Lou Qijun is one of the many Chinese toy and gift manufacturers who anticipates a visit from Santa Claus every year in the form of seasonal orders from Europe and North America.

BEIJING: Although China does not celebrate Christmas, Lou Qijun is one of the many Chinese toy and gift manufacturers who anticipates a visit from Santa Claus every year in the form of seasonal orders from Europe and North America.

Not so this year, says Lou, chairman of Yiwu Qiling Toys Co. Ltd., a leading toy producer in east China's Yiwu city of Zhejiang province, after returning from the Canton Fair, the country's biggest trade show which concluded late last week.

Lou's Christmas orders from Europe and the United States is down by more than a third. The financial crisis has forced Western families to trim their budgets this Christmas.

Lou says the busy season in Yiwu, a major production base, usually runs from June to October, as big foreign toy companies generally place their Christmas orders months in advance.

"We have not seen a rush of orders so far this year."

Lou and his peers have also been disturbed by cancelled orders. Lou's plant had about eight percent of Christmas tree orders cancelled because many small outlets in Europe and the United States had pulled back orders from intermediary purchasers who signed agreements with Lou.

Lou is one of many toy makers who have fallen victims to the deepening global economic downturn that has gripped the West. Many foreign buyers became extremely cautious this year, either cutting purchases or putting short-term orders, according to a survey by China's ministry of commerce (MOC).

The financial crisis that originated in Wall Street and swept the world has gone beyond the toy sector and bitten into the Chinese economy.

Chinese manufacturers from other export-oriented sectors, textiles, garments and shoes, among others, also felt the pinch of slackening demand. Over the past two months, many labour-intensive factories have shut down, including those run by large Hong Kong-listed manufacturers, leaving massive numbers of workers jobless.

China Customs figures show exports, a major driver of the national economy, at $1.07 trillion in the first three quarters. Although 22.3 percent up from the same period last year, the growth rate was 4.8 percentage points lower.

During the same period, China's GDP growth slowed to 9.9 percent, down 2.3 percentage points from the same period last year and falling to single figures for the first time in five years.

The slowdown of the Chinese economy, the world's fourth largest, is partly due to shrinking demand from abroad and partly to worsening downward pressure from weak domestic demand, a consequence of an inadequate social security system, and higher costs of raw materials and labour, which have hurt corporate investment.

Lingering inflationary pressure reined in domestic demand, experts said. In the nine months from September 2007, the consumer price index (CPI), the main gauge of inflation, had signalled caution.

The CPI rose 4.6 percent in September over the same period last year, the National Bureau of Statistics said. The figure was markedly down from 7.1 percent in June, 6.3 percent in July, 4.9 percent in August and a near 12-year-high of 8.7 percent in February.

"The figure indicated the government's measures to tame inflation were effective, and the inflationary pressure has been greatly eased," said Zhuang Jian, an Asian Development Bank (ADB) economist.

The central bank slashed interest rates for the third time in two months. This was a timely response to the rate cuts by other central banks worldwide and part of a coordinated effort to stem the global financial crisis.

The State Council, or cabinet, also scrapped the five percent individual income tax on savings interest earnings.

To help exporters cope with smaller profit margins, the yuan's appreciation and rising production costs, the government raised tax rebates for a quarter of total exported goods.

The trade surplus shrank 2.6 percent in the first three quarters from a year earlier sapped by weakening foreign demand.

"We have to shift our strategy. We are busy replacing toy packages with Russian notes and we are adjusting products to show Russian styles," said Lou.

He estimates the Russian market has accounted for 30 percent of Christmas gift exports in Yiwu. Exports to the Middle East and Brazil, which are further from the financial turmoil, increased considerably to offset drops to Western Europe and the United States.

"We have to speed up our business in Russia. We will be finished if the Wall Street financial tsunami freezes Russian consumption one day," said Lou.

![submenu-img]() Viral video: Kind man assists duck family in crossing the road, internet lauds him

Viral video: Kind man assists duck family in crossing the road, internet lauds him![submenu-img]() Can you see the Great Wall of China from space? here's the truth

Can you see the Great Wall of China from space? here's the truth![submenu-img]() Ashutosh Rana breaks silence on his deepfake video supporting a political party: 'I would only be answerable to...'

Ashutosh Rana breaks silence on his deepfake video supporting a political party: 'I would only be answerable to...'![submenu-img]() Meet India's most talented superstar, is actor, dancer, stuntman, singer, lyricist; not Ranbir, Shah Rukh, Aamir, Salman

Meet India's most talented superstar, is actor, dancer, stuntman, singer, lyricist; not Ranbir, Shah Rukh, Aamir, Salman![submenu-img]() This flop film was headlined by star kid, marked south actress's Bollywood debut, made in Rs 120 crore, earned just...

This flop film was headlined by star kid, marked south actress's Bollywood debut, made in Rs 120 crore, earned just...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Aamir Khan, Naseeruddin Shah, Sonali Bendre celebrate 25 years of Sarfarosh, attend film's special screening

Aamir Khan, Naseeruddin Shah, Sonali Bendre celebrate 25 years of Sarfarosh, attend film's special screening![submenu-img]() Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’

Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’![submenu-img]() Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates

Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Ashutosh Rana breaks silence on his deepfake video supporting a political party: 'I would only be answerable to...'

Ashutosh Rana breaks silence on his deepfake video supporting a political party: 'I would only be answerable to...'![submenu-img]() Meet India's most talented superstar, is actor, dancer, stuntman, singer, lyricist; not Ranbir, Shah Rukh, Aamir, Salman

Meet India's most talented superstar, is actor, dancer, stuntman, singer, lyricist; not Ranbir, Shah Rukh, Aamir, Salman![submenu-img]() This flop film was headlined by star kid, marked south actress's Bollywood debut, made in Rs 120 crore, earned just...

This flop film was headlined by star kid, marked south actress's Bollywood debut, made in Rs 120 crore, earned just...![submenu-img]() India's most successful star kid was superstar at 14, daughter of tawaif, affair with married star broke her, died at...

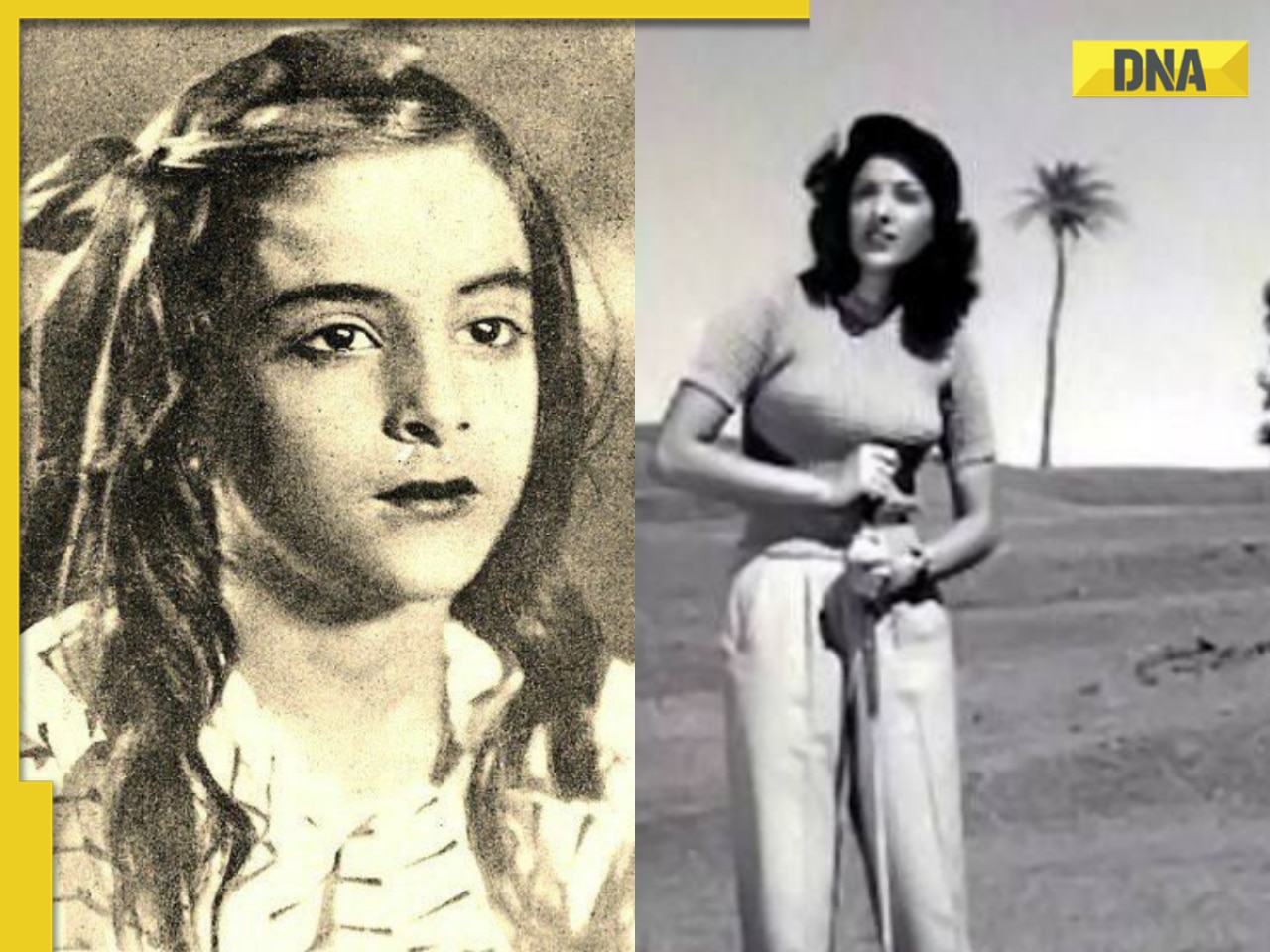

India's most successful star kid was superstar at 14, daughter of tawaif, affair with married star broke her, died at...![submenu-img]() India's biggest flop actor, worked with superstars, married girl half his age, once left Aamir's film midway due to..

India's biggest flop actor, worked with superstars, married girl half his age, once left Aamir's film midway due to..![submenu-img]() England pace legend James Anderson set to retire from Test cricket after talks with Brendon McCullum

England pace legend James Anderson set to retire from Test cricket after talks with Brendon McCullum![submenu-img]() IPL 2024: Shubman Gill, Sai Sudharsan centuries guide Gujarat Titans to 35-run win over Chennai Super Kings

IPL 2024: Shubman Gill, Sai Sudharsan centuries guide Gujarat Titans to 35-run win over Chennai Super Kings![submenu-img]() KKR vs MI IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

KKR vs MI IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() 'It's ego-driven...': Ex-RCB star on Hardik Pandya's captaincy in IPL 2024

'It's ego-driven...': Ex-RCB star on Hardik Pandya's captaincy in IPL 2024![submenu-img]() BCCI to advertise for Team India's new head coach after T20 World Cup

BCCI to advertise for Team India's new head coach after T20 World Cup![submenu-img]() Viral video: Kind man assists duck family in crossing the road, internet lauds him

Viral video: Kind man assists duck family in crossing the road, internet lauds him![submenu-img]() Can you see the Great Wall of China from space? here's the truth

Can you see the Great Wall of China from space? here's the truth![submenu-img]() Mother bear teaches cubs how to cross a road with caution, video goes viral

Mother bear teaches cubs how to cross a road with caution, video goes viral![submenu-img]() Meet the tawaif, real courtesan of Heeramandi, was once highest paid item girl, was killed by....

Meet the tawaif, real courtesan of Heeramandi, was once highest paid item girl, was killed by....![submenu-img]() Mukesh Ambani’s old image with billionaire friends go viral, Harsh Goenka makes joke of…

Mukesh Ambani’s old image with billionaire friends go viral, Harsh Goenka makes joke of…

)

)

)

)

)

)