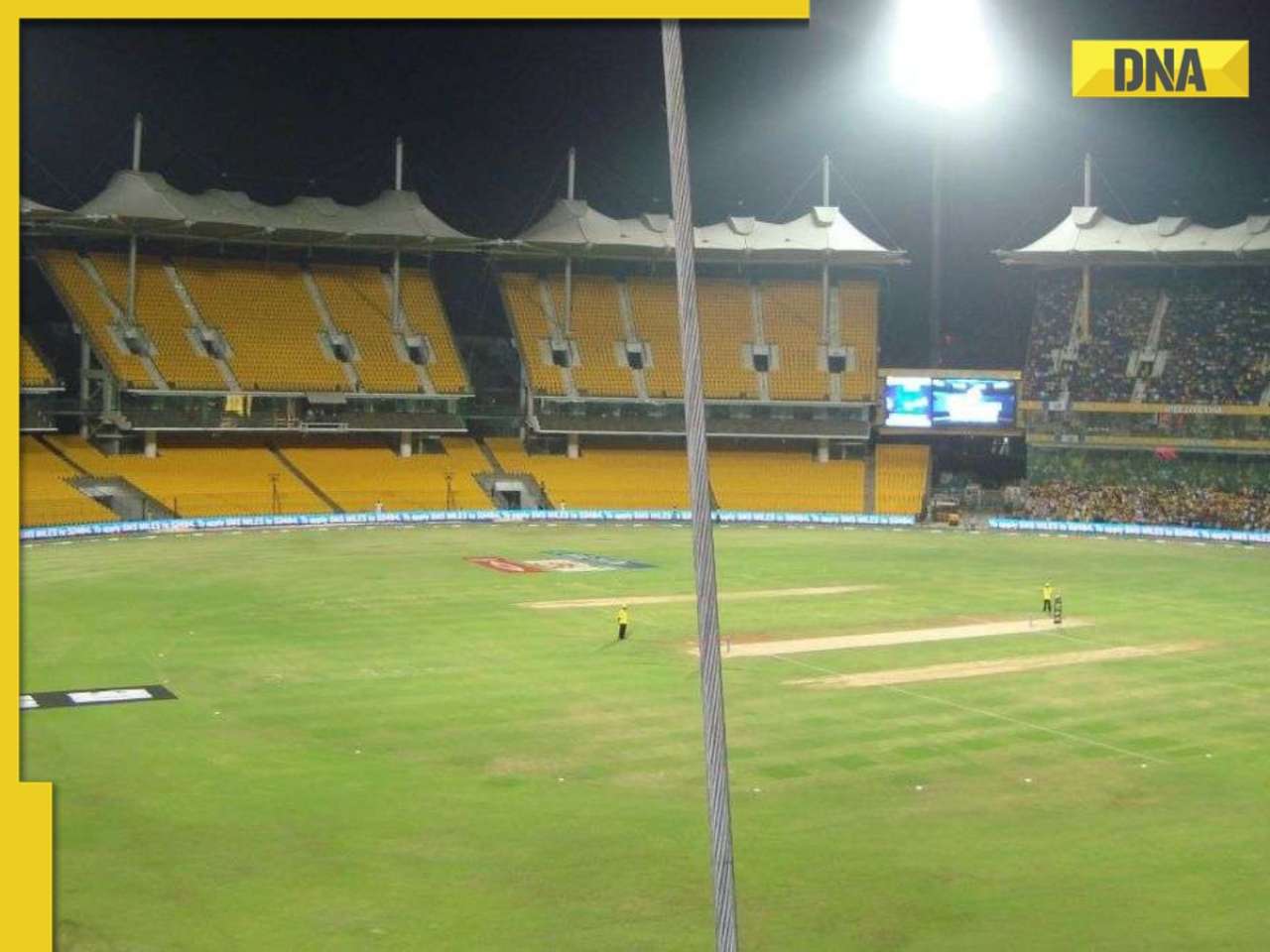

MS Dhoni steps out to cast his vote for Lok Sabha polls in Ranchi, crowd goes crazy - Watch![submenu-img]() KKR vs SRH, IPL 2024 Final: Will rain play spoilsport in Chennai? Here's weather forecast for May 26

KKR vs SRH, IPL 2024 Final: Will rain play spoilsport in Chennai? Here's weather forecast for May 26![submenu-img]() Karan Johar announces his next directorial on 52nd birthday, fans say 'please bring back SRK and Kajol'

Karan Johar announces his next directorial on 52nd birthday, fans say 'please bring back SRK and Kajol'![submenu-img]() Meet woman, who holds Guinness World Record for longest fingernails, hasn't cut them since 1997, she is from...

Meet woman, who holds Guinness World Record for longest fingernails, hasn't cut them since 1997, she is from...![submenu-img]() Maharashtra 10th Result 2024: MSBSHSE SSC Class 10 to be released on May 27, know how to download scorecards

Maharashtra 10th Result 2024: MSBSHSE SSC Class 10 to be released on May 27, know how to download scorecards![submenu-img]() Maharashtra 10th Result 2024: MSBSHSE SSC Class 10 to be released on May 27, know how to download scorecards

Maharashtra 10th Result 2024: MSBSHSE SSC Class 10 to be released on May 27, know how to download scorecards![submenu-img]() Odisha Board 10th Result 2024: BSE Odisha Matric Result 2024 date, time announced, check latest update here

Odisha Board 10th Result 2024: BSE Odisha Matric Result 2024 date, time announced, check latest update here![submenu-img]() Meet student who cleared JEE Advanced with AIR 99, then dropped out of IIT counselling due to..

Meet student who cleared JEE Advanced with AIR 99, then dropped out of IIT counselling due to..![submenu-img]() IIT-JEE topper joins IIT Delhi with AIR 1, leaves it after few months without graduation due to...

IIT-JEE topper joins IIT Delhi with AIR 1, leaves it after few months without graduation due to...![submenu-img]() Meet man, tailor's son who sold newspapers to pay fees, cracked UPSC without coaching to become IAS officer, got AIR…

Meet man, tailor's son who sold newspapers to pay fees, cracked UPSC without coaching to become IAS officer, got AIR…![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes

Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes ![submenu-img]() Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'

Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'![submenu-img]() AI models play volley ball on beach in bikini

AI models play volley ball on beach in bikini![submenu-img]() AI models set goals for pool parties in sizzling bikinis this summer

AI models set goals for pool parties in sizzling bikinis this summer![submenu-img]() In pics: Aditi Rao Hydari being 'pocket full of sunshine' at Cannes in floral dress, fans call her 'born aesthetic'

In pics: Aditi Rao Hydari being 'pocket full of sunshine' at Cannes in floral dress, fans call her 'born aesthetic'![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?

DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() Karan Johar announces his next directorial on 52nd birthday, fans say 'please bring back SRK and Kajol'

Karan Johar announces his next directorial on 52nd birthday, fans say 'please bring back SRK and Kajol'![submenu-img]() Meet superstar who faced casting couch at 17, was asked to 'compromise', wear a bikini for shoot, she is now..

Meet superstar who faced casting couch at 17, was asked to 'compromise', wear a bikini for shoot, she is now..![submenu-img]() Meet actor who made superhit debut, then gave 40 flop films, still lives luxurious life, net worth is..

Meet actor who made superhit debut, then gave 40 flop films, still lives luxurious life, net worth is..![submenu-img]() Dalljiet Kaur accuses husband Nikhil Patel of having extramarital affair, seems to confirm separation: 'Family is...'

Dalljiet Kaur accuses husband Nikhil Patel of having extramarital affair, seems to confirm separation: 'Family is...'![submenu-img]() Meet first Indian actress to win acting honour at Cannes; social media changed her life, she is…

Meet first Indian actress to win acting honour at Cannes; social media changed her life, she is…![submenu-img]() Meet woman, who holds Guinness World Record for longest fingernails, hasn't cut them since 1997, she is from...

Meet woman, who holds Guinness World Record for longest fingernails, hasn't cut them since 1997, she is from...![submenu-img]() Viral video: Tourist teeters on edge of Victoria Falls, internet reacts

Viral video: Tourist teeters on edge of Victoria Falls, internet reacts![submenu-img]() Viral video: Fearless cat defends against deadly cobra attack, internet is stunned

Viral video: Fearless cat defends against deadly cobra attack, internet is stunned![submenu-img]() Viral video: Restaurant's green chilli halwa preparation shocks internet, watch

Viral video: Restaurant's green chilli halwa preparation shocks internet, watch![submenu-img]() Viral video: Majestic lion welcomes US photographer with a roaring greeting, watch

Viral video: Majestic lion welcomes US photographer with a roaring greeting, watch

)

)

)

)

)

)