Kumar, a senior officer with the Indian Audit and Accounts Service, is on a high these days.

Kumar, a senior officer with the Indian Audit and Accounts Service, is on a high these days. Over the next few months, he expects to bring home a brand new Honda City car as his balance salary arrears under the Sixth Pay Commission are paid out.

Under the revised pay scale applicable to his post, Kumar’s take home has almost doubled. And with arrears being paid from January 1, 2006, he gets a windfall of around Rs 7 lakh over and above the monthly packet. Some 40% of the arrears were paid in October-November, last year. The rest would come in by September this year.

And Kumar isn’t the only one buying a car this year. He can name many in his department who are waiting eagerly, as also several of his friends and training mates in other central government services.

In fact, given the size of the payouts, any central government employee who is not buying a car this year must be looking at buying or building a house, or acquiring some expensive household goods, says Kumar.

The buoyancy isn’t lost on the car manufacturers, who have had several quarters of slowdown now. Many have been running special discount schemes for government and public sector employees with an eye on the arrear payouts and higher salaries.

Market leader Maruti Suzuki has in fact started reaping the benefits of the scheme it launched last year, offering government employees discounts of Rs 7,000-10,000 depending on the model. A spokesperson of the company says the company has sold around 40,000 cars to government employees since last year.

Hyundai is also offering discounts. Rajeev Mitra, head of corporate communications, Hyundai Motors says the company started a scheme in October 2008, applicable on Santro i10, Getz (petrol variant), Accent (executive) and Verna. The discount ranges between Rs 14,000 and Rs 29, 000.

Among others, Honda is offering big discounts, too, and finding takers.

So, if one were to ask how many economic stimuli the Manmohan Singh government has tried giving the economy till date, the answer is four, not three as most people would say.

The hike in salaries of 1.7 crore central government, state government and public sector employees, and increase in pensions of around 1 crore pensioners, who together constitute 11% of households in India, was the first, and by far the biggest economic stimulus, say analysts.

Analysts Nemkumar, Gopal Ritolia and Ashutosh Datar of India Infoline believe the biggest stimuli to both household consumption and savings in financial years 2009 and 2010 will come from the $45 billion (around Rs 2.25 lakh crore) pay hike to government employees based on the recommendations of the Sixth Pay Commission.

If these people go out and spend a portion of this, it may turn out to be a bigger stimulus than the three stimuli the government has officially announced after this, the three analysts write in a February 26 report titled ‘Pay Commission - A serendipitous stimulus’.

Also, since the increase in salaries was backdated (from January 2006), the government had to pay arrears to these employees and pensioners.

Sujan Hajra, chief economist, Anand Rathi says that for the next fiscal, the ball park gross figure for what the central government employees will get paid is Rs 36,000 crore (60% of the payout remaining). “If we assume that state governments will give the same hike as the central government, the payout in their case will be Rs 1,80,000 crore (considering the number of state government employees is many times more).”

Typically, state governments give only 75% of the central government pay most of the times. “But even a Rs 1,35,000 crore package (75% of Rs 1,80,000 crore) is much bigger than the officially announced stimuli. It will add more than 1% of GDP,” says Hajra.

But just what proportion of these arrears will be spent?

Sonal Varma, India economist with Japanese brokerage Nomura International sees a 50:50 split between spending and saving on the arrears.

Arrears are a “good income boost and we could see some impact on sectors like auto, where numbers in January already showed a rise,” says Varma. “Though it is difficult to say how much of it will be spent, government employees don’t have to worry about job losses as much as private employees, so they may spend more.”

And car manufacturers aren’t the only ones seen benefiting. Besides auto, the India Infoline analysts see cement, white goods manufacturers and to some extent FMCG companies benefiting, too.

Among listed auto companies, they expect Maruti, Hero Honda and Bajaj to be the key beneficiaries.

Vaishali Jajoo, analyst with Angel Broking, dittoes.

An analyst with a leading brokerage firm includes jewellery, durables and apparels among the likely gainers from the Pay Commission bonanza. And retailers and paint makers, too.

Ajit Joshi, CEO and managing director, Croma is optimistic.

So is Roli Malhotra, manager- marketing, Sia Lifestyles. “A major chunk will go towards immediate aspirational spends on economical lifestyle solutions, like silver or silver jewellery or art jewellery and garments.”

But the macro uncertainties cannot be lost sight of.

Laveesh Bhandari, economist at Delhi-based Indicus Analytics, says, in times such as these, people may think of saving rather than spending.

Anubhuti Sahay, associate economist at Standard Chartered Bank, says the increase in salary would have led to higher growth and inflation in normal times, but not in the current situation. “Though public sector employees don’t have to worry about job losses, they too will be cautious,” she adds.

![submenu-img]() Meet IIT-JEE topper with AIR 1, son of government school teachers, he went on to pursue...

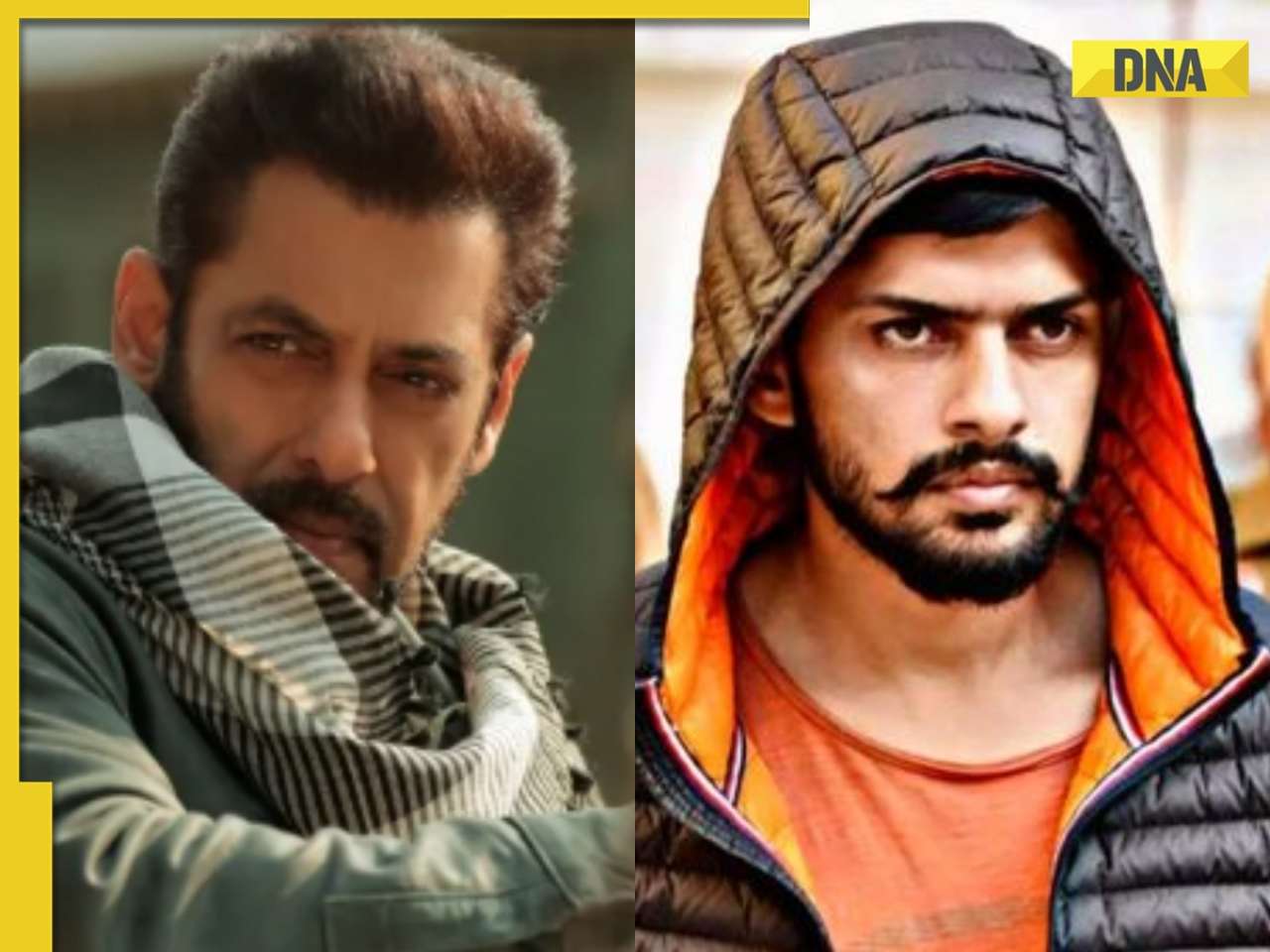

Meet IIT-JEE topper with AIR 1, son of government school teachers, he went on to pursue...![submenu-img]() Salman Khan house firing case: One more Lawrence Bishnoi gang member arrested by Mumbai Police

Salman Khan house firing case: One more Lawrence Bishnoi gang member arrested by Mumbai Police ![submenu-img]() Mukesh Ambani to host Anant-Radhika's second pre-wedding function: Trip to start from Italy with 800 guests and end in..

Mukesh Ambani to host Anant-Radhika's second pre-wedding function: Trip to start from Italy with 800 guests and end in..![submenu-img]() Driver caught on camera running over female toll plaza staff on Delhi-Meerut expressway, watch video

Driver caught on camera running over female toll plaza staff on Delhi-Meerut expressway, watch video![submenu-img]() 'If you come and do something here...': EAM S Jaishankar on India's 'message' against terrorism

'If you come and do something here...': EAM S Jaishankar on India's 'message' against terrorism![submenu-img]() Meet IIT-JEE topper with AIR 1, son of government school teachers, he went on to pursue...

Meet IIT-JEE topper with AIR 1, son of government school teachers, he went on to pursue...![submenu-img]() TN 11th Result 2024: TNDGE Tamil Nadu HSE (+1) result declared, direct link here

TN 11th Result 2024: TNDGE Tamil Nadu HSE (+1) result declared, direct link here![submenu-img]() Meet doctor who cracked UPSC exam with AIR 9 but didn’t became IAS due to…

Meet doctor who cracked UPSC exam with AIR 9 but didn’t became IAS due to…![submenu-img]() TN 11th Result 2024 to be declared today; know how to check

TN 11th Result 2024 to be declared today; know how to check![submenu-img]() Meet man who worked as coolie, studied from railway's WiFi, then cracked UPSC exam to become IAS, secured AIR...

Meet man who worked as coolie, studied from railway's WiFi, then cracked UPSC exam to become IAS, secured AIR...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...

Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...![submenu-img]() Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses

Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses![submenu-img]() Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...

Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...![submenu-img]() In pics: Ram Charan gets mobbed by fans during his visit to Pithapuram for ‘indirect campaign’ for uncle Pawan Kalyan

In pics: Ram Charan gets mobbed by fans during his visit to Pithapuram for ‘indirect campaign’ for uncle Pawan Kalyan![submenu-img]() Streaming This Week: Yodha, Aavesham, Murder In Mahim, Undekhi season 3, latest OTT releases to binge-watch

Streaming This Week: Yodha, Aavesham, Murder In Mahim, Undekhi season 3, latest OTT releases to binge-watch![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Salman Khan house firing case: One more Lawrence Bishnoi gang member arrested by Mumbai Police

Salman Khan house firing case: One more Lawrence Bishnoi gang member arrested by Mumbai Police ![submenu-img]() Meet actress, who got rejected for her looks, had no hit for 15 years; later beat Alia, Deepika, Katrina at box office

Meet actress, who got rejected for her looks, had no hit for 15 years; later beat Alia, Deepika, Katrina at box office![submenu-img]() Abdu Rozik breaks silence on his wedding announcement being called ‘publicity stunt’: ‘The whole world is…’

Abdu Rozik breaks silence on his wedding announcement being called ‘publicity stunt’: ‘The whole world is…’![submenu-img]() Meet actress who made debut with Salman Khan, had super flop career, then got TB, now lives in chawl, runs..

Meet actress who made debut with Salman Khan, had super flop career, then got TB, now lives in chawl, runs..![submenu-img]() Meet actress who worked with Naseeruddin Shah, sister of popular models, is now getting trolled on social media for..

Meet actress who worked with Naseeruddin Shah, sister of popular models, is now getting trolled on social media for..![submenu-img]() Driver caught on camera running over female toll plaza staff on Delhi-Meerut expressway, watch video

Driver caught on camera running over female toll plaza staff on Delhi-Meerut expressway, watch video![submenu-img]() Delhi man takes 200 flights in 110 days, steals lakhs worth of jewelry from passengers

Delhi man takes 200 flights in 110 days, steals lakhs worth of jewelry from passengers![submenu-img]() Viral video: Man makes paratha with 'diesel', internet reacts

Viral video: Man makes paratha with 'diesel', internet reacts![submenu-img]() Viral video of 'black jalebi' leaves internet in shock; netizens say 'hey bhagwan...'

Viral video of 'black jalebi' leaves internet in shock; netizens say 'hey bhagwan...'![submenu-img]() Real-life Bambi and Thumper? Adorable deer and rabbit video melts hearts online

Real-life Bambi and Thumper? Adorable deer and rabbit video melts hearts online

)

)

)

)

)

)