MTN, which has seen about 60 per cent jump in its shares in the past one year on speculations of a possible buyout, advised its shareholders to exercise caution while dealing in its shares.

NEW DELHI: South African telecom firm MTN, which has seen about 60 per cent jump in its shares in the past one year on speculations of a possible buyout, on Monday advised its shareholders to exercise caution while dealing in its shares.

In a cautionary announcement on the Johannesburg stock exchange, MTN said, "Shareholders are advised to continue to exercise caution when dealing in the company's securities until a further announcement is made."

The company has made the cautionary announcement following it being approached by the Reliance Communications with regards to a potential business combination between the two.

"MTN has agreed to enter into exclusive negotiations for a period of up to 45 days in respect of such potential combination. There is no certainty that these discussions will result in a transaction," the company said.

The scrip was trading at down 7.2 per cent at 144.70 South African rands on the Johannesburg Stock Exchange in the morning trade.

MTN shares had dropped by 0.5 per cent on Friday to 156.2 South African rands, pulling the company's market capitalisation to close to 290 billion rands ($37.9 billion). The share price had risen to a high of 160 rands amid talks with Bharti, giving it a market capitalisation of close to $40 billion.

From the time when MTN and Bharti first disclosed being engaged in talks for a possible deal earlier this month, the shares of South African firm had gained by over 20 per cent -- adding close to 10 billion dollars to the company's market value to near $40 billion.

The MTN stock was trading nearly 130 rands a share before the reports started surfacing about a potential acquisition by Bharti Airtel. At that time, the company's market cap stood at near $31 billion.

MTN shares have surged by close to 60 per cent in the past one year, partly due to robust financial results of the company, but mostly on the back of consistent rumours about its acquisition by a foreign entity.

Prior to the latest round of talks with India's Bharti, the stock had earlier peaked after China Mobile was rumoured to be preparing a bid for MTN. However, those rumours proved to be a damp squib.

Even amidst Bharti and MTN being engaged in talks, rumours had surfaced about rival bids being launched by other entities, including India's Reliance Communications, China Mobile, Indian-origin Arun Sarin-led British telecom giant Vodafone, Egypt's Orascom, UAE's Etisalat, Germany's Deutsche Telekom and Russia's Vimpelcom.

However, all these rumours came to nothing with all the rumoured suitors mostly denying any such move.

![submenu-img]() MS Dhoni steps out to cast his vote for Lok Sabha polls in Ranchi, crowd goes crazy - Watch

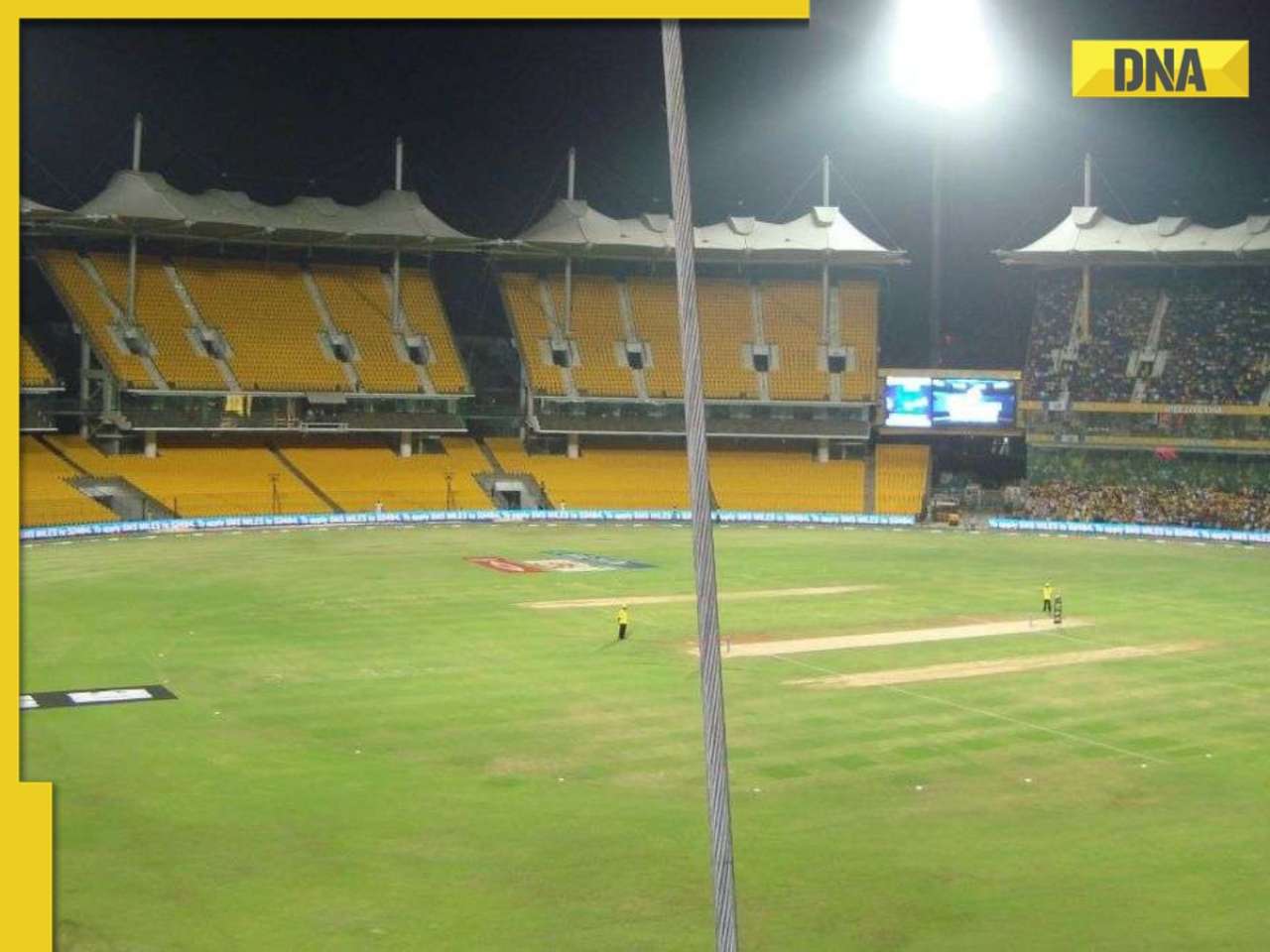

MS Dhoni steps out to cast his vote for Lok Sabha polls in Ranchi, crowd goes crazy - Watch![submenu-img]() KKR vs SRH, IPL 2024 Final: Will rain play spoilsport in Chennai? Here's weather forecast for May 26

KKR vs SRH, IPL 2024 Final: Will rain play spoilsport in Chennai? Here's weather forecast for May 26![submenu-img]() Karan Johar announces his next directorial on 52nd birthday, fans say 'please bring back SRK and Kajol'

Karan Johar announces his next directorial on 52nd birthday, fans say 'please bring back SRK and Kajol'![submenu-img]() Meet woman, who holds Guinness World Record for longest fingernails, hasn't cut them since 1997, she is from...

Meet woman, who holds Guinness World Record for longest fingernails, hasn't cut them since 1997, she is from...![submenu-img]() Maharashtra 10th Result 2024: MSBSHSE SSC Class 10 to be released on May 27, know how to download scorecards

Maharashtra 10th Result 2024: MSBSHSE SSC Class 10 to be released on May 27, know how to download scorecards![submenu-img]() Maharashtra 10th Result 2024: MSBSHSE SSC Class 10 to be released on May 27, know how to download scorecards

Maharashtra 10th Result 2024: MSBSHSE SSC Class 10 to be released on May 27, know how to download scorecards![submenu-img]() Odisha Board 10th Result 2024: BSE Odisha Matric Result 2024 date, time announced, check latest update here

Odisha Board 10th Result 2024: BSE Odisha Matric Result 2024 date, time announced, check latest update here![submenu-img]() Meet student who cleared JEE Advanced with AIR 99, then dropped out of IIT counselling due to..

Meet student who cleared JEE Advanced with AIR 99, then dropped out of IIT counselling due to..![submenu-img]() IIT-JEE topper joins IIT Delhi with AIR 1, leaves it after few months without graduation due to...

IIT-JEE topper joins IIT Delhi with AIR 1, leaves it after few months without graduation due to...![submenu-img]() Meet man, tailor's son who sold newspapers to pay fees, cracked UPSC without coaching to become IAS officer, got AIR…

Meet man, tailor's son who sold newspapers to pay fees, cracked UPSC without coaching to become IAS officer, got AIR…![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes

Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes ![submenu-img]() Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'

Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'![submenu-img]() AI models play volley ball on beach in bikini

AI models play volley ball on beach in bikini![submenu-img]() AI models set goals for pool parties in sizzling bikinis this summer

AI models set goals for pool parties in sizzling bikinis this summer![submenu-img]() In pics: Aditi Rao Hydari being 'pocket full of sunshine' at Cannes in floral dress, fans call her 'born aesthetic'

In pics: Aditi Rao Hydari being 'pocket full of sunshine' at Cannes in floral dress, fans call her 'born aesthetic'![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?

DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() Karan Johar announces his next directorial on 52nd birthday, fans say 'please bring back SRK and Kajol'

Karan Johar announces his next directorial on 52nd birthday, fans say 'please bring back SRK and Kajol'![submenu-img]() Meet superstar who faced casting couch at 17, was asked to 'compromise', wear a bikini for shoot, she is now..

Meet superstar who faced casting couch at 17, was asked to 'compromise', wear a bikini for shoot, she is now..![submenu-img]() Meet actor who made superhit debut, then gave 40 flop films, still lives luxurious life, net worth is..

Meet actor who made superhit debut, then gave 40 flop films, still lives luxurious life, net worth is..![submenu-img]() Dalljiet Kaur accuses husband Nikhil Patel of having extramarital affair, seems to confirm separation: 'Family is...'

Dalljiet Kaur accuses husband Nikhil Patel of having extramarital affair, seems to confirm separation: 'Family is...'![submenu-img]() Meet first Indian actress to win acting honour at Cannes; social media changed her life, she is…

Meet first Indian actress to win acting honour at Cannes; social media changed her life, she is…![submenu-img]() Meet woman, who holds Guinness World Record for longest fingernails, hasn't cut them since 1997, she is from...

Meet woman, who holds Guinness World Record for longest fingernails, hasn't cut them since 1997, she is from...![submenu-img]() Viral video: Tourist teeters on edge of Victoria Falls, internet reacts

Viral video: Tourist teeters on edge of Victoria Falls, internet reacts![submenu-img]() Viral video: Fearless cat defends against deadly cobra attack, internet is stunned

Viral video: Fearless cat defends against deadly cobra attack, internet is stunned![submenu-img]() Viral video: Restaurant's green chilli halwa preparation shocks internet, watch

Viral video: Restaurant's green chilli halwa preparation shocks internet, watch![submenu-img]() Viral video: Majestic lion welcomes US photographer with a roaring greeting, watch

Viral video: Majestic lion welcomes US photographer with a roaring greeting, watch

)

)

)

)

)

)