‘Vetri’ in Tamil means victory. Not a bad name to have on board when you are starting off to make your mark among three dozen competitors, some of them multi-billion dollar gorillas.

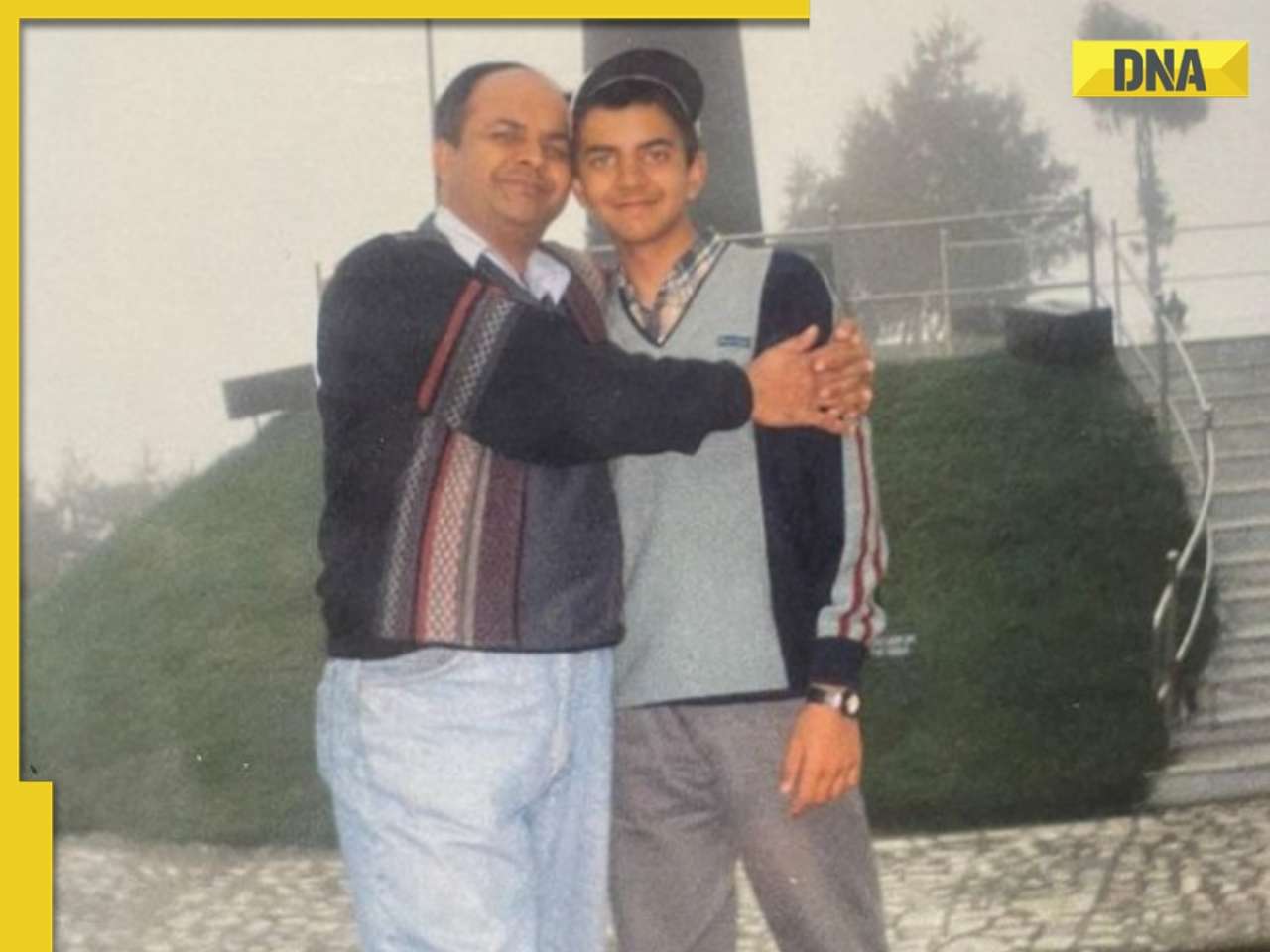

‘Vetri’ in Tamil means victory. Not a bad name to have on board when you are starting off to make your mark among three dozen competitors, some of them multi-billion dollar gorillas. But, Vetri M Subramaniam brings in much more than a talismanic name.

Of his 14-year love affair with the Indian markets, a considerable part has been spent in the UK as an advisor to Boyer Allan Investment Management, where he helped launch an India-dedicated offshore fund. In his earlier stint at home, Subramaniam managed investments for Kotak Mahindra MF and Sharekhan.com and handled sales for SSKI Securities. Vetri learnt his management lessons at IIM-Bangalore.

The head of equity at Religare Aegon Asset Management says the focus will be on to bring out the plain vanilla products, irrespective of prevailing market conditions. “Our perspective is to roll out basic products without worrying too much about things not in our control. One thing we want to ensure is that we don’t plan for a tailwind and then run into a headwind,” he said.

The headwinds the market is facing have their origins in mid-2006. The RBI had clearly hinted tightening measures then. The market did not take cognisance of that and rallied further. “Unfortunately, when the effects of 18 months of tightening spree should have cooled down inflation, it started flaring up as a result of rising oil prices. Global liquidity position has deteriorated making things worse for the market.”

But there is some hope as oil prices are ‘pretty near the tipping point’, he said. While the supply-side issues are being addressed, demand destruction would eventually lead to a fall in prices.

Where does one make money next year? Subramaniam feels adjusting for the amount of pain, simplest returns one can make is from debt investments like fixed deposits and fixed maturity plans (FMPs).

The concerns of inflation being more than the returns seem misplaced. “We seem to be a little carried away by the past.

What you have to worry is inflation from here to next 12 months. It could be a lot lesser. Considering the underlying volatility one might face in other asset classes, it is not all that bad to deal with debt,” equities chief of Religare Aegon said.

But he is quick to add asset class shifts should be based on long-term investment strategy and not on one-year views. He recollects how in 2003 it was so difficult to convince anyone to purchase equity. People had 10-15% exposure to equities, at the most. It was a complete contrast in Diwali 2007.

“I was running into people who were 80% on equity. Logically, given the steep rise in equity market and relative lull in other asset classes, your 15% asset allocation in 2003 would have automatically become 70% plus. The trick with asset allocation is to keep shaving off regularly. Also, you should not shift from 0-50% or vice versa at one go.”

But foreign institutional investors seem to be making the shift at one go selling over $6 billion in six months. Subramaniam said the outflows are a result of the global de-leveraging. “We are seeing the reverse of liquidity creation process, which was started in 2003-04. In India’s case, flows are affected more because of the curb on P-notes, which was a simple way for overseas investors to invest here.”

In the scenario, Subramaniam will be a little wary of companies, which will face cost pressures due to falling demand and capex-heavy companies, which will get hit by high interest rates. Stocks with no earnings visibility in the next five-six years but quoting at high PE due to sum of the parts valuation are also a no-no.

Big users of steel will face difficulties given the sharp run up in the prices. “Only tailwind, I see, is for companies that will benefit from agri-based rural income. For the first time since the mid-90s, terms of trade are favourable with rise in volumes and higher prices.”

Among the sectors, though IT looks good, it’s not all rosy. “The IT rally of the last few months is primarily due to the depreciating rupee. Given the global economic scenario, the outlook remains cautious,” Subramaniam said.

n_subramanian@dnaindia.net

![submenu-img]() Anant Raj Ventures into tier 2 and tier 3 cities, pioneering growth in India’s real estate sector

Anant Raj Ventures into tier 2 and tier 3 cities, pioneering growth in India’s real estate sector![submenu-img]() Sophie Turner reveals she wanted to terminate her first pregnancy with Joe Jonas: 'Didn't know if I wanted...'

Sophie Turner reveals she wanted to terminate her first pregnancy with Joe Jonas: 'Didn't know if I wanted...'![submenu-img]() Meet outsider who was given no money for first film, battled depression, now charges Rs 20 crore per film

Meet outsider who was given no money for first film, battled depression, now charges Rs 20 crore per film![submenu-img]() This is owner of most land in India, owns land in every state, total value is Rs...

This is owner of most land in India, owns land in every state, total value is Rs...![submenu-img]() Meet man who built Rs 39832 crore company after quitting high-paying job, his net worth is..

Meet man who built Rs 39832 crore company after quitting high-paying job, his net worth is..![submenu-img]() Meet woman who first worked at TCS, then left SBI job, cracked UPSC exam with AIR...

Meet woman who first worked at TCS, then left SBI job, cracked UPSC exam with AIR...![submenu-img]() Meet engineer, IIT grad who left lucrative job to crack UPSC in 1st attempt, became IAS, married to an IAS, got AIR...

Meet engineer, IIT grad who left lucrative job to crack UPSC in 1st attempt, became IAS, married to an IAS, got AIR...![submenu-img]() Meet Indian woman who after completing engineering directly got job at Amazon, then Google, Microsoft by using just...

Meet Indian woman who after completing engineering directly got job at Amazon, then Google, Microsoft by using just...![submenu-img]() Meet man who is 47, aspires to crack UPSC, has taken 73 Prelims, 43 Mains, Vikas Divyakirti is his...

Meet man who is 47, aspires to crack UPSC, has taken 73 Prelims, 43 Mains, Vikas Divyakirti is his...![submenu-img]() IIT graduate gets job with Rs 100 crore salary package, fired within a year, he is now working as…

IIT graduate gets job with Rs 100 crore salary package, fired within a year, he is now working as…![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() In pics: Taarak Mehta Ka Ooltah Chashmah actress Deepti Sadhwani dazzles in orange at Cannes debut, sets new record

In pics: Taarak Mehta Ka Ooltah Chashmah actress Deepti Sadhwani dazzles in orange at Cannes debut, sets new record![submenu-img]() Ananya Panday stuns in unseen bikini pictures in first post amid breakup reports, fans call it 'Aditya Roy Kapur's loss'

Ananya Panday stuns in unseen bikini pictures in first post amid breakup reports, fans call it 'Aditya Roy Kapur's loss'![submenu-img]() Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...

Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...![submenu-img]() Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses

Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses![submenu-img]() Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...

Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Sophie Turner reveals she wanted to terminate her first pregnancy with Joe Jonas: 'Didn't know if I wanted...'

Sophie Turner reveals she wanted to terminate her first pregnancy with Joe Jonas: 'Didn't know if I wanted...'![submenu-img]() Meet outsider who was given no money for first film, battled depression, now charges Rs 20 crore per film

Meet outsider who was given no money for first film, battled depression, now charges Rs 20 crore per film![submenu-img]() Meet actress who quit high-paying job for films, director replaced her with star kid, had no money, now lives in...

Meet actress who quit high-paying job for films, director replaced her with star kid, had no money, now lives in...![submenu-img]() This star kid's last 3 films lost Rs 5000000000 at box office, has no solo hit in 5 years, now has lost four films to...

This star kid's last 3 films lost Rs 5000000000 at box office, has no solo hit in 5 years, now has lost four films to...![submenu-img]() Meet actress viral for just walking on screen, belongs to royal family, has no solo hit in 15 years, but still is…

Meet actress viral for just walking on screen, belongs to royal family, has no solo hit in 15 years, but still is…![submenu-img]() This is owner of most land in India, owns land in every state, total value is Rs...

This is owner of most land in India, owns land in every state, total value is Rs...![submenu-img]() Blinkit now gives free dhaniya with veggie orders, thanks to Mumbai mom

Blinkit now gives free dhaniya with veggie orders, thanks to Mumbai mom![submenu-img]() Meet man, an Indian who entered NASA's Hall of Fame by hacking, earlier worked on Apple's...

Meet man, an Indian who entered NASA's Hall of Fame by hacking, earlier worked on Apple's...![submenu-img]() 14 majestic lions cross highway in Gujarat's Amreli, video goes viral

14 majestic lions cross highway in Gujarat's Amreli, video goes viral![submenu-img]() Here's why Isha Ambani was not present during Met Gala 2024 red carpet

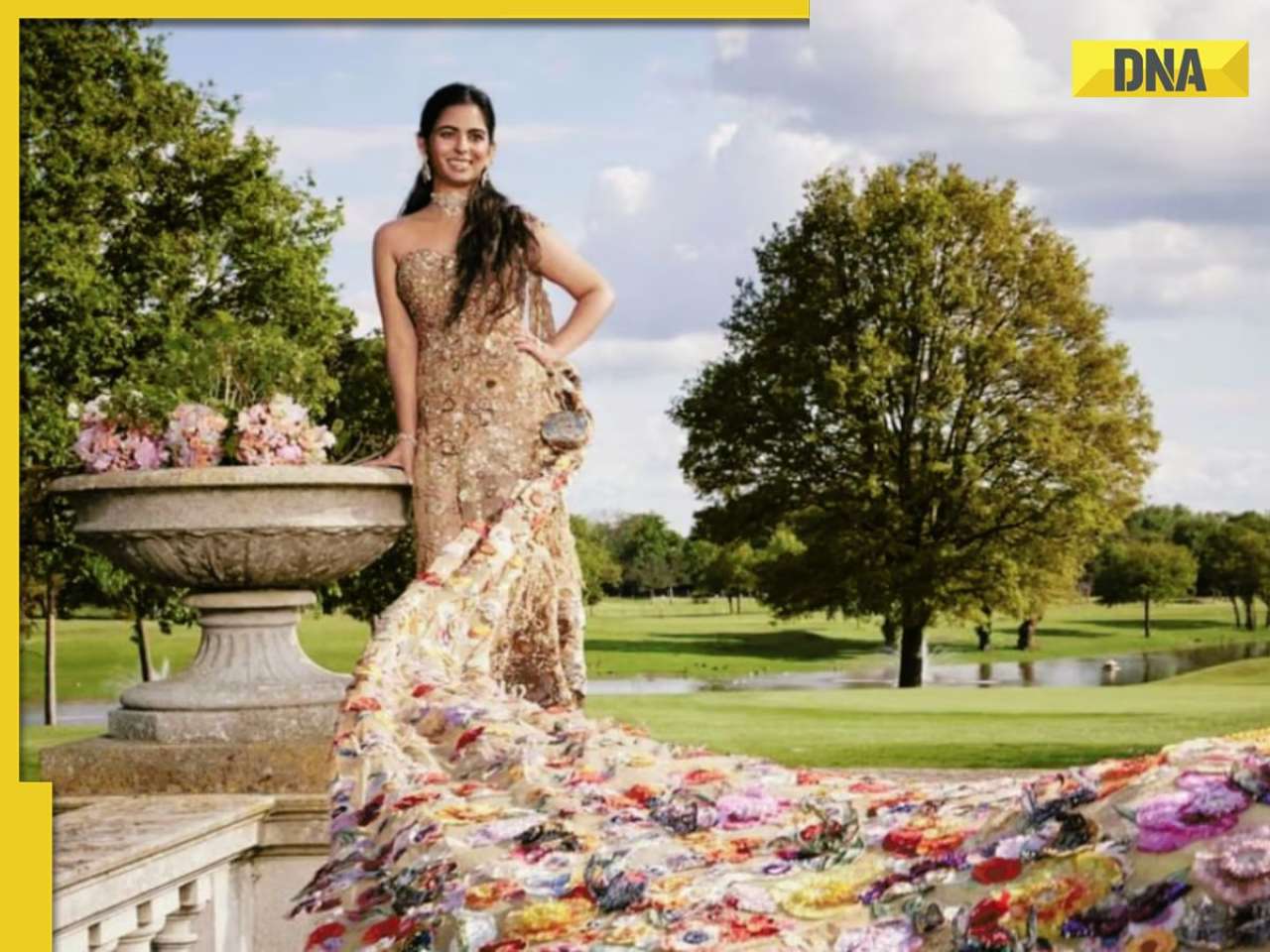

Here's why Isha Ambani was not present during Met Gala 2024 red carpet

)

)

)

)

)

)