The economic downturn has started to reflect on the credit quality of Indian companies.

The economic downturn has started to reflect on the credit quality of Indian companies.

According to rating agency Crisil, 13 companies defaulted on loans in 2008-09, the highest since the late nineties. These are the first instances of defaults after a gap of three years.

The quantum of debt instruments/ facilities on which Crisil ratings have been downgraded to 'D' on the long-term scale or 'P5' on the short-term scale amounts to about Rs 3,200 crore, a Crisil relase said.

Ajay Dwivedi, director-ratings, Crisil, said companies that defaulted in 2008-09 faced a severe strain on their working capital due to the economic slowdown. “Of the 13 defaults in 2008-09, seven were in the textile industry, and three were suppliers to the real estate industry,” he said.

Crisil’s definition of defaults is stricter than banks. Unlike banks which count a loan as a default only if it is not paid for 90 days from the due date, Crisil counts a default even if the borrower misses one.

Crisil also downgraded ratings of 84 companies in 2008-09, the highest since 1998-99, while upgrading only two. In 2007-08, there were 14 downgrades and 9 upgrades.

Crisil’s rival Moody’s-owned Icra also separately said that it has downgraded ratings on a host of Indian companies. Naresh Takkar, managing director, Icra, told DNA Money, “The number of downgrades has increased sharply. The number of downgrades this year has been 61 compared with 15 last year. There has been one upgrade compared with 10 last year.”

Roopa Kudva, managing director and CEO, Crisil, said downgrades have outnumbered upgrades since April 2007. Companies with negative outlooks have also increased, she noted.

"Over the past six months, the pace of downgrades has clearly accelerated. Moreover, as on March 31, 2009, 13.8% of Crisil’s long-term ratings had negative outlooks, the highest since Crisil introduced rating outlooks in 2003,” Kudva said in a press release.

Kudva warned that continued economic deceleration can cause more downgrades over the next 12 to 18 months, unless the ongoing efforts to revive the global economy with fiscal and monetary measures start showing results.

Crisil expects the credit pressure on the textile and real estate sectors to continue especially in real estate, which is prone to delayed payments and write offs.

Real estate companies have been stuck with land banks and high debt. Banks are not lending to real estate companies except for construction purposes. Other avenues have also evaporated as equity markets have slowed, foreign money has become expensive and advance money from home buyers is difficult to come by as prices remain high.

Raman Uberoi, senior director, Crisil, said textile companies with a heavy exposure to the export sector have seen a slowdown in demand. “For some of these companies even a delay in payments by one or two customers has an impact. Also, if payments come in 120 days instead of 90 days its an issue,” Uberoi said adding that even a large company like Arvind Mills had to face a downgrade because of its high debt.

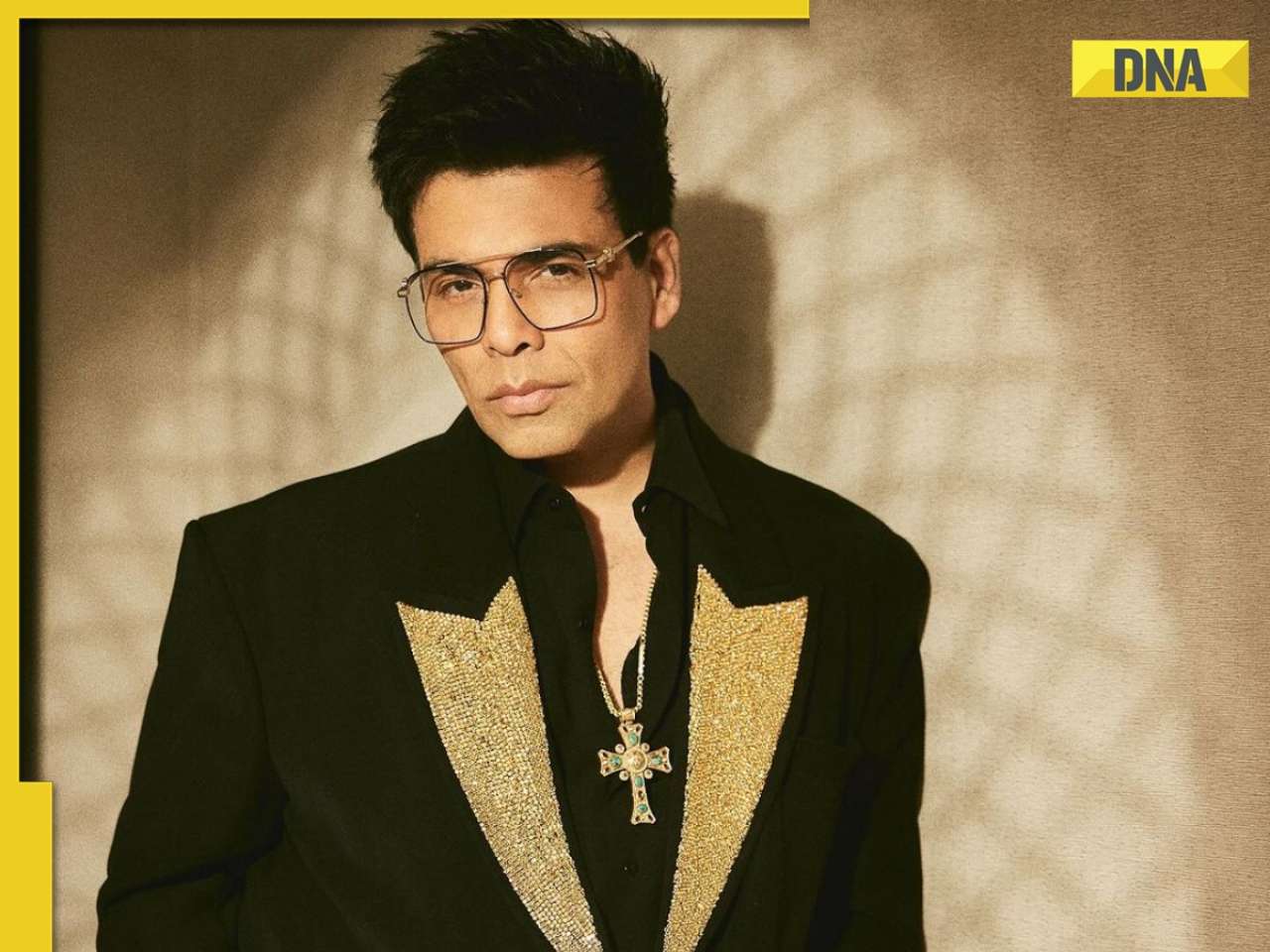

![submenu-img]() Meet India's highest paid director, charges 30 times more than his stars; not Hirani, Rohit Shetty, Atlee, Karan Johar

Meet India's highest paid director, charges 30 times more than his stars; not Hirani, Rohit Shetty, Atlee, Karan Johar![submenu-img]() Indian government issues warning for Google users, sensitive information can be leaked if…

Indian government issues warning for Google users, sensitive information can be leaked if…![submenu-img]() Prajwal Revanna Sex Scandal Case: Several women left home amid fear after clips surfaced, claims report

Prajwal Revanna Sex Scandal Case: Several women left home amid fear after clips surfaced, claims report![submenu-img]() Meet man who studied at IIT, IIM, started his own company, now serving 20-year jail term for…

Meet man who studied at IIT, IIM, started his own company, now serving 20-year jail term for…![submenu-img]() Gautam Adani’s project likely to get Rs 170000000000 push from SBI, making India’s largest…

Gautam Adani’s project likely to get Rs 170000000000 push from SBI, making India’s largest…![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates

Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() Meet India's highest paid director, charges 30 times more than his stars; not Hirani, Rohit Shetty, Atlee, Karan Johar

Meet India's highest paid director, charges 30 times more than his stars; not Hirani, Rohit Shetty, Atlee, Karan Johar![submenu-img]() This superstar worked as clerk, was banned from wearing black, received death threats; later became India's most...

This superstar worked as clerk, was banned from wearing black, received death threats; later became India's most...![submenu-img]() Karan Johar slams comic for mocking him, bashes reality show for 'disrespecting' him: 'When your own industry...'

Karan Johar slams comic for mocking him, bashes reality show for 'disrespecting' him: 'When your own industry...'![submenu-img]() Kapoor family's forgotten hero, highest paid actor, gave more hits than Raj Kapoor, Ranbir, never called star because...

Kapoor family's forgotten hero, highest paid actor, gave more hits than Raj Kapoor, Ranbir, never called star because...![submenu-img]() Meet actress who lost stardom after getting pregnant at 15, husband cheated on her, she sold candles for living, now...

Meet actress who lost stardom after getting pregnant at 15, husband cheated on her, she sold candles for living, now...![submenu-img]() IPL 2024: Kolkata Knight Riders take top spot after 98 runs win over Lucknow Super Giants

IPL 2024: Kolkata Knight Riders take top spot after 98 runs win over Lucknow Super Giants![submenu-img]() ICC Women’s T20 World Cup 2024 schedule announced; India to face Pakistan on....

ICC Women’s T20 World Cup 2024 schedule announced; India to face Pakistan on....![submenu-img]() IPL 2024: Bowlers dominate as CSK beat PBKS by 28 runs

IPL 2024: Bowlers dominate as CSK beat PBKS by 28 runs![submenu-img]() IPL 2024: Big blow to CSK as star pacer returns home due to...

IPL 2024: Big blow to CSK as star pacer returns home due to...![submenu-img]() SRH vs MI IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

SRH vs MI IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() Job applicant offers to pay Rs 40000 to Bengaluru startup founder, here's what happened next

Job applicant offers to pay Rs 40000 to Bengaluru startup founder, here's what happened next![submenu-img]() Viral video: Family fearlessly conducts puja with live black cobra, internet reacts

Viral video: Family fearlessly conducts puja with live black cobra, internet reacts![submenu-img]() Woman demands Rs 50 lakh after receiving chicken instead of paneer

Woman demands Rs 50 lakh after receiving chicken instead of paneer![submenu-img]() Who is Manahel al-Otaibi, Saudi women's rights activist jailed for 11 years over clothing choices?

Who is Manahel al-Otaibi, Saudi women's rights activist jailed for 11 years over clothing choices?![submenu-img]() In candid rapid fire, Rahul Gandhi reveals why white T-shirts are his signature attire, watch

In candid rapid fire, Rahul Gandhi reveals why white T-shirts are his signature attire, watch

)

)

)

)

)

)