World stocks rose 1% to their highest level in over a week and heading for their fourth straight day of gains as investors banked on global economic recovery to trump concerns over euro zone debt.

World stocks rose 1% today to their highest level in over a week and heading for their fourth straight day of gains as investors banked on global economic recovery to trump concerns over euro zone debt.

The euro also followed up its best week this year against the dollar to rise 1%. It gained 1.6% last week after slumping to a four-year low to the greenback.

A tentative equity rally since late May has lifted world stocks by around 6% from their lows. The index was up 0.9% by 1145 GMT on Monday.

Similarly, MSCI's main emerging market stock index has gained more than 9% since hitting a year low on May 25. It was up 1.4% on Monday.

While markets were spooked a week back by US data showing measly growth in private sector job creation, strong economic data from China has reinforced a belief that the world recovery is indeed gaining traction.

In the United States, president Barack Obama is stepping up a push for more government spending to boost the economy via tax breaks to some businesses and more jobless benefits, adding to last year's $863 billion stimulus.

Part of the current rally is due to this year's sell off -- world stocks are down 6% year to date and 8.2% for the second quarter -- but it is also the result of a belief among many investors that the underlying economic backdrop is relatively positive and that will support corporate earnings.

David Buik, senior partner at BGC partners said the wave of risk aversion in May had left shares a bit "oversold".

"Second quarter earnings will be somewhat better than people expect and there may be just a little bit of mileage left in the current rally," Buik said.

The pan-European FTSEurofirst 300 was up 0.8% to a four-week high after strong euro zone industrial output rekindled optimism over the bloc's economic outlook.

The rally was driven by banking, mining and commodity stocks, all of which tend to gain when economic sentiment is on the plus side.

A slight easing in worries over the euro zone crisis helped the banking sector, with leading banks Barclays, Societe Generale and Deutsche Bank rising 0.9 to 2.6%.

US stock futures pointed to a higher open on Wall Street, adding to last week's gains and tracking gains in global equities, with futures for the S&P 500, Dow Jones and Nasdaq 100 all up around 0.8%.

Earlier, Japan's Nikkei closed up 1.8%, driven higher by exporters, again a group with a high correlation to economic growth.

"What is helping the market is the notion that a double dip recession is not a big risk," said Bernard McAlinden, investment strategist at NCB Stockbrokers in Dublin. "I think that is what the markets are latching on to."

The euro firmed against the dollar, as hedge funds covered short positions on the single European currency.

The euro traded with gains of around 1% versus the dollar at $1.2231 after hitting the day's high of $1.2258 on trading platform EBS.

It has risen more than 2.4% over the past five trading sessions but

is still down around 15% year to date.

"The dollar is softer against the euro as steady sentiment helped risk currencies recover further," said Geoffrey Yu, currency strategist at UBS.

"Equity markets performed solidly, especially on the back of expectations that policy will remain relatively loose for an extended period globally."

Overall, however, negative sentiment about the euro, prompted by fears for euro zone debt and the economic cost of cutting it, remained, with analysts ascribing the streak of gains to the market's pro-risk mood.

US Treasuries fell, with benchmark 10-year note yielding 3.2804%, up 4.8 basis points on the day. Two-year yields were up 3.2 basis points at 0.7661%.

Euro zone bonds likewise weakened, with the 10-year Bund yield at 2.629 %, up 6 basis points.

![submenu-img]() Delhi-NCR weather update: Rain in parts of Delhi, Noida after record heat

Delhi-NCR weather update: Rain in parts of Delhi, Noida after record heat![submenu-img]() Hardik Pandya finally breaks silence amid divorce rumours with Natasa Stankovic

Hardik Pandya finally breaks silence amid divorce rumours with Natasa Stankovic![submenu-img]() Watch viral video: 17 cars gutted as fire erupts at parking lot in Delhi

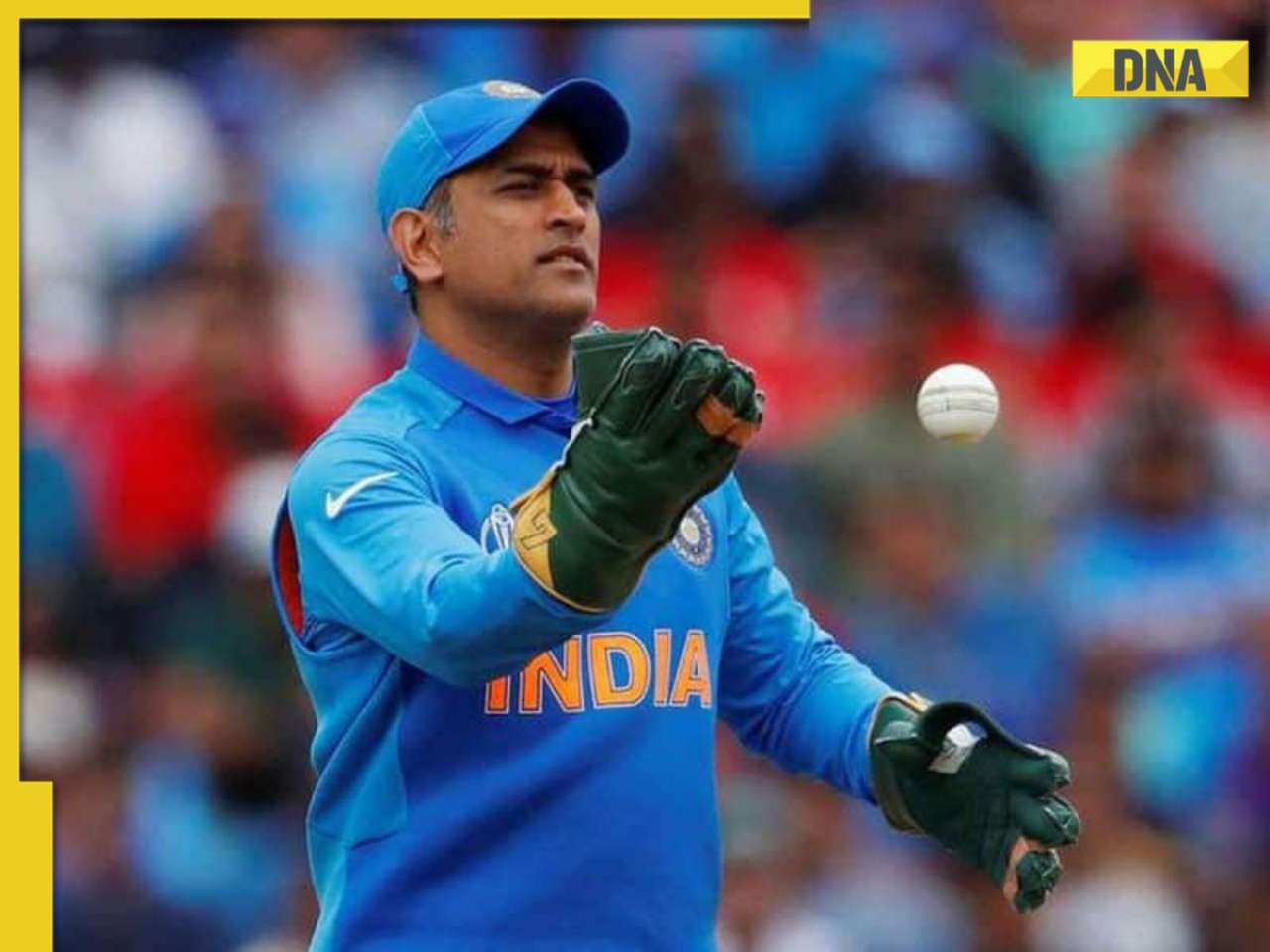

Watch viral video: 17 cars gutted as fire erupts at parking lot in Delhi![submenu-img]() Explained: Why MS Dhoni cannot apply for India head coach job

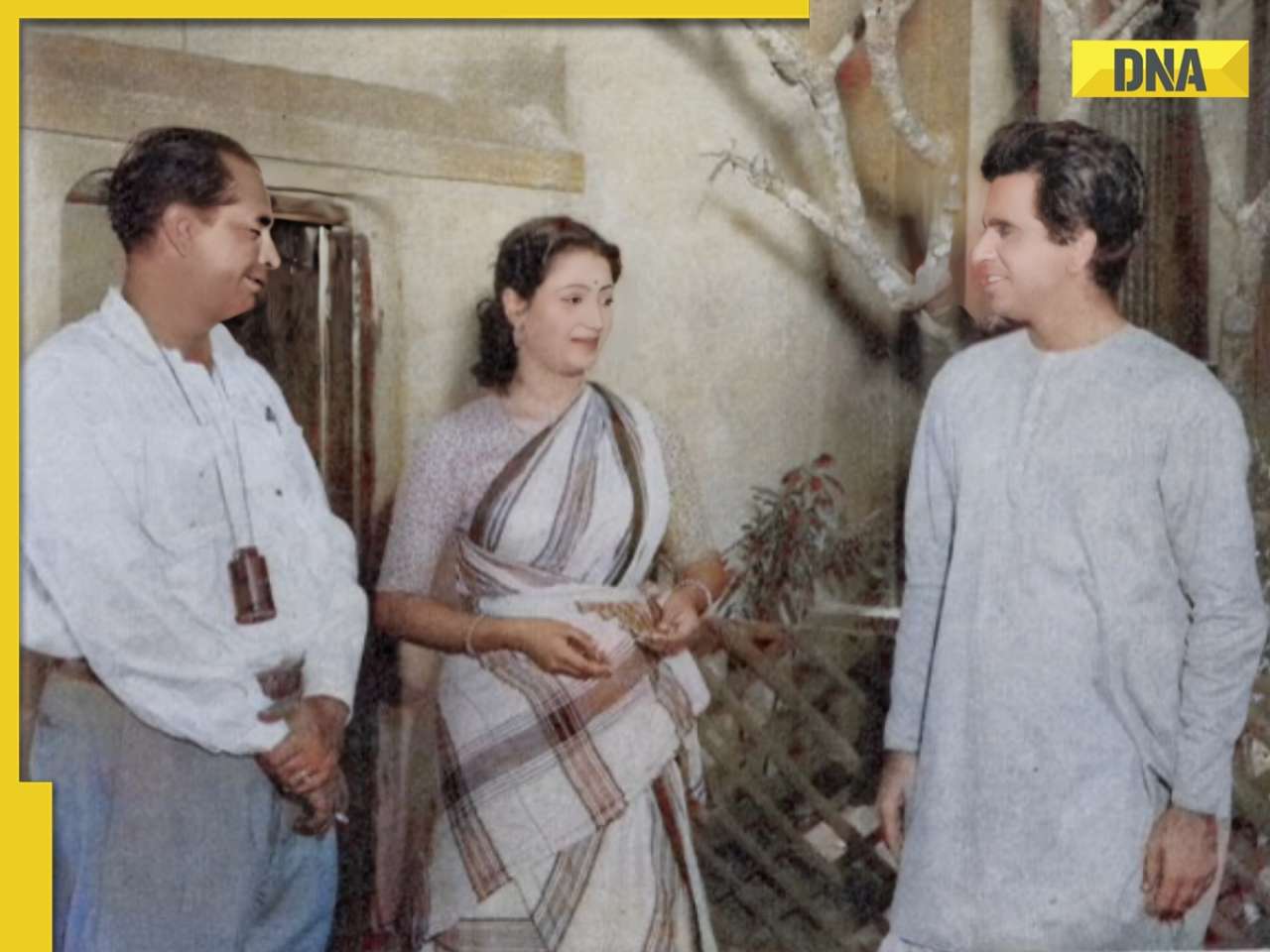

Explained: Why MS Dhoni cannot apply for India head coach job![submenu-img]() Nargis, Bina Rai, Suraiya rejected this role, chosen actress refused Filmfare Award; film became classic, is based on...

Nargis, Bina Rai, Suraiya rejected this role, chosen actress refused Filmfare Award; film became classic, is based on...![submenu-img]() RBSE 10th Result 2024: Rajasthan Board Class 10 results to be out today; check time, direct link here

RBSE 10th Result 2024: Rajasthan Board Class 10 results to be out today; check time, direct link here![submenu-img]() Meet Indian genius who founded India's first pharma company, he is called 'Father of...

Meet Indian genius who founded India's first pharma company, he is called 'Father of...![submenu-img]() DU Admission 2024: Delhi University launches admission portal to 71000 UG seats; check details

DU Admission 2024: Delhi University launches admission portal to 71000 UG seats; check details![submenu-img]() Meet IAS officer, who became UPSC topper in 1st attempt, sister is also IAS officer, mother cracked UPSC exam, she is...

Meet IAS officer, who became UPSC topper in 1st attempt, sister is also IAS officer, mother cracked UPSC exam, she is...![submenu-img]() Meet student who cleared JEE Advanced with AIR 1, went to IIT Bombay but left after a year due to..

Meet student who cleared JEE Advanced with AIR 1, went to IIT Bombay but left after a year due to..![submenu-img]() DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo

DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo![submenu-img]() DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here

DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() Avneet Kaur shines in navy blue gown with shimmery trail at Cannes 2024, fans say 'she is unstoppable now'

Avneet Kaur shines in navy blue gown with shimmery trail at Cannes 2024, fans say 'she is unstoppable now'![submenu-img]() Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes

Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes ![submenu-img]() Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'

Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'![submenu-img]() AI models play volley ball on beach in bikini

AI models play volley ball on beach in bikini![submenu-img]() AI models set goals for pool parties in sizzling bikinis this summer

AI models set goals for pool parties in sizzling bikinis this summer![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?

DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() Nargis, Bina Rai, Suraiya rejected this role, chosen actress refused Filmfare Award; film became classic, is based on...

Nargis, Bina Rai, Suraiya rejected this role, chosen actress refused Filmfare Award; film became classic, is based on...![submenu-img]() Meet Shah Rukh Khan, Akshay Kumar’s heroine, who gave 19 flops in 14 years, quit films; now runs India’s first…

Meet Shah Rukh Khan, Akshay Kumar’s heroine, who gave 19 flops in 14 years, quit films; now runs India’s first…![submenu-img]() Meet actress, who lost films to star kids, was insulted by on shoot; later worked in biggest Indian film, is worth...

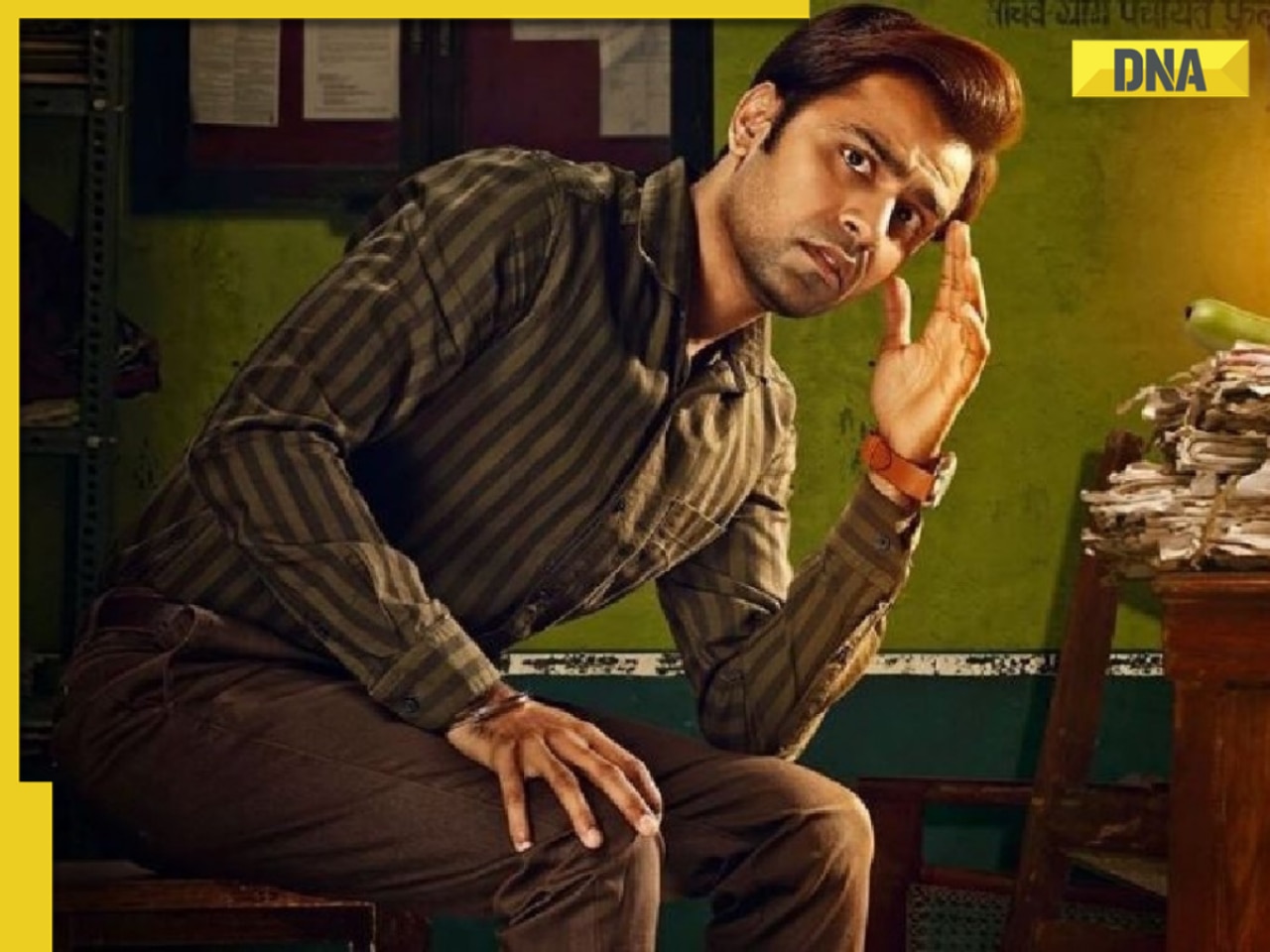

Meet actress, who lost films to star kids, was insulted by on shoot; later worked in biggest Indian film, is worth...![submenu-img]() Jitendra Kumar says there is scope for multiple seasons of Panchayat, opens up on chances of season 4 | Exclusive

Jitendra Kumar says there is scope for multiple seasons of Panchayat, opens up on chances of season 4 | Exclusive![submenu-img]() Randeep Hooda marks Swatantrya Veer Savarkar OTT release with visit to cellular jail in Andaman, sees Savarkar's cell

Randeep Hooda marks Swatantrya Veer Savarkar OTT release with visit to cellular jail in Andaman, sees Savarkar's cell![submenu-img]() Meet Mukesh Ambani's bahu Radhika Merchant's makeup artist, whose client is Alia Bhatt, her fees is...

Meet Mukesh Ambani's bahu Radhika Merchant's makeup artist, whose client is Alia Bhatt, her fees is...![submenu-img]() 'All Eyes On Rafah' campaign goes viral on social media, here's what the image means

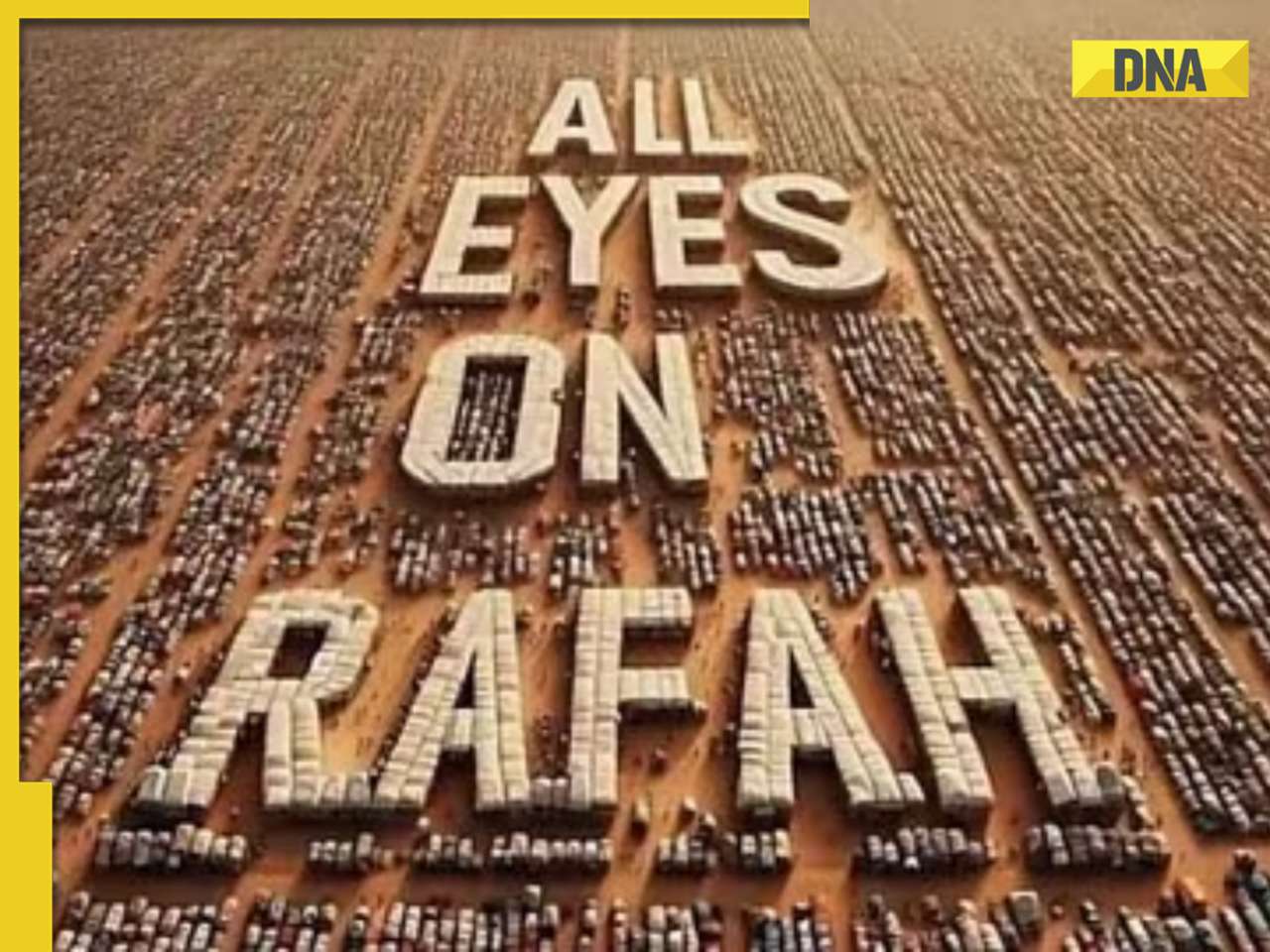

'All Eyes On Rafah' campaign goes viral on social media, here's what the image means![submenu-img]() Mukesh Ambani's son Anant Ambani, Radhika Merchant's 2nd pre-wedding bash begins today: Know all details here

Mukesh Ambani's son Anant Ambani, Radhika Merchant's 2nd pre-wedding bash begins today: Know all details here![submenu-img]() Viral video: Woman takes over streets of London in lungi, here’s how locals reacted

Viral video: Woman takes over streets of London in lungi, here’s how locals reacted![submenu-img]() Which countries are witnessing rapid increase in Muslim population? Where does India stand? Check full list here

Which countries are witnessing rapid increase in Muslim population? Where does India stand? Check full list here

)

)

)

)

)

)