The Indian markets had entered last week on a high note after a strong closing the previous week, only to witness profit-taking.

The Indian markets had entered last week on a high note after a strong closing the previous week, only to witness profit-taking.

The benchmark Nifty fell over 200 points to close at around 4,715. The Nifty April futures added some short positions as the open interest (OI) rose by over 4.3 lakh units and the premium fell substantially.

The market witnessed high volatility during the first 2 days with the Nifty moving in an intraday range of over 5%. The build-up of shorts on Monday resulted in the Nifty falling on Tuesday and touching a low of around 4,625.

But, at these levels, the cost of carry (CoC) in the Nifty futures witnessed a steep rise, with the OI rising by over 5 million shares, indicating strong support for the Nifty. The rise in OI also indicates the confidence of market players to go long at these levels.

Globally, things were steady as the US market showed its strength notwithstanding the data that came in during the week. News like the fresh issues of Lehman Bros and UBS being underwritten the same day has resulted in investor confidence returning to the markets. The Dow was up nearly 400 points on Tuesday.

Backed by buoyant global markets, the Indian markets also opened with a strong gap, but surrendered all the gains on account of profit booking. The 4,950-5,000 levels seem to be a strong barrier for the Nifty to cross. One could say this because the CoC for the Nifty futures starts decreasing near these levels with the OI shedding indicating long unwinding.

The Nifty almost gave flat closings on Wednesday and Thursday with high intraday volatility and finally succumbed to across-the-board selling pressure on Friday after the announcement of the inflation numbers.

The rising inflation resulted in fear amongst investors of a possible rate hike and what followed was selling in the banking stocks, which were strong most of the week, backed by strength in the US financials.

On the stocks front, FMCG continued to impress with huge long positions getting built. IT stocks, which witnessed some profit taking during the initial days of the week, recovered strongly. Among the refining stocks, RPL witnessed strong build-ups on the long side.

The OI for RPL April futures rose over 18% during the week to 46.4 million shares. Index heavyweight ONGC also witnessed strong build-ups and moved to touch the Rs1,060 levels before witnessing profit booking. Capital goods major Bhel witnessed heavy shorts getting built after the quarterly numbers reported were found to be below expectations.

We believe that range trading would continue in the coming weeks before any fundamental trigger results in the range getting broken. The range would ideally be 4,600-4,950. On an intraday basis, Nifty can test the 4,500 levels.

We are positive on the FMCG majors like Hind Unilever and Colgate. We might also see positive movements in RPL, ONGC. Bhel, which witnessed heavy short buildup, can see some short covering taking place.

The author is head, derivatives and strategy, PINC Research

![submenu-img]() MS Dhoni steps out to cast his vote for Lok Sabha polls in Ranchi, crowd goes crazy - Watch

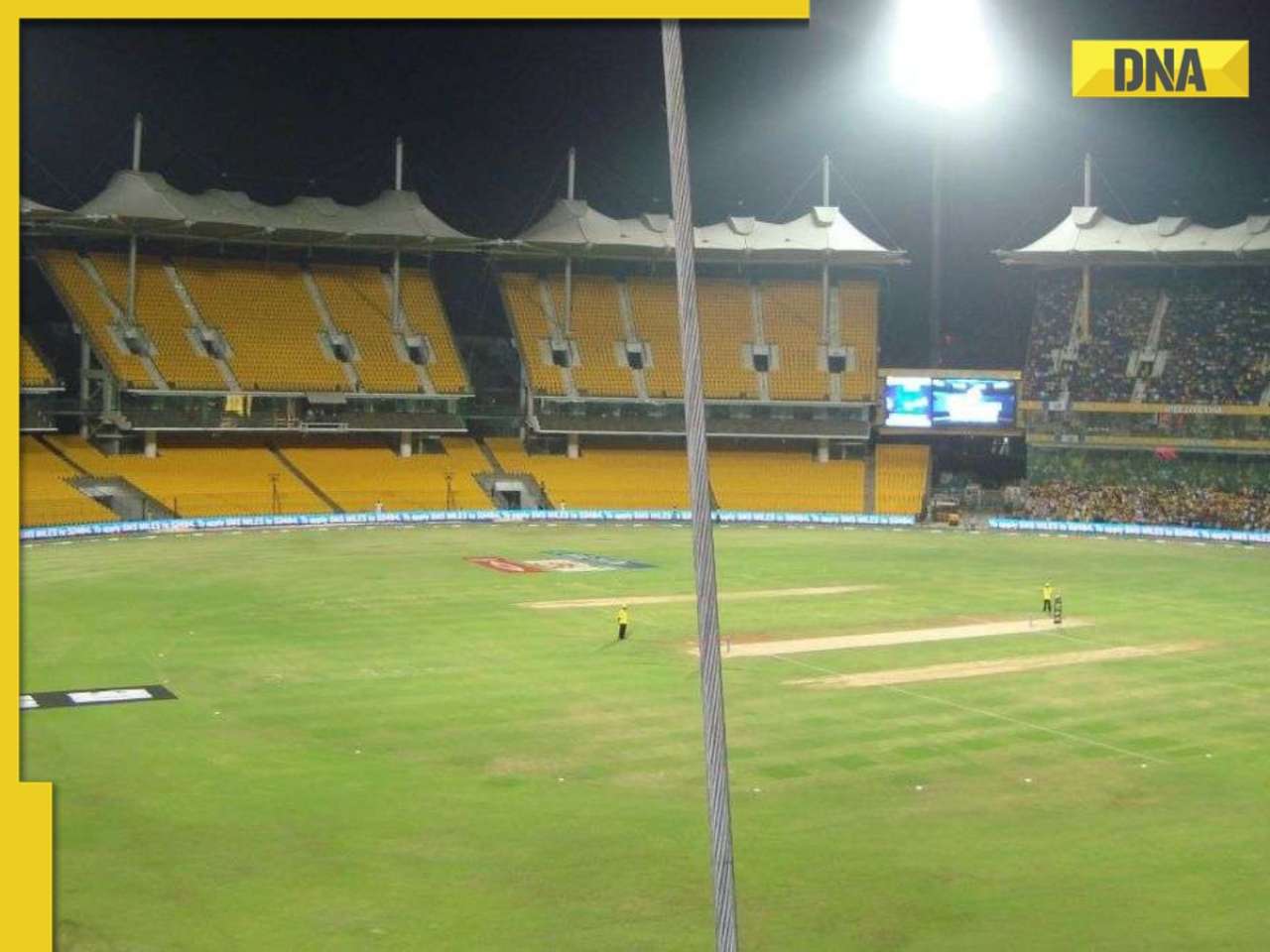

MS Dhoni steps out to cast his vote for Lok Sabha polls in Ranchi, crowd goes crazy - Watch![submenu-img]() KKR vs SRH, IPL 2024 Final: Will rain play spoilsport in Chennai? Here's weather forecast for May 26

KKR vs SRH, IPL 2024 Final: Will rain play spoilsport in Chennai? Here's weather forecast for May 26![submenu-img]() Karan Johar announces his next directorial on 52nd birthday, fans say 'please bring back SRK and Kajol'

Karan Johar announces his next directorial on 52nd birthday, fans say 'please bring back SRK and Kajol'![submenu-img]() Meet woman, who holds Guinness World Record for longest fingernails, hasn't cut them since 1997, she is from...

Meet woman, who holds Guinness World Record for longest fingernails, hasn't cut them since 1997, she is from...![submenu-img]() Maharashtra 10th Result 2024: MSBSHSE SSC Class 10 to be released on May 27, know how to download scorecards

Maharashtra 10th Result 2024: MSBSHSE SSC Class 10 to be released on May 27, know how to download scorecards![submenu-img]() Maharashtra 10th Result 2024: MSBSHSE SSC Class 10 to be released on May 27, know how to download scorecards

Maharashtra 10th Result 2024: MSBSHSE SSC Class 10 to be released on May 27, know how to download scorecards![submenu-img]() Odisha Board 10th Result 2024: BSE Odisha Matric Result 2024 date, time announced, check latest update here

Odisha Board 10th Result 2024: BSE Odisha Matric Result 2024 date, time announced, check latest update here![submenu-img]() Meet student who cleared JEE Advanced with AIR 99, then dropped out of IIT counselling due to..

Meet student who cleared JEE Advanced with AIR 99, then dropped out of IIT counselling due to..![submenu-img]() IIT-JEE topper joins IIT Delhi with AIR 1, leaves it after few months without graduation due to...

IIT-JEE topper joins IIT Delhi with AIR 1, leaves it after few months without graduation due to...![submenu-img]() Meet man, tailor's son who sold newspapers to pay fees, cracked UPSC without coaching to become IAS officer, got AIR…

Meet man, tailor's son who sold newspapers to pay fees, cracked UPSC without coaching to become IAS officer, got AIR…![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes

Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes ![submenu-img]() Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'

Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'![submenu-img]() AI models play volley ball on beach in bikini

AI models play volley ball on beach in bikini![submenu-img]() AI models set goals for pool parties in sizzling bikinis this summer

AI models set goals for pool parties in sizzling bikinis this summer![submenu-img]() In pics: Aditi Rao Hydari being 'pocket full of sunshine' at Cannes in floral dress, fans call her 'born aesthetic'

In pics: Aditi Rao Hydari being 'pocket full of sunshine' at Cannes in floral dress, fans call her 'born aesthetic'![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?

DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() Karan Johar announces his next directorial on 52nd birthday, fans say 'please bring back SRK and Kajol'

Karan Johar announces his next directorial on 52nd birthday, fans say 'please bring back SRK and Kajol'![submenu-img]() Meet superstar who faced casting couch at 17, was asked to 'compromise', wear a bikini for shoot, she is now..

Meet superstar who faced casting couch at 17, was asked to 'compromise', wear a bikini for shoot, she is now..![submenu-img]() Meet actor who made superhit debut, then gave 40 flop films, still lives luxurious life, net worth is..

Meet actor who made superhit debut, then gave 40 flop films, still lives luxurious life, net worth is..![submenu-img]() Dalljiet Kaur accuses husband Nikhil Patel of having extramarital affair, seems to confirm separation: 'Family is...'

Dalljiet Kaur accuses husband Nikhil Patel of having extramarital affair, seems to confirm separation: 'Family is...'![submenu-img]() Meet first Indian actress to win acting honour at Cannes; social media changed her life, she is…

Meet first Indian actress to win acting honour at Cannes; social media changed her life, she is…![submenu-img]() Meet woman, who holds Guinness World Record for longest fingernails, hasn't cut them since 1997, she is from...

Meet woman, who holds Guinness World Record for longest fingernails, hasn't cut them since 1997, she is from...![submenu-img]() Viral video: Tourist teeters on edge of Victoria Falls, internet reacts

Viral video: Tourist teeters on edge of Victoria Falls, internet reacts![submenu-img]() Viral video: Fearless cat defends against deadly cobra attack, internet is stunned

Viral video: Fearless cat defends against deadly cobra attack, internet is stunned![submenu-img]() Viral video: Restaurant's green chilli halwa preparation shocks internet, watch

Viral video: Restaurant's green chilli halwa preparation shocks internet, watch![submenu-img]() Viral video: Majestic lion welcomes US photographer with a roaring greeting, watch

Viral video: Majestic lion welcomes US photographer with a roaring greeting, watch

)

)

)

)

)

)