Calls for Citigroup chief executive Chuck Prince’s resignation grew louder after the largest US bank warned that its third-quarter profit would slide 60%.

Calls for CEO’s resignation rise after US bank forecasts 60% drop in Q3 net

NEW YORK: Calls for Citigroup chief executive Chuck Prince’s resignation grew louder on Monday after the largest US bank warned that its third-quarter profit would slide 60%, the latest stumble in the 57-year-old lawyer’s rocky tenure.

Critics had argued for Prince’s dismissal in the past, but investors became less shrill after a solid second quarter and a widening subprime mortgage crisis that seemed to engulf every bank.

But Citi on Monday said its performance in the third quarter was weak even considering the weak markets. The bank forecast a 60% drop in third-quarter net income, further frustrating investors who have seen the stock decline 16% this year.

At least one major analyst, Deutsche Bank’s Mike Mayo, said Prince should go. “We’re calling for a change in CEO,” he said. “A $6 billion write-down is the tipping point of bad performance at the company by Chuck Prince.”

Citigroup declined to comment.

The latest turn of fortune for Prince comes as he marks his fourth full year in the role at the top of largest US bank by market capitalisation. Citi shares have edged up 1.9% since Prince took over as CEO from Sanford Weill, compared with a 20% gain in the Philadelphia KBW Bank Index over the same four-year period.

The last two years have been particularly troubled, as the New York-based bank’s largest individual shareholder, Saudi Prince Alwaleed bin Talal, demanded “draconian” steps to cut costs and Prince has faced calls from some investors to break up the bank.

The bank’s executive ranks have been in turmoil, as it earlier this year removed Sallie Krawcheck as chief financial officer, and wealth management chief Todd Thomson quit.

Prince responded to calls for his ouster with a plan to slash 17,000 jobs and cut $4.6 billion in annual costs, a bid to reverse a long-standing problem with costs outpacing revenues and operating income.

The perception that he was starting to make progress before investors’ wholesale retreat from risk this summer may help Prince survive his current problems.

Besides, his backers point out, the chief executive should hardly be blamed for a credit crunch that is taking a heavy toll on much of the industry.

“He’s still under pressure, but this (warning) has nothing to do with his job security,” said Bill Fitzpatrick, an analyst at Johnson Asset Management. “If you’re looking to throw him under the bus, this isn’t really something that comes into play.”

Prince also continues to enjoy the support of the bank’s largest individual shareholder, Prince Alwaleed. “I’m backing the management of Citi and Chuck Prince. They have my full support,” Alwaleed said on Monday.

“No financial institution is immune from the financial turmoil in global markets.”

Yet in some respects Prince looked to have been caught offguard by the latest credit crisis.

In August, for instance, he told the New York Times in an interview: “We see a lot of people on the Street who are scared. We are not scared. We are not panicked. We are not rattled. Our team has been through this before.”

And just weeks before that, he told the Financial Times that Citigroup was “still dancing” in the leveraged loan arena — comments that raised many eyebrows.

What might be most worrisome for Prince is the share price reaction to the warning, at least if William Smith, chief

executive of SAM Advisors LLC, which owns Citigroup shares,is right.

Citi shares were up $1.37, or 2.9%, at $48.04 in afternoon trading. “The only reason the shares are up is people

are betting this guy is gone,” said Smith, a long-time Smith critic.

![submenu-img]() Viral video: Kind man assists duck family in crossing the road, internet lauds him

Viral video: Kind man assists duck family in crossing the road, internet lauds him![submenu-img]() Can you see the Great Wall of China from space? here's the truth

Can you see the Great Wall of China from space? here's the truth![submenu-img]() Ashutosh Rana breaks silence on his deepfake video supporting a political party: 'I would only be answerable to...'

Ashutosh Rana breaks silence on his deepfake video supporting a political party: 'I would only be answerable to...'![submenu-img]() Meet India's most talented superstar, is actor, dancer, stuntman, singer, lyricist; not Ranbir, Shah Rukh, Aamir, Salman

Meet India's most talented superstar, is actor, dancer, stuntman, singer, lyricist; not Ranbir, Shah Rukh, Aamir, Salman![submenu-img]() This flop film was headlined by star kid, marked south actress's Bollywood debut, made in Rs 120 crore, earned just...

This flop film was headlined by star kid, marked south actress's Bollywood debut, made in Rs 120 crore, earned just...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Aamir Khan, Naseeruddin Shah, Sonali Bendre celebrate 25 years of Sarfarosh, attend film's special screening

Aamir Khan, Naseeruddin Shah, Sonali Bendre celebrate 25 years of Sarfarosh, attend film's special screening![submenu-img]() Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’

Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’![submenu-img]() Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates

Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Ashutosh Rana breaks silence on his deepfake video supporting a political party: 'I would only be answerable to...'

Ashutosh Rana breaks silence on his deepfake video supporting a political party: 'I would only be answerable to...'![submenu-img]() Meet India's most talented superstar, is actor, dancer, stuntman, singer, lyricist; not Ranbir, Shah Rukh, Aamir, Salman

Meet India's most talented superstar, is actor, dancer, stuntman, singer, lyricist; not Ranbir, Shah Rukh, Aamir, Salman![submenu-img]() This flop film was headlined by star kid, marked south actress's Bollywood debut, made in Rs 120 crore, earned just...

This flop film was headlined by star kid, marked south actress's Bollywood debut, made in Rs 120 crore, earned just...![submenu-img]() India's most successful star kid was superstar at 14, daughter of tawaif, affair with married star broke her, died at...

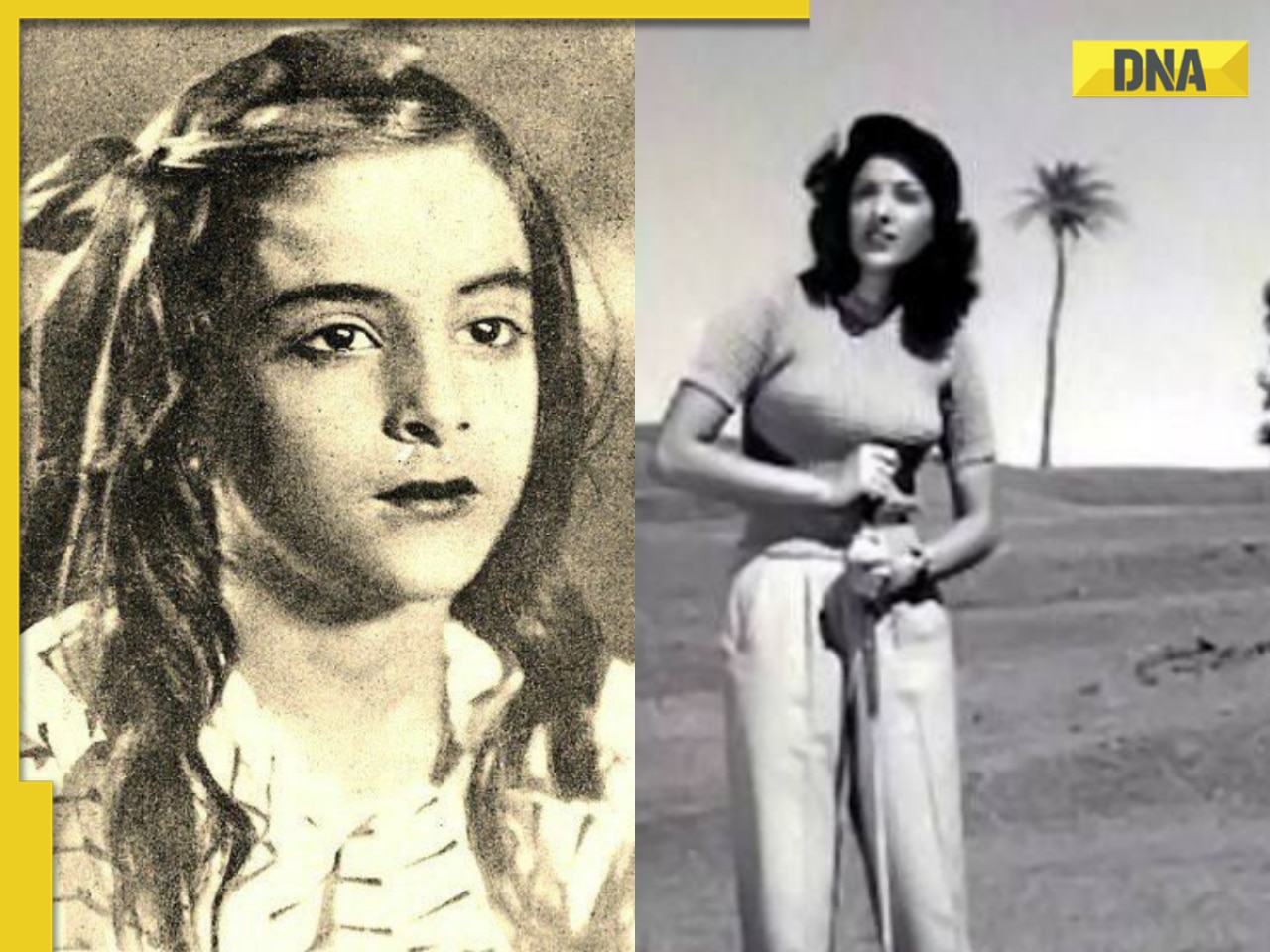

India's most successful star kid was superstar at 14, daughter of tawaif, affair with married star broke her, died at...![submenu-img]() India's biggest flop actor, worked with superstars, married girl half his age, once left Aamir's film midway due to..

India's biggest flop actor, worked with superstars, married girl half his age, once left Aamir's film midway due to..![submenu-img]() England pace legend James Anderson set to retire from Test cricket after talks with Brendon McCullum

England pace legend James Anderson set to retire from Test cricket after talks with Brendon McCullum![submenu-img]() IPL 2024: Shubman Gill, Sai Sudharsan centuries guide Gujarat Titans to 35-run win over Chennai Super Kings

IPL 2024: Shubman Gill, Sai Sudharsan centuries guide Gujarat Titans to 35-run win over Chennai Super Kings![submenu-img]() KKR vs MI IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

KKR vs MI IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() 'It's ego-driven...': Ex-RCB star on Hardik Pandya's captaincy in IPL 2024

'It's ego-driven...': Ex-RCB star on Hardik Pandya's captaincy in IPL 2024![submenu-img]() BCCI to advertise for Team India's new head coach after T20 World Cup

BCCI to advertise for Team India's new head coach after T20 World Cup![submenu-img]() Viral video: Kind man assists duck family in crossing the road, internet lauds him

Viral video: Kind man assists duck family in crossing the road, internet lauds him![submenu-img]() Can you see the Great Wall of China from space? here's the truth

Can you see the Great Wall of China from space? here's the truth![submenu-img]() Mother bear teaches cubs how to cross a road with caution, video goes viral

Mother bear teaches cubs how to cross a road with caution, video goes viral![submenu-img]() Meet the tawaif, real courtesan of Heeramandi, was once highest paid item girl, was killed by....

Meet the tawaif, real courtesan of Heeramandi, was once highest paid item girl, was killed by....![submenu-img]() Mukesh Ambani’s old image with billionaire friends go viral, Harsh Goenka makes joke of…

Mukesh Ambani’s old image with billionaire friends go viral, Harsh Goenka makes joke of…

)

)

)

)

)

)