Despite all the uncertainties related to spectrum availability, the government is targeting revenue worth Rs 30,000 crore to Rs 40,000 crore from 3G and wireless broadband auctions.

NEW DLEHI; In the backdrop of scarce spectrum or airwave, the government has announced a global auction policy for 3G (third generation) telecom and wireless broadband services, all on the condition of availability.

Union communications minister A Raja said on Friday the number of operators in a circle or a service area offering 3G could go up to 10, while the initial number will be 5. He added that the number of operators would be subject to availability of spectrum.

Despite all the uncertainties related to spectrum availability, the government is targeting revenue worth Rs 30,000 crore to Rs 40,000 crore from 3G and wireless broadband auctions.

Delhi and Mumbai, the two most happening telecom markets in India, for instance, cannot accommodate more than 2 to 3 telcos offering 3G services, out of which one slot will certainly go to Mahanagar Telephone Nigam Ltd (MTNL).

Realistically speaking, Delhi and Mumbai cannot have more than one private operator each for 3G, where the demand for the service is expected to be maximum.

The other telecom PSU, Bharat Sanchar Nigam Ltd (BSNL), would get a reserved 3G slot across the country except in Delhi and Mumbai.

Raja admitted that, while pointing out that most other circles (except Delhi and Mumbai) could have 3 to 5 operators in “the near future”. And the number could go up to 10, if more spectrum is available.

When asked about the status of spectrum availability with the Department of Telecommunications (DoT), Raja failed to come up with a clear answer.

He only said that effort is on to get unused spectrum vacated from defence forces and space agencies.

The National Security Advisor, Raja said, was advising the defence ministry on the matter, and that within two months the issue could be resolved.

However, the defence ministry’s stand is that an alternate communications system should be in place for the forces (army, navy and air force) before it could vacate any spectrum.

But, DoT is insisting on phased vacation of spectrum after an alternate network for the

air force is in place.

It is learnt that there hasn’t been much interaction between the defence ministry and DoT over the matter in the recent months.

According to DoT officials, the 3G global auction could be completed over the next four months. Players like Bharti are saying that they could roll out 3G services within 6 months after grant of spectrum.

Going by the DoT version, the 3G auction process will be completed by the end of this year, and that should be the timeframe for spectrum allocation as well.

So, by June 2009, many players like Bharti could be ready to roll out services. The current UPA government’s regime would come to an end around April-May 2009.

For the global auction, the reserve price for pan-India 3G licence has been kept at Rs 2,020 crore.

While for the A circle cities and towns (Delhi, Mumbai, Maharashtra, Gujarat, Andhra Pradesh, Karnataka, Tamil Nadu) the reserve price is Rs 160 crore each, that for B circle (Kolkata, Kerala, Punjab, Haryana, UP (West), UP (East), Rajasthan, Madhya Pradesh and West Bengal) it is Rs 80 crore each. For C circle towns (Himachal, Bihar, Orissa, Assam, North East and Jammu and Kashmir), the reserve price has been kept at Rs 30 crore each.

Spectrum in the 2.1 GHz band would be allocated for 3G services.

For broadband wireless services, the reserve price for auction would be 25% of the 3G price.

Separate auction would be conducted for each telecom service area or circle by a specialized agency. For both 3G and broadband, the highest bid price has to be matched by all successful players in a circle.

Besides existing telecom players in fixed telephony and 2G mobile services, new and foreign players will also be allowed to bid. The new players should have 3G experience in some part of the globe. Also, the new players have to pay an entry fee equivalent to the Unified Access Service Licence (UASL) currently at Rs 1,650 crore for a pan-India presence. The recent entrants in the telecom space like Swan, Videocon and Unitech would be permitted to bid for 3G as they already have the UASL licence.

While there wont be any spectrum usage charge in the first year of 3G operations, thereon 1 per cent of the AGR would have to be paid to the government. DoT has fixed rollout obligations and penalty for spectrum hoarding as well. The 3G licence would be for a period of 20 years.

But, the government has made it clear that it reserves the right to amend or modify these terms and conditions before the commencement of the auction process. And, the final conditions shall be indicated in the bidding document.

CDMA Development Group (CDG) India country head B V Raman said, “We welcome DOT’s decision to open internationally harmonised bands, namely 450, 1900 & 2100 MHz. bands for 3G services. CDG also hopes that the DOT will make spectrum available in the 450 & 1900 MHz. bands for auction at the earliest.” CDMA represents players like Reliance Communications and Tata Teleservices.

GSMA, the global trade body for the mobile industry, and the Cellular Operators Association of India (COAI), have welcomed the government’s plans to award licenses for 3G spectrum via an auction and to automatically extend the underlying 2G licenses to make them co-terminous with the 3G allocations.

“The Indian Government’s 3G policy is a fair and transparent way of allocating additional spectrum amongst the Indian service providers. Furthermore, the automatic extension of the underlying 2G licences will ensure continuity and stability of service and is in the interest of Indian consumers,” they said. GSM players include Bharti, Vodafone, BSNL, Idea and Aircel.

![submenu-img]() Meet IIT-JEE topper with AIR 1, son of government school teachers, he went on to pursue...

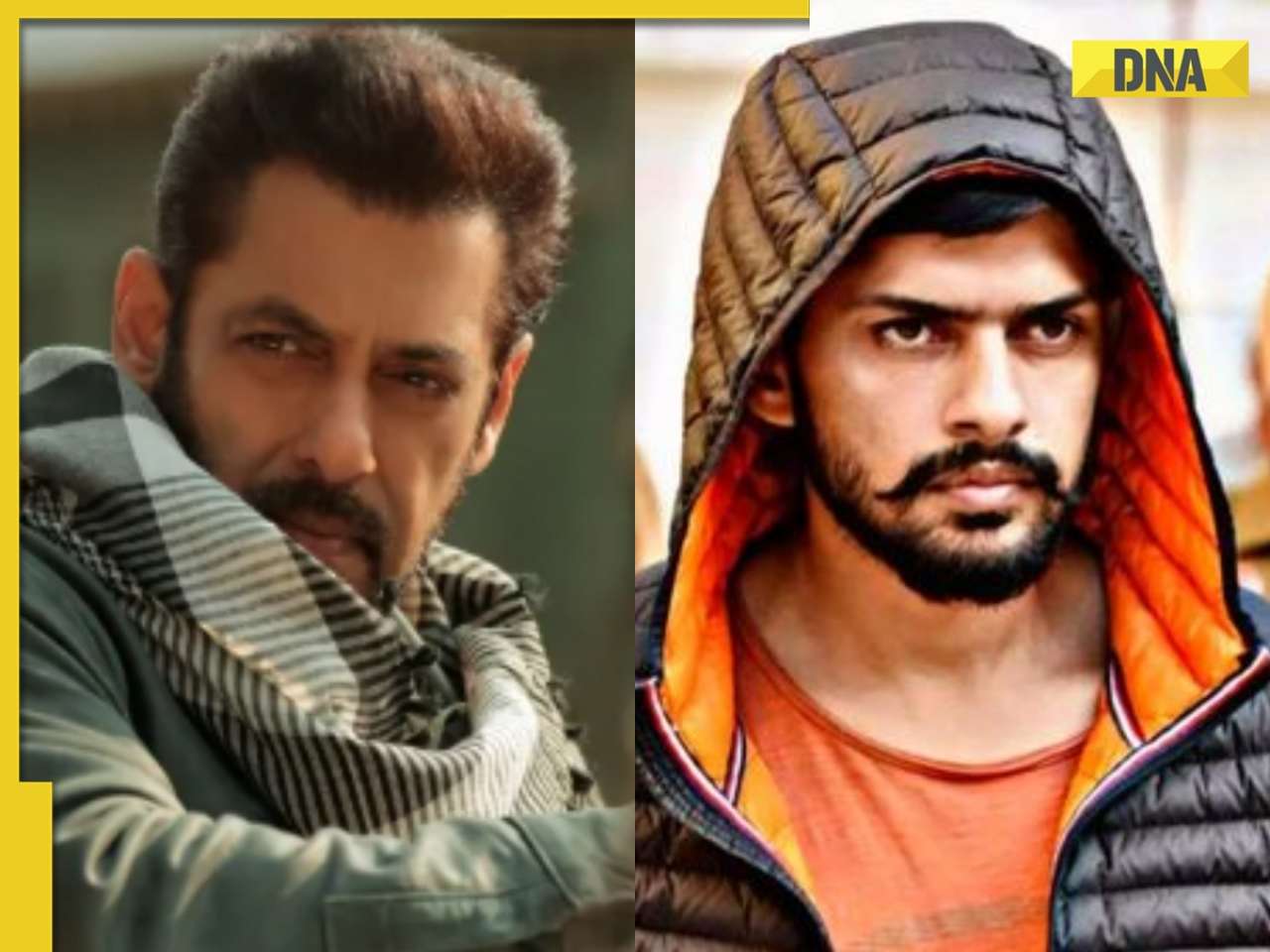

Meet IIT-JEE topper with AIR 1, son of government school teachers, he went on to pursue...![submenu-img]() Salman Khan house firing case: One more Lawrence Bishnoi gang member arrested by Mumbai Police

Salman Khan house firing case: One more Lawrence Bishnoi gang member arrested by Mumbai Police ![submenu-img]() Mukesh Ambani to host Anant-Radhika's second pre-wedding function: Trip to start from Italy with 800 guests and end in..

Mukesh Ambani to host Anant-Radhika's second pre-wedding function: Trip to start from Italy with 800 guests and end in..![submenu-img]() Driver caught on camera running over female toll plaza staff on Delhi-Meerut expressway, watch video

Driver caught on camera running over female toll plaza staff on Delhi-Meerut expressway, watch video![submenu-img]() 'If you come and do something here...': EAM S Jaishankar on India's 'message' against terrorism

'If you come and do something here...': EAM S Jaishankar on India's 'message' against terrorism![submenu-img]() Meet IIT-JEE topper with AIR 1, son of government school teachers, he went on to pursue...

Meet IIT-JEE topper with AIR 1, son of government school teachers, he went on to pursue...![submenu-img]() TN 11th Result 2024: TNDGE Tamil Nadu HSE (+1) result declared, direct link here

TN 11th Result 2024: TNDGE Tamil Nadu HSE (+1) result declared, direct link here![submenu-img]() Meet doctor who cracked UPSC exam with AIR 9 but didn’t became IAS due to…

Meet doctor who cracked UPSC exam with AIR 9 but didn’t became IAS due to…![submenu-img]() TN 11th Result 2024 to be declared today; know how to check

TN 11th Result 2024 to be declared today; know how to check![submenu-img]() Meet man who worked as coolie, studied from railway's WiFi, then cracked UPSC exam to become IAS, secured AIR...

Meet man who worked as coolie, studied from railway's WiFi, then cracked UPSC exam to become IAS, secured AIR...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...

Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...![submenu-img]() Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses

Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses![submenu-img]() Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...

Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...![submenu-img]() In pics: Ram Charan gets mobbed by fans during his visit to Pithapuram for ‘indirect campaign’ for uncle Pawan Kalyan

In pics: Ram Charan gets mobbed by fans during his visit to Pithapuram for ‘indirect campaign’ for uncle Pawan Kalyan![submenu-img]() Streaming This Week: Yodha, Aavesham, Murder In Mahim, Undekhi season 3, latest OTT releases to binge-watch

Streaming This Week: Yodha, Aavesham, Murder In Mahim, Undekhi season 3, latest OTT releases to binge-watch![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Salman Khan house firing case: One more Lawrence Bishnoi gang member arrested by Mumbai Police

Salman Khan house firing case: One more Lawrence Bishnoi gang member arrested by Mumbai Police ![submenu-img]() Meet actress, who got rejected for her looks, had no hit for 15 years; later beat Alia, Deepika, Katrina at box office

Meet actress, who got rejected for her looks, had no hit for 15 years; later beat Alia, Deepika, Katrina at box office![submenu-img]() Abdu Rozik breaks silence on his wedding announcement being called ‘publicity stunt’: ‘The whole world is…’

Abdu Rozik breaks silence on his wedding announcement being called ‘publicity stunt’: ‘The whole world is…’![submenu-img]() Meet actress who made debut with Salman Khan, had super flop career, then got TB, now lives in chawl, runs..

Meet actress who made debut with Salman Khan, had super flop career, then got TB, now lives in chawl, runs..![submenu-img]() Meet actress who worked with Naseeruddin Shah, sister of popular models, is now getting trolled on social media for..

Meet actress who worked with Naseeruddin Shah, sister of popular models, is now getting trolled on social media for..![submenu-img]() Driver caught on camera running over female toll plaza staff on Delhi-Meerut expressway, watch video

Driver caught on camera running over female toll plaza staff on Delhi-Meerut expressway, watch video![submenu-img]() Delhi man takes 200 flights in 110 days, steals lakhs worth of jewelry from passengers

Delhi man takes 200 flights in 110 days, steals lakhs worth of jewelry from passengers![submenu-img]() Viral video: Man makes paratha with 'diesel', internet reacts

Viral video: Man makes paratha with 'diesel', internet reacts![submenu-img]() Viral video of 'black jalebi' leaves internet in shock; netizens say 'hey bhagwan...'

Viral video of 'black jalebi' leaves internet in shock; netizens say 'hey bhagwan...'![submenu-img]() Real-life Bambi and Thumper? Adorable deer and rabbit video melts hearts online

Real-life Bambi and Thumper? Adorable deer and rabbit video melts hearts online

)

)

)

)

)

)