The announcement came at an interactive session organised for the round even as the last day for submission of bids has been pushed from April 11 to April 25.

NEW DELHI: While the interpretation of Section 80-IB of the Income-Tax (I-T) Act for the oil and gas sector has still not become clear for the industry, the ministry of petroleum and natural gas on Monday said that it would press for getting a clarification from the ministry of finance on it before the close of bidding for the seventh round of New Exploration and Licensing Policy (NELP).

The announcement came at an interactive session organised for the round even as the last day for submission of bids has been pushed from April 11 to April 25.

“We have revised the schedule for promotional road shows in Singapore and Australia. The road show in Singapore will now be held on March 28, and the one in Perth on March 31.

This leaves very little time for companies to evaluate data and take a bid so the bid closing date has been postponed,” said Anil Jain, joint secretary (exploration), ministry of petroleum and natural gas at the session.

The government has offered 57 oil and gas blocks, including 19 in deep sea, 29 on land and nine in shallow water areas in the seventh round. It will complete the bid evaluation, award and signing of production sharing contract by July-August.

Finance minister P Chidambaram, through the Finance Bill and an accompanying memorandum tabled in the Lok Sabha, has proposed a new clause in sub-section 80-IB(9) that takes away “petroleum and natural gas” from the definition of “mineral oil”.

Incidentally, such a move would leave nothing in the category of mineral oil since there is no other oil that is commercially produced from minerals, except crude oil that has been referred to as petroleum.

“We (the government) stand committed to the tax holiday…There is confusion. (We) expect resolution of the issue before the bid closing date,” said another senior ministry official while replying to queries from the prospective bidders.

Another interpretation of the change that is doing the rounds is that the lifting of tax holiday benefit would be applicable to only those companies that produce crude oil as well as have refineries since there is a latent benefit for these companies, said an official.

However, this version can be questioned since the production sharing contract (PSC), signed at the time of assignment of contract, spells out explicitly that the first right of purchase rests with the government or its nominee.

Sources had earlier told DNA Money that the ministry of finance, in fact, wanted to remove natural gas from the mineral oil definition that would not only adversely impact Reliance Industries Ltd and Oil and Natural Gas Corporation but all the companies that have discovered natural gas or have pledged investment under NELP regime.

![submenu-img]() Viral video: Kind man assists duck family in crossing the road, internet lauds him

Viral video: Kind man assists duck family in crossing the road, internet lauds him![submenu-img]() Can you see the Great Wall of China from space? here's the truth

Can you see the Great Wall of China from space? here's the truth![submenu-img]() Ashutosh Rana breaks silence on his deepfake video supporting a political party: 'I would only be answerable to...'

Ashutosh Rana breaks silence on his deepfake video supporting a political party: 'I would only be answerable to...'![submenu-img]() Meet India's most talented superstar, is actor, dancer, stuntman, singer, lyricist; not Ranbir, Shah Rukh, Aamir, Salman

Meet India's most talented superstar, is actor, dancer, stuntman, singer, lyricist; not Ranbir, Shah Rukh, Aamir, Salman![submenu-img]() This flop film was headlined by star kid, marked south actress's Bollywood debut, made in Rs 120 crore, earned just...

This flop film was headlined by star kid, marked south actress's Bollywood debut, made in Rs 120 crore, earned just...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Aamir Khan, Naseeruddin Shah, Sonali Bendre celebrate 25 years of Sarfarosh, attend film's special screening

Aamir Khan, Naseeruddin Shah, Sonali Bendre celebrate 25 years of Sarfarosh, attend film's special screening![submenu-img]() Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’

Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’![submenu-img]() Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates

Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Ashutosh Rana breaks silence on his deepfake video supporting a political party: 'I would only be answerable to...'

Ashutosh Rana breaks silence on his deepfake video supporting a political party: 'I would only be answerable to...'![submenu-img]() Meet India's most talented superstar, is actor, dancer, stuntman, singer, lyricist; not Ranbir, Shah Rukh, Aamir, Salman

Meet India's most talented superstar, is actor, dancer, stuntman, singer, lyricist; not Ranbir, Shah Rukh, Aamir, Salman![submenu-img]() This flop film was headlined by star kid, marked south actress's Bollywood debut, made in Rs 120 crore, earned just...

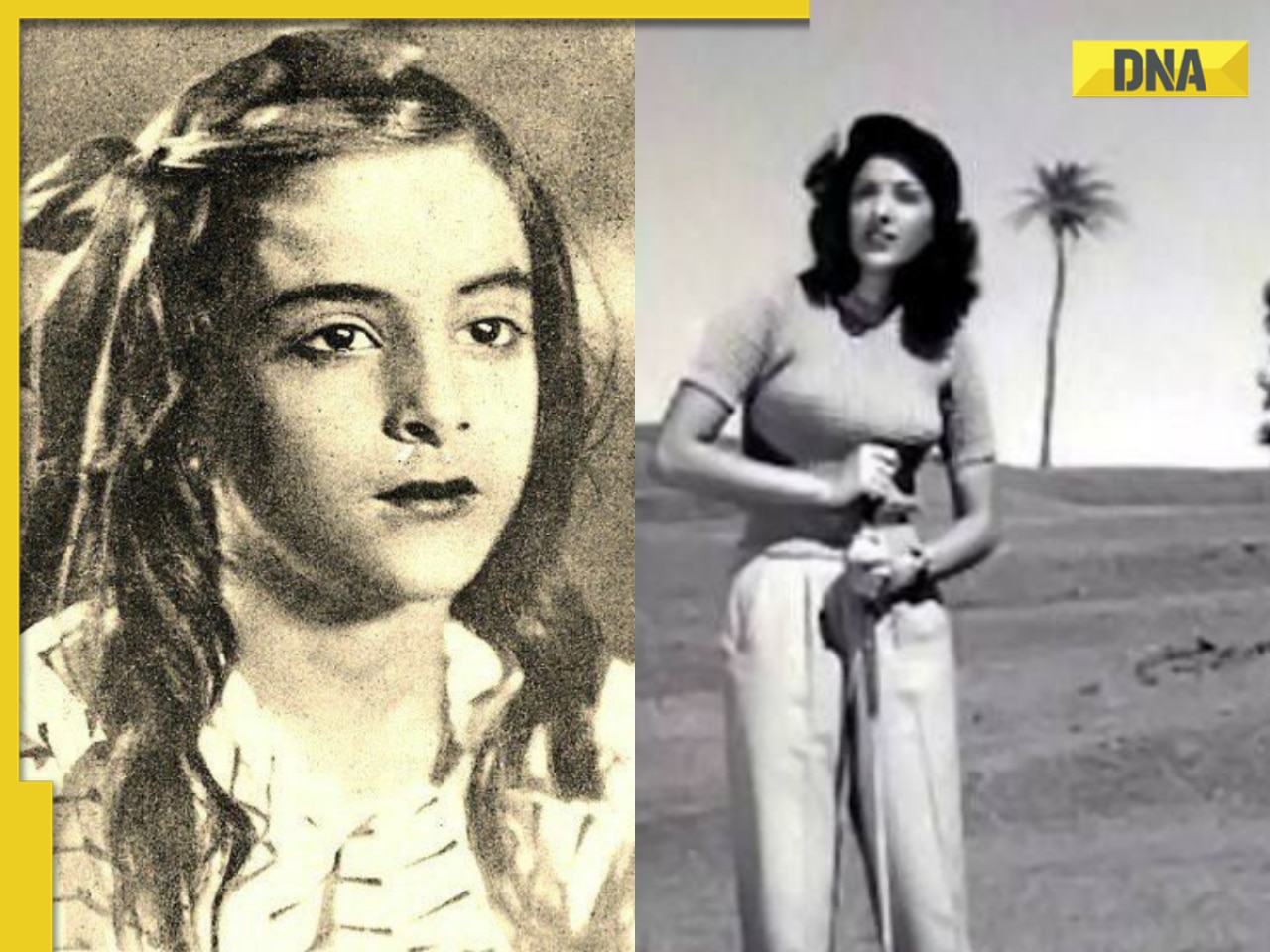

This flop film was headlined by star kid, marked south actress's Bollywood debut, made in Rs 120 crore, earned just...![submenu-img]() India's most successful star kid was superstar at 14, daughter of tawaif, affair with married star broke her, died at...

India's most successful star kid was superstar at 14, daughter of tawaif, affair with married star broke her, died at...![submenu-img]() India's biggest flop actor, worked with superstars, married girl half his age, once left Aamir's film midway due to..

India's biggest flop actor, worked with superstars, married girl half his age, once left Aamir's film midway due to..![submenu-img]() England pace legend James Anderson set to retire from Test cricket after talks with Brendon McCullum

England pace legend James Anderson set to retire from Test cricket after talks with Brendon McCullum![submenu-img]() IPL 2024: Shubman Gill, Sai Sudharsan centuries guide Gujarat Titans to 35-run win over Chennai Super Kings

IPL 2024: Shubman Gill, Sai Sudharsan centuries guide Gujarat Titans to 35-run win over Chennai Super Kings![submenu-img]() KKR vs MI IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

KKR vs MI IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() 'It's ego-driven...': Ex-RCB star on Hardik Pandya's captaincy in IPL 2024

'It's ego-driven...': Ex-RCB star on Hardik Pandya's captaincy in IPL 2024![submenu-img]() BCCI to advertise for Team India's new head coach after T20 World Cup

BCCI to advertise for Team India's new head coach after T20 World Cup![submenu-img]() Viral video: Kind man assists duck family in crossing the road, internet lauds him

Viral video: Kind man assists duck family in crossing the road, internet lauds him![submenu-img]() Can you see the Great Wall of China from space? here's the truth

Can you see the Great Wall of China from space? here's the truth![submenu-img]() Mother bear teaches cubs how to cross a road with caution, video goes viral

Mother bear teaches cubs how to cross a road with caution, video goes viral![submenu-img]() Meet the tawaif, real courtesan of Heeramandi, was once highest paid item girl, was killed by....

Meet the tawaif, real courtesan of Heeramandi, was once highest paid item girl, was killed by....![submenu-img]() Mukesh Ambani’s old image with billionaire friends go viral, Harsh Goenka makes joke of…

Mukesh Ambani’s old image with billionaire friends go viral, Harsh Goenka makes joke of…

)

)

)

)

)

)