Dalal Street may turn bullish next week on the weekend-development of India getting a crucial waiver in the nuclear deal with the US

MUMBAI: Dalal Street may turn bullish next week on the weekend-development of India getting a crucial waiver in the nuclear deal with the US, but cues from global stock markets would remain a key driver, analysts believe.

With the much-touted Indo-US nuclear deal getting the green signal from the 45-member Nuclear Suppliers Group (NSG) for the waiver, domestic markets are expected to start next week on a strong note, they said.

"The nuclear waiver is a positive thing for the market. The Indian markets were holding back because the investors were apprehensive about the NSG decision," domestic brokerage firm SMC Global's Vice President Rajesh Jain said.

The waiver would enable India to carry out civil nuclear commerce, ending 34 years of isolation enforced in the wake of the 1974 Pokharan nuclear tests.

"Markets are likely to open strong on Monday and can look forward for a better week," Jain said.

After a strong opening driven by positive sentiments created by nuclear deal waiver, the Indian markets could take cues from the global market, but a positive sentiment should prevail, he added.

However, the continuing stalemate over Tata's Nano plant at Singur in West Bengal could turn out to be detrimental for the domestic bourses, some other brokers said.

Domestic markets would also be keenly watching the meeting of the Organisation of Petroleum Exporting Countries next week. OPEC is scheduled to meet on September 9 in Vienna, where a decision is expected on whether to cut down oil production or leave it unchanged.

The 13 OPEC countries account for 40 per cent of world's oil production and crude oil prices have always been a key factor for the stock market movements.

"The FIIs are not investing in any of the Asian markets as the positive sentiments are not there. Till the time the global markets do not come out of bearishness, any rally would be short lived," Jain said.

Having sold shares worth a total of close to Rs 28,000 crore so far this year, FIIs bought shares worth over Rs 500 crore in first week of September.

"Political uncertainty in Singur could also act as a dampener for the foreign investors. Further, the OPEC meet will be decisive factor for the market movement with investors closely watching the decision," Jain noted.

On the positive side, inflation has declined for the second week in a row. As on August 23 inflation stood at 12.34 per cent with prices of many food items including fruits and vegetables falling during the period.

However, Reserve Bank of India's new Governor D Subbarao, who took charge on Friday, has indicated the apex bank would continue to pursue policies to contain inflation to seven per cent by the end of current fiscal.

"The immediate priority for me as the Governor of RBI will be to manage inflation and anchor inflationary expectations," Subbarao has said. The new RBI governor's moves are also likely to be closely watched by the markets.

Meanwhile, recessionary fears in the US economy is persisting with the country witnessing job losses for the eight straight month till August.

According to the US Labor Department, payrolls shrank by 84,000 last month, higher than the 51,000 jobs lost in July.

The benchmark 30-share BSE Sensex lost 80.70 points or 0.55 per cent to 14,483.83 while wide-based Nifty lost 7.70 points or 0.17 per cent to 4352.30 in the week ended Sept 5. The market declined in three out of four trading sessions in the truncated week.

![submenu-img]() Anant Raj Ventures into tier 2 and tier 3 cities, pioneering growth in India’s real estate sector

Anant Raj Ventures into tier 2 and tier 3 cities, pioneering growth in India’s real estate sector![submenu-img]() Sophie Turner reveals she wanted to terminate her first pregnancy with Joe Jonas: 'Didn't know if I wanted...'

Sophie Turner reveals she wanted to terminate her first pregnancy with Joe Jonas: 'Didn't know if I wanted...'![submenu-img]() Meet outsider who was given no money for first film, battled depression, now charges Rs 20 crore per film

Meet outsider who was given no money for first film, battled depression, now charges Rs 20 crore per film![submenu-img]() This is owner of most land in India, owns land in every state, total value is Rs...

This is owner of most land in India, owns land in every state, total value is Rs...![submenu-img]() Meet man who built Rs 39832 crore company after quitting high-paying job, his net worth is..

Meet man who built Rs 39832 crore company after quitting high-paying job, his net worth is..![submenu-img]() Meet woman who first worked at TCS, then left SBI job, cracked UPSC exam with AIR...

Meet woman who first worked at TCS, then left SBI job, cracked UPSC exam with AIR...![submenu-img]() Meet engineer, IIT grad who left lucrative job to crack UPSC in 1st attempt, became IAS, married to an IAS, got AIR...

Meet engineer, IIT grad who left lucrative job to crack UPSC in 1st attempt, became IAS, married to an IAS, got AIR...![submenu-img]() Meet Indian woman who after completing engineering directly got job at Amazon, then Google, Microsoft by using just...

Meet Indian woman who after completing engineering directly got job at Amazon, then Google, Microsoft by using just...![submenu-img]() Meet man who is 47, aspires to crack UPSC, has taken 73 Prelims, 43 Mains, Vikas Divyakirti is his...

Meet man who is 47, aspires to crack UPSC, has taken 73 Prelims, 43 Mains, Vikas Divyakirti is his...![submenu-img]() IIT graduate gets job with Rs 100 crore salary package, fired within a year, he is now working as…

IIT graduate gets job with Rs 100 crore salary package, fired within a year, he is now working as…![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() In pics: Taarak Mehta Ka Ooltah Chashmah actress Deepti Sadhwani dazzles in orange at Cannes debut, sets new record

In pics: Taarak Mehta Ka Ooltah Chashmah actress Deepti Sadhwani dazzles in orange at Cannes debut, sets new record![submenu-img]() Ananya Panday stuns in unseen bikini pictures in first post amid breakup reports, fans call it 'Aditya Roy Kapur's loss'

Ananya Panday stuns in unseen bikini pictures in first post amid breakup reports, fans call it 'Aditya Roy Kapur's loss'![submenu-img]() Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...

Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...![submenu-img]() Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses

Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses![submenu-img]() Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...

Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Sophie Turner reveals she wanted to terminate her first pregnancy with Joe Jonas: 'Didn't know if I wanted...'

Sophie Turner reveals she wanted to terminate her first pregnancy with Joe Jonas: 'Didn't know if I wanted...'![submenu-img]() Meet outsider who was given no money for first film, battled depression, now charges Rs 20 crore per film

Meet outsider who was given no money for first film, battled depression, now charges Rs 20 crore per film![submenu-img]() Meet actress who quit high-paying job for films, director replaced her with star kid, had no money, now lives in...

Meet actress who quit high-paying job for films, director replaced her with star kid, had no money, now lives in...![submenu-img]() This star kid's last 3 films lost Rs 5000000000 at box office, has no solo hit in 5 years, now has lost four films to...

This star kid's last 3 films lost Rs 5000000000 at box office, has no solo hit in 5 years, now has lost four films to...![submenu-img]() Meet actress viral for just walking on screen, belongs to royal family, has no solo hit in 15 years, but still is…

Meet actress viral for just walking on screen, belongs to royal family, has no solo hit in 15 years, but still is…![submenu-img]() This is owner of most land in India, owns land in every state, total value is Rs...

This is owner of most land in India, owns land in every state, total value is Rs...![submenu-img]() Blinkit now gives free dhaniya with veggie orders, thanks to Mumbai mom

Blinkit now gives free dhaniya with veggie orders, thanks to Mumbai mom![submenu-img]() Meet man, an Indian who entered NASA's Hall of Fame by hacking, earlier worked on Apple's...

Meet man, an Indian who entered NASA's Hall of Fame by hacking, earlier worked on Apple's...![submenu-img]() 14 majestic lions cross highway in Gujarat's Amreli, video goes viral

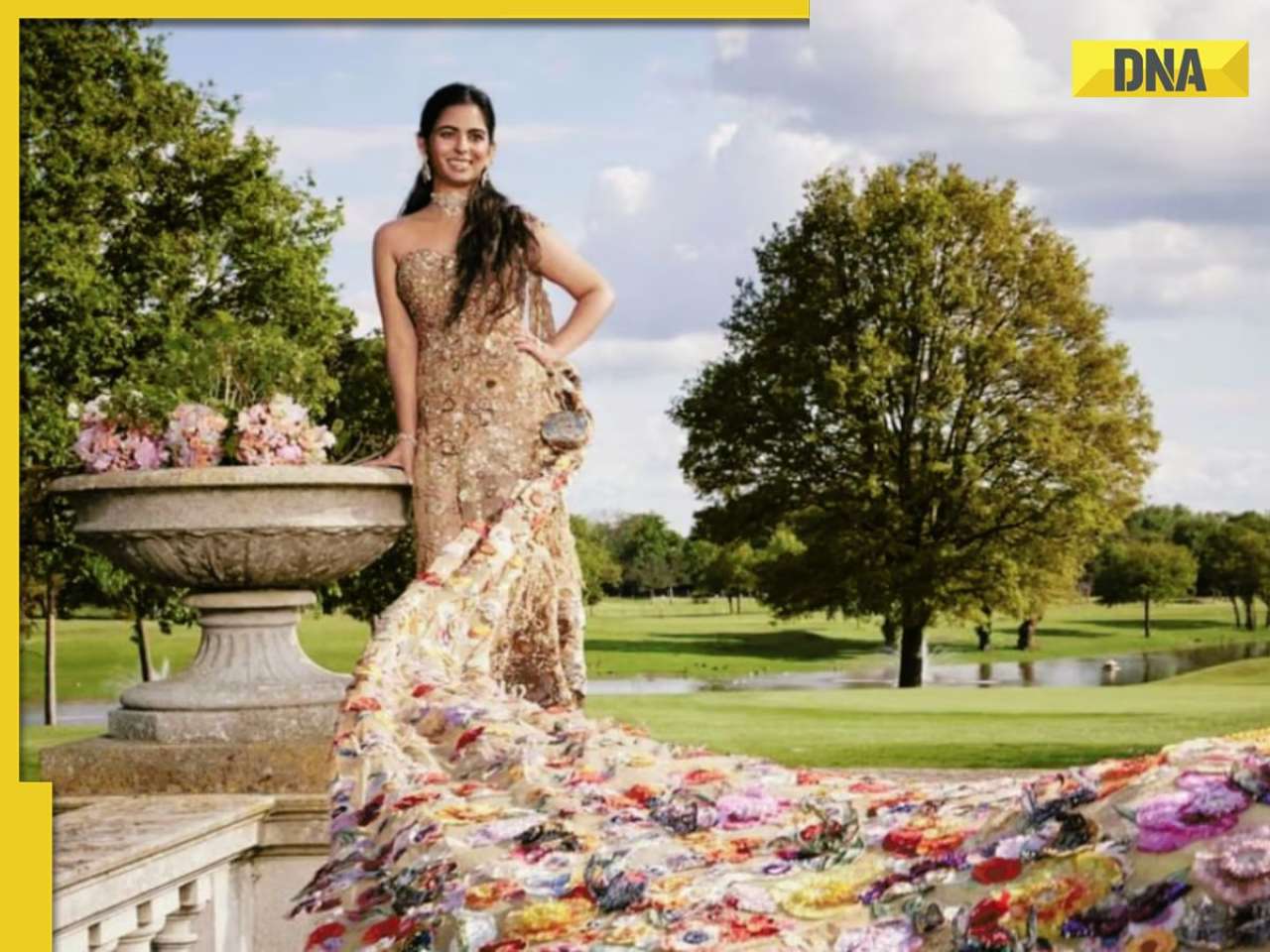

14 majestic lions cross highway in Gujarat's Amreli, video goes viral![submenu-img]() Here's why Isha Ambani was not present during Met Gala 2024 red carpet

Here's why Isha Ambani was not present during Met Gala 2024 red carpet

)

)

)

)

)

)