In its Financial Stability Report, the central bank says risks to India's banking sector have risen in the last six months, given a deterioration in asset quality and lacklustre corporate profit growth

Stressed balance-sheets of large- and medium-sized firms have increased the risks to the banking sector during the half-year ended September 2015 due to deteriorating asset quality, lower soundness and sluggish profitability, the Reserve Bank of India (RBI) said in its Financial Stability Report (FSR).

However, it said that though the stress tests revealed resilience, the system could become vulnerable if the macroeconomic conditions deteriorate sharply.

The total bad loans rose to 5.1% of total advances of the banking system at the end of the second quarter that ended September 30, 2015, from 4.6% in March 2015, the central bank said in the report.

In the foreword to the FSR, RBI governor Raghuram Rajan said the corporate sector vulnerabilities and the impact of their weak balance-sheets on the financial system need closer monitoring.

The report warned that the bad loans in the banking system were emanating from large corporate borrowers who are struggling to repay their debt as they are over-leveraged. This is despite the fact that the companies' ability to repay improved as measured by earnings relative to interest it owed the banks. The dominance of Ponzi borrowers can cause disruptions in the financial system when asset prices stop rising, it said. Ponzi borrowers are those whose current cash flows were insufficient to meet the debt obligations but borrowed on the faith that appreciation in the asset values could take care of such obligations.

The proportion of the bad loans of large borrowers climbed 87.4% in the half-year ended September, 2015 from 798.2% at the end of March 2015. Five sub-sectors mining, iron & steel, textiles, infrastructure and aviation which together constituted 24.2% of the total advances of banks at the end of first quarter ended June 30, 2015. They comprised 53% of the total stressed advances. Aviation sector reported stressed assets of 61% in the first quarter of 2015-16, up from 58.9% in the preceeding quarter, infrastructure sector reported a rise in stressed assets to 24.2% from 22.9% in the preceeding quarter.

The FSR said, "The performance of these sectors and their impact on the asset quality of the banks continue to be a matter of concern." Credit growth of all SCBs, on a year-on-year basis, further declined to 9.4% from 9.7% while the growth in deposits declined to 9.9% from 10.7% between March and September 2015. Within the bank-groups, public sector banks (PSBs) continued to register subdued performance in credit as well as deposits, whereas private sector banks (PVBs) and foreign banks (FBs) showed robust growth during the same period.

Rajan flagged off concerns on cyber security which, he said, will be a major challenge. He said in the foreword to the report, "Cyber security is more of a strategic issue than a mere operational concern, requiring board level understanding of the threats and solutions therefore."

"Despite domestic inflation coming down significantly, we should not lose sight of the fact that the climatic conditions have tended to be more erratic and unpredictable. This will have an impact on the volatility of inflation and perhaps its level." Rajan added in the foreword.

India, he said, appears to be relatively better placed compared to many of its emerging market peers, thanks to a combination of prudent policy measures and benign commodity prices.

"There are a few issues that we need to take note of as we prepare to take on the emerging risks," he said.

![submenu-img]() Viral video: Kind man assists duck family in crossing the road, internet lauds him

Viral video: Kind man assists duck family in crossing the road, internet lauds him![submenu-img]() Can you see the Great Wall of China from space? here's the truth

Can you see the Great Wall of China from space? here's the truth![submenu-img]() Ashutosh Rana breaks silence on his deepfake video supporting a political party: 'I would only be answerable to...'

Ashutosh Rana breaks silence on his deepfake video supporting a political party: 'I would only be answerable to...'![submenu-img]() Meet India's most talented superstar, is actor, dancer, stuntman, singer, lyricist; not Ranbir, Shah Rukh, Aamir, Salman

Meet India's most talented superstar, is actor, dancer, stuntman, singer, lyricist; not Ranbir, Shah Rukh, Aamir, Salman![submenu-img]() This flop film was headlined by star kid, marked south actress's Bollywood debut, made in Rs 120 crore, earned just...

This flop film was headlined by star kid, marked south actress's Bollywood debut, made in Rs 120 crore, earned just...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Aamir Khan, Naseeruddin Shah, Sonali Bendre celebrate 25 years of Sarfarosh, attend film's special screening

Aamir Khan, Naseeruddin Shah, Sonali Bendre celebrate 25 years of Sarfarosh, attend film's special screening![submenu-img]() Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’

Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’![submenu-img]() Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates

Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Ashutosh Rana breaks silence on his deepfake video supporting a political party: 'I would only be answerable to...'

Ashutosh Rana breaks silence on his deepfake video supporting a political party: 'I would only be answerable to...'![submenu-img]() Meet India's most talented superstar, is actor, dancer, stuntman, singer, lyricist; not Ranbir, Shah Rukh, Aamir, Salman

Meet India's most talented superstar, is actor, dancer, stuntman, singer, lyricist; not Ranbir, Shah Rukh, Aamir, Salman![submenu-img]() This flop film was headlined by star kid, marked south actress's Bollywood debut, made in Rs 120 crore, earned just...

This flop film was headlined by star kid, marked south actress's Bollywood debut, made in Rs 120 crore, earned just...![submenu-img]() India's most successful star kid was superstar at 14, daughter of tawaif, affair with married star broke her, died at...

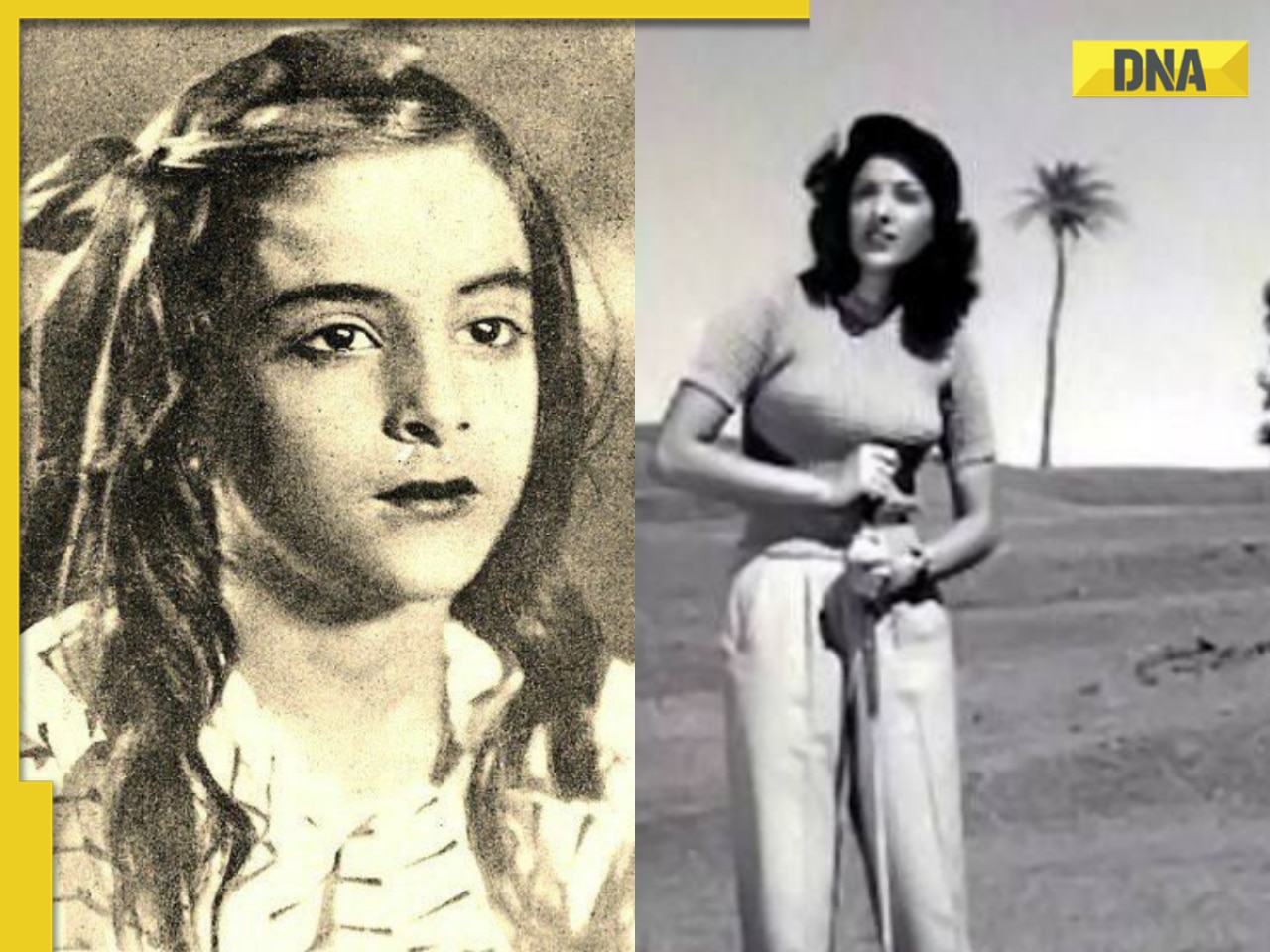

India's most successful star kid was superstar at 14, daughter of tawaif, affair with married star broke her, died at...![submenu-img]() India's biggest flop actor, worked with superstars, married girl half his age, once left Aamir's film midway due to..

India's biggest flop actor, worked with superstars, married girl half his age, once left Aamir's film midway due to..![submenu-img]() England pace legend James Anderson set to retire from Test cricket after talks with Brendon McCullum

England pace legend James Anderson set to retire from Test cricket after talks with Brendon McCullum![submenu-img]() IPL 2024: Shubman Gill, Sai Sudharsan centuries guide Gujarat Titans to 35-run win over Chennai Super Kings

IPL 2024: Shubman Gill, Sai Sudharsan centuries guide Gujarat Titans to 35-run win over Chennai Super Kings![submenu-img]() KKR vs MI IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

KKR vs MI IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() 'It's ego-driven...': Ex-RCB star on Hardik Pandya's captaincy in IPL 2024

'It's ego-driven...': Ex-RCB star on Hardik Pandya's captaincy in IPL 2024![submenu-img]() BCCI to advertise for Team India's new head coach after T20 World Cup

BCCI to advertise for Team India's new head coach after T20 World Cup![submenu-img]() Viral video: Kind man assists duck family in crossing the road, internet lauds him

Viral video: Kind man assists duck family in crossing the road, internet lauds him![submenu-img]() Can you see the Great Wall of China from space? here's the truth

Can you see the Great Wall of China from space? here's the truth![submenu-img]() Mother bear teaches cubs how to cross a road with caution, video goes viral

Mother bear teaches cubs how to cross a road with caution, video goes viral![submenu-img]() Meet the tawaif, real courtesan of Heeramandi, was once highest paid item girl, was killed by....

Meet the tawaif, real courtesan of Heeramandi, was once highest paid item girl, was killed by....![submenu-img]() Mukesh Ambani’s old image with billionaire friends go viral, Harsh Goenka makes joke of…

Mukesh Ambani’s old image with billionaire friends go viral, Harsh Goenka makes joke of…

)

)

)

)

)

)