1/ TAKEN BY SURPRISE

Investors piled into safe-haven assets after U. S. cruise missiles rained down on a Syrian airbase, following a policy shift by U. S. President Donald Trump.

Following are five big themes likely to dominate thinking of investors and traders in the coming week and the Reuters stories related to them.

1/ TAKEN BY SURPRISE

Investors piled into safe-haven assets after U.S. cruise missiles rained down on a Syrian airbase, following a policy shift by U.S. President Donald Trump. Analysts were quick to interpret the strike, in response to a chemical weapons attack blamed on Syria, as a signal to Russia and to other countries such as China, North Korea and Iran. Markets largely reversed course after U.S. officials said the airstrike was a "one-off". Friday's events have put investors on notice that geopolitics is likely to remain a major theme for markets this year. But they will also remain wary of assuming they know what Trump is thinking.

* U.S. fires missiles at Assad airbase; Russia denounces aggression

* China's Xi urges trade cooperation in first meeting with Trump

2/ BITTER DIVISION

Turkey holds a referendum on April 17 on replacing the country's parliamentary system with an executive U.S.-style presidency for Tayyip Erdogan. The result still looks like a coin toss but is guaranteed to trigger major moves in the lira and Turkey's stock and bond markets whichever way it goes. The referendum has bitterly divided the country. Opponents fear increasing authoritarianism from Erdogan, a leader they see as bent on eroding modern Turkey's democracy and secular foundations, while his campaign, in which he and government ministers have dominated the airwaves with multiple speeches daily, has strongly played the nationalist card to woo voters at home and abroad. The lira has lost almost a quarter of its value over the last year and analysts are predicting another dive if Erdogan wins and a jump if he doesn't.

* TAKE-A-LOOK-Turkey's referendum on boosting Erdogan's powers

* Kurds 're-energise' independence plan for post-jihadist Iraq

3/ GOLDILOCKS IN EUROPE?

JPMorgan, Citigroup and Wells Fargo will on Thursday kick-start a busy few weeks of corporate results and optimism is high. A synchronised uptick in profit forecasts as well as in GDP across every major market in the world is under way for the first time since 2010. Stock market valuations, running above historical averages, are already reflecting some of the upbeat sentiment so the bar for disappointments, particularly in the United States, is low. In Europe, the mood is even perkier thanks to relatively cheaper valuations, a definitive improvement in the macroeconomic backdrop and a still-accommodative central bank.

* Earnings growth across major markets:http://tmsnrt.rs/2ogGqDz

* Global growth forecasts:http://tmsnrt.rs/2nLr2ey

* European ETF inflows jump in March, equities in demand: Blackrock iShares

* Robotics ETF, anyone? Forms float trendy trackers in Europe

4/ HOT CROSS BUNDS

What better place to keep money safe from potential geopolitical shocks than German debt? Germany sells its benchmark 10-year bonds, one of the world's most liquid financial instruments, in the coming week. But, after failed auctions of both two- and five-year debt in recent weeks, the auspices are not the best. Germany's 10-year borrowing costs have halved since mid-March as yields dropped from a 0.509 percent peak to 0.22 percent. While this would suggest buying interest, this is actually much more an adjustment in monetary policy expectations. Last month, all the talk was about how the European Central Bank was planning to "normalise" its monetary policy stance, aided and abetted by some fighting talk from Bundesbank chief Jens Weidmann. But those expectations have cooled after recent signals from European policymakers and doubts over the "Trumpflation" trade. If the auction attracts fewer bids than the 3 billion euros on offer (and the small amount would tend to make this less likely) it would be the first failed auction of German 10-year bonds since September.

* ECB's Draghi sees no need to deviate from stated policy path

* Euro zone bond yields near lows as investors read monetary policy runes.

* Euro zone government debt auction calendar

5/ CHINA RISING

Whatever presidents Donald Trump and Xi Jinping had to say about trade at their first summit, growth in Chinese imports is expected to have remained strong in March. Trade and inflation data are due in the coming week as part of a suite of indicators expected to show solid growth in the world's second largest economy. Inflation is expected to remain mild, with consumer prices up 1.0 percent year-on-year after slowing to 0.8 percent in the previous month.

* China March data seen showing solid growth

* China FX reserves stay above $3 trillion after small March rise

* China data calendar

(This article has not been edited by DNA's editorial team and is auto-generated from an agency feed.)

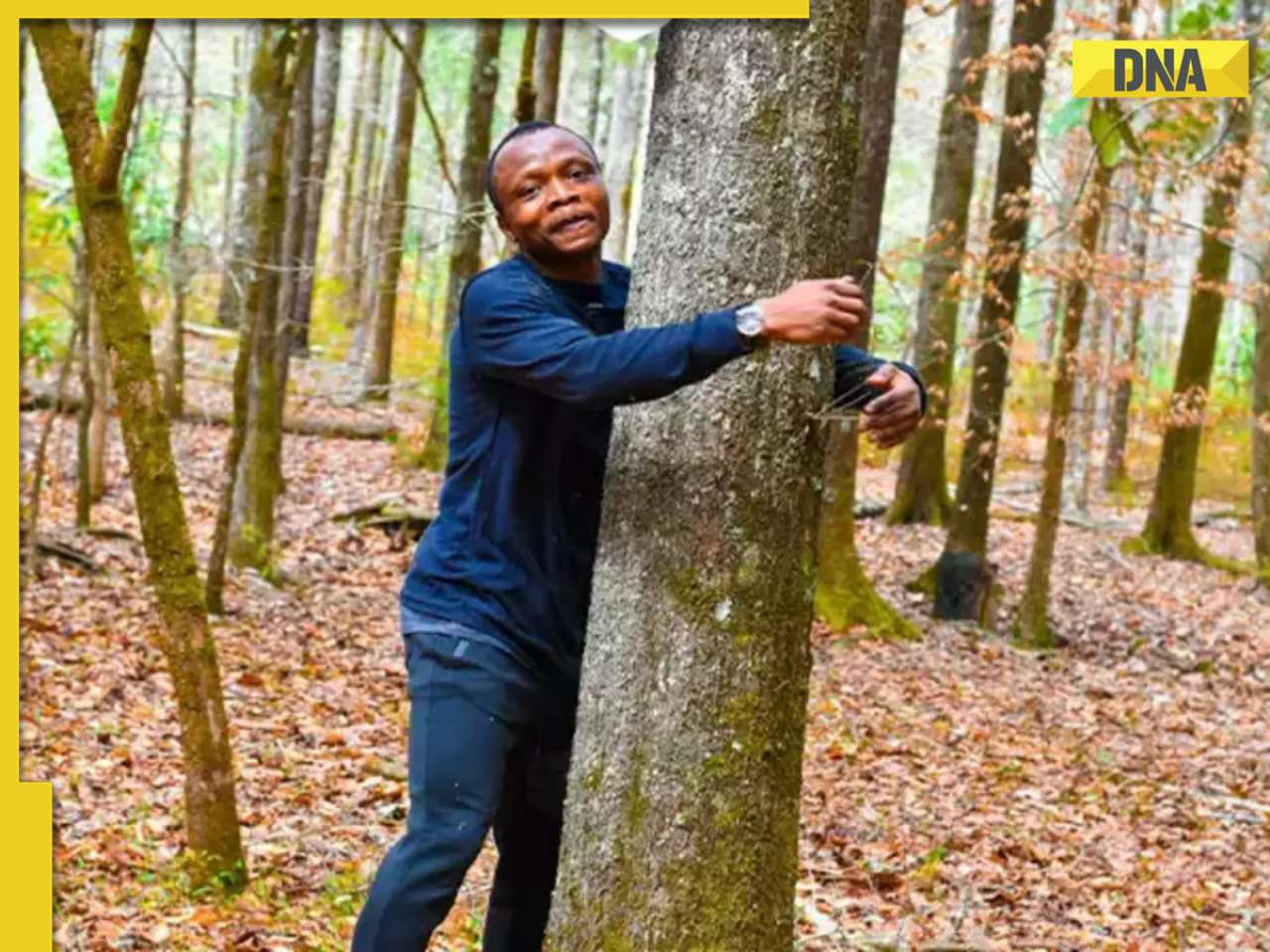

![submenu-img]() Viral video: Ghana man smashes world record by hugging over 1,100 trees in just one hour

Viral video: Ghana man smashes world record by hugging over 1,100 trees in just one hour![submenu-img]() This actress, who gave blockbusters, starved to look good, fainted at many events; later was found dead at...

This actress, who gave blockbusters, starved to look good, fainted at many events; later was found dead at...![submenu-img]() Taarak Mehta actor Gurucharan Singh operated more than 10 bank accounts: Report

Taarak Mehta actor Gurucharan Singh operated more than 10 bank accounts: Report![submenu-img]() Ambani, Adani, Tata will move to Dubai if…: Economist shares insights on inheritance tax

Ambani, Adani, Tata will move to Dubai if…: Economist shares insights on inheritance tax![submenu-img]() Cargo plane lands without front wheels in terrifying viral video, watch

Cargo plane lands without front wheels in terrifying viral video, watch![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’

Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’![submenu-img]() Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates

Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() This actress, who gave blockbusters, starved to look good, fainted at many events; later was found dead at...

This actress, who gave blockbusters, starved to look good, fainted at many events; later was found dead at...![submenu-img]() Taarak Mehta actor Gurucharan Singh operated more than 10 bank accounts: Report

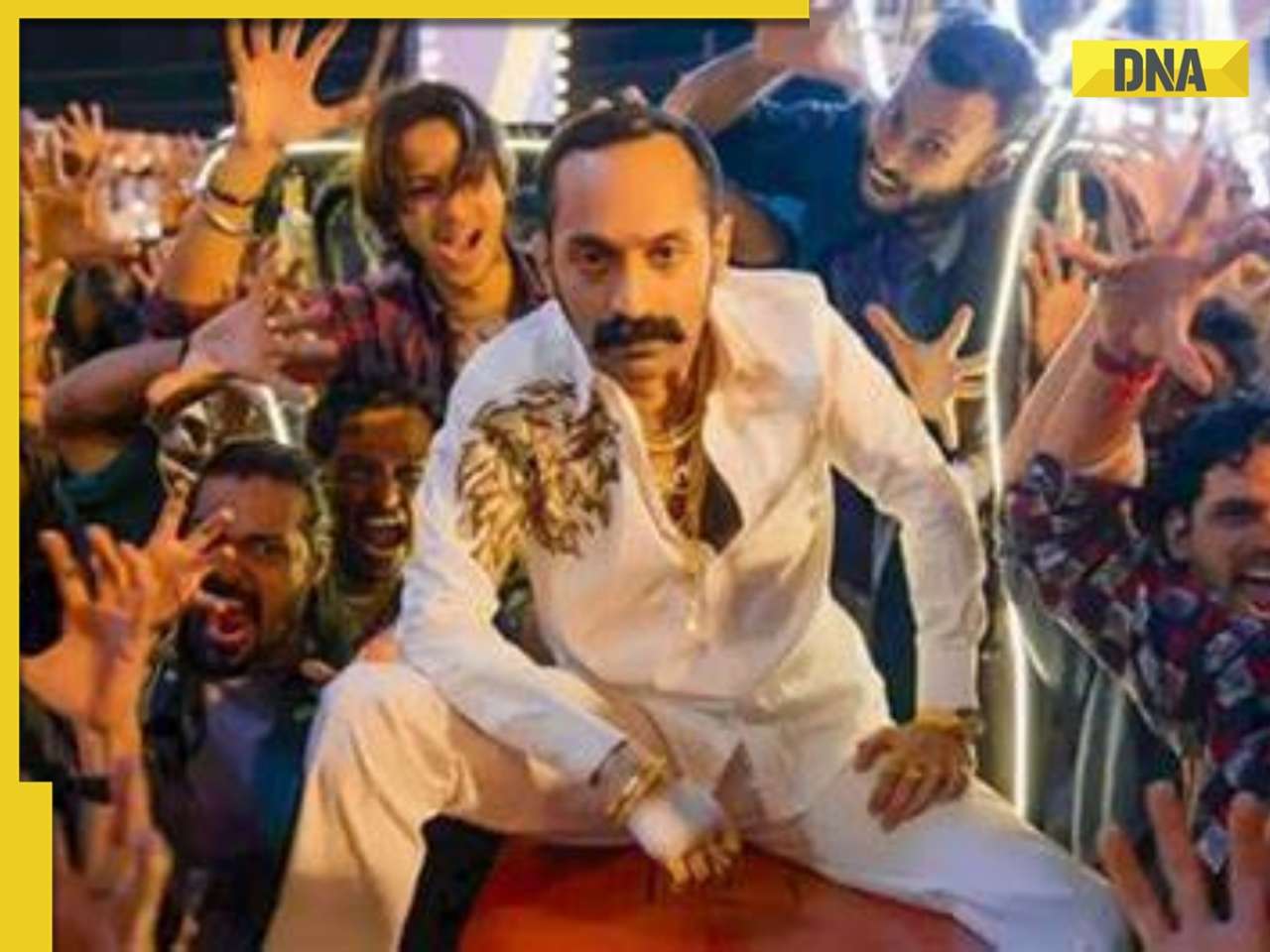

Taarak Mehta actor Gurucharan Singh operated more than 10 bank accounts: Report![submenu-img]() Aavesham OTT release: When, where to watch Fahadh Faasil's blockbuster action comedy

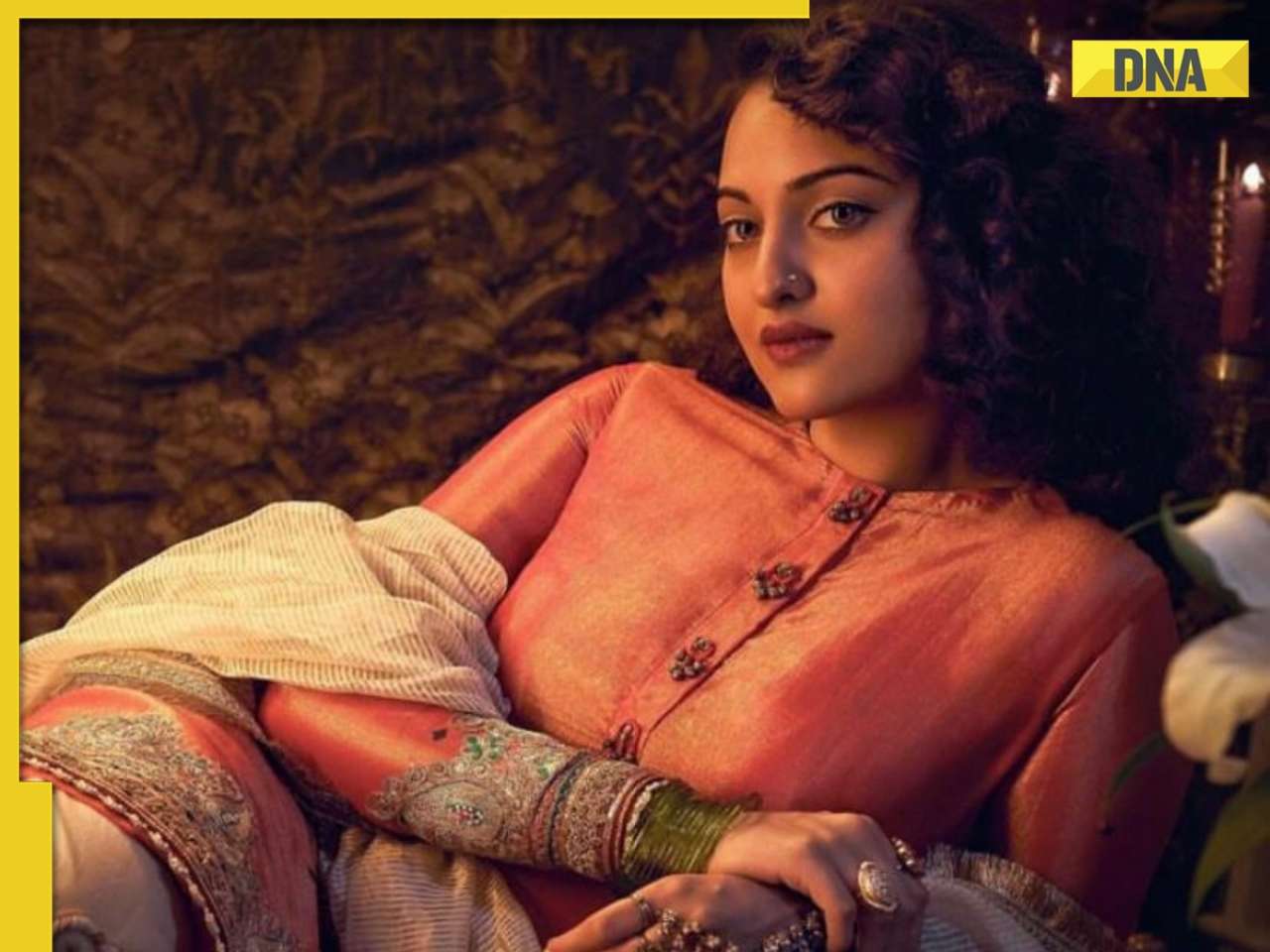

Aavesham OTT release: When, where to watch Fahadh Faasil's blockbuster action comedy![submenu-img]() Sonakshi Sinha slams trolls for crticising Heeramandi while praising Bridgerton: ‘Bhansali is selling you a…’

Sonakshi Sinha slams trolls for crticising Heeramandi while praising Bridgerton: ‘Bhansali is selling you a…’![submenu-img]() Sanjeev Jha reveals why he cast Chandan Roy in his upcoming film Tirichh: 'He is just like a rubber' | Exclusive

Sanjeev Jha reveals why he cast Chandan Roy in his upcoming film Tirichh: 'He is just like a rubber' | Exclusive![submenu-img]() IPL 2024: Mumbai Indians knocked out after Sunrisers Hyderabad beat Lucknow Super Giants by 10 wickets

IPL 2024: Mumbai Indians knocked out after Sunrisers Hyderabad beat Lucknow Super Giants by 10 wickets![submenu-img]() PBKS vs RCB IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

PBKS vs RCB IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() PBKS vs RCB IPL 2024 Dream11 prediction: Fantasy cricket tips for Punjab Kings vs Royal Challengers Bengaluru

PBKS vs RCB IPL 2024 Dream11 prediction: Fantasy cricket tips for Punjab Kings vs Royal Challengers Bengaluru![submenu-img]() Watch: Bangladesh cricketer Shakib Al Hassan grabs fan requesting selfie by his neck, video goes viral

Watch: Bangladesh cricketer Shakib Al Hassan grabs fan requesting selfie by his neck, video goes viral![submenu-img]() IPL 2024 Points table, Orange and Purple Cap list after Delhi Capitals beat Rajasthan Royals by 20 runs

IPL 2024 Points table, Orange and Purple Cap list after Delhi Capitals beat Rajasthan Royals by 20 runs![submenu-img]() Viral video: Ghana man smashes world record by hugging over 1,100 trees in just one hour

Viral video: Ghana man smashes world record by hugging over 1,100 trees in just one hour![submenu-img]() Cargo plane lands without front wheels in terrifying viral video, watch

Cargo plane lands without front wheels in terrifying viral video, watch![submenu-img]() Tiger cub mimics its mother in viral video, internet can't help but go aww

Tiger cub mimics its mother in viral video, internet can't help but go aww![submenu-img]() Octopus crawls across dining table in viral video, internet is shocked

Octopus crawls across dining table in viral video, internet is shocked![submenu-img]() This Rs 917 crore high-speed rail bridge took 9 years to build, but it leads nowhere, know why

This Rs 917 crore high-speed rail bridge took 9 years to build, but it leads nowhere, know why

)

)

)

)

)

)