The Aditya Birla Group company Hindalco on Sunday announced the acquisition of the US-based aluminum firm Novelis for $6 billion in an all-cash deal.

MUMBAI: If the Tatas pulled off a multi-billion-dollar acquisition, can the Birlas be far behind?

Hindalco Industries, a flagship company of the Aditya Birla group, on Sunday announced an agreement to acquire Novelis Inc, the largest flat-rolled aluminium maker in the world, for $6 billion (Rs 26,400 crore), which includes $2.4 billion of debt on the books.

The all-cash deal will involve payment of $3.55 billion in cash to Novelis shareholders, at $44.93 a share. The Novelis share closed on Friday at $38.54 on the New York Stock Exchange.

Announcing the deal, Kumar Mangalam Birla, chairman of the Aditya Birla group, the fourth-largest Indian business group by sales turnover ($12 billion at last count), said: “The deal will catapult the group to the Fortune 500 list three years ahead of what we had targeted.” Birla had spoken of his Fortune 500 ambitions in DNA Money’s inaugural issue on July 30, 2005.

The deal, when consummated in the second quarter this year, will also catapult Hindalco to No 5 rank globally as an integrated aluminium player. On the Birla radar for some time now, Novelis Inc is the world’s largest flat rolled aluminum maker, and will thus make Hindalco No 1 by far in this category. Novelis has been a loss-making company waiting to be acquired. Its woes stem from the fact that it has no captive source of bauxite, which forces it to buy alumina, the main raw material, from the spot markets.

In the nine months to September, 2006, Novelis had reported a loss of $170 million largely because it is locked into fixed-price contracts with many customers that run upto 2011. Birla will have to carry the can till then.

The story line for the Birla deal almost runs parallel to what Tata Steel’s logic was in acquiring Corus Group for $12 billion.

It will give Hindalco a quick entry into value-added aluminum products that include sheet metal for cars and cans for beverages. “We need technology. We need to move into the high end of the aluminum market”, says Debu Bhattacharya, managing director of Hindalco.

Hindalco, like Tata Steel, is also in the midst of a gargantuan greenfield capacity expansion plan that’ll cost it a whopping sum of Rs 25,000 crore.

The young scion of the Birla family, 39, who’s known for his tenacity when pursuing an acquisition, brought along his mother, Rajashree, also the vice-chairman of his group, and his wife Neerja to the press conference.

“We have been conservative with our business and we’ll remain very competitive”, says Birla, who admitted that Hindalco will face the pangs of acquiring Novelis for a couple of more years. While $ 2.8 billion of the funds required will come from recourse financing, the balance of $750 million will come from Hindalco and group company Essel Iron Ore Mining.

The Birlas were confident that a repeat of Corus, where the initial Tata bid faced a challenge from CSN of Brazil, is unlikely. “We have secured the Novelis board’s support on Hindalco’s offer of $44.93 a share.” The price represents a premium of about 17% over the stock’s closing price on Friday last week.”

The Birlas are certain that they have locked in the deal, thanks to the shrewd manner in which they have structured it. Any interloper walking in late to place a bid will have to pay US $100 million (Rs 441 crore) as breakoff fee to the Birlas. The Birlas have also put in a clause in the agreement that any new bid has be at least $3-4 higher than what they have promised to pay. “I can bet that we’ll get it,” says Debu Bhattacharya.

WHAT THE DEAL IS ABOUT

Hindalco, India’s largest non-ferrous metals company with a 60% domestic market share, is buying Novelis, the world’s leading producer of rolled aluminium products, for $6 billion (over Rs 26,000 crore), including outstanding debt. This will be the second-largest global acquisition by an Indian company, following the recent Tata deal to buy Corus for $12.16 billion.

WHY IT MAKES SENSE

The deal will create the world’s largest aluminium rolling group, providing cost synergies with Hindalco, which is one of the biggest producers of primary aluminium in Asia. The combo will create an integrated aluminium player with low-cost metal sourcing from India and access to some of Novelis’ biggest customers. Novelis made a loss of

$170 million in the nine months to September, 2006, due to high metal prices.

WHO IS NOVELIS?

Novelis, which could report a turnover of around $10 billion in 2006 (nine-month figures: $7.4 billion), was incorporated two years ago to run Alcan’s rolled products businesses. It is a global leader with a 19% market share. Its clients include General Motors, Coca-Cola, and Kodak. It operates in four continents - North & South America, Asia and Europe — with 34 operating facilities in 11 countries and 12,500 employees.

WHEN THE DEAL WILL HAPPEN

Under the agreement, Novelis shareholders will receive $44.93 in cash for each outstanding common share. This is a 17% premium over Novelis’ closing price on the New York Stock Exchange last Friday. The boards of Novelis and Hindalco have approved the deal, but two-thirds of shareholders have to nod acceptance. Once regulatory approvals are given under Canadian law, the deal can be sealed by June.

HOW PRUDENT IS THE DEAL?

By buying a company two-and-a-half times its size, Hindalco will have to work on delivering the cost synergies quickly. Novelis carries a huge debt burden of $2.4 billion on its books, and its losses are the result of fixed-price contracts with customers at a time when aluminium prices have been rising. Losses can be blotted out only if aluminium prices start falling. Hindalco’s profits are robust enough to carry the day.

WHERE'S THE MONEY COMING FROM?

The $6 billion imputed value of Novelis includes a cash payment worth $3.55 billion to Novelies’ shareholders and debt worth $2.4 billion. The cash is being substantially borrowed from banks ($2.8 billion) through a device called “recourse financing”, with the balance coming from group companies Hindalco ($450 million), and Essel Iron Ore Mining ($300 million), another Aditya Birla company.

![submenu-img]() Mukesh Ambani’s daughter Isha Ambani’s firm launches new brand, Reliance’s Rs 8200000000000 company to…

Mukesh Ambani’s daughter Isha Ambani’s firm launches new brand, Reliance’s Rs 8200000000000 company to…![submenu-img]() Sonali Bendre says producers called her 'too thin', tried to ‘fatten her up' during the 90s: ‘They'd just tell me...'

Sonali Bendre says producers called her 'too thin', tried to ‘fatten her up' during the 90s: ‘They'd just tell me...'![submenu-img]() Heavy rains in UAE again: Dubai flights cancelled, schools and offices shut

Heavy rains in UAE again: Dubai flights cancelled, schools and offices shut![submenu-img]() When 3 Bollywood films with same story released together, two even had same hero, all were hits, one launched star kid

When 3 Bollywood films with same story released together, two even had same hero, all were hits, one launched star kid![submenu-img]() Gautam Adani’s firm gets Rs 33350000000 from five banks, to use money for…

Gautam Adani’s firm gets Rs 33350000000 from five banks, to use money for…![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

Actors who died due to cosmetic surgeries![submenu-img]() See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol

See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol ![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() Sonali Bendre says producers called her 'too thin', tried to ‘fatten her up' during the 90s: ‘They'd just tell me...'

Sonali Bendre says producers called her 'too thin', tried to ‘fatten her up' during the 90s: ‘They'd just tell me...'![submenu-img]() When 3 Bollywood films with same story released together, two even had same hero, all were hits, one launched star kid

When 3 Bollywood films with same story released together, two even had same hero, all were hits, one launched star kid![submenu-img]() Salman Khan house firing case: Family of deceased accused claims police 'murdered' him, says ‘He was not the kind…’

Salman Khan house firing case: Family of deceased accused claims police 'murdered' him, says ‘He was not the kind…’![submenu-img]() Meet actor banned by entire Bollywood, was sent to jail for years, fought cancer, earned Rs 3000 crore on comeback

Meet actor banned by entire Bollywood, was sent to jail for years, fought cancer, earned Rs 3000 crore on comeback ![submenu-img]() Karan Johar wants to ‘disinherit’ son Yash after his ‘you don’t deserve anything’ remark: ‘Roohi will…’

Karan Johar wants to ‘disinherit’ son Yash after his ‘you don’t deserve anything’ remark: ‘Roohi will…’![submenu-img]() IPL 2024: Bhuvneshwar Kumar's last ball wicket power SRH to 1-run win against RR

IPL 2024: Bhuvneshwar Kumar's last ball wicket power SRH to 1-run win against RR![submenu-img]() BCCI reacts to Rinku Singh’s exclusion from India T20 World Cup 2024 squad, says ‘he has done…’

BCCI reacts to Rinku Singh’s exclusion from India T20 World Cup 2024 squad, says ‘he has done…’![submenu-img]() MI vs KKR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

MI vs KKR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() IPL 2024: How can RCB and MI still qualify for playoffs?

IPL 2024: How can RCB and MI still qualify for playoffs?![submenu-img]() MI vs KKR IPL 2024 Dream11 prediction: Fantasy cricket tips for Mumbai Indians vs Kolkata Knight Riders

MI vs KKR IPL 2024 Dream11 prediction: Fantasy cricket tips for Mumbai Indians vs Kolkata Knight Riders ![submenu-img]() '25 virgin girls' are part of Kim Jong un's 'pleasure squad', some for sex, some for dancing, some for...

'25 virgin girls' are part of Kim Jong un's 'pleasure squad', some for sex, some for dancing, some for...![submenu-img]() Man dances with horse carrying groom in viral video, internet loves it

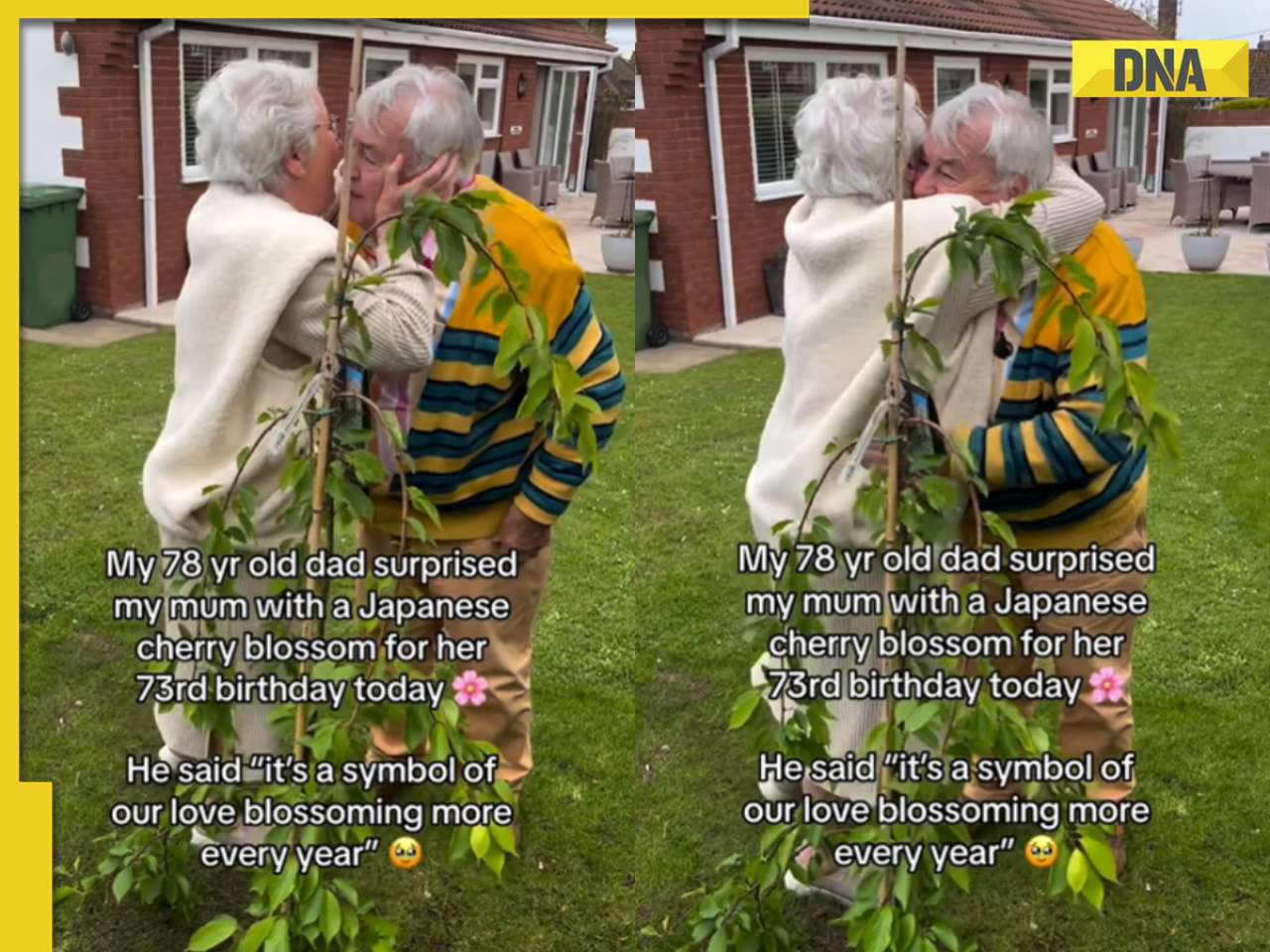

Man dances with horse carrying groom in viral video, internet loves it ![submenu-img]() Viral video: 78-year-old man's heartwarming surprise for wife sparks tears of joy

Viral video: 78-year-old man's heartwarming surprise for wife sparks tears of joy![submenu-img]() Man offers water to thirsty camel in scorching desert, viral video wins hearts

Man offers water to thirsty camel in scorching desert, viral video wins hearts![submenu-img]() Pakistani groom gifts framed picture of former PM Imran Khan to bride, her reaction is now a viral video

Pakistani groom gifts framed picture of former PM Imran Khan to bride, her reaction is now a viral video

)

)

)

)

)

)

)