Barack Obama’s plan to revamp tax rules, end the tax deferral system and aggressively collect taxes on corporate foreign earnings sparked a visceral reaction.

US president Barack Obama’s plan to revamp tax rules, end the tax deferral system and aggressively collect taxes on corporate foreign earnings sparked a visceral reaction on Monday from corporate America. It also got a cagey response from Capitol Hill.

The new rules will affect multinationals such as General Electric and Proctor & Gamble and US outsourcers of every stripe. US tech firms which have significant operations in India say they are concerned that they could be hit with a much higher tax bill if deferrals are eliminated.

Rajiv Khanna, partner in legal firm Greenberg Traurig and president of the India-America Chamber of Commerce, said the proposed tax plan attempted to plug the tax arbitrage loophole, but would make doing business more expensive.

“You don’t create economic prosperity in the US by destroying the global competitiveness of American companies,” said Khanna, adding that the Obama plan took unfair aim at outsourcing which helped US firms stay competitive.

“It is the wrong idea, at the wrong time for the wrong reasons,” said John Castellani, president of the Business Roundtable, an association of CEOs of major corporations.

Speaking in the White House on Monday, Obama vowed to push forward with his plan, which would curb overseas tax advantages enjoyed by US firms.

“The US tax code makes it all too easy for a number — a small number of individuals and companies to abuse overseas tax havens to avoid paying any taxes at all,” he said.

Obama contends that the existing system gives US companies an incentive to invest overseas in countries like India rather than create jobs in the US. “It’s a tax code that says you should pay lower taxes if you create a job in Bangalore, India, than if you create one in Buffalo, New York,” Obama said Monday.

US businesses argue the deferral system helps them compete against foreign companies that pay taxes only in the countries where they generate profits.

“The proposals are disastrous. US corporate tax of 35% is one of the highest in the world,” said a senior executive at IBM, which has more than 70,000 employees in India. About 58% of IBM’s revenue now comes from outside North America.

“Ending the deferral system would be an increased expense for US companies. It makes us less competitive against foreign firms who are only subject to one level of tax,” he added.

Under current law, American corporations with subsidiaries in foreign countries can defer paying US taxes on the profits of those subsidiaries until the money is repatriated to the US.

If US companies leave the money overseas, they can avoid American taxes on those profits indefinitely. If the money is brought to the US, corporations can subtract foreign taxes already paid.

Corporate America says the current tax rules are aimed primarily at putting US companies on an “equal tax footing” with international rivals, many of which benefit from favourable tax treatment by their home countries.

It is not a slam-dunk proposal, however. Obama expects a major fight with corporations, lobbyists and their supporters in Congress.

“Deferral has been mischaracterised as a “tax break” but is actually a vital mechanism providing relief for American businesses from double taxation,” said Chamber of Commerce chief economist Marty Regalia.

The Chamber and about 200 big US firms have already signed a petition asking Congress to kill the plan.

![submenu-img]() Viral video: Kind man assists duck family in crossing the road, internet lauds him

Viral video: Kind man assists duck family in crossing the road, internet lauds him![submenu-img]() Can you see the Great Wall of China from space? here's the truth

Can you see the Great Wall of China from space? here's the truth![submenu-img]() Ashutosh Rana breaks silence on his deepfake video supporting a political party: 'I would only be answerable to...'

Ashutosh Rana breaks silence on his deepfake video supporting a political party: 'I would only be answerable to...'![submenu-img]() Meet India's most talented superstar, is actor, dancer, stuntman, singer, lyricist; not Ranbir, Shah Rukh, Aamir, Salman

Meet India's most talented superstar, is actor, dancer, stuntman, singer, lyricist; not Ranbir, Shah Rukh, Aamir, Salman![submenu-img]() This flop film was headlined by star kid, marked south actress's Bollywood debut, made in Rs 120 crore, earned just...

This flop film was headlined by star kid, marked south actress's Bollywood debut, made in Rs 120 crore, earned just...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Aamir Khan, Naseeruddin Shah, Sonali Bendre celebrate 25 years of Sarfarosh, attend film's special screening

Aamir Khan, Naseeruddin Shah, Sonali Bendre celebrate 25 years of Sarfarosh, attend film's special screening![submenu-img]() Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’

Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’![submenu-img]() Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates

Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Ashutosh Rana breaks silence on his deepfake video supporting a political party: 'I would only be answerable to...'

Ashutosh Rana breaks silence on his deepfake video supporting a political party: 'I would only be answerable to...'![submenu-img]() Meet India's most talented superstar, is actor, dancer, stuntman, singer, lyricist; not Ranbir, Shah Rukh, Aamir, Salman

Meet India's most talented superstar, is actor, dancer, stuntman, singer, lyricist; not Ranbir, Shah Rukh, Aamir, Salman![submenu-img]() This flop film was headlined by star kid, marked south actress's Bollywood debut, made in Rs 120 crore, earned just...

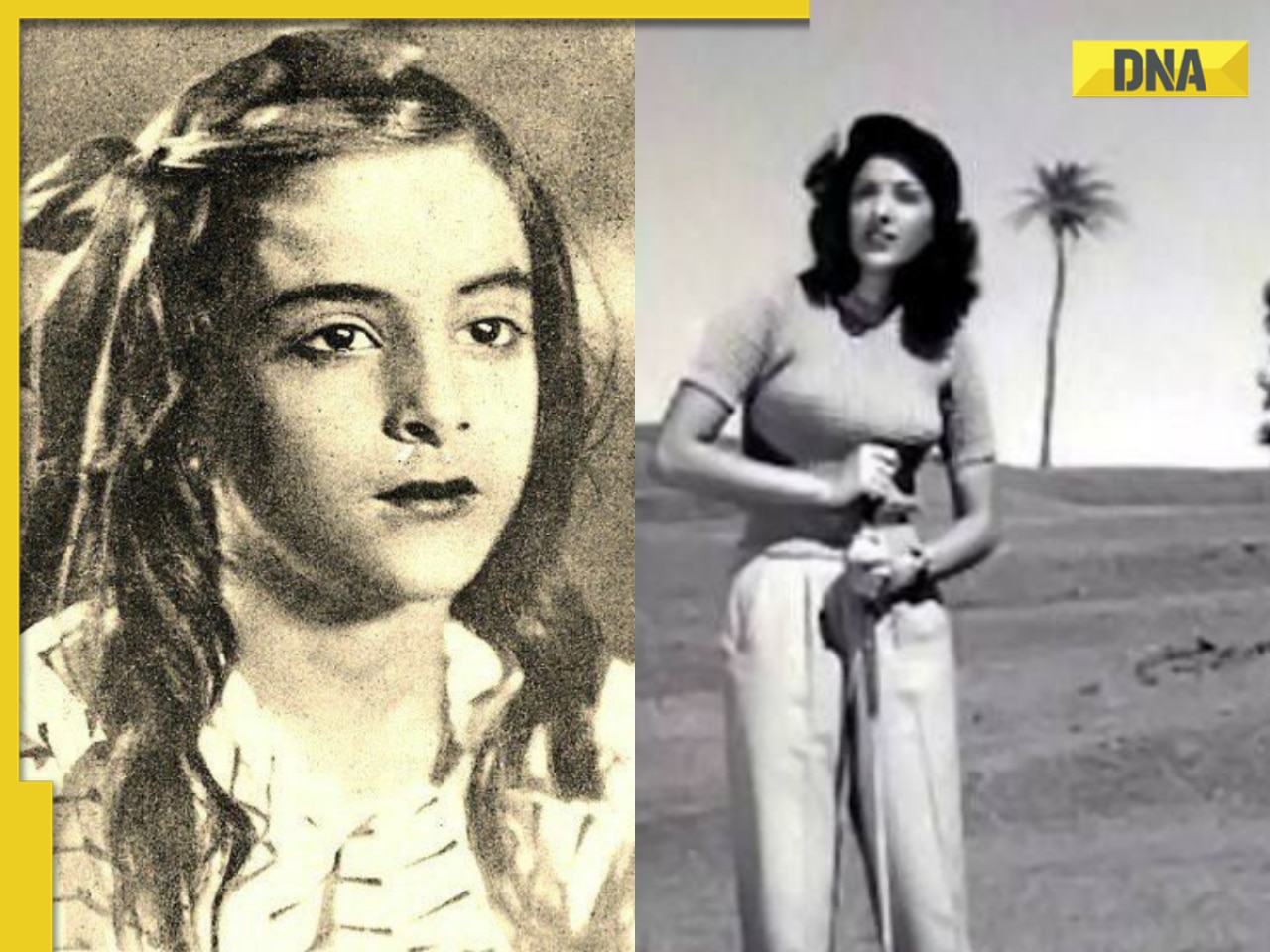

This flop film was headlined by star kid, marked south actress's Bollywood debut, made in Rs 120 crore, earned just...![submenu-img]() India's most successful star kid was superstar at 14, daughter of tawaif, affair with married star broke her, died at...

India's most successful star kid was superstar at 14, daughter of tawaif, affair with married star broke her, died at...![submenu-img]() India's biggest flop actor, worked with superstars, married girl half his age, once left Aamir's film midway due to..

India's biggest flop actor, worked with superstars, married girl half his age, once left Aamir's film midway due to..![submenu-img]() England pace legend James Anderson set to retire from Test cricket after talks with Brendon McCullum

England pace legend James Anderson set to retire from Test cricket after talks with Brendon McCullum![submenu-img]() IPL 2024: Shubman Gill, Sai Sudharsan centuries guide Gujarat Titans to 35-run win over Chennai Super Kings

IPL 2024: Shubman Gill, Sai Sudharsan centuries guide Gujarat Titans to 35-run win over Chennai Super Kings![submenu-img]() KKR vs MI IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

KKR vs MI IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() 'It's ego-driven...': Ex-RCB star on Hardik Pandya's captaincy in IPL 2024

'It's ego-driven...': Ex-RCB star on Hardik Pandya's captaincy in IPL 2024![submenu-img]() BCCI to advertise for Team India's new head coach after T20 World Cup

BCCI to advertise for Team India's new head coach after T20 World Cup![submenu-img]() Viral video: Kind man assists duck family in crossing the road, internet lauds him

Viral video: Kind man assists duck family in crossing the road, internet lauds him![submenu-img]() Can you see the Great Wall of China from space? here's the truth

Can you see the Great Wall of China from space? here's the truth![submenu-img]() Mother bear teaches cubs how to cross a road with caution, video goes viral

Mother bear teaches cubs how to cross a road with caution, video goes viral![submenu-img]() Meet the tawaif, real courtesan of Heeramandi, was once highest paid item girl, was killed by....

Meet the tawaif, real courtesan of Heeramandi, was once highest paid item girl, was killed by....![submenu-img]() Mukesh Ambani’s old image with billionaire friends go viral, Harsh Goenka makes joke of…

Mukesh Ambani’s old image with billionaire friends go viral, Harsh Goenka makes joke of…

)

)

)

)

)

)