In the last 35 months, fast moving consumer goods (FMCG) major Marico Industries has notched up seven acquisitions.

In the last 35 months, fast moving consumer goods (FMCG) major Marico Industries has notched up seven acquisitions. Its fledgling international consumer products business now accounts for 16% of the group’s turnover, or Rs 300 crore. International revenues are growing at 59%, thanks to recent acquisitions in Egypt and South Africa. Marico plans to use the beachheads in Egypt and South Africa to tap the neighbouring countries in Africa and West Asia. Vijay Subramaniam, chief executive officer (international business), Marico Industries, talked about the group’ international foray and other plans in a onversation with DNA Money’s Satish John. Excerpts:

Marico recently acquired companies in Egypt and South Africa. How has your overseas business evolved over the years?

Internally, we call ourselves the international business group. It was conceived in the mid-90s, mainly as an export outfit. In our brand portfolio, we have Parachute and Saffola. These brands have a lot of equity in other countries that have Indians. We found that a lot of our products were being made available through the grey channel.

The group was set up to counter this.

Over time, we have made three or four significant shifts in our strategy.

We have moved from a largely India-centric approach to products targeted at Indians in foreign countries.

Secondly, we moved from an export mindset to a local mindset and from a

methodology that involved only organic growth to one with both organic and inorganic growth. Lastly, we have gone from being a company known for its oil-based products to one with many more products such as gels, creams lotions, cream gels and others. That’s how we are moving across the curve.

That gives us an idea of how Marico has changed over time. Where is it placed now?

Today, we have four or five hubs that cater to 20-odd countries. Our Bangladesh operations are run 90% by people from that region. We have operations in the Gulf, which is headquartered in Dubai. Then we have presence in Egypt and South Africa, where we entered recently. In the US too, we have a small skincare business called Sundari. Plus, we do exports from India.

In the last couple of years, we have grown at 60% plus.

Today, we contribute 16% to the group’s revenues. And we would like to see this contribution go up to 20%.

By when do you see overseas revenues contributing 20% to Marico’s turnover?

I wouldn’t want to put a deadline to it. Maybe in a couple of years.

Has growth come mainly from acquisitions?

From both, organic and inorganic routes. If you look at our business portfolio today, roughly 60% comes from organic growth and 40% from inorganic growth through our recent brand acquisitions.

But when you rely on inorganic growth, you also have to ensure your home-grown brands continue to grow. If you look at our topline growth, our organic growth is 20% plus, which is in line with our CAGR in the last 3 or 4 years. We will be growing at 20% plus and our overall growth will be 16%.

Where is this growth coming from?

Growth is coming both from existing geographies - Bangladesh and the Gulf - and newer markets such as South Africa and Egypt. We are growing much faster because we have a much smaller base.

Egypt has a free trade agreement with the Middle East and North African countries. Will Egypt become a manufacturing hub to tap countries in those regions?

We were already in the Gulf before we entered Egypt. We are looking at this region very closely. The Middle East and North African regions are good markets with a lot of potential. In GCC countries, we are the market leaders with Parachute cream in the UAE, ahead of international brands such as Brylcream.

In Egypt, with the brands we have acquired, we are number one and two. Put together, we have 60% market share. Our plan is to extend some of these brands to neighbouring geographies. We’re also looking at launching some of our home-grown brands there.

When will this expansion into neighbouring countries happen?

Our first priority is stabilising our operations before we introduce other brands. So, a couple of years will go into that.

How is integration different in, say Bangladesh or Egypt?

It is quite different. In an overseas acquisition, the challenges tend to be more than a local one because of sheer newness in terms of the market, terrain and culture. To that extent, there is a lot of integration that needs to be done to absorb the acquisition. At times, the teams involved in the negotiations agree to get the two sides aligned so that the business momentum is not lost.

We have followed different types of integration models. For the acquisition in Egypt, we acquired a company that was owned and controlled by the father and run by the son.

But in South Africa, we retained the same management.

Typically when we acquire a company, we try to imbibe their culture. In Egypt, when we built a new office, we built a prayer room. Chairs in our office in Egypt are placed sideways instead of facing the host, keeping in the mind the country’s culture. There, eye-to-eye contact is considered rude. During Ramadan, we change the office timings to accommodate fasting and prayers. We hold Marico iftaar. So, we make course corrections wherever required.

Some companies are facing trouble with acquisitions. Have you been lucky so far?

So far, so good. It is a bit like my son’s toy car. When it hits a hurdle or a wall, the car reverses and moves on. When we acquired the Egyptian brands, their combined market share was 58%. Now, it is 61%. We are clocking double-digit growth and we are tracking well.

Are consumers in Bangladesh, Egypt and South Africa very different from the average Indian customer?

The consumers there are like consumer anywhere else. There is greater stress on value for money. If you look at, say the UAE, organised retail controls 55% of the FMCG market. There, you are dealing with bigger chains such as Carrefour. In South Africa, the organised retail control 40-45% of the market. South African consumers prefer larger packs. But in Bangladesh, like in India, consumers gravitate towards smaller packs. In Egypt, where modern trade is evolving, the FMCG business mirrors the Indian market as it is driven by wholesalers.

Any learnings from your overseas exposure?

When we entered the Gulf region, we actually went with our traditional oil format. Then we realised it is not a large enough playing field and if we need a large playing field, we need to introduce cream-based products for haircare etc. We now have market leadership in creams in the UAE. We actually introduced the cream pack in India, fairly quickly. One of the formats we acquired in Egypt is in a unique category called gel cream. We are experimenting with it and prototyping the product in India. There could be some lessons in handling modern trade from the experience gained in South Africa.

Will the overseas strategy revolve around acquisitions?

In Bangladesh, we started out in the organic mode. Parachute is among the top 20 trusted brands there and is the market leader with a dominant share. We acquired regional brands only later. The operation per se is organic.

In the UAE, we built from scratch. Then we acquired brands in Egypt and South Africa. We are looking at certain geographies for growth, a couple being the MENA region and the African belt. This would explain our acquisitions in Egypt and South Africa. If you look at the population, South Africa has 45-50 million people and Egypt 70 million. The sizes are much smaller than India. We will try for leadership in these markets and will look at growing in Morocco and Libya through Egypt.

How soon do you plan to enter Libya and Morocco?

We are trying to make Egypt the manufacturing hub. Through our acquisitions there, we have bought two manufacturing plants. We are in the process of setting up a third manufacturing plant for Rs 10-12 crore and it will be commissioned by year-end. We will market our current brands as well as new brands in MENA regions from there.

But Marico is still seen as an edible oil manufacturer and a conservative company when it comes to growth?

Marico was identified by Standard & Poor’s as one of the global challengers last year. Our approach is focussed on depth. We typically enter a geography, invest in a brand and make it strong. We try and build a clutch of markets from scratch. Our business is not very exports-led. We are catering to a niche market. We look at the best way to cater to that market and invest in those brands accordingly. The brands wouldn’t have grown without sustained investments.

j_satish@dnaindia.net

![submenu-img]() Bigg Boss OTT 3: Anil Kapoor confirmed as new host, says 'jhakaas nahi kuch khaas karte hai', leaves netizens divided

Bigg Boss OTT 3: Anil Kapoor confirmed as new host, says 'jhakaas nahi kuch khaas karte hai', leaves netizens divided![submenu-img]() Felony charges and political ambitions: Donald Trump at the legal and electoral crossroads

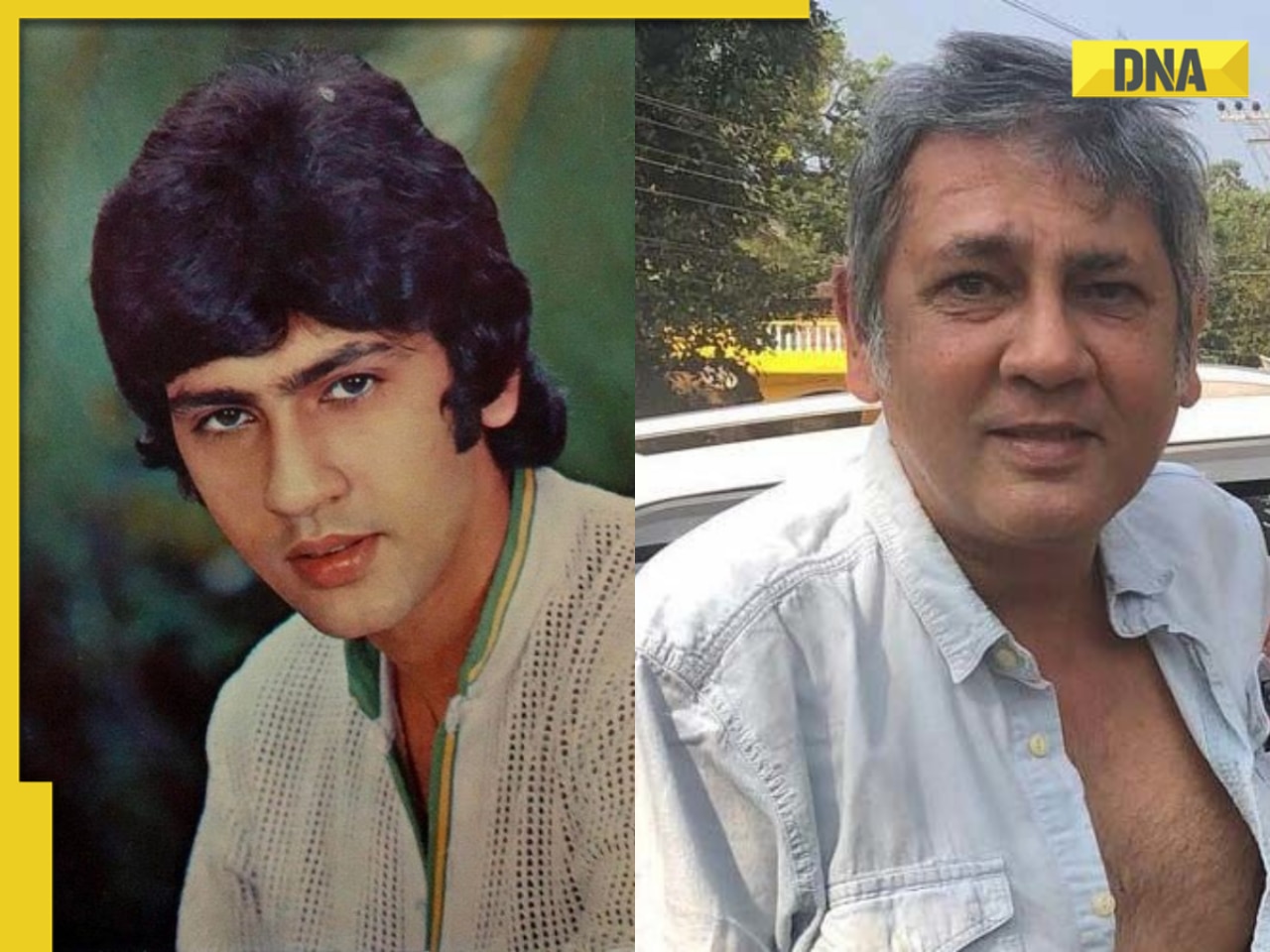

Felony charges and political ambitions: Donald Trump at the legal and electoral crossroads![submenu-img]() This actor left UPSC dreams for Bollywood, was launched by Amitabh, fought Shah Rukh, then disappeared for years, now...

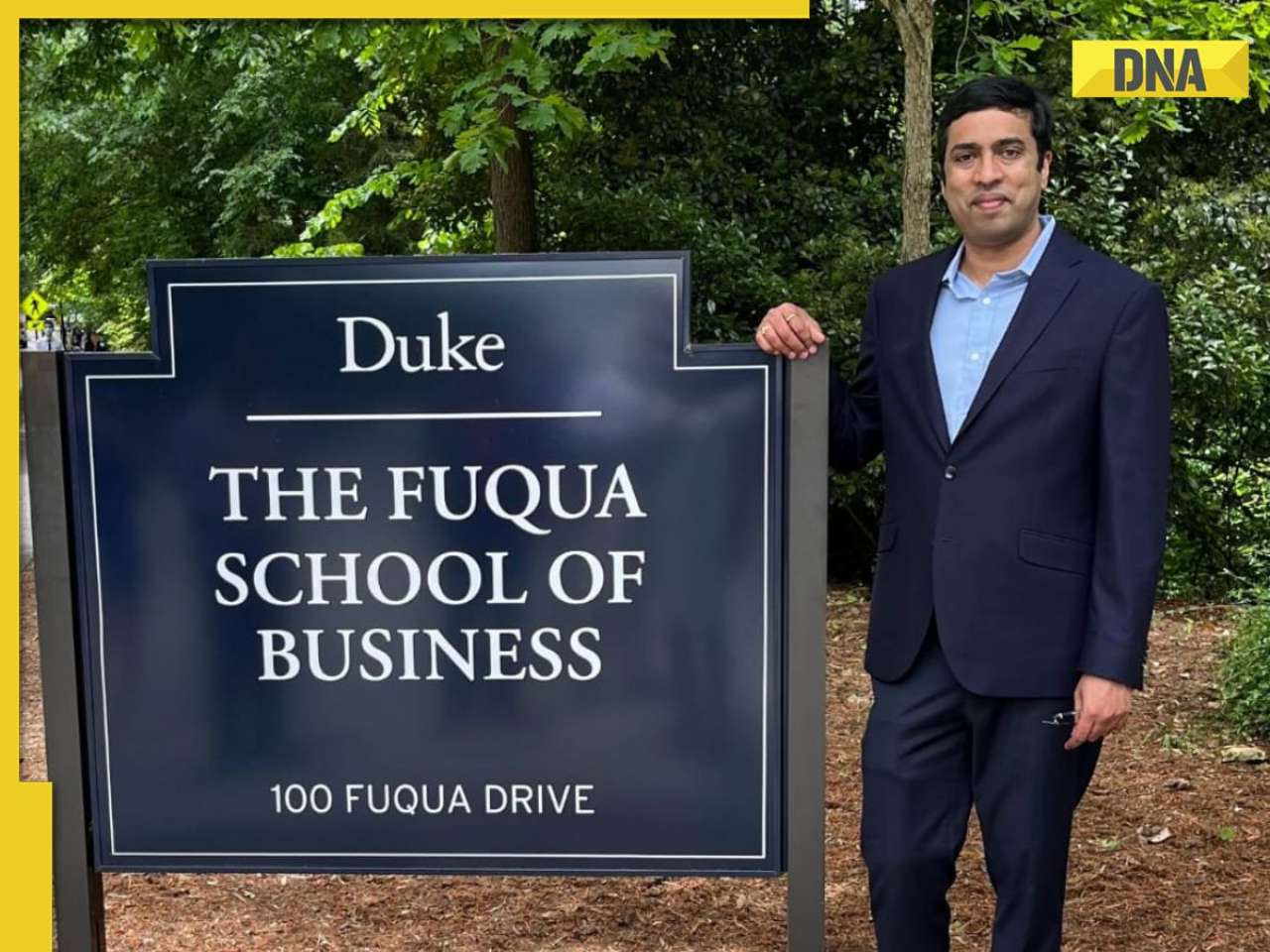

This actor left UPSC dreams for Bollywood, was launched by Amitabh, fought Shah Rukh, then disappeared for years, now...![submenu-img]() Data-Driven Decision Making: Leveraging KPI Metrics for Strategic Insight

Data-Driven Decision Making: Leveraging KPI Metrics for Strategic Insight![submenu-img]() Exploring transformative potential of application modernisation for sustainable solutions in future

Exploring transformative potential of application modernisation for sustainable solutions in future![submenu-img]() Stunning images of deep space captured by NASA's Hubble Space telescope

Stunning images of deep space captured by NASA's Hubble Space telescope![submenu-img]() Does eating mangoes increase blood sugar levels?

Does eating mangoes increase blood sugar levels?![submenu-img]() 8 Indian inventions that shaped course of history

8 Indian inventions that shaped course of history![submenu-img]() 8 magnesium-rich foods for people with diabetes

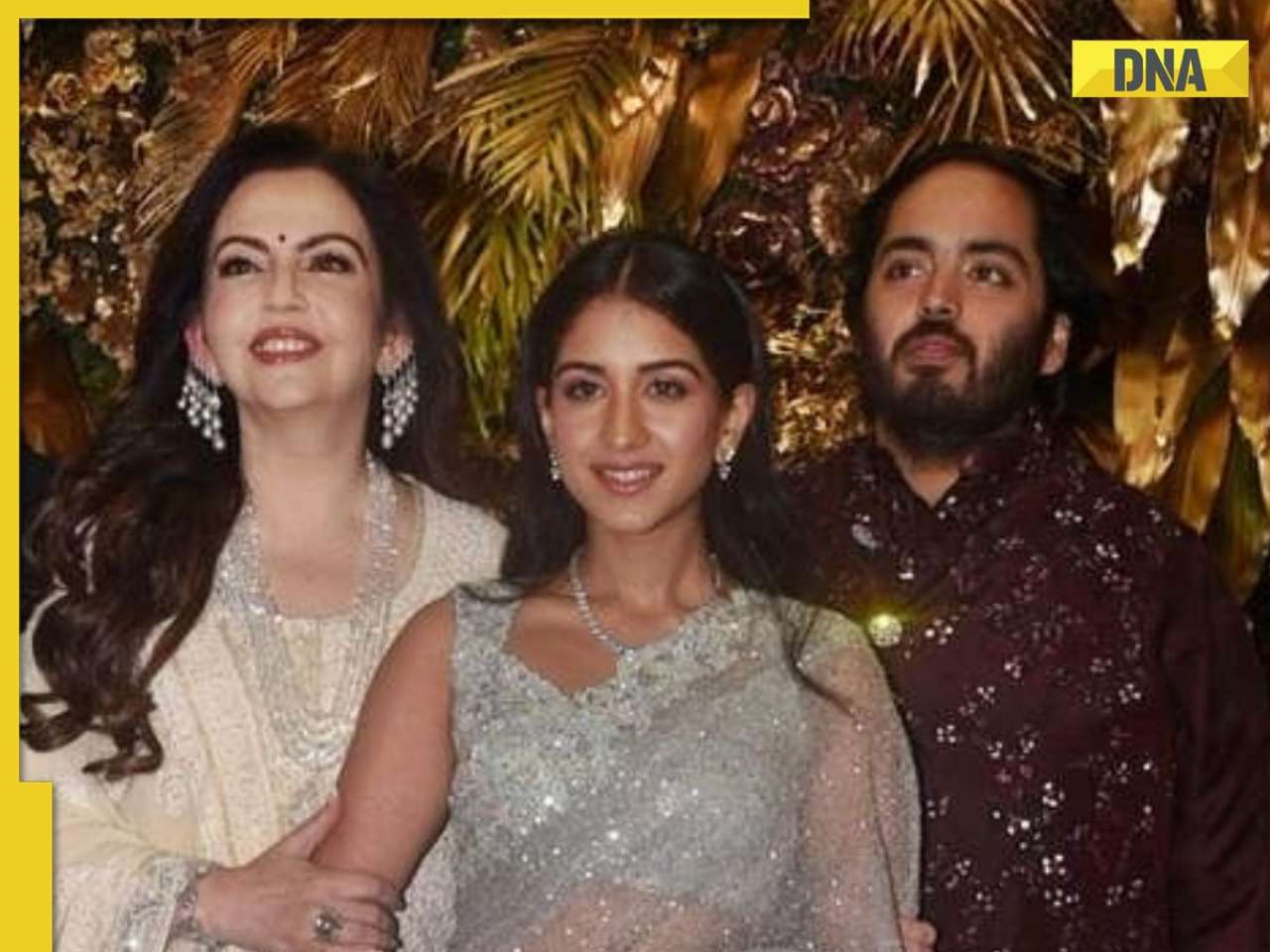

8 magnesium-rich foods for people with diabetes![submenu-img]() Inside pics of luxury cruise hosting Anant Ambani, Radhika Merchant's pre-wedding bash

Inside pics of luxury cruise hosting Anant Ambani, Radhika Merchant's pre-wedding bash![submenu-img]() Meet Indian genius who won National Spelling Bee contest in US at age 12, he is from…

Meet Indian genius who won National Spelling Bee contest in US at age 12, he is from…![submenu-img]() Meet man who became IIT Bombay professor at just 22, got sacked from IIT after some years because..

Meet man who became IIT Bombay professor at just 22, got sacked from IIT after some years because..![submenu-img]() Meet Indian genius, son of constable, worked with IIT, NASA, then went missing, was found after years in...

Meet Indian genius, son of constable, worked with IIT, NASA, then went missing, was found after years in...![submenu-img]() Meet IAS officer who was victim of domestic violence, mother of two, cracked UPSC exam in first attempt, she's posted in

Meet IAS officer who was victim of domestic violence, mother of two, cracked UPSC exam in first attempt, she's posted in![submenu-img]() RBSE Class 5th, 8th Result 2024 Date, Time: Rajasthan board to announce results today, get direct link here

RBSE Class 5th, 8th Result 2024 Date, Time: Rajasthan board to announce results today, get direct link here![submenu-img]() DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo

DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo![submenu-img]() DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here

DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() Streaming This Week: Panchayat season 3, Swatantrya Veer Savarkar, Illegal season 3, latest OTT releases to binge-watch

Streaming This Week: Panchayat season 3, Swatantrya Veer Savarkar, Illegal season 3, latest OTT releases to binge-watch![submenu-img]() Avneet Kaur shines in navy blue gown with shimmery trail at Cannes 2024, fans say 'she is unstoppable now'

Avneet Kaur shines in navy blue gown with shimmery trail at Cannes 2024, fans say 'she is unstoppable now'![submenu-img]() Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes

Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes ![submenu-img]() Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'

Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'![submenu-img]() AI models play volley ball on beach in bikini

AI models play volley ball on beach in bikini![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?

DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() Bigg Boss OTT 3: Anil Kapoor confirmed as new host, says 'jhakaas nahi kuch khaas karte hai', leaves netizens divided

Bigg Boss OTT 3: Anil Kapoor confirmed as new host, says 'jhakaas nahi kuch khaas karte hai', leaves netizens divided![submenu-img]() This actor left UPSC dreams for Bollywood, was launched by Amitabh, fought Shah Rukh, then disappeared for years, now...

This actor left UPSC dreams for Bollywood, was launched by Amitabh, fought Shah Rukh, then disappeared for years, now...![submenu-img]() Bujii and Bhairava review: Prabhas' futuristic Baahubali-type Kalki 2898 prelude AD is fun, AI Keerthy steals the show

Bujii and Bhairava review: Prabhas' futuristic Baahubali-type Kalki 2898 prelude AD is fun, AI Keerthy steals the show![submenu-img]() This actress gave no hits in 9 years, no Bollywood releases in 5 years, charges Rs 40 crore per film, net worth is..

This actress gave no hits in 9 years, no Bollywood releases in 5 years, charges Rs 40 crore per film, net worth is..![submenu-img]() Mr & Mrs Mahi review: Janhvi, Rajkummar's earnest performances can't save film that doesn't really get cricket or women

Mr & Mrs Mahi review: Janhvi, Rajkummar's earnest performances can't save film that doesn't really get cricket or women![submenu-img]() Viral video: Little girl’s adorable dance to 'Ruki Sukhi Roti' will melt your heart, watch

Viral video: Little girl’s adorable dance to 'Ruki Sukhi Roti' will melt your heart, watch![submenu-img]() Groom jumps off stage for impromptu dance with friends, viral video leaves netizens in splits

Groom jumps off stage for impromptu dance with friends, viral video leaves netizens in splits![submenu-img]() Viral video: Chinese man stuns internet by balancing sewing machine on glass bottles, watch

Viral video: Chinese man stuns internet by balancing sewing machine on glass bottles, watch![submenu-img]() Watch: First video of Mukesh Ambani's son Anant Ambani-Radhika Merchant's 2nd pre-wedding bash goes viral

Watch: First video of Mukesh Ambani's son Anant Ambani-Radhika Merchant's 2nd pre-wedding bash goes viral![submenu-img]() Viral video: Outrage over woman's dance at Mumbai airport sparks calls for action, watch

Viral video: Outrage over woman's dance at Mumbai airport sparks calls for action, watch

)

)

)

)

)

)