It’s other income rather than the interest generating part of the banking business that has driven profits in the second quarter.

Most banks have seen only a marginal rise in net interest income

MUMBAI: It’s other income rather than the interest generating part of the banking business that has driven profits in the second quarter.

An analysis of the results of 30 banks shows that aggregate profits grew by 22.22% in the September 2007 quarter (over the same period last year) to Rs 6,362.9 crore.

However, aggregate net interest income (NII or interest earned on loans minus the interest paid on deposits) increased by only 11.25% to Rs 14,833.36 crore.

This shows that profits were helped by other income (fee based income and treasury gains), which increased by 40.42% to Rs 8,394.6 crore.

The Q2 results of State Bank India (SBI) follow the pattern. While the NII increased by 6.3% to Rs 3,762.92 crore, net profit rose by 36% to Rs 1,611.42 crore. It was other income which came to the rescue, increasing by 42% to Rs 2,041.94 crore.

Other banks that have seen a considerable rise in other income are AXIS Bank (87%), IDBI Bank (121.32%), Indian Bank (67.47%), Kotak Mahindra Bank (95.85%), State Bank of Hyderabad (60.51%), State Bank of Mysore (71.22%), UCO Bank (91.94%), Union Bank of India (77.61%), Yes Bank (109.9%) and Punjab National Bank (64.72%).

For most banks, NII has grown slowly. At the same time, NIM (NII expressed as a percentage of average assets during the quarter) has gone down.

Shahina Mukadam, head of Research at IDBI Capital, says, “NIMs have been under pressure as the cost of funds has gone up. However, good growth in other income has reduced the pressure on NIMs.”

Take the case of SBI, the NIM for the six months ended September stands at 2.84%. Even as SBI has not disclosed separate NIMs for Q2, it’s NIM for Q1 FY08 stood at 2.97%. This suggests that the NIM this quarter is lower. This can be attributed to the lower NII growth.

Banks are facing a huge challenge owing to the overall credit-growth slowdown because of rising interest rates.

At the same time, owing to competition, they haven’t been able to cut interest rates on deposits, leading to slower growth in NIIs.

Moreover, because of the higher interest rates on fixed deposits, more depositors are putting money in them rather than letting it sit idle in current and savings account

(CASA) deposits.

A higher share of CASA deposits means banks have access to cheaper funds, improving margins.

In the case of SBI, the CASA ratio as on September 30, 2007, slipped to 37.13% from 41% in Q1 FY08.

A slightly comforting performance came from ICICI Bank, which posted a 33.9% rise in NII to Rs 1,786 crore.

Pathik Gandotra, Nilesh Parikh and Neha Agarwal of SSKI, in a report dated October 19, say: “The bank has used its capital issue proceeds to retire part of the high-cost deposits. Aided by 45% growth in current account deposits, ICICI’s CASA ratio has improved by 300 basis points to 25%.”

HDFC Bank enjoys one of the best CASA ratios in the banking space. Its CASA for Q2 stands at 52.5%. Punit Srivastava, analyst from ENAM Securities, in a report dated October 12, 2007, says, “HDFC Bank’s net profit grew 40% YoY during Q2FY08, driven by 48% growth in NII.”

Analysts expect that the credit slowdown would linger for some time. Till then, looks like other income will be the saving grace.

![submenu-img]() Meet woman who ran away from home at 15, slept on railway station, built Rs 104 crore company, she is...

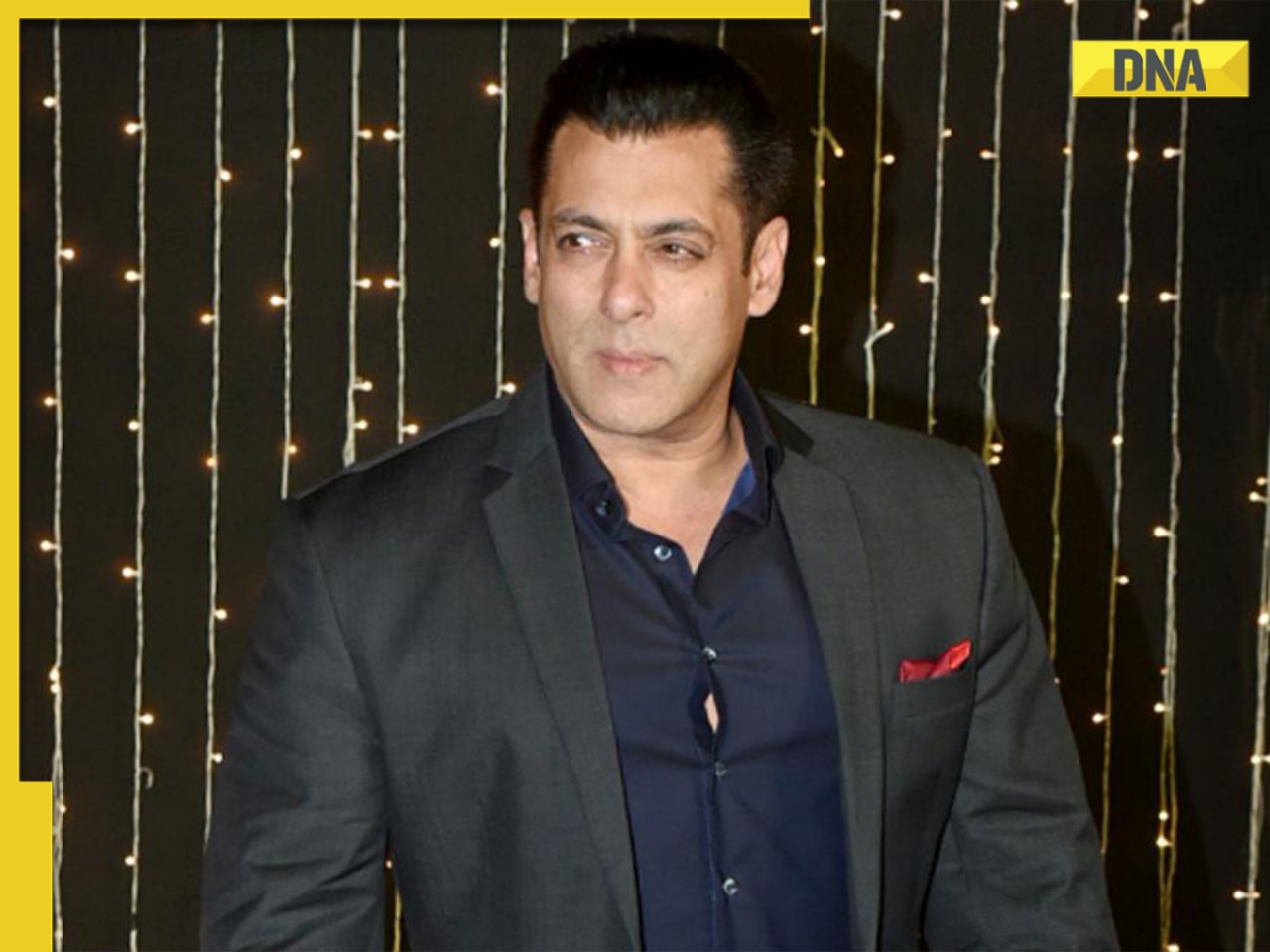

Meet woman who ran away from home at 15, slept on railway station, built Rs 104 crore company, she is...![submenu-img]() Salman Khan house firing case: Fifth suspect arrested from Rajasthan, has ties to...

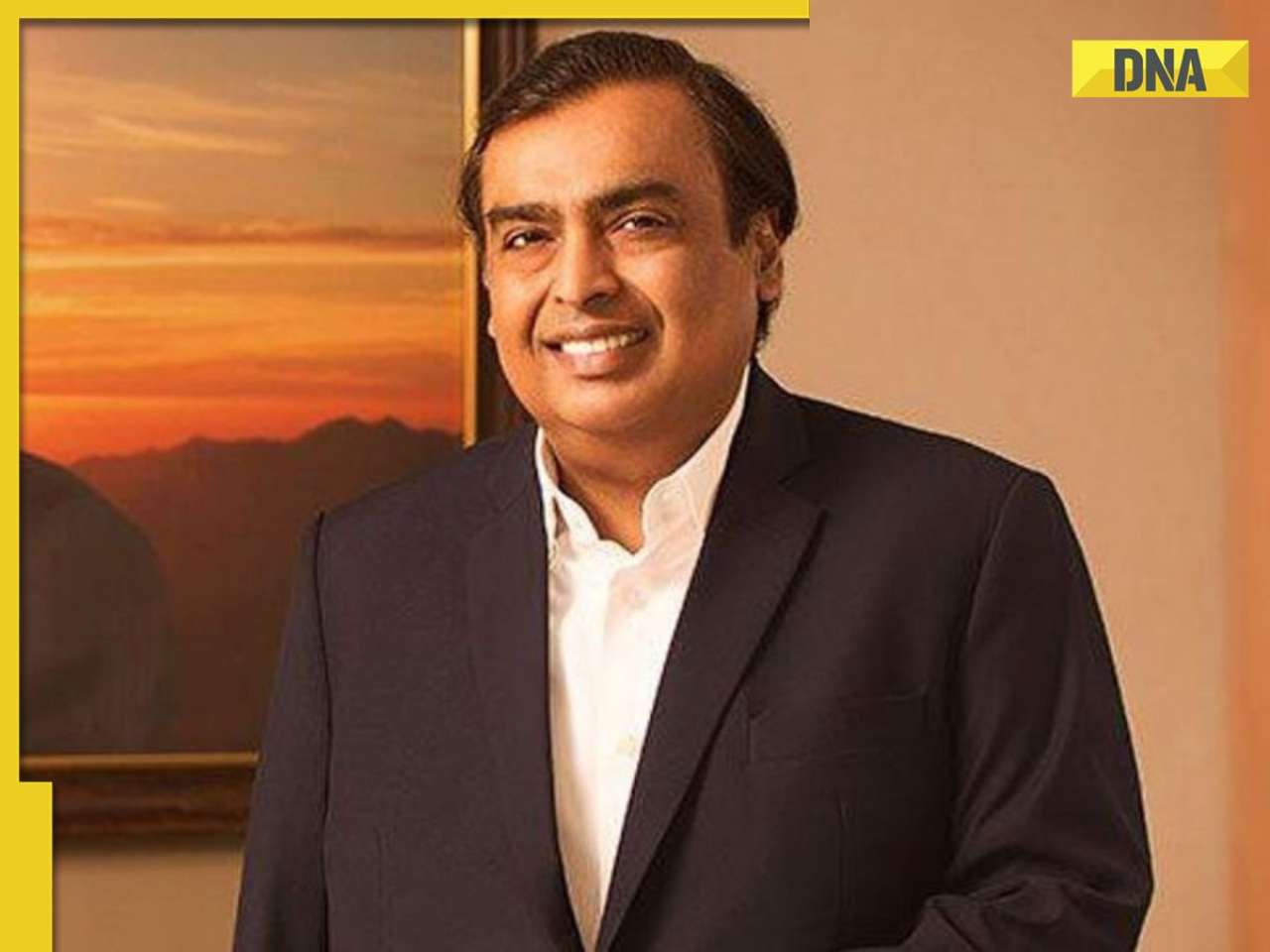

Salman Khan house firing case: Fifth suspect arrested from Rajasthan, has ties to... ![submenu-img]() Mukesh Ambani’s Reliance firm to enter Rs 963170000000 auction, aims to buy…

Mukesh Ambani’s Reliance firm to enter Rs 963170000000 auction, aims to buy…![submenu-img]() Meet actor who washed dishes in hotel, debuted with Rs 1600-crore hit, beat Shah Rukh, Salman, Aamir at box office at 18

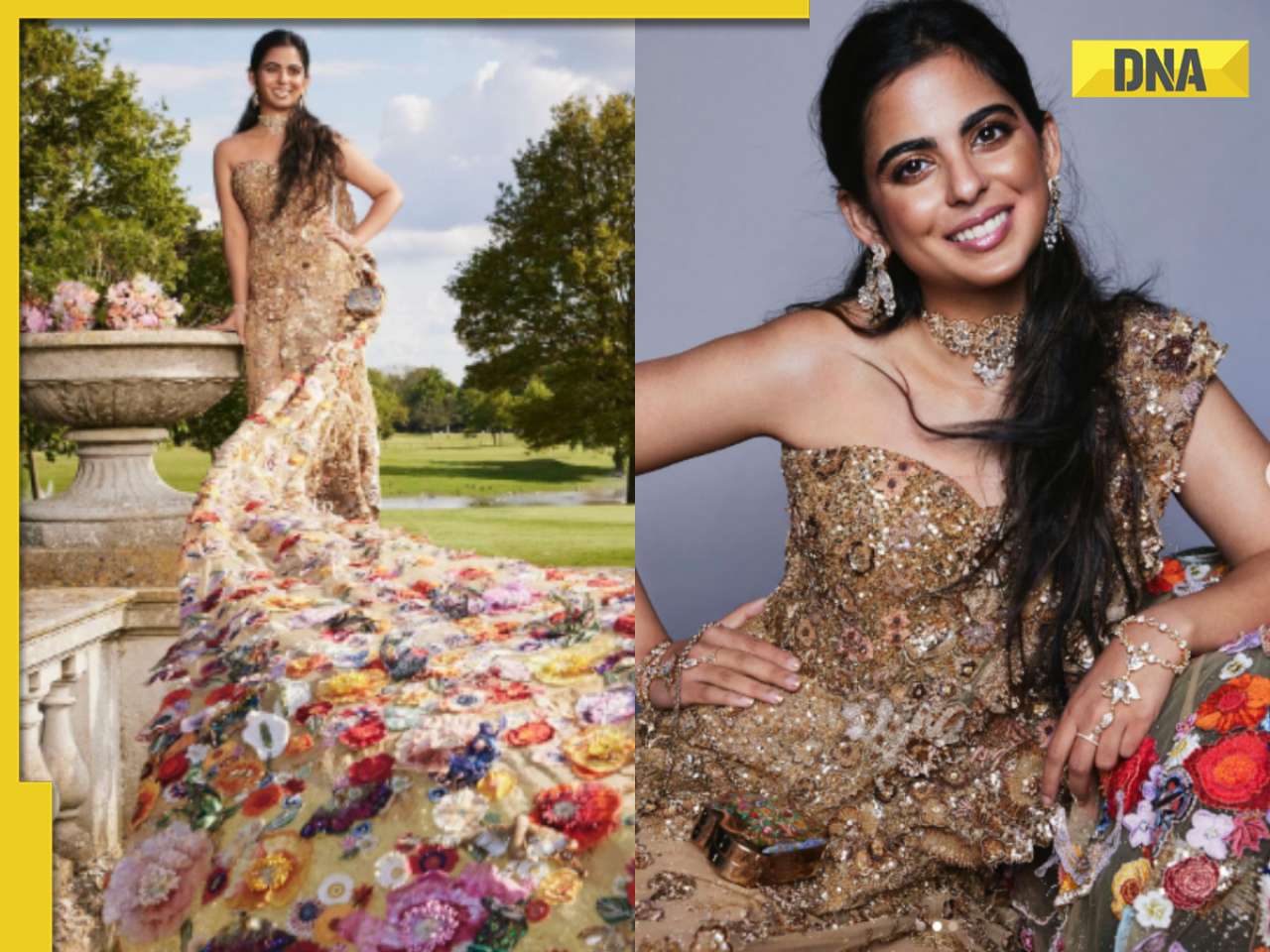

Meet actor who washed dishes in hotel, debuted with Rs 1600-crore hit, beat Shah Rukh, Salman, Aamir at box office at 18![submenu-img]() Isha Ambani's Met Gala 2024 saree gown was created in over 10,000 hours, see pics

Isha Ambani's Met Gala 2024 saree gown was created in over 10,000 hours, see pics![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’

Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’![submenu-img]() Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates

Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() Salman Khan house firing case: Fifth suspect arrested from Rajasthan, has ties to...

Salman Khan house firing case: Fifth suspect arrested from Rajasthan, has ties to... ![submenu-img]() Meet actor who washed dishes in hotel, debuted with Rs 1600-crore hit, beat Shah Rukh, Salman, Aamir at box office at 18

Meet actor who washed dishes in hotel, debuted with Rs 1600-crore hit, beat Shah Rukh, Salman, Aamir at box office at 18![submenu-img]() This superstar was active on internet even before it came to India, called Bollywood's computer guru, not Amitabh, SRK

This superstar was active on internet even before it came to India, called Bollywood's computer guru, not Amitabh, SRK![submenu-img]() This singer left Air Force, sang at churches, became superstar; later his father killed him after...

This singer left Air Force, sang at churches, became superstar; later his father killed him after...![submenu-img]() Most popular Indian song ever on Spotify has 50 crore streams; it's not Besharam Rang, Pehle Bhi Main, Oo Antava, Naina

Most popular Indian song ever on Spotify has 50 crore streams; it's not Besharam Rang, Pehle Bhi Main, Oo Antava, Naina![submenu-img]() IPL 2024: Suryakumar Yadav's century power MI to 7-wicket win over SRH

IPL 2024: Suryakumar Yadav's century power MI to 7-wicket win over SRH![submenu-img]() DC vs RR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

DC vs RR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() Watch: Team India’s new jersey for T20 World Cup 2024 unveiled

Watch: Team India’s new jersey for T20 World Cup 2024 unveiled![submenu-img]() DC vs RR IPL 2024 Dream11 prediction: Fantasy cricket tips for Delhi Capitals vs Rajasthan Royals

DC vs RR IPL 2024 Dream11 prediction: Fantasy cricket tips for Delhi Capitals vs Rajasthan Royals![submenu-img]() IPL 2024: Kolkata Knight Riders take top spot after 98 runs win over Lucknow Super Giants

IPL 2024: Kolkata Knight Riders take top spot after 98 runs win over Lucknow Super Giants![submenu-img]() Isha Ambani's Met Gala 2024 saree gown was created in over 10,000 hours, see pics

Isha Ambani's Met Gala 2024 saree gown was created in over 10,000 hours, see pics![submenu-img]() Indian-origin man says Apple CEO Tim Cook pushed him...

Indian-origin man says Apple CEO Tim Cook pushed him...![submenu-img]() Meet man whose salary was only Rs 83 but his net worth grew by Rs 7010577000000 in 2023, he is Mukesh Ambani's...

Meet man whose salary was only Rs 83 but his net worth grew by Rs 7010577000000 in 2023, he is Mukesh Ambani's...![submenu-img]() Job applicant offers to pay Rs 40000 to Bengaluru startup founder, here's what happened next

Job applicant offers to pay Rs 40000 to Bengaluru startup founder, here's what happened next![submenu-img]() Viral video: Family fearlessly conducts puja with live black cobra, internet reacts

Viral video: Family fearlessly conducts puja with live black cobra, internet reacts

)

)

)

)

)

)