Commodity shipping and tanker rates, which touched record highs last year, are expected to remain firm this year as well.

Baltic Dry Index likely to correct further, but going will still be strong

MUMBAI: Commodity shipping and tanker rates, which touched record highs last year, are expected to remain firm this year as well.

On the dry bulk side, which includes shipping coal, iron ore, cement and grains, London-based Baltic Exchange’s Baltic Dry Index (BDI), an indicator of commodity shipping rates, is at an all-time high and analysts remain bullish on the index for this year, too.

Ole Slorer and Darren Gacicia, analysts with Morgan Stanley Research, in their December 2007 report said the extraordinary conditions of 2007 were not expected to be repeated, but the next two years would still be solid by historical standards.

Imports by developing countries like China and India are expected to be the biggest driver for dry bulk rates. India’s coal requirements are set to increase with the ultra mega power plants planned. On the other hand, China’s growing steel industry now has to look beyond India for its iron ore imports and South America is the only next option.

“The key for freight rates is not only the quantum of cargo but also from where it is coming and the distance it is travelling,” reasoned Anjali Kumar, company spokesperson, Great Eastern Shipping.

Meanwhile, BDI, which breached the 11,000 mark in December 2007, fell 1.51% to 8,756 on January 3, 2008 — the lowest in over three months.

Experts look at it as a correction, attributed partly to lower iron ore imports by Chinese steelmakers. They maintain, however, that the indices cannot fall beyond a point (~8,000-9,000) and will eventually rule at a healthy level.

However, an Essar Shipping spokesman said the US subprime crisis could queer the pitch. “The dry indices would largely depend on how the US resolves the subprime crisis, as it affects the commodity demands from countries like China, eventually influencing the freight rates,” he said.

In the tanker segment, after an interesting journey with highs and sudden lows last year, very large crude carrier (VLCC) rates reached a record high of $219,000 per day in December 2007 as compared with $59,000 in the first quarter and $29,850 in the third quarter of FY07. The Aframax and Suezmax type of tankers also recorded almost 100% growth in rates owing to the severe winters in the American and European regions.

Slorer and Gacicia added that although the current lofty environment in the tanker rates might be unsustainable, the outlook for the year as a whole appears to be a lot better than indicated by consensus earnings expectations.

Kapil Yadav, analyst with Dolat Capital said, “Tanker rates would drop as the winter passes by. However, they would definitely be much higher, around $80,000-90,000 per day in VLCC, which is still more than 100%.”

Shortage in the fleet supply is also expected to be one of the crucial factors in the rising shipping rates. A look at the carrying capacity of the global fleet shows that commodity ships has climbed to 386 million dead weight tonnes (DWT) and tankers to 382 DWT. Deadweight tonne is a measure of a ship’s capacity for carrying cargo, fuel and supplies. However, this increase in demand is far more than the fleet supply.

Kumar, on the other hand, feels supply will ease going forward as some of the fleet on order is to be delivered in a phased manner in 2-3 years.

Also, the South Korean government’s decision to defer the ban on single-hull vessels by two years will add to available ships, the Essar Shipping spokesperson added.

A senior official of a leading Indian shipping line said, “The winter of 2009 would see historically high rates for tankers as there would be a huge shortage of VLCCs.”

Given all these, industry watchers are optimistic for freight rates to remain firm in both dry and wet markets.

s_archana23@dnaindia.net

![submenu-img]() Meet IIT-JEE topper with AIR 1, son of government school teachers, he went on to pursue...

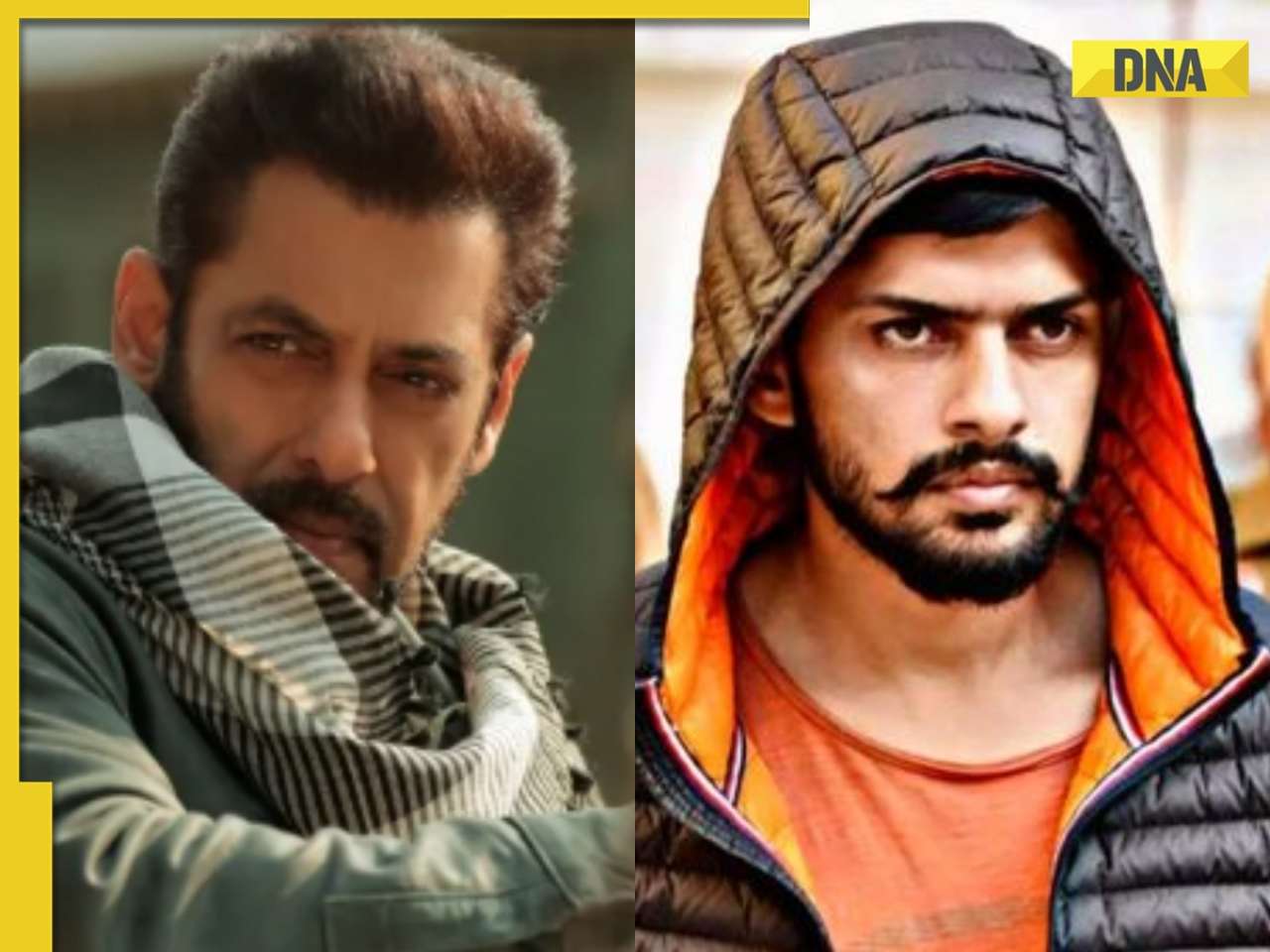

Meet IIT-JEE topper with AIR 1, son of government school teachers, he went on to pursue...![submenu-img]() Salman Khan house firing case: One more Lawrence Bishnoi gang member arrested by Mumbai Police

Salman Khan house firing case: One more Lawrence Bishnoi gang member arrested by Mumbai Police ![submenu-img]() Mukesh Ambani to host Anant-Radhika's second pre-wedding function: Trip to start from Italy with 800 guests and end in..

Mukesh Ambani to host Anant-Radhika's second pre-wedding function: Trip to start from Italy with 800 guests and end in..![submenu-img]() Driver caught on camera running over female toll plaza staff on Delhi-Meerut expressway, watch video

Driver caught on camera running over female toll plaza staff on Delhi-Meerut expressway, watch video![submenu-img]() 'If you come and do something here...': EAM S Jaishankar on India's 'message' against terrorism

'If you come and do something here...': EAM S Jaishankar on India's 'message' against terrorism![submenu-img]() Meet IIT-JEE topper with AIR 1, son of government school teachers, he went on to pursue...

Meet IIT-JEE topper with AIR 1, son of government school teachers, he went on to pursue...![submenu-img]() TN 11th Result 2024: TNDGE Tamil Nadu HSE (+1) result declared, direct link here

TN 11th Result 2024: TNDGE Tamil Nadu HSE (+1) result declared, direct link here![submenu-img]() Meet doctor who cracked UPSC exam with AIR 9 but didn’t became IAS due to…

Meet doctor who cracked UPSC exam with AIR 9 but didn’t became IAS due to…![submenu-img]() TN 11th Result 2024 to be declared today; know how to check

TN 11th Result 2024 to be declared today; know how to check![submenu-img]() Meet man who worked as coolie, studied from railway's WiFi, then cracked UPSC exam to become IAS, secured AIR...

Meet man who worked as coolie, studied from railway's WiFi, then cracked UPSC exam to become IAS, secured AIR...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...

Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...![submenu-img]() Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses

Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses![submenu-img]() Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...

Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...![submenu-img]() In pics: Ram Charan gets mobbed by fans during his visit to Pithapuram for ‘indirect campaign’ for uncle Pawan Kalyan

In pics: Ram Charan gets mobbed by fans during his visit to Pithapuram for ‘indirect campaign’ for uncle Pawan Kalyan![submenu-img]() Streaming This Week: Yodha, Aavesham, Murder In Mahim, Undekhi season 3, latest OTT releases to binge-watch

Streaming This Week: Yodha, Aavesham, Murder In Mahim, Undekhi season 3, latest OTT releases to binge-watch![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Salman Khan house firing case: One more Lawrence Bishnoi gang member arrested by Mumbai Police

Salman Khan house firing case: One more Lawrence Bishnoi gang member arrested by Mumbai Police ![submenu-img]() Meet actress, who got rejected for her looks, had no hit for 15 years; later beat Alia, Deepika, Katrina at box office

Meet actress, who got rejected for her looks, had no hit for 15 years; later beat Alia, Deepika, Katrina at box office![submenu-img]() Abdu Rozik breaks silence on his wedding announcement being called ‘publicity stunt’: ‘The whole world is…’

Abdu Rozik breaks silence on his wedding announcement being called ‘publicity stunt’: ‘The whole world is…’![submenu-img]() Meet actress who made debut with Salman Khan, had super flop career, then got TB, now lives in chawl, runs..

Meet actress who made debut with Salman Khan, had super flop career, then got TB, now lives in chawl, runs..![submenu-img]() Meet actress who worked with Naseeruddin Shah, sister of popular models, is now getting trolled on social media for..

Meet actress who worked with Naseeruddin Shah, sister of popular models, is now getting trolled on social media for..![submenu-img]() Driver caught on camera running over female toll plaza staff on Delhi-Meerut expressway, watch video

Driver caught on camera running over female toll plaza staff on Delhi-Meerut expressway, watch video![submenu-img]() Delhi man takes 200 flights in 110 days, steals lakhs worth of jewelry from passengers

Delhi man takes 200 flights in 110 days, steals lakhs worth of jewelry from passengers![submenu-img]() Viral video: Man makes paratha with 'diesel', internet reacts

Viral video: Man makes paratha with 'diesel', internet reacts![submenu-img]() Viral video of 'black jalebi' leaves internet in shock; netizens say 'hey bhagwan...'

Viral video of 'black jalebi' leaves internet in shock; netizens say 'hey bhagwan...'![submenu-img]() Real-life Bambi and Thumper? Adorable deer and rabbit video melts hearts online

Real-life Bambi and Thumper? Adorable deer and rabbit video melts hearts online

)

)

)

)

)

)