- Home

- Latest News

![submenu-img]() Meet IIT-JEE topper with AIR 1, son of government school teachers, he went on to pursue...

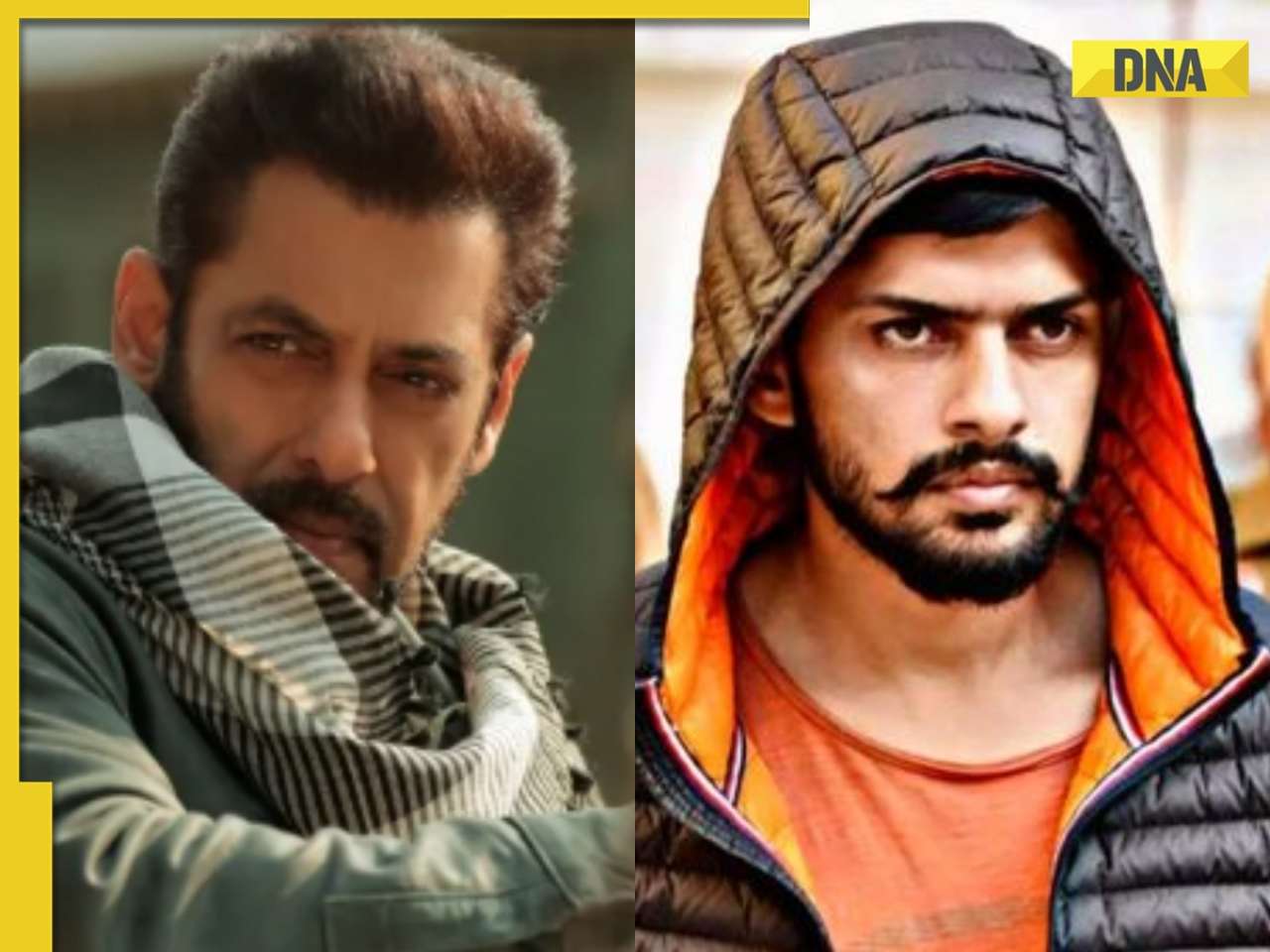

Meet IIT-JEE topper with AIR 1, son of government school teachers, he went on to pursue...![submenu-img]() Salman Khan house firing case: One more Lawrence Bishnoi gang member arrested by Mumbai Police

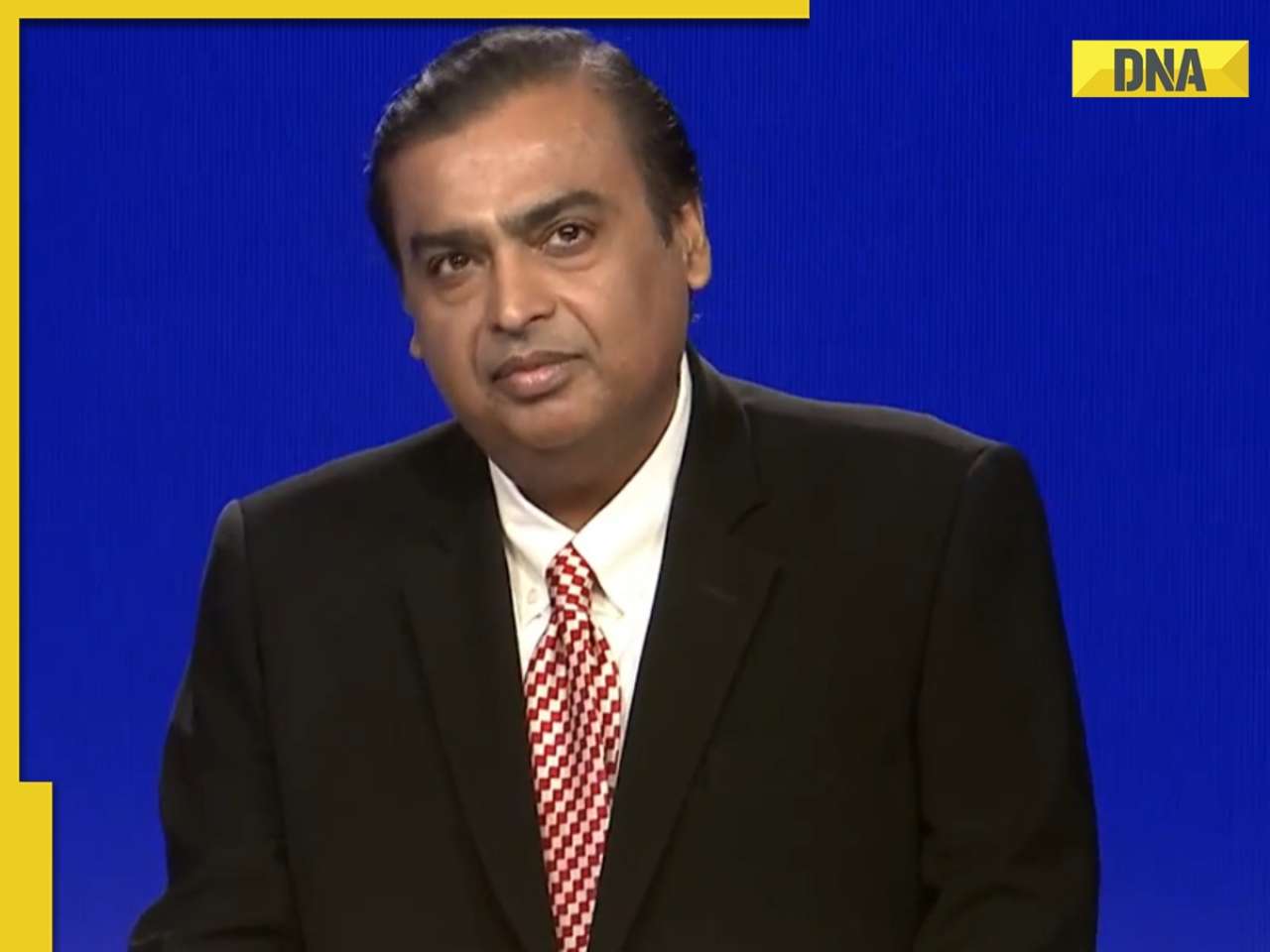

Salman Khan house firing case: One more Lawrence Bishnoi gang member arrested by Mumbai Police ![submenu-img]() Mukesh Ambani to host Anant-Radhika's second pre-wedding function: Trip to start from Italy with 800 guests and end in..

Mukesh Ambani to host Anant-Radhika's second pre-wedding function: Trip to start from Italy with 800 guests and end in..![submenu-img]() Driver caught on camera running over female toll plaza staff on Delhi-Meerut expressway, watch video

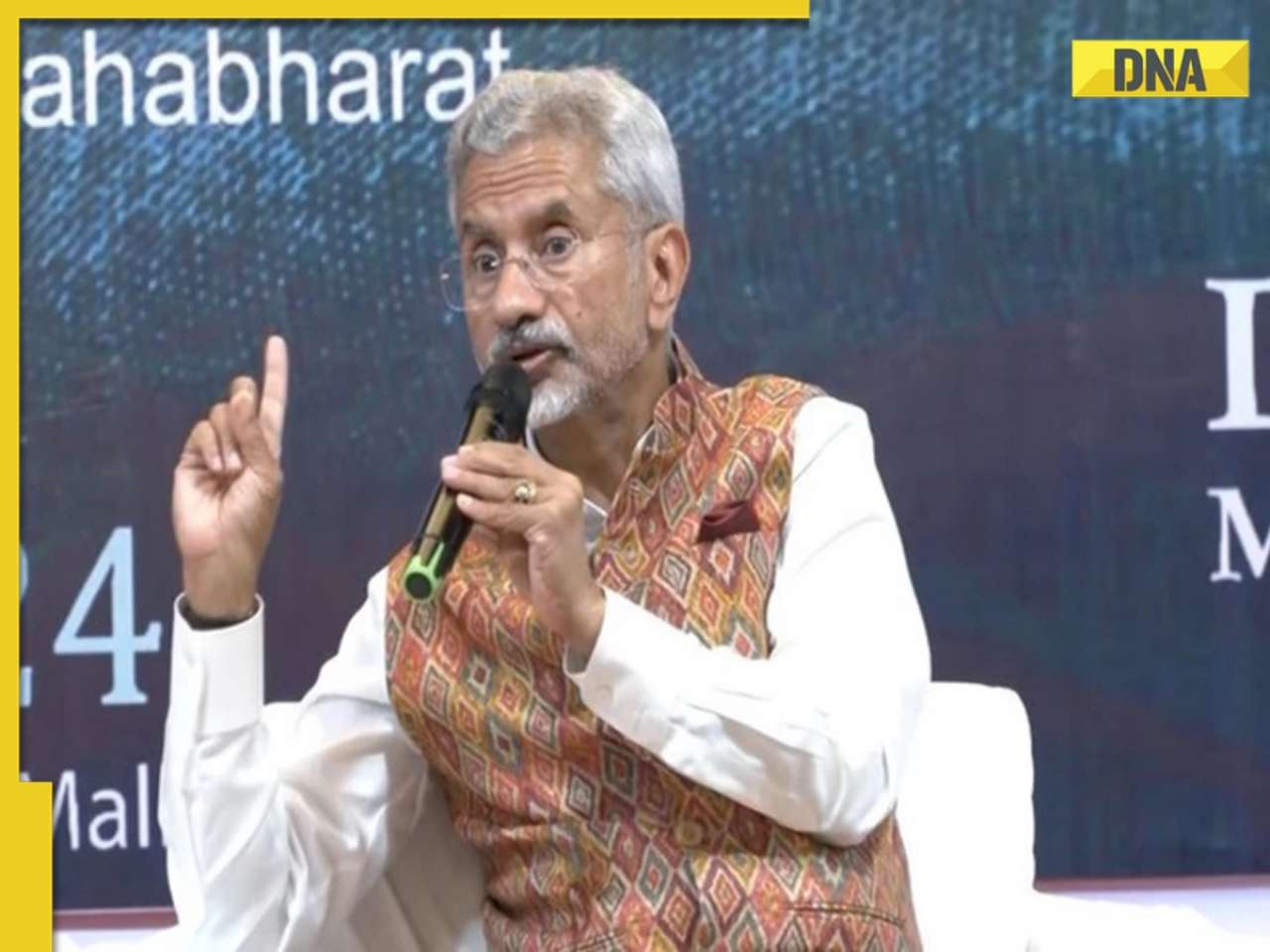

Driver caught on camera running over female toll plaza staff on Delhi-Meerut expressway, watch video![submenu-img]() 'If you come and do something here...': EAM S Jaishankar on India's 'message' against terrorism

'If you come and do something here...': EAM S Jaishankar on India's 'message' against terrorism

- Election 2024

- Webstory

- IPL 2024

- Education

![submenu-img]() Meet IIT-JEE topper with AIR 1, son of government school teachers, he went on to pursue...

Meet IIT-JEE topper with AIR 1, son of government school teachers, he went on to pursue...![submenu-img]() TN 11th Result 2024: TNDGE Tamil Nadu HSE (+1) result declared, direct link here

TN 11th Result 2024: TNDGE Tamil Nadu HSE (+1) result declared, direct link here![submenu-img]() Meet doctor who cracked UPSC exam with AIR 9 but didn’t became IAS due to…

Meet doctor who cracked UPSC exam with AIR 9 but didn’t became IAS due to…![submenu-img]() TN 11th Result 2024 to be declared today; know how to check

TN 11th Result 2024 to be declared today; know how to check![submenu-img]() Meet man who worked as coolie, studied from railway's WiFi, then cracked UPSC exam to become IAS, secured AIR...

Meet man who worked as coolie, studied from railway's WiFi, then cracked UPSC exam to become IAS, secured AIR...

- DNA Verified

![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

- Her DNA

- Photos

![submenu-img]() Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...

Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...![submenu-img]() Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses

Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses![submenu-img]() Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...

Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...![submenu-img]() In pics: Ram Charan gets mobbed by fans during his visit to Pithapuram for ‘indirect campaign’ for uncle Pawan Kalyan

In pics: Ram Charan gets mobbed by fans during his visit to Pithapuram for ‘indirect campaign’ for uncle Pawan Kalyan![submenu-img]() Streaming This Week: Yodha, Aavesham, Murder In Mahim, Undekhi season 3, latest OTT releases to binge-watch

Streaming This Week: Yodha, Aavesham, Murder In Mahim, Undekhi season 3, latest OTT releases to binge-watch

- DNA Explainers

![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

- Entertainment

![submenu-img]() Salman Khan house firing case: One more Lawrence Bishnoi gang member arrested by Mumbai Police

Salman Khan house firing case: One more Lawrence Bishnoi gang member arrested by Mumbai Police ![submenu-img]() Meet actress, who got rejected for her looks, had no hit for 15 years; later beat Alia, Deepika, Katrina at box office

Meet actress, who got rejected for her looks, had no hit for 15 years; later beat Alia, Deepika, Katrina at box office![submenu-img]() Abdu Rozik breaks silence on his wedding announcement being called ‘publicity stunt’: ‘The whole world is…’

Abdu Rozik breaks silence on his wedding announcement being called ‘publicity stunt’: ‘The whole world is…’![submenu-img]() Meet actress who made debut with Salman Khan, had super flop career, then got TB, now lives in chawl, runs..

Meet actress who made debut with Salman Khan, had super flop career, then got TB, now lives in chawl, runs..![submenu-img]() Meet actress who worked with Naseeruddin Shah, sister of popular models, is now getting trolled on social media for..

Meet actress who worked with Naseeruddin Shah, sister of popular models, is now getting trolled on social media for..

- Viral News

![submenu-img]() Driver caught on camera running over female toll plaza staff on Delhi-Meerut expressway, watch video

Driver caught on camera running over female toll plaza staff on Delhi-Meerut expressway, watch video![submenu-img]() Delhi man takes 200 flights in 110 days, steals lakhs worth of jewelry from passengers

Delhi man takes 200 flights in 110 days, steals lakhs worth of jewelry from passengers![submenu-img]() Viral video: Man makes paratha with 'diesel', internet reacts

Viral video: Man makes paratha with 'diesel', internet reacts![submenu-img]() Viral video of 'black jalebi' leaves internet in shock; netizens say 'hey bhagwan...'

Viral video of 'black jalebi' leaves internet in shock; netizens say 'hey bhagwan...'![submenu-img]() Real-life Bambi and Thumper? Adorable deer and rabbit video melts hearts online

Real-life Bambi and Thumper? Adorable deer and rabbit video melts hearts online

)

)

)

)

)

)