President Barack Obama on Monday is scheduled to submit to Congress his fiscal 2013 budget proposal, which attempts to chart a fiscal path for the next 10 years.

President Barack Obama on Monday is scheduled to submit to Congress his fiscal 2013 budget proposal, which attempts to chart a fiscal path for the next 10 years.

Presidents' budget blueprints often are ignored by Congress and this year, Republicans in the House of Representatives are expected to criticize spending proposals in this Democratic initiative, especially with the two political parties gearing up for the November elections.

Even if they end up being ignored by Congress, major elements of Obama's newest budget proposal likely will be debated throughout this year and possibly into next year, depending on the outcome of the November 6 presidential and congressional elections.

Here are some highlights of Obama's budget, as outlined on Friday by senior administration officials:

* DEFICITS/SPENDING CUTS

The U.S. budget deficit is expected to dip to $901 billion in fiscal 2013, which starts on October 1, down from a projected $1.33 trillion this year.

Obama's budget adheres to a deficit-reduction law enacted in August, which places caps on many domestic programs in order to reduce spending by nearly $1 trillion over 10 years.

The White House projects that under the Obama budget, discretionary spending (money for programs that get renewed annually) would fall from 8.7% of Gross Domestic Product in 2011 to 5% in 2022.

A total of $4 trillion in spending cuts are included in the budget plan so that deficits fall to 2.8% of the economy in 2018, down from 8.5% forecast for this year.

* TAXES

Obama is again proposing to raise taxes on the wealthy. For households making more than $1 million a year, a minimum 30% tax rate would be instituted. This is known as the "Buffett Rule," named after billionaire Warren Buffett, who says he should not enjoy a lower tax rate than his secretary.

Republicans in Congress have opposed raising tax rates on any income group.

The Obama budget also would let the 2001 and 2003 tax cuts ushered in by then-President George W. Bush expire for the highest earners. It also would eliminate some tax breaks for the wealthy. But no details have been released yet.

On corporate taxes, an administration official said that an initiative to lower the rate will be unveiled later this month. The current top corporate tax rate of 35% is expected to be lowered to the high 20s under a plan the White House is weighing.

The White House said that for every $1 in new revenue the Obama budget would raise from those making more than $250,000 a year and from closing corporate "loopholes," his plan would cut $2.50 in spending, including the deficit-reduction steps enacted last year.

*JOB CREATION

Last September, Obama unveiled a $447 billion job creation plan that Republicans in Congress have blocked. His budget outlines more than $350 billion in short-term job growth steps, which incorporates many of the ideas he floated in September.

This includes $50 billion in spending to improve roads, rails and airport runways "to create thousands" of jobs, according to a White House preview. Surface transportation funding over six years would be $476 billion and would be paid for through existing fees and savings from winding down the wars in Iraq and Afghanistan.

Another $60 billion would be dedicated to modernizing schools and helping states hire teachers and emergency workers.

A small business tax credit would be aimed at firms that hire new employees.

* OTHER SAVINGS

Obama's budget will call for more than $360 billion in savings over 10 years to Medicare and Medicaid healthcare programs for the elderly and poor, as well as other healthcare programs. Another $278 billion would be cut from programs including farm subsidies and federal employees' pensions.

Department of Defense spending, not including war funding, would be $487 billion over 10 years below the amount envisioned in the 2012 budget. The overall defense budget, including funds for the wars in Iraq and Afghanistan, would be 5% below the level enacted this year.

A senior administration official also said that about $600 billion in automatic spending cuts for the military that are set to trigger in early 2013 would be replaced by a "balanced deficit-reduction package."

![submenu-img]() 'They unilaterally took some measures': EAM Jaishankar on new Nepal 100 rupee currency

'They unilaterally took some measures': EAM Jaishankar on new Nepal 100 rupee currency![submenu-img]() Meet Ice Cream Lady of India, who built Rs 6000 crore company, started with small investment of Rs…

Meet Ice Cream Lady of India, who built Rs 6000 crore company, started with small investment of Rs…![submenu-img]() ‘Canada a rule-of-law country’: PM Trudeau after 3 Indian arrested over Hardeep Nijjar's murder

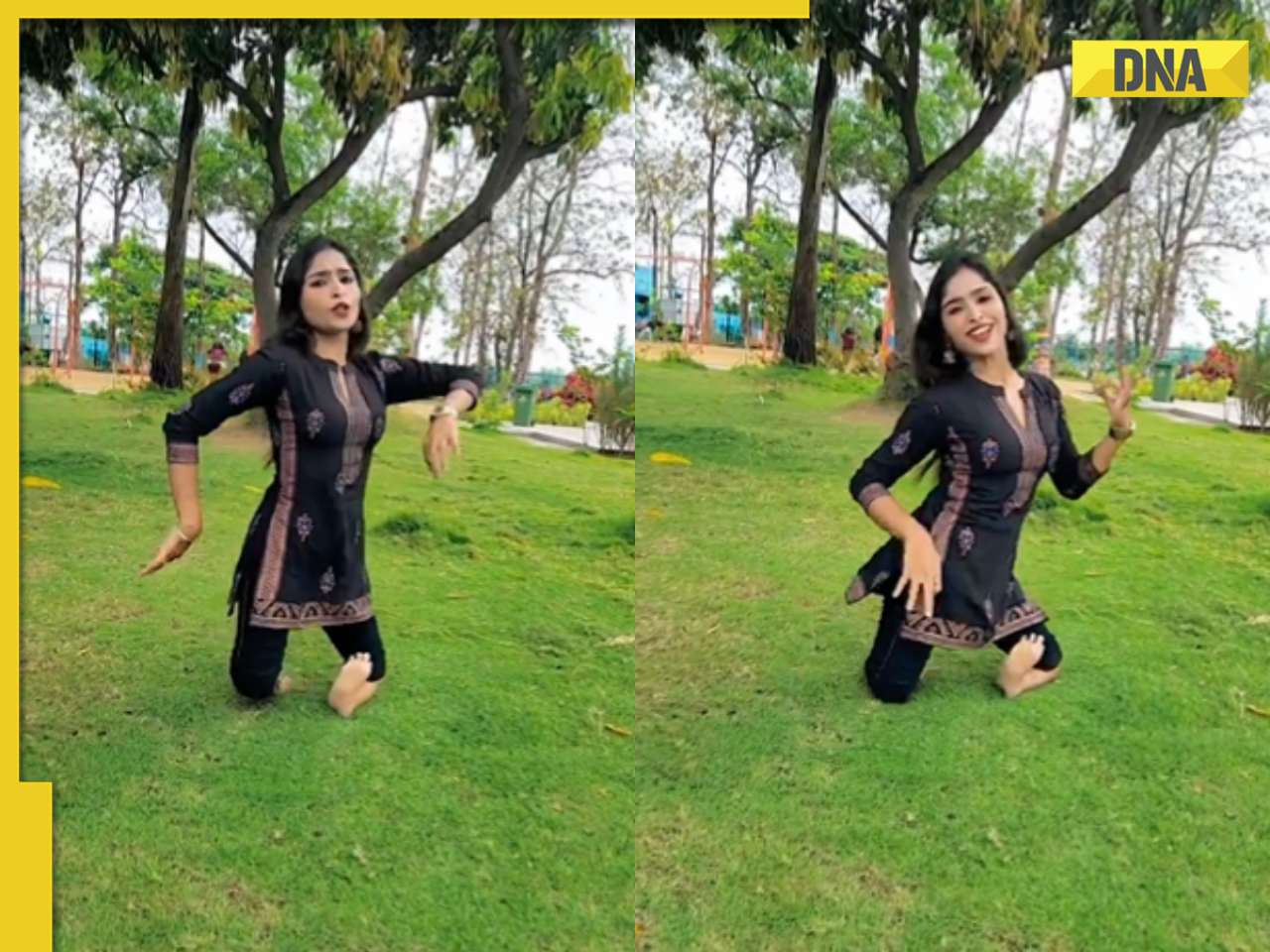

‘Canada a rule-of-law country’: PM Trudeau after 3 Indian arrested over Hardeep Nijjar's murder![submenu-img]() Viral video: Specially-abled girl’s energetic dance to Bollywood song wows internet, watch

Viral video: Specially-abled girl’s energetic dance to Bollywood song wows internet, watch![submenu-img]() 'Baap re baap': Imtiaz Ali reveals Diljit Dosanjh was scandalised by old women's 'vulgar' improvisation on Chamkila set

'Baap re baap': Imtiaz Ali reveals Diljit Dosanjh was scandalised by old women's 'vulgar' improvisation on Chamkila set![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

Actors who died due to cosmetic surgeries![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() 'Baap re baap': Imtiaz Ali reveals Diljit Dosanjh was scandalised by old women's 'vulgar' improvisation on Chamkila set

'Baap re baap': Imtiaz Ali reveals Diljit Dosanjh was scandalised by old women's 'vulgar' improvisation on Chamkila set![submenu-img]() This actor, who worked with Karan Johar and Farhan Akhtar, gave superhit shows, saw failed marriage, killed himself at..

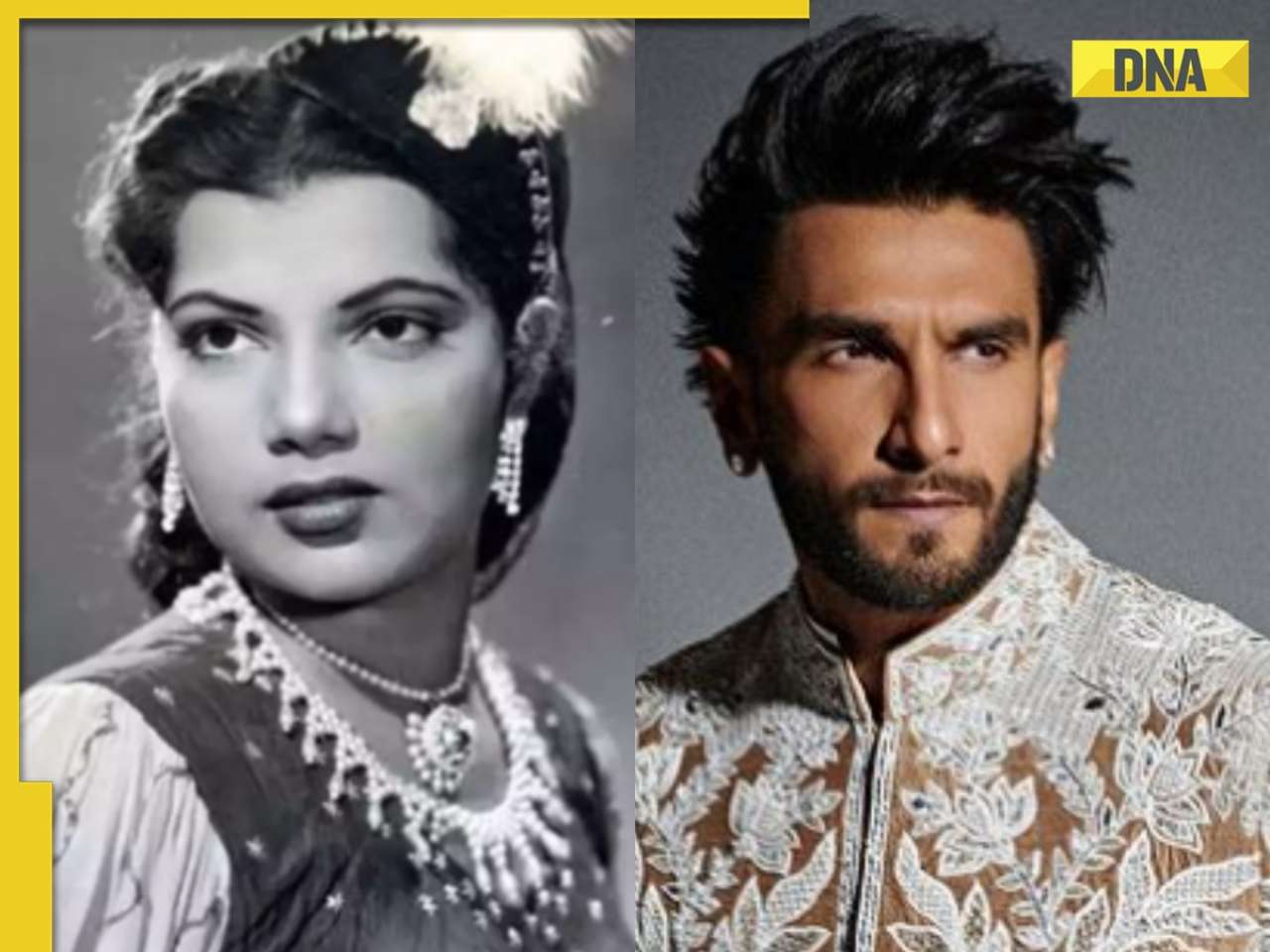

This actor, who worked with Karan Johar and Farhan Akhtar, gave superhit shows, saw failed marriage, killed himself at..![submenu-img]() Did you know Ranveer Singh's grandmother was popular actress? Worked with Raj Kapoor; her career affected due to...

Did you know Ranveer Singh's grandmother was popular actress? Worked with Raj Kapoor; her career affected due to...![submenu-img]() India's highest-paid TV actress began working at 8, her Bollywood films flopped, was seen in Bigg Boss 1, now charges...

India's highest-paid TV actress began working at 8, her Bollywood films flopped, was seen in Bigg Boss 1, now charges...![submenu-img]() Shreyas Talpade wonders if his heart attack was due to Covid vaccine: 'We don’t know what we have taken inside...'

Shreyas Talpade wonders if his heart attack was due to Covid vaccine: 'We don’t know what we have taken inside...'![submenu-img]() IPL 2024: Faf du Plessis, Virat Kohli help Royal Challengers Bengaluru defeat Gujarat Titans by 4 wickets

IPL 2024: Faf du Plessis, Virat Kohli help Royal Challengers Bengaluru defeat Gujarat Titans by 4 wickets![submenu-img]() IPL 2024: Why is Sai Kishore not playing today's RCB vs GT match?

IPL 2024: Why is Sai Kishore not playing today's RCB vs GT match?![submenu-img]() 'Mumbai Indians ki kahani khatam': Ex-India star slams Hardik Pandya after MI's loss to KKR at Wankhede

'Mumbai Indians ki kahani khatam': Ex-India star slams Hardik Pandya after MI's loss to KKR at Wankhede![submenu-img]() LSG vs KKR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

LSG vs KKR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() LSG vs KKR IPL 2024 Dream11 prediction: Fantasy cricket tips for Lucknow Super Giants vs Kolkata Knight Riders

LSG vs KKR IPL 2024 Dream11 prediction: Fantasy cricket tips for Lucknow Super Giants vs Kolkata Knight Riders![submenu-img]() Viral video: Specially-abled girl’s energetic dance to Bollywood song wows internet, watch

Viral video: Specially-abled girl’s energetic dance to Bollywood song wows internet, watch![submenu-img]() Viral video: Man educates younger brother about mensuration, internet is highly impressed

Viral video: Man educates younger brother about mensuration, internet is highly impressed![submenu-img]() Girl's wedding dance to Haryanvi song interrupted by mother in viral video, internet reacts

Girl's wedding dance to Haryanvi song interrupted by mother in viral video, internet reacts![submenu-img]() Viral video: Man fearlessly grabs dozens of snakes, internet is scared

Viral video: Man fearlessly grabs dozens of snakes, internet is scared![submenu-img]() This mysterious mobile phone number was suspended after three users...

This mysterious mobile phone number was suspended after three users...

)

)

)

)

)

)