Tata Chemicals (TCL) is a player in the chemicals, fertilisers and food-additives space.

Tata Chemicals (TCL) is a player in the chemicals, fertilisers and food-additives space. It is a pioneer in branded salt and is one of the largest soda-ash manufacturers in the world. It makes sodium bicarbonate and other chemicals. For consumers, it also markets baking soda.

TCL’s manufacturing facilities for various products are located at Haldia in West Bengal, Mithapur in Gujarat and Babrala in Uttar Pradesh. It also has international capacities for soda ash and fertilisers.

Business: TCL’s consumer products business has two major product lines — of branded salt and sodium bicarbonate. Amongst salts, Tata Salt, its packaged brand, is most popular while Samunder Crystal is refined, iodised, clean, white-crystal salt, providing an alternative to unbranded crystalline salts. Tata Salt is the top selling brand with 44% market share. It has recently entered the West Asian market by launching the Topp brand in Dubai.

Farmers and dairy owners extensively use salts for cattle and poultry feed. TCL manufactures vacuum salt for consumption by livestock. Its refined sodium bicarbonate (non-chloride source of sodium) is ideal for poultry feeds and dairy animals.

TCL’s sodium bicarbonate plant has a capacity to manufacture 50,000 tonnes per annum. It manufactures technical granular and refined forms of it. Sodium bicarbonate products are marketed in India, Bangladesh, West Asia and Africa.

Chemicals comprise an important strategic business segment for TCL. Soda ash manufactured at Mithapur is a major component of this segment. Major supplies are to the glass industry. The Mithapur cement plant utilises the solid waste generated during manufacture of soda ash. This plant has a capacity to produce 1,500 tonnes per day of ordinary Portland cement and pozzolana Portland cement. It supplies low-cost caustic soda used in various industries as rayon, cellophane, soap, pulp and paper. It produces hydrochloric acid and liquid chlorine besides bromine and bromine-based compounds and gypsum.

The fertiliser plant at Babrala manufactures 8,64000 tonnes of urea, which is almost 12% of urea produced by the private sector in India. Phosphatic chemicals and fertilisers are manufactured at Haldia.

Investment rationale: Amongst TCL business segments, consumer products business is very steady. With Tata Salt enjoying the lead, newer brand I-shakti had also attained 14% market share in the first year of launch, taking TCL’s total market share to 58%.

The fertilisers business remains insulated from the global downturn and turmoil. De-bottlenecking was completed at Babrala plant in March 2009.

Its capacity has been boosted to 1115 million metric tonnes (mt) per year from previous 864.6 mt per year at an investment of Rs 208 crore. International prices of urea will not impact the company and minimum prices of $250 per mt remains guaranteed. TCL owns 35% of global low-cost natural soda ash capacity and is amongst the capable of withstanding an extreme slowdown. While developing markets of Africa and Asia are facing the threat of volume shrinkage, production cuts by China have helped TCL counter this.

TCL benefits from its global presence. It also has adequate capacities for soda ash outside India and decline in freight costs and reduced energy costs augur well. Domestic prices have seen reduction of 6%. Mithapur plant manufacturing soda ash has access to its own limestone quarries and saltpans making TCL cope with price reductions. Demand, on the other hand, remains stable in the domestic market.

TCL plans venturing into biofuels segment. A small biofuel plant is being commissioned at Nanded with capacity of 30 KL per day to assess viability of seed provisioning or sugarcane. A joint venture agreement with Singapore Temasek Life Sciences Lab is again directed towards bio-diesels project.

Concerns: TCL with its abilities is making efforts to make up for the soda ash volume losses and price corrections in the coming times. However any more negative surprises can impact revenues and profitability.

Supplies from China are another cause of concern. Government considering 31% safeguard duty on supplies from China will benefit TCL. Moreover, major Chinese capacities are synthetic and cannot compete with natural soda ash in long term.

Valuations: TCL posted a robust topline of Rs 3,495.59 crore at the end of third quarter, which grew 106% y-o-y from last year’s Rs 1,694.11 crore.

However, operating margins declined 339 basis points as costs of raw material and other input costs moved up sharply. Overall expenditure grew 115% to Rs 3,051.54 crore. Net profit thereby was somehow maintained at Rs 91 crore, although profit margins declined 277 bps. Reduction in input costs as energy, raw material etc will benefit and margins will improve from fourth quarter onwards.

With consumer products business being a steady growth contributor, fertiliser business will benefit from enhanced capacities at Babrala. With some concerns on global soda ash volumes and prices, TCL remains a good bet for investors with medium to long-term investment horizon.

Disclosure: The writer does not hold any shares in the company

![submenu-img]() Anant Raj Ventures into tier 2 and tier 3 cities, pioneering growth in India’s real estate sector

Anant Raj Ventures into tier 2 and tier 3 cities, pioneering growth in India’s real estate sector![submenu-img]() Sophie Turner reveals she wanted to terminate her first pregnancy with Joe Jonas: 'Didn't know if I wanted...'

Sophie Turner reveals she wanted to terminate her first pregnancy with Joe Jonas: 'Didn't know if I wanted...'![submenu-img]() Meet outsider who was given no money for first film, battled depression, now charges Rs 20 crore per film

Meet outsider who was given no money for first film, battled depression, now charges Rs 20 crore per film![submenu-img]() This is owner of most land in India, owns land in every state, total value is Rs...

This is owner of most land in India, owns land in every state, total value is Rs...![submenu-img]() Meet man who built Rs 39832 crore company after quitting high-paying job, his net worth is..

Meet man who built Rs 39832 crore company after quitting high-paying job, his net worth is..![submenu-img]() Meet woman who first worked at TCS, then left SBI job, cracked UPSC exam with AIR...

Meet woman who first worked at TCS, then left SBI job, cracked UPSC exam with AIR...![submenu-img]() Meet engineer, IIT grad who left lucrative job to crack UPSC in 1st attempt, became IAS, married to an IAS, got AIR...

Meet engineer, IIT grad who left lucrative job to crack UPSC in 1st attempt, became IAS, married to an IAS, got AIR...![submenu-img]() Meet Indian woman who after completing engineering directly got job at Amazon, then Google, Microsoft by using just...

Meet Indian woman who after completing engineering directly got job at Amazon, then Google, Microsoft by using just...![submenu-img]() Meet man who is 47, aspires to crack UPSC, has taken 73 Prelims, 43 Mains, Vikas Divyakirti is his...

Meet man who is 47, aspires to crack UPSC, has taken 73 Prelims, 43 Mains, Vikas Divyakirti is his...![submenu-img]() IIT graduate gets job with Rs 100 crore salary package, fired within a year, he is now working as…

IIT graduate gets job with Rs 100 crore salary package, fired within a year, he is now working as…![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() In pics: Taarak Mehta Ka Ooltah Chashmah actress Deepti Sadhwani dazzles in orange at Cannes debut, sets new record

In pics: Taarak Mehta Ka Ooltah Chashmah actress Deepti Sadhwani dazzles in orange at Cannes debut, sets new record![submenu-img]() Ananya Panday stuns in unseen bikini pictures in first post amid breakup reports, fans call it 'Aditya Roy Kapur's loss'

Ananya Panday stuns in unseen bikini pictures in first post amid breakup reports, fans call it 'Aditya Roy Kapur's loss'![submenu-img]() Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...

Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...![submenu-img]() Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses

Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses![submenu-img]() Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...

Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Sophie Turner reveals she wanted to terminate her first pregnancy with Joe Jonas: 'Didn't know if I wanted...'

Sophie Turner reveals she wanted to terminate her first pregnancy with Joe Jonas: 'Didn't know if I wanted...'![submenu-img]() Meet outsider who was given no money for first film, battled depression, now charges Rs 20 crore per film

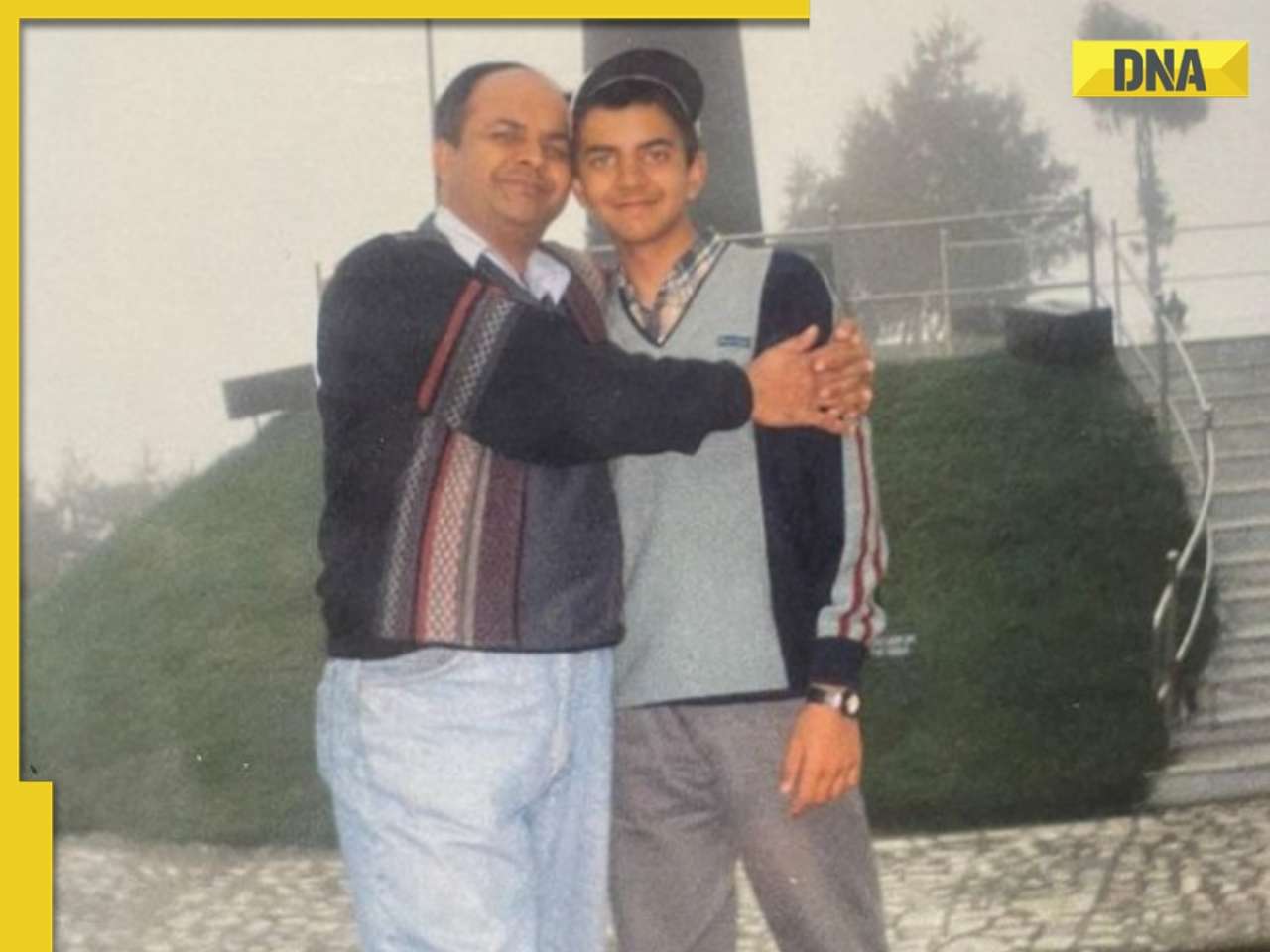

Meet outsider who was given no money for first film, battled depression, now charges Rs 20 crore per film![submenu-img]() Meet actress who quit high-paying job for films, director replaced her with star kid, had no money, now lives in...

Meet actress who quit high-paying job for films, director replaced her with star kid, had no money, now lives in...![submenu-img]() This star kid's last 3 films lost Rs 5000000000 at box office, has no solo hit in 5 years, now has lost four films to...

This star kid's last 3 films lost Rs 5000000000 at box office, has no solo hit in 5 years, now has lost four films to...![submenu-img]() Meet actress viral for just walking on screen, belongs to royal family, has no solo hit in 15 years, but still is…

Meet actress viral for just walking on screen, belongs to royal family, has no solo hit in 15 years, but still is…![submenu-img]() This is owner of most land in India, owns land in every state, total value is Rs...

This is owner of most land in India, owns land in every state, total value is Rs...![submenu-img]() Blinkit now gives free dhaniya with veggie orders, thanks to Mumbai mom

Blinkit now gives free dhaniya with veggie orders, thanks to Mumbai mom![submenu-img]() Meet man, an Indian who entered NASA's Hall of Fame by hacking, earlier worked on Apple's...

Meet man, an Indian who entered NASA's Hall of Fame by hacking, earlier worked on Apple's...![submenu-img]() 14 majestic lions cross highway in Gujarat's Amreli, video goes viral

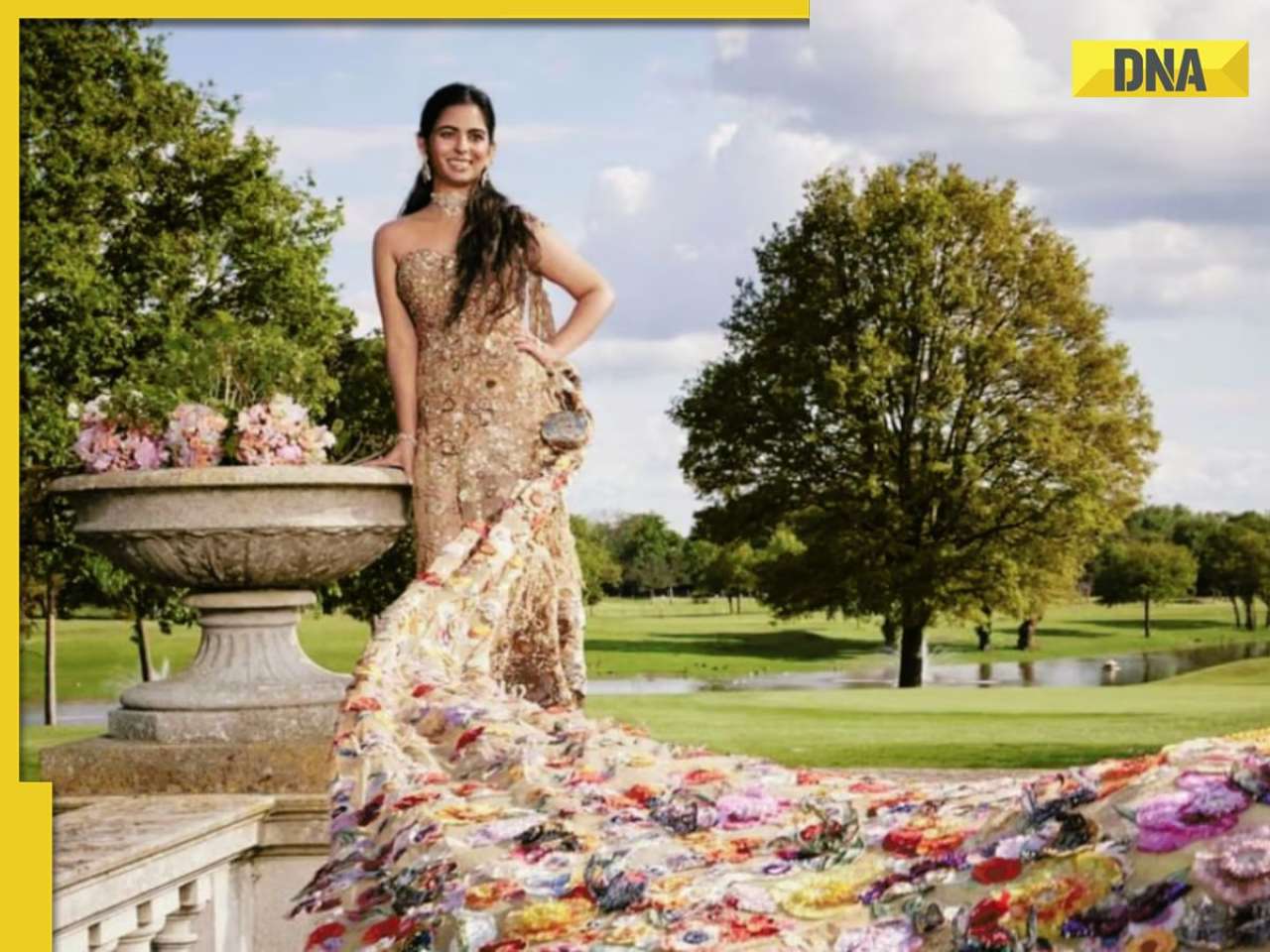

14 majestic lions cross highway in Gujarat's Amreli, video goes viral![submenu-img]() Here's why Isha Ambani was not present during Met Gala 2024 red carpet

Here's why Isha Ambani was not present during Met Gala 2024 red carpet

)

)

)

)

)

)