Is it Indonesia spelt wrongly? Has the US Department of State added one more to its list of strangely named regions like Near-East (there is no Far-East) and South and Central Asia (there is no North)?

ICICI Pru takes the AMC flair for nomenclature a bit too far with its latest offering

MUMBAI: Is it Indonesia spelt wrongly? Has the US Department of State added one more to its list of strangely named regions like Near-East (there is no Far-East) and South and Central Asia (there is no North)? Then, what does ICICI Prudential Indo Asia Equity Fund, the latest offering from the fund house, propose to do?

Going by the company, its latest fund offering would be an open-ended equity diversified scheme that will invest 65% or more of its corpus directly in Indian equities across market capitalisation and the rest in Asian Equity Fund, an open-ended equity fund managed by Prudential Asset Management, Singapore, predominantly investing in equity markets across the Asia-Pacific region.

But, isn't India a part of Asia, too?

As such, the Asia Equity Fund that the Indian fund will invest in, doesn't have a very long track record. But, even the short track record doesn't look impressive. The fund, whose institutional version was launched in 2003 and the retail portion only in 2005, has a corpus of $590 million. The fund's allocation is mainly to three countries - Korea (22.6%), Hong Kong (21%) and Taiwan (19.9%). Samsung Electronics is the top holding with an allocation of 4.8% of the portfolio. As per the fund manager's presentation at its launch, the scheme had not been able to beat its benchmark MSCI AC Far East Free ex Japan index in the one-year period ending June 29.

Given this, the potential upside on the Indian fund's investment in the Asia Equity Fund appears limited.

Here's what could have forced chief investment officer Nilesh Shah and his team to make this geo-strategic discovery.

1. This is the global funds season and fund houses are running out of names. In the last couple of months, at least four fund houses have launched global schemes with names like Global Advantage, Emerging Markets, World and Offshore. So, here's one named after Asia.

2. And why the Indo prefix? According to a tax rule, for a scheme to be treated as an equity mutual fund and taxed accordingly, it should invest not less than 65% of its corpus in Indian equities and equity related securities. Hence the decision to restrict diversification to mere 35% of the corpus.

3. Fund houses launching global products only have as many choices as their overseas partner can offer. For example, DSPML had to choose from the Merill Lynch's array of funds, just as ICICI Pru has gone for Prudential's. By the way, Prudential has some interestingly named funds - like the Dragon Peacock Fund, which predictably invests in the hottest growing economies, China and India! For some reason, though, the managers have decided to go for a sub-fund of the foreign partner's International Opportunities Fund.

The bottomline is the same as in case of the other "global" products we have discussed - only investors who have enough exposure to local investment avenues should consider this fund. Even for such investors, though, this fund does not spell much geographical diversification - it will invest only in Asia, but Japanese companies are out of bounds.

![submenu-img]() Viral video: Kind man assists duck family in crossing the road, internet lauds him

Viral video: Kind man assists duck family in crossing the road, internet lauds him![submenu-img]() Can you see the Great Wall of China from space? here's the truth

Can you see the Great Wall of China from space? here's the truth![submenu-img]() Ashutosh Rana breaks silence on his deepfake video supporting a political party: 'I would only be answerable to...'

Ashutosh Rana breaks silence on his deepfake video supporting a political party: 'I would only be answerable to...'![submenu-img]() Meet India's most talented superstar, is actor, dancer, stuntman, singer, lyricist; not Ranbir, Shah Rukh, Aamir, Salman

Meet India's most talented superstar, is actor, dancer, stuntman, singer, lyricist; not Ranbir, Shah Rukh, Aamir, Salman![submenu-img]() This flop film was headlined by star kid, marked south actress's Bollywood debut, made in Rs 120 crore, earned just...

This flop film was headlined by star kid, marked south actress's Bollywood debut, made in Rs 120 crore, earned just...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Aamir Khan, Naseeruddin Shah, Sonali Bendre celebrate 25 years of Sarfarosh, attend film's special screening

Aamir Khan, Naseeruddin Shah, Sonali Bendre celebrate 25 years of Sarfarosh, attend film's special screening![submenu-img]() Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’

Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’![submenu-img]() Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates

Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Ashutosh Rana breaks silence on his deepfake video supporting a political party: 'I would only be answerable to...'

Ashutosh Rana breaks silence on his deepfake video supporting a political party: 'I would only be answerable to...'![submenu-img]() Meet India's most talented superstar, is actor, dancer, stuntman, singer, lyricist; not Ranbir, Shah Rukh, Aamir, Salman

Meet India's most talented superstar, is actor, dancer, stuntman, singer, lyricist; not Ranbir, Shah Rukh, Aamir, Salman![submenu-img]() This flop film was headlined by star kid, marked south actress's Bollywood debut, made in Rs 120 crore, earned just...

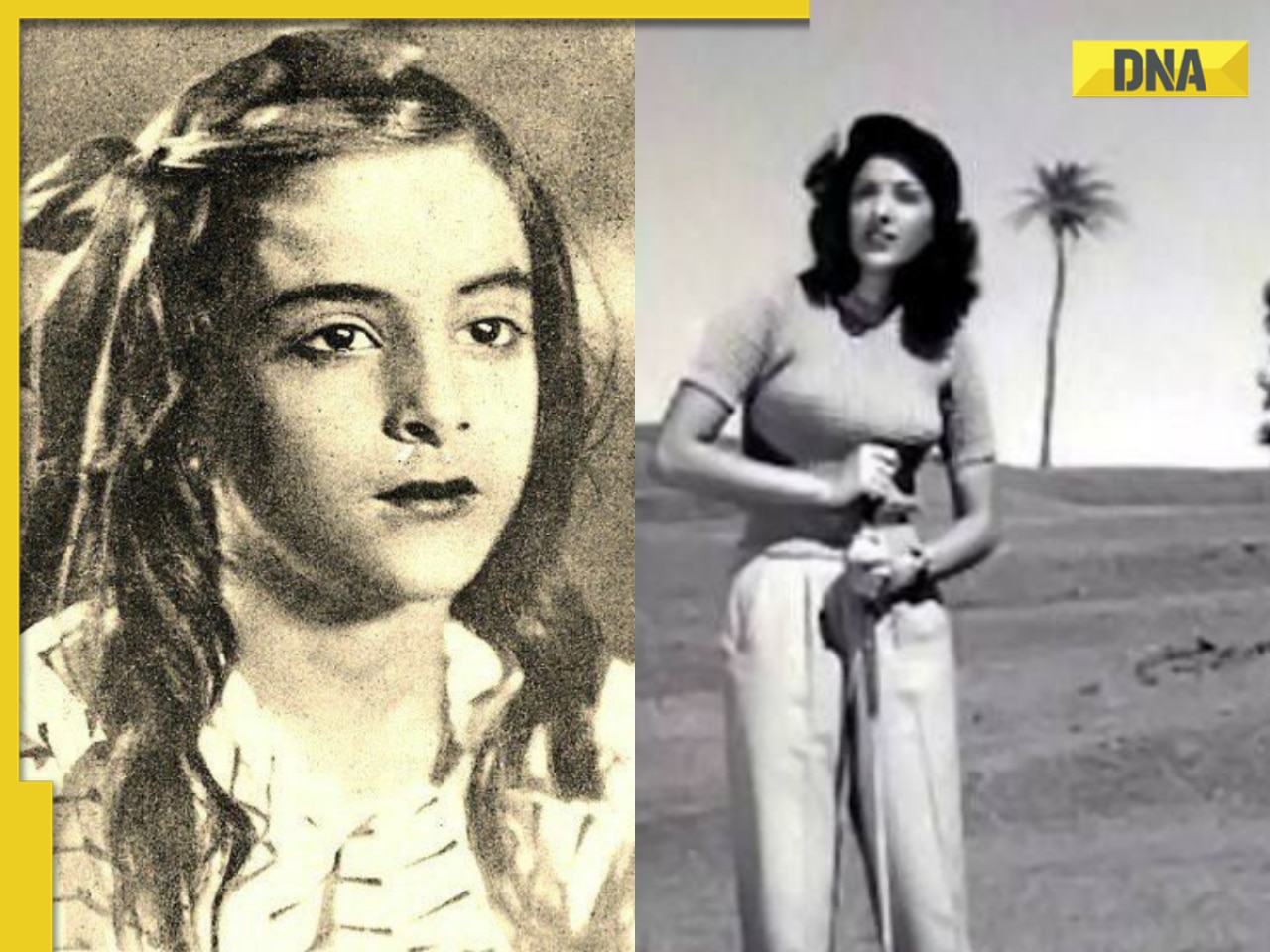

This flop film was headlined by star kid, marked south actress's Bollywood debut, made in Rs 120 crore, earned just...![submenu-img]() India's most successful star kid was superstar at 14, daughter of tawaif, affair with married star broke her, died at...

India's most successful star kid was superstar at 14, daughter of tawaif, affair with married star broke her, died at...![submenu-img]() India's biggest flop actor, worked with superstars, married girl half his age, once left Aamir's film midway due to..

India's biggest flop actor, worked with superstars, married girl half his age, once left Aamir's film midway due to..![submenu-img]() England pace legend James Anderson set to retire from Test cricket after talks with Brendon McCullum

England pace legend James Anderson set to retire from Test cricket after talks with Brendon McCullum![submenu-img]() IPL 2024: Shubman Gill, Sai Sudharsan centuries guide Gujarat Titans to 35-run win over Chennai Super Kings

IPL 2024: Shubman Gill, Sai Sudharsan centuries guide Gujarat Titans to 35-run win over Chennai Super Kings![submenu-img]() KKR vs MI IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

KKR vs MI IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() 'It's ego-driven...': Ex-RCB star on Hardik Pandya's captaincy in IPL 2024

'It's ego-driven...': Ex-RCB star on Hardik Pandya's captaincy in IPL 2024![submenu-img]() BCCI to advertise for Team India's new head coach after T20 World Cup

BCCI to advertise for Team India's new head coach after T20 World Cup![submenu-img]() Viral video: Kind man assists duck family in crossing the road, internet lauds him

Viral video: Kind man assists duck family in crossing the road, internet lauds him![submenu-img]() Can you see the Great Wall of China from space? here's the truth

Can you see the Great Wall of China from space? here's the truth![submenu-img]() Mother bear teaches cubs how to cross a road with caution, video goes viral

Mother bear teaches cubs how to cross a road with caution, video goes viral![submenu-img]() Meet the tawaif, real courtesan of Heeramandi, was once highest paid item girl, was killed by....

Meet the tawaif, real courtesan of Heeramandi, was once highest paid item girl, was killed by....![submenu-img]() Mukesh Ambani’s old image with billionaire friends go viral, Harsh Goenka makes joke of…

Mukesh Ambani’s old image with billionaire friends go viral, Harsh Goenka makes joke of…

)

)

)

)

)

)