Meet Guy Kawasaki, managing director of Garage Technology Ventures, an early-stage venture capital firm, and author of eight management books...

The interview is over. I gather my things and start to leave. At that moment, he asks me. “Have you ever been to Dhobi Ghat?” The question, coming from a venture capitalist and author of several management bestsellers, takes me totally by surprise. I respond with a nod of my head, muttering, yes. “I think I have some sort of karmic connection with the place. I absolutely love it. And I cannot figure out how can shirts come out so white from such black water,” he says.

Meet Guy Kawasaki, managing director of Garage Technology Ventures, an early-stage venture capital firm, and author of eight management books including The Art of the Start, Rules for Revolutionaries, How to Drive Your Competition Crazy, Selling the Dream, and The Macintosh Way. Previously, he was an Apple Fellow at Apple Computer, Inc. Kawasaki was in India as a part of the Premier Business Leadership Series organised by business intelligence company SAS. In this interview, Kawasaki lets loose on … well, many things:

You once refused the CEO’s job at Yahoo...

(Laughs) Well to be more accurate I turned down an interview for the CEO’s position. At that time, my wife and I had one child and she was pregnant with our second child. We were living in San Francisco and Yahoo was down at Stanford, Menlo Park. Or maybe even Sunnyvale. So it was a good one-hour drive away, which in Mumbai is like one kilometre but in California is fifty miles. I just told them that I did not want to drive that much every day. Also Yahoo’s first permutation was more or less a directory of websites. I didn’t see how could it be a business either. Or opportunity.

Do you regret it?

Well, you know, I probably would have gotten the job, I probably would have gotten 5% or 10% of Yahoo. So I would be worth $2 billion today. Yeah.

So, what is it that you would have done with Yahoo right now?

I would sell to Bill Gates for $46 billion, like that (Laughs). Absolutely. I think that was a very good offer which they refused. And we will see how that plays out. Having said that, I actually think Yahoo is stronger than most people give it credit. Yahoo has search, they have stores, answers, and Flickr, email, dating and you name it. A lot of things have to go wrong for Yahoo at many places for it to go down. So I could build a case that Yahoo is a safer company, because it has more different kinds of revenue streams.

You know the market is fickle. Right now, the market is going ga-ga over Google. Clearly they own the search engine space and they are constantly making it better. They have interesting things like Google groups, Gmail, Google labs, Google analytics. There is a lot of cool stuff. They bought YouTube. What an innovative company! However, the real money spinner are the ads that are positioned next to search results. And that is one helluva trick they have.

They tried Gmail. I don’t think they are making any money out of it. So some day the press may just as easily turn around and say Google lacks diversification and Yahoo is a better business because it has many streams of revenue. That is a flip of the coin and that could happen at any time.

How do you decide whether to put money in a project or not?

The most important factor to me is, will I use the product or do I use the product? That limits me because that means I probably don’t do biotech. Not that I have perfect health.

I do consumer facing, Web 2.0, e-commerce … those kind of things.

When you fall in love, part of falling in love is convincing yourself that warts and imperfections don’t matter or don’t exist or can be fixed. Same thing is true for a venture capitalist. If you are not in love, the warts are insurmountable. If you do fall in love you try to ignore them, fix them or you rationalise them. That’s the nature of the venture capital game. Every deal has warts.

Having said that, that has led me into bad investments also. But that’s how I work. I am not proven as a VC, not in the sense of funding a Google or a Yahoo, a Cisco or an Apple.

Maybe you shouldn’t be asking me for advice (Laughs).

How do you figure out whether an idea is financially viable?

It’s two different things, there is the financially viable and there is venture capital-fundable. The two are not the same.

If it’s financially viable I am assuming it’s venture capital-fundable….

No, that’s not true. I will give you an extreme example. Let us say you are going to start a consulting service to help people converge from Windows XP to Vista. There will be infinite demand for that and it’s a perfectly viable business. But no VC would fund it. It’s a viable business not fundable.

A VC is looking for the next Google. So we want to put in a million dollars and get back a billion, roughly (Laughs). Not that it ever happens that way.

So how does the VC figure out that a particular deal is fundable?

Let me give you an example. Suppose someone came to you and said, I am going to make a company so that people can sell used printers online. A sceptic would say that if you are the seller of a printer, how do you know that you are going to get paid. If you are a buyer of the printer, how would you know that the printer is going to work. So you’d say, you know, eBay is a stupid idea.

Today people buy hundred thousand dollars-worth Ferraris on eBay without seeing it, which just boggles my mind. If you looked back at the very initial stage you might have said that eBay is not a viable business. And you’d be very wrong.

I think the key is that at a stage the company is raising money, it is already showing that it is going to be successful.

So what you are basically saying is that a VC can come in after the business has shown some amount of success…

No, I am not saying that. This is one method. There are other methods as well. If someone with a PhD in Material Sciences comes to you and says he has an idea to make solar panels two times more efficient at half the price, doesn’t take much to think ‘Wow! You know 4X improvement in solar panels.’ That’s fundable and viable. Might not be possible…

Sometimes it is the pedigree of the entrepreneur. We will take this extreme example. Meg Whitman has retired from eBay. And if she runs around Silicon Valley saying well I did the bid and ask system at eBay and I think I have a way to revolutionise online commerce, that will just destroy Amazon. She would be funded, right. Meg Whitman did eBay. Of course, she can do an Amazon killer. I’d write a cheque on the spot. So that’s the third way.

And there is a fourth way, too. The fourth way is what I would call the Sequoia way. The Sequoia way is to find two engineering students who are building a product that they want to use. And that creates Google and Yahoo. So Sequoia is the VC you have to admire. You don’t do Google, and Yahoo, and Cisco and Apple, by mistake. Clearly, they know what they are doing.

So VCs getting it right is sheer luck?

Other than Sequoia and Kleiner Perkins, who have shown to be lucky, many many times, most of it is luck. I do not believe that a VC could cause the success of a company. They might help it a little bit. And of course, they bring in money that funds the development. But beyond that I don’t think VCs add that much value.

That’s a big thing to say coming from a VC. What kind of pitches do you hear the most these days?

What happens very often, whenever you see a huge success, immediately there are clones. When a YouTube happens, in the next six months, there is YouTube for China, YouTube for India, YouTube for old people, for kids, g-rated YouTube, YouTube for left-handed people, right-handed people and so on. That’s what happens. And typically once a YouTube is sold for $1.7 billion, it’s too late to create the next YouTube.

Are there examples of any clones having done as well as the original entity….

Well you could say that Windows is a good example (Laughs…)

What are the things that a person making pitch should keep in mind?

Have you ever seen a website called www.hotornot.com? That’s where girls upload pictures and you have to vote, hot or not. That’s what venture capital is like, you look at the girl’s picture and you decide in two seconds. Now by contrast there is something called www.eharmony.com, which gives you a lot of psychographic profiles. What you like, what you dislike, etc

That’s what people think venture capital is like. I find out, you as a VC, what are you interested in, how can I communicate to you and I show you I have these qualities. But really, venture capitalists like hot or not. In the first two or three minutes of the pitch, people have decided. So the most important part of the pitch is the first two or three minutes. And most people completely blow that.

They waste in several ways. One is they like to introduce every member of the team. The only bio that matters is I was co-founder of Google. Okay (jumps up) that’s interesting! However, you know something like I was a marketing manager at Microsoft and I took more dot.net courses than anybody else. Who cares?

The most important thing to do in the first thirty seconds is to explain what the hell do you do. They say we make enterprise software to destroy spam. Alternatively, we make a place where people can upload video and other people can watch it. They should be able to explain the idea in 30 seconds and not use words like strategic, partnership, curve jumping, paradigm shifting, revolutionary… It’s all bullshit. All bullshit. We just want to know what do you do.

How does any budding entrepreneur reach you?

Email is the only way. My email is guy@garage.com

You have worked for Apple. What is it that makes Apple a highly innovative company?

Steve Jobs. Steve has visions and perspective which most mortals don’t have. So it’s primarily Steve Jobs.

There is news going around about him not being well…

What happens if that happens? Well, probably for good five years, Apple can coast on what he has already done.

But are there people around who could take over?

Obviously no one can replace Steve Jobs. But obviously the sun will still rise tomorrow. So no one really knows. No one is eternal. IBM is doing okay, Thomas Watson is long gone.

Is Bill Gates as closely related to Microsoft as Steve Jobs is to Apple?

I think less so. Steve Jobs is more important to Apple than Bill Gates is to Microsoft and, ironically, you could say it is to Bill Gates’ credit. That he has built a system that he can retire. Steve Ballmer can also retire. He has chosen not to, but he could. Microsoft is still much larger than Apple. But I think more people admire Apple.

Apple is supposed to die every few years. Apple is completely cyclical. Right now they are doing great and I could tell you that things are probably not as good as it appears because when Apple is doing lousy it is not as lousy as it appears. People tend to write it off too quickly and they build it up too fast.

Why is that?

I don’t know. Apple is like an emotional thing. People have an emotional attachment with Apple that they don’t have to any other company.

k_vivek@dnaindia.net

![submenu-img]() Bigg Boss OTT 3: Anil Kapoor confirmed as new host, says 'jhakaas nahi kuch khaas karte hai', leaves netizens divided

Bigg Boss OTT 3: Anil Kapoor confirmed as new host, says 'jhakaas nahi kuch khaas karte hai', leaves netizens divided![submenu-img]() Felony charges and political ambitions: Donald Trump at the legal and electoral crossroads

Felony charges and political ambitions: Donald Trump at the legal and electoral crossroads![submenu-img]() This actor left UPSC dreams for Bollywood, was launched by Amitabh, fought Shah Rukh, then disappeared for years, now...

This actor left UPSC dreams for Bollywood, was launched by Amitabh, fought Shah Rukh, then disappeared for years, now...![submenu-img]() Data-Driven Decision Making: Leveraging KPI Metrics for Strategic Insight

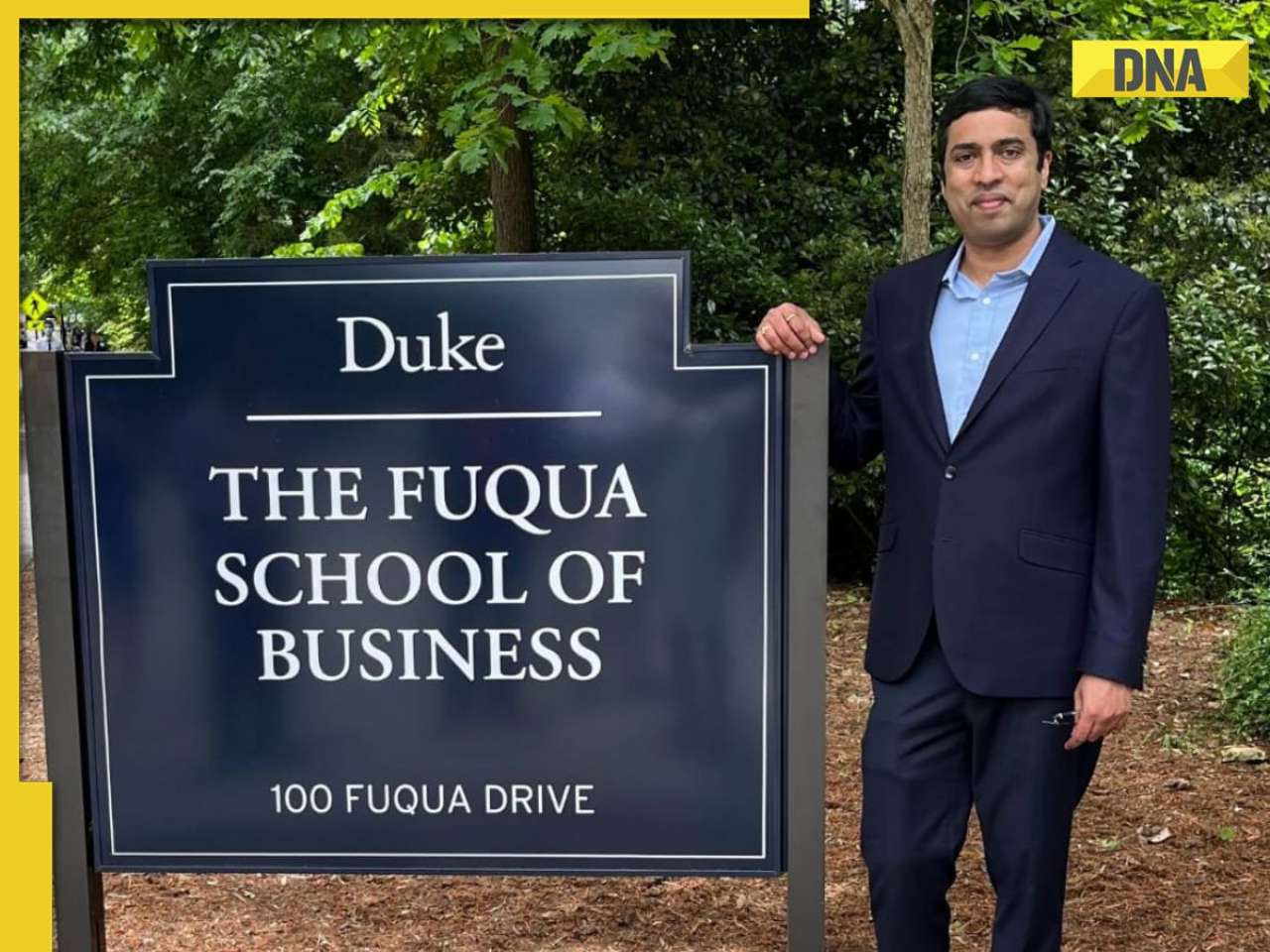

Data-Driven Decision Making: Leveraging KPI Metrics for Strategic Insight![submenu-img]() Exploring transformative potential of application modernisation for sustainable solutions in future

Exploring transformative potential of application modernisation for sustainable solutions in future![submenu-img]() Meet Indian genius who won National Spelling Bee contest in US at age 12, he is from…

Meet Indian genius who won National Spelling Bee contest in US at age 12, he is from…![submenu-img]() Meet man who became IIT Bombay professor at just 22, got sacked from IIT after some years because..

Meet man who became IIT Bombay professor at just 22, got sacked from IIT after some years because..![submenu-img]() Meet Indian genius, son of constable, worked with IIT, NASA, then went missing, was found after years in...

Meet Indian genius, son of constable, worked with IIT, NASA, then went missing, was found after years in...![submenu-img]() Meet IAS officer who was victim of domestic violence, mother of two, cracked UPSC exam in first attempt, she's posted in

Meet IAS officer who was victim of domestic violence, mother of two, cracked UPSC exam in first attempt, she's posted in![submenu-img]() RBSE Class 5th, 8th Result 2024 Date, Time: Rajasthan board to announce results today, get direct link here

RBSE Class 5th, 8th Result 2024 Date, Time: Rajasthan board to announce results today, get direct link here![submenu-img]() DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo

DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo![submenu-img]() DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here

DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() Streaming This Week: Panchayat season 3, Swatantrya Veer Savarkar, Illegal season 3, latest OTT releases to binge-watch

Streaming This Week: Panchayat season 3, Swatantrya Veer Savarkar, Illegal season 3, latest OTT releases to binge-watch![submenu-img]() Avneet Kaur shines in navy blue gown with shimmery trail at Cannes 2024, fans say 'she is unstoppable now'

Avneet Kaur shines in navy blue gown with shimmery trail at Cannes 2024, fans say 'she is unstoppable now'![submenu-img]() Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes

Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes ![submenu-img]() Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'

Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'![submenu-img]() AI models play volley ball on beach in bikini

AI models play volley ball on beach in bikini![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?

DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() Bigg Boss OTT 3: Anil Kapoor confirmed as new host, says 'jhakaas nahi kuch khaas karte hai', leaves netizens divided

Bigg Boss OTT 3: Anil Kapoor confirmed as new host, says 'jhakaas nahi kuch khaas karte hai', leaves netizens divided![submenu-img]() This actor left UPSC dreams for Bollywood, was launched by Amitabh, fought Shah Rukh, then disappeared for years, now...

This actor left UPSC dreams for Bollywood, was launched by Amitabh, fought Shah Rukh, then disappeared for years, now...![submenu-img]() Bujii and Bhairava review: Prabhas' futuristic Baahubali-type Kalki 2898 prelude AD is fun, AI Keerthy steals the show

Bujii and Bhairava review: Prabhas' futuristic Baahubali-type Kalki 2898 prelude AD is fun, AI Keerthy steals the show![submenu-img]() This actress gave no hits in 9 years, no Bollywood releases in 5 years, charges Rs 40 crore per film, net worth is..

This actress gave no hits in 9 years, no Bollywood releases in 5 years, charges Rs 40 crore per film, net worth is..![submenu-img]() Mr & Mrs Mahi review: Janhvi, Rajkummar's earnest performances can't save film that doesn't really get cricket or women

Mr & Mrs Mahi review: Janhvi, Rajkummar's earnest performances can't save film that doesn't really get cricket or women![submenu-img]() Viral video: Little girl’s adorable dance to 'Ruki Sukhi Roti' will melt your heart, watch

Viral video: Little girl’s adorable dance to 'Ruki Sukhi Roti' will melt your heart, watch![submenu-img]() Groom jumps off stage for impromptu dance with friends, viral video leaves netizens in splits

Groom jumps off stage for impromptu dance with friends, viral video leaves netizens in splits![submenu-img]() Viral video: Chinese man stuns internet by balancing sewing machine on glass bottles, watch

Viral video: Chinese man stuns internet by balancing sewing machine on glass bottles, watch![submenu-img]() Watch: First video of Mukesh Ambani's son Anant Ambani-Radhika Merchant's 2nd pre-wedding bash goes viral

Watch: First video of Mukesh Ambani's son Anant Ambani-Radhika Merchant's 2nd pre-wedding bash goes viral![submenu-img]() Viral video: Outrage over woman's dance at Mumbai airport sparks calls for action, watch

Viral video: Outrage over woman's dance at Mumbai airport sparks calls for action, watch

)

)

)

)

)

)