Shrugging off concerns over rising inflation and a hike in the Cash Reserve Ratio, the BSE benchmark Sensex gained 4.0% to recapture the 17K peak this week.

MUMBAI: Shrugging off concerns over rising inflation and a hike in the Cash Reserve Ratio, the Bombay Stock Exchange benchmark Sensex gained 4.0 per cent to recapture the psychologically important 17K peak in the week, largely driven by robust earnings by frontline stocks.

In the week to April 26, the BSE barometer advanced by another 644.78 points or 3.91 per cent to end the week at 17,125.98 from its last weekend's close of 16,481.20.

The broader 50-share S&P CNX Nifty of the National Stock Exchange also spurted by 153.30 points or 3.09 per cent to close the week at 5,111.70 from its last weekend's close.

Investors looked optimistic over the prospect of capital inflows into Indian equity markets after key corporates came out with encouraging fourth quarter financial results and global markets showed signs of recovery, providing bourses a major trigger.

The marketwide rollover of nearly 82 per cent to May series is also seen as a bullish factor by marketmen.

Global stocks are expected to move upwards as world's largest economy showed signs of resilence after an ecnouraging US jobs and manufacturing data this week.

Analysts said the outlook for the market is good as some some frontline companies such as Reliance Communications, Hindustan Unilever, Reliance Energy and ICICI Bank will unveil financial results next week.

The Reserve Bank of India's annual monetary policy review on April 29 and the US Federal Reserve meeting at month-end also is expected to play a crucial role in determining the market direction, they added.

Analysts foresee a possibility of a rate hike at home, while they do not rule out a rate cut by the Federal Reserve.

FII inflows, however, hold the key for any major move in the market. Foreign Institutional Investors (FIIs) were net buyers to the tune of Rs 600 crore (including provisional number of April 25) so far in the month.

Meanwhile, inflation again jumped to 7.33 per cent for the week ended April 12, bringing pressure on the government to initiate steps to rein in prices and the central bank to tighten money supply.

The broad-based BSE-100 index strengthened by 338.01 points or 3.87 per cent to end the week at 9,078.68 from its last weekend's close of 8,749.67.

The BSE-200 index and the Dollex-200 were quoted higher at 2,130.19 and 883.32 at the weekend compared to their last weekend's close of 2,051.87 and 855.64 respectively.

The BSE-500 index improved further by 239.42 points to close the week at 6,794.59 from preceding weekend's close of 6,555.17 and the Dollex-30 ended higher at 3,501.97 from 3,389.12.

On the NSE, the S&P CNX Defty rose further by 112.75 points or 2.62 per cent to finish the week at 4,415.45 from 4,302.70 and the CNX Nifty Junior flared up by another 390.45 points or 4.55 per cent to conclude the week at 8,963.80 from 8,573.35 at the last weekend.

Bullion: Gold prices continued its downward march on the bullion market during the week under review due to lack of local demand coupled with stockists offerings on the back of sharp fall in global markets.

Silver prices declined sharply due to poor offtake coupled with fresh stockists offerings.

Precious metals complex suffered significant losses in New york on Wednesday as the US dollar gained and oil prices fell from record highs, a trader said.

Gold investors have also been disappointed by a large physical offtake out of the world's largest gold exchange traded fund, a dealer added.

In Comex division of New york, gold prices June contract ended lower at 889.70 dollar per ounce as against 915.20 dollar per ounce previously and silver July contact also closed lower at 16.9580 dollar per ounce as against 17.93 dollar per ounce previously.

In Hong Kong, gold prices also ended sharply lower at 882.50/883.20 dollar per ounce as against 943.70/944.40 dollar and in London, it was quoted lower in the afternoon as 891.50 dollar per ounce as against 908.25 dollar previously.

Turning to the local market, standard gold (99.5 purity) dropped by Rs 345 per 10 grams to Rs 11,550 from the last weekend's level of Rs 11,895.

Pure gold (99.9 purity) also fell by Rs 340 per 10 grams to Rs 11,610 from Rs 11,950.

Silver ready (.999 fineness) slipped by Rs 1,100 per kilo to Rs 22,845 from Rs 23,945.

![submenu-img]() Anant Raj Ventures into tier 2 and tier 3 cities, pioneering growth in India’s real estate sector

Anant Raj Ventures into tier 2 and tier 3 cities, pioneering growth in India’s real estate sector![submenu-img]() Sophie Turner reveals she wanted to terminate her first pregnancy with Joe Jonas: 'Didn't know if I wanted...'

Sophie Turner reveals she wanted to terminate her first pregnancy with Joe Jonas: 'Didn't know if I wanted...'![submenu-img]() Meet outsider who was given no money for first film, battled depression, now charges Rs 20 crore per film

Meet outsider who was given no money for first film, battled depression, now charges Rs 20 crore per film![submenu-img]() This is owner of most land in India, owns land in every state, total value is Rs...

This is owner of most land in India, owns land in every state, total value is Rs...![submenu-img]() Meet man who built Rs 39832 crore company after quitting high-paying job, his net worth is..

Meet man who built Rs 39832 crore company after quitting high-paying job, his net worth is..![submenu-img]() Meet woman who first worked at TCS, then left SBI job, cracked UPSC exam with AIR...

Meet woman who first worked at TCS, then left SBI job, cracked UPSC exam with AIR...![submenu-img]() Meet engineer, IIT grad who left lucrative job to crack UPSC in 1st attempt, became IAS, married to an IAS, got AIR...

Meet engineer, IIT grad who left lucrative job to crack UPSC in 1st attempt, became IAS, married to an IAS, got AIR...![submenu-img]() Meet Indian woman who after completing engineering directly got job at Amazon, then Google, Microsoft by using just...

Meet Indian woman who after completing engineering directly got job at Amazon, then Google, Microsoft by using just...![submenu-img]() Meet man who is 47, aspires to crack UPSC, has taken 73 Prelims, 43 Mains, Vikas Divyakirti is his...

Meet man who is 47, aspires to crack UPSC, has taken 73 Prelims, 43 Mains, Vikas Divyakirti is his...![submenu-img]() IIT graduate gets job with Rs 100 crore salary package, fired within a year, he is now working as…

IIT graduate gets job with Rs 100 crore salary package, fired within a year, he is now working as…![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() In pics: Taarak Mehta Ka Ooltah Chashmah actress Deepti Sadhwani dazzles in orange at Cannes debut, sets new record

In pics: Taarak Mehta Ka Ooltah Chashmah actress Deepti Sadhwani dazzles in orange at Cannes debut, sets new record![submenu-img]() Ananya Panday stuns in unseen bikini pictures in first post amid breakup reports, fans call it 'Aditya Roy Kapur's loss'

Ananya Panday stuns in unseen bikini pictures in first post amid breakup reports, fans call it 'Aditya Roy Kapur's loss'![submenu-img]() Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...

Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...![submenu-img]() Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses

Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses![submenu-img]() Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...

Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Sophie Turner reveals she wanted to terminate her first pregnancy with Joe Jonas: 'Didn't know if I wanted...'

Sophie Turner reveals she wanted to terminate her first pregnancy with Joe Jonas: 'Didn't know if I wanted...'![submenu-img]() Meet outsider who was given no money for first film, battled depression, now charges Rs 20 crore per film

Meet outsider who was given no money for first film, battled depression, now charges Rs 20 crore per film![submenu-img]() Meet actress who quit high-paying job for films, director replaced her with star kid, had no money, now lives in...

Meet actress who quit high-paying job for films, director replaced her with star kid, had no money, now lives in...![submenu-img]() This star kid's last 3 films lost Rs 5000000000 at box office, has no solo hit in 5 years, now has lost four films to...

This star kid's last 3 films lost Rs 5000000000 at box office, has no solo hit in 5 years, now has lost four films to...![submenu-img]() Meet actress viral for just walking on screen, belongs to royal family, has no solo hit in 15 years, but still is…

Meet actress viral for just walking on screen, belongs to royal family, has no solo hit in 15 years, but still is…![submenu-img]() This is owner of most land in India, owns land in every state, total value is Rs...

This is owner of most land in India, owns land in every state, total value is Rs...![submenu-img]() Blinkit now gives free dhaniya with veggie orders, thanks to Mumbai mom

Blinkit now gives free dhaniya with veggie orders, thanks to Mumbai mom![submenu-img]() Meet man, an Indian who entered NASA's Hall of Fame by hacking, earlier worked on Apple's...

Meet man, an Indian who entered NASA's Hall of Fame by hacking, earlier worked on Apple's...![submenu-img]() 14 majestic lions cross highway in Gujarat's Amreli, video goes viral

14 majestic lions cross highway in Gujarat's Amreli, video goes viral![submenu-img]() Here's why Isha Ambani was not present during Met Gala 2024 red carpet

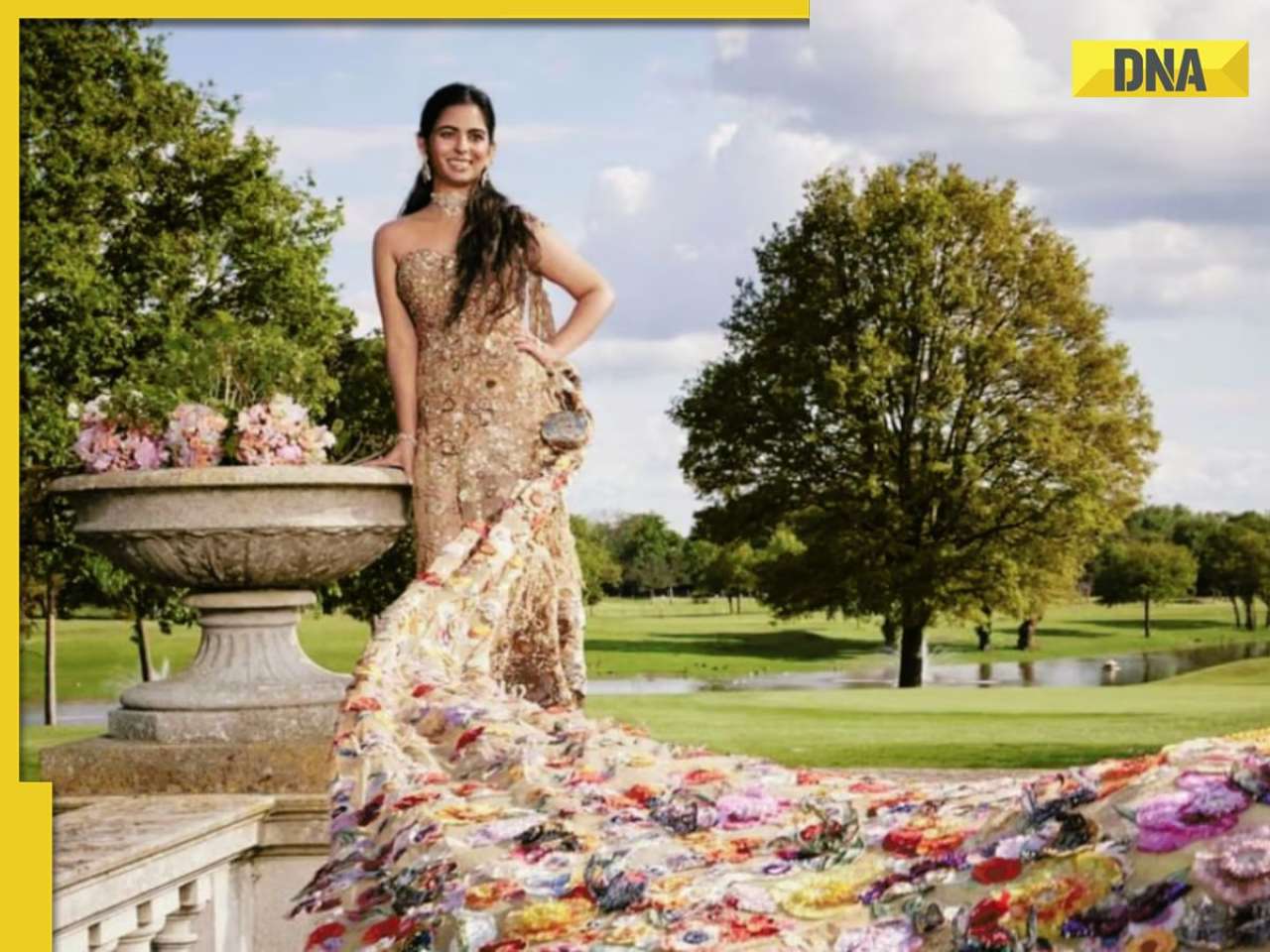

Here's why Isha Ambani was not present during Met Gala 2024 red carpet

)

)

)

)

)

)