Retail investors will soon get a composite platform to trade in foreign securities and derivatives in multiple stock markets.

Retail investors will soon get a composite platform to trade in foreign securities and derivatives in multiple stock markets.

Interactive Brokers, an NYSE-listed broker will give its Indian clients direct access to over 80 exchanges in 17 countries from a single screen. Interactive is a member of NSE and has recently received regulatory clearances to launch its India operations.

Through the IB universal account, which Interactive plans to launch by early March, one can trade stocks, options, futures, forex, and bonds, all from the same Trader Workstation screen. The client’s transaction history and positions are all reported in a single statement.

London-based Gerald Perez, managing director, Interactive Brokers, who is in Mumbai for the launch, told DNA Money, “We will be focusing on individual investors. We will allow individuals to trade internationally in addition to the local market on the same platform. The experience is going to be one low-cost solution for trading in markets around the world.”

While it will allow individuals to open both cash and leverage accounts for local trades, foreign trading will be allowed only on cash basis.

At present, Indian investors have access to global markets through their local brokers. But most local brokers do not have direct membership in overseas exchanges. This considerably increases the cost of trading for individuals.

However, being a member of top stock exchanges around the world, including NYSE, LSE and leading options exchange CBOE, Interactive will be able to cut down lot of these costs, said Perez. “In the channel process, as the number of layers go up, everyone wants money. For us, we are a member of 80 exchanges and we are our own technology company. Therefore, end-user cost is significantly lower. Also, a number of Indian brokers are reviewing their models after the recent meltdown.”

Interactive’s system allows trading in multiple markets without opening multiple currency accounts. When you want to trade a product denominated in another currency, a loan is created which is secured by your deposited currency. If you wish to eliminate the loan, you may do so at any time by trading currencies through the broker’s IB Ideal network or depositing money in another currency.

For each account, a single base currency designation must be made that determines an account’s statement and margin requirement translation currency.

Interactive also has plans to allow foreign traders to participate directly in Indian exchanges once the regulatory hurdles are off.

“Our goal is, in eventual future, to allow foreign investors to trade in Indian markets. But right now, there are regulatory issues. Unless they are cleared, we won’t offer those services now,” Perez said.

![submenu-img]() Anant Raj Ventures into tier 2 and tier 3 cities, pioneering growth in India’s real estate sector

Anant Raj Ventures into tier 2 and tier 3 cities, pioneering growth in India’s real estate sector![submenu-img]() Sophie Turner reveals she wanted to terminate her first pregnancy with Joe Jonas: 'Didn't know if I wanted...'

Sophie Turner reveals she wanted to terminate her first pregnancy with Joe Jonas: 'Didn't know if I wanted...'![submenu-img]() Meet outsider who was given no money for first film, battled depression, now charges Rs 20 crore per film

Meet outsider who was given no money for first film, battled depression, now charges Rs 20 crore per film![submenu-img]() This is owner of most land in India, owns land in every state, total value is Rs...

This is owner of most land in India, owns land in every state, total value is Rs...![submenu-img]() Meet man who built Rs 39832 crore company after quitting high-paying job, his net worth is..

Meet man who built Rs 39832 crore company after quitting high-paying job, his net worth is..![submenu-img]() Meet woman who first worked at TCS, then left SBI job, cracked UPSC exam with AIR...

Meet woman who first worked at TCS, then left SBI job, cracked UPSC exam with AIR...![submenu-img]() Meet engineer, IIT grad who left lucrative job to crack UPSC in 1st attempt, became IAS, married to an IAS, got AIR...

Meet engineer, IIT grad who left lucrative job to crack UPSC in 1st attempt, became IAS, married to an IAS, got AIR...![submenu-img]() Meet Indian woman who after completing engineering directly got job at Amazon, then Google, Microsoft by using just...

Meet Indian woman who after completing engineering directly got job at Amazon, then Google, Microsoft by using just...![submenu-img]() Meet man who is 47, aspires to crack UPSC, has taken 73 Prelims, 43 Mains, Vikas Divyakirti is his...

Meet man who is 47, aspires to crack UPSC, has taken 73 Prelims, 43 Mains, Vikas Divyakirti is his...![submenu-img]() IIT graduate gets job with Rs 100 crore salary package, fired within a year, he is now working as…

IIT graduate gets job with Rs 100 crore salary package, fired within a year, he is now working as…![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() In pics: Taarak Mehta Ka Ooltah Chashmah actress Deepti Sadhwani dazzles in orange at Cannes debut, sets new record

In pics: Taarak Mehta Ka Ooltah Chashmah actress Deepti Sadhwani dazzles in orange at Cannes debut, sets new record![submenu-img]() Ananya Panday stuns in unseen bikini pictures in first post amid breakup reports, fans call it 'Aditya Roy Kapur's loss'

Ananya Panday stuns in unseen bikini pictures in first post amid breakup reports, fans call it 'Aditya Roy Kapur's loss'![submenu-img]() Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...

Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...![submenu-img]() Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses

Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses![submenu-img]() Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...

Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Sophie Turner reveals she wanted to terminate her first pregnancy with Joe Jonas: 'Didn't know if I wanted...'

Sophie Turner reveals she wanted to terminate her first pregnancy with Joe Jonas: 'Didn't know if I wanted...'![submenu-img]() Meet outsider who was given no money for first film, battled depression, now charges Rs 20 crore per film

Meet outsider who was given no money for first film, battled depression, now charges Rs 20 crore per film![submenu-img]() Meet actress who quit high-paying job for films, director replaced her with star kid, had no money, now lives in...

Meet actress who quit high-paying job for films, director replaced her with star kid, had no money, now lives in...![submenu-img]() This star kid's last 3 films lost Rs 5000000000 at box office, has no solo hit in 5 years, now has lost four films to...

This star kid's last 3 films lost Rs 5000000000 at box office, has no solo hit in 5 years, now has lost four films to...![submenu-img]() Meet actress viral for just walking on screen, belongs to royal family, has no solo hit in 15 years, but still is…

Meet actress viral for just walking on screen, belongs to royal family, has no solo hit in 15 years, but still is…![submenu-img]() This is owner of most land in India, owns land in every state, total value is Rs...

This is owner of most land in India, owns land in every state, total value is Rs...![submenu-img]() Blinkit now gives free dhaniya with veggie orders, thanks to Mumbai mom

Blinkit now gives free dhaniya with veggie orders, thanks to Mumbai mom![submenu-img]() Meet man, an Indian who entered NASA's Hall of Fame by hacking, earlier worked on Apple's...

Meet man, an Indian who entered NASA's Hall of Fame by hacking, earlier worked on Apple's...![submenu-img]() 14 majestic lions cross highway in Gujarat's Amreli, video goes viral

14 majestic lions cross highway in Gujarat's Amreli, video goes viral![submenu-img]() Here's why Isha Ambani was not present during Met Gala 2024 red carpet

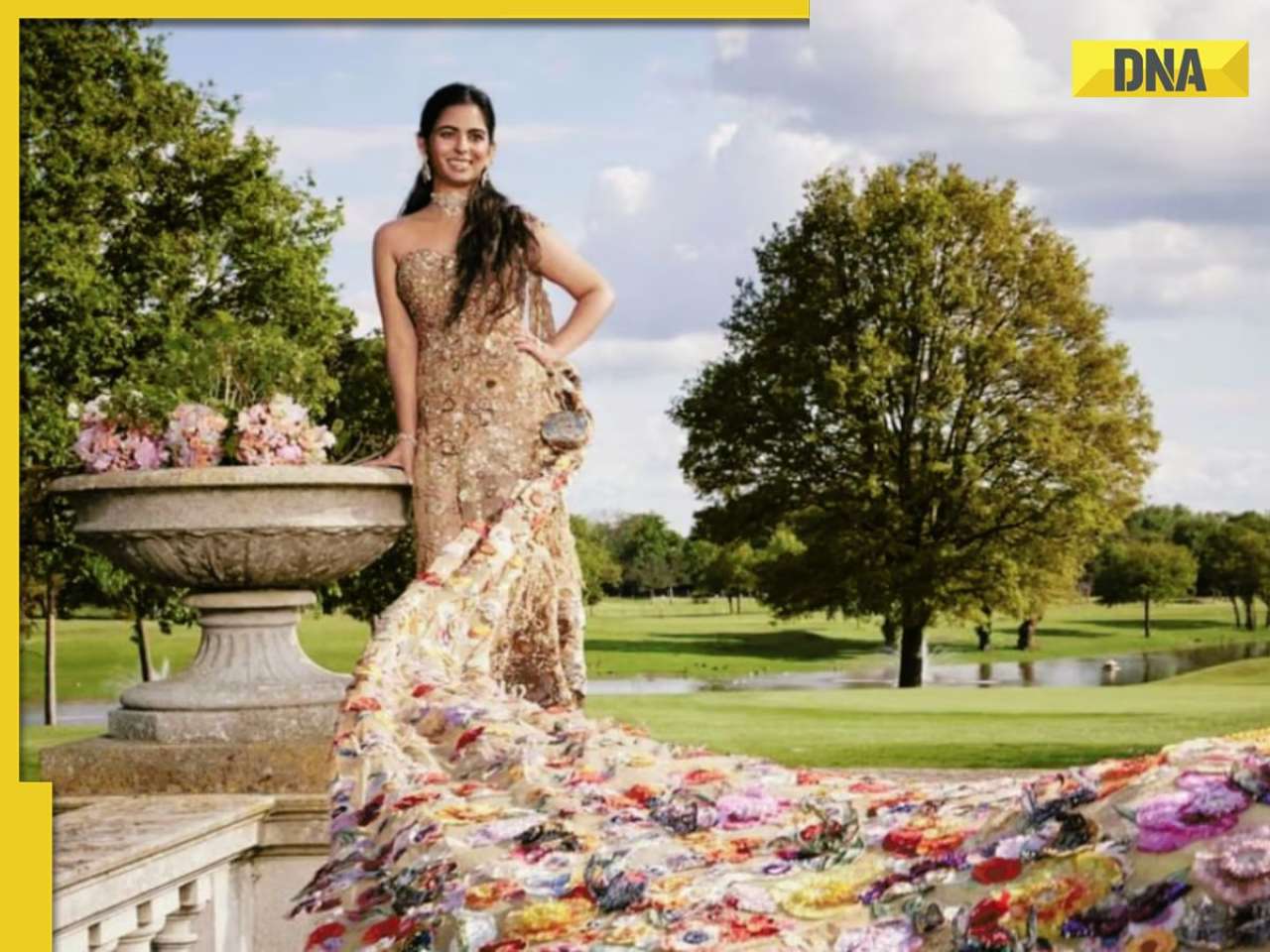

Here's why Isha Ambani was not present during Met Gala 2024 red carpet

)

)

)

)

)

)