The heart of Palaniappan Chidambaram’s fifth Budget speech — the Rs 60,000 crore farm loan waiver — is nowhere to be found in the body of the 2008-09 Budget.

So most of bad debt would be private money lenders’ dues

Also, did the waiver move happen at Rae Bareilly on Feb 20?

The heart of Palaniappan Chidambaram’s fifth Budget speech — the Rs 60,000 crore farm loan waiver — is nowhere to be found in the body of the 2008-09 Budget.

The expenditure list did not refer to it even in small print, like in the case of oil and fertiliser deficits of Rs 18,757 crore kept as an off-budget affair.

Chidambaram has asked for no budgetary support for his gift and yet wants the Parliament to bless the write-off of Rs 60,000 crore of bank money, which represents the hard-earned deposits of people at large —- something over which the Parliament has no control.

When asked, in the absence of budgetary support, where from will the banks find the money to book the write-off, the finance minister has been evasive.

He said the government will provide liquidity to the banks equivalent to the write-off over the period during which they would have recovered the Rs 60,000 crore.

Anyone with a basic understanding of finance and accounts will know that the issue in a write-off, which dents the profit & loss account, is not liquidity, but solvency and capital adequacy.

So the minister seems to have gone wrong on first principles of finance and accounts. Or, if he is right, then the banks must have already made provisions in their profit & loss accounts to cover most of the waiver, and already taken the hit in their balance sheets.

If that is the case, then the finance minister is suppressing a decision that was taken by the banks themselves and palming it off as the “momentous” decision of the UPA government.

More interestingly, according to the latest RBI Report on Trend and Progress of Banking in India 2006-07 [Page 96] the gross NPA of all commercial banks put together was Rs 50,519 crore, out of which the share of NPAs on farmers’ loans was only Rs 7,367 crore.

That is, out of the outstanding farm loans of Rs 230,180 crore, the gross NPA is Rs 7,367 crore. The net, thus, must be far less.

Chidambaram then tells the nation that banks will write off Rs 60,000 crore as bad loans that are irrecoverable.

See the effect of the write off. The net owned funds of scheduled commercial banks as on March 31, 2007, stood at Rs 2,19,174 crore. The write-off would cut out a huge amount from this number and bring it down and undermine capital adequacy.

There’s more: Three disturbing clues indicate that the debt write off decision could be an interpolation in the Budget speech that had already been readied.

All that was perhaps done was to add a para, No. 73, which did not affect the numbers as the waiver was just an oral gift by banks —- there was no use of government money.

There are some interesting clues which bare how the waiver was smuggled into the budget

First, the idea to write off banks’ debt was never in contemplation as other, perhaps better, measures were in the pipeline.

In his 2006-07 Budget speech, Chidabaram had referred to the recommendations of the Dr Radhakrishna Group On Farmers’ Indebtedness and assured the Parliament that he “would act on the report as soon as it is received”, implying that the report would be implemented.

The report, submitted in August 2007, said, contrary to Chidambaram’s view that the debt due to the banks kill the farmers, it is the farmers’ debt obligations to private money lenders that kill them.

The group found that some 74% of credit line for farmers came from private sources at interest ranging from 20% to 36% plus with small farmers who account for 80% of the indebted dependent more on such loans.

The panel had called for social efforts to settle the private debts and also commended one time term loan to the farmers to help them to pay off the exploitative private loans.

In its mid-term review [October 2007], the RBI constituted a working group to examine the panel’s suggestions and submit its views by December 2007 after consulting all stake holders.

The minister’s assurance to the Parliament was being followed up by the Reserve Bank of India. So, till December 2007, at least there could be no proposal for a write-off.

The Radhakrishna Group had zeroed in on the true evil —- private money-lending —- as the villain. But there is not a word in the Budget speech about how to deal with the menace of the killer private lending.

Second, the clue within the minister’s Budget speech is critical. In Paras 10 and 56, Chidambaram says that by March 2008, agricultural credit will exceed the target to top Rs 240,000 crore; for the year 2008-09, he set a target of Rs 280,000.

When Paras 10 and 56 were keyed in, obviously the write-off mentioned was nowhere in the horizon.

Here is the math that indicates that it was a later interpolation.

The figures Rs 240,000 crore for 2007-08 and Rs 280,000 crore for 2008-09 include the amount of Rs 60,000 crore as there was to be no waiver.

Chidambaram had included the amount of Rs 60,000 crore that will remain part of loans outstanding and due a year from now. So the decision to write it off in June 2008 came clearly after keying in of paras 10 and 56.

But at what point in time would this Para 73 have been smuggled in?

A clue again: On February 20, Chidambaram shared dais with Sonia Gandhi, Rahul Gandhi and Murali Deora at a farmers’ rally in Rae Bareilly.

Reports say that Sonia asked Chidambaram in front of the farmers “to keep the hardships faced by [among others] farmers in mind, while preparing his Budget”.

Agreeing with her, he told the farmers that the banks “are not doing a favour when they lend money to you” and added, they “are discharging their duty, when they are lending the money”.

If, at Rae Bareilly, Chidambaram reminds banks of their duty to lend, having already decided in New Delhi to write off what was lent earlier, that would be, by inference, great deception.

But with Sonia’s command and the minister’s response at the farmers’ rally, it is more benign to infer that the ‘momentous’ write-off decision was taken at the rally or at a tea after the rally, not at North Block.

QED: The Rae Bareilly road show cost the nation Rs 60,000 crore, with no relief to the farmers from the private debts - or the real evil.

![submenu-img]() This classic was made by director in frustration, was rejected by Amitabh, Naseer, inspired many filmmakers, earned...

This classic was made by director in frustration, was rejected by Amitabh, Naseer, inspired many filmmakers, earned...![submenu-img]() Panchayat's Durgesh Kumar says viral 'Dekh raha hai Binod' line is not his anymore, reacts to memes | Exclusive

Panchayat's Durgesh Kumar says viral 'Dekh raha hai Binod' line is not his anymore, reacts to memes | Exclusive![submenu-img]() 'Against Gambhir becoming the coach...': Sourav Ganguly gets slammed by fans for indirect tweet towards BCCI

'Against Gambhir becoming the coach...': Sourav Ganguly gets slammed by fans for indirect tweet towards BCCI![submenu-img]() 'The Indian Sarcasm': From Humble Beginnings to Conquering Social Media

'The Indian Sarcasm': From Humble Beginnings to Conquering Social Media ![submenu-img]() As rumours of divorce with Natasa Stankovic get stronger, fans wonder where is Hardik Pandya?

As rumours of divorce with Natasa Stankovic get stronger, fans wonder where is Hardik Pandya?![submenu-img]() Meet IAS officer who was victim of domestic violence, mother of two, cracked UPSC exam in first attempt, she's posted in

Meet IAS officer who was victim of domestic violence, mother of two, cracked UPSC exam in first attempt, she's posted in![submenu-img]() RBSE Class 5th, 8th Result 2024 Date, Time: Rajasthan board to announce results today, get direct link here

RBSE Class 5th, 8th Result 2024 Date, Time: Rajasthan board to announce results today, get direct link here![submenu-img]() RBSE Rajasthan Class 10 board results out, check direct link here to know results

RBSE Rajasthan Class 10 board results out, check direct link here to know results![submenu-img]() RBSE 10th Result 2024: Rajasthan Board Class 10 results to be out today; check time, direct link here

RBSE 10th Result 2024: Rajasthan Board Class 10 results to be out today; check time, direct link here![submenu-img]() Meet Indian genius who founded India's first pharma company, he is called 'Father of...

Meet Indian genius who founded India's first pharma company, he is called 'Father of...![submenu-img]() DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo

DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo![submenu-img]() DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here

DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() Streaming This Week: Panchayat season 3, Swatantrya Veer Savarkar, Illegal season 3, latest OTT releases to binge-watch

Streaming This Week: Panchayat season 3, Swatantrya Veer Savarkar, Illegal season 3, latest OTT releases to binge-watch![submenu-img]() Avneet Kaur shines in navy blue gown with shimmery trail at Cannes 2024, fans say 'she is unstoppable now'

Avneet Kaur shines in navy blue gown with shimmery trail at Cannes 2024, fans say 'she is unstoppable now'![submenu-img]() Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes

Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes ![submenu-img]() Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'

Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'![submenu-img]() AI models play volley ball on beach in bikini

AI models play volley ball on beach in bikini![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?

DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() This classic was made by director in frustration, was rejected by Amitabh, Naseer, inspired many filmmakers, earned...

This classic was made by director in frustration, was rejected by Amitabh, Naseer, inspired many filmmakers, earned...![submenu-img]() Panchayat's Durgesh Kumar says viral 'Dekh raha hai Binod' line is not his anymore, reacts to memes | Exclusive

Panchayat's Durgesh Kumar says viral 'Dekh raha hai Binod' line is not his anymore, reacts to memes | Exclusive![submenu-img]() Dalljiet Kaur's husband Nikhil Patel reveals why their relationship ended, breaks silence on extra-marital allegations

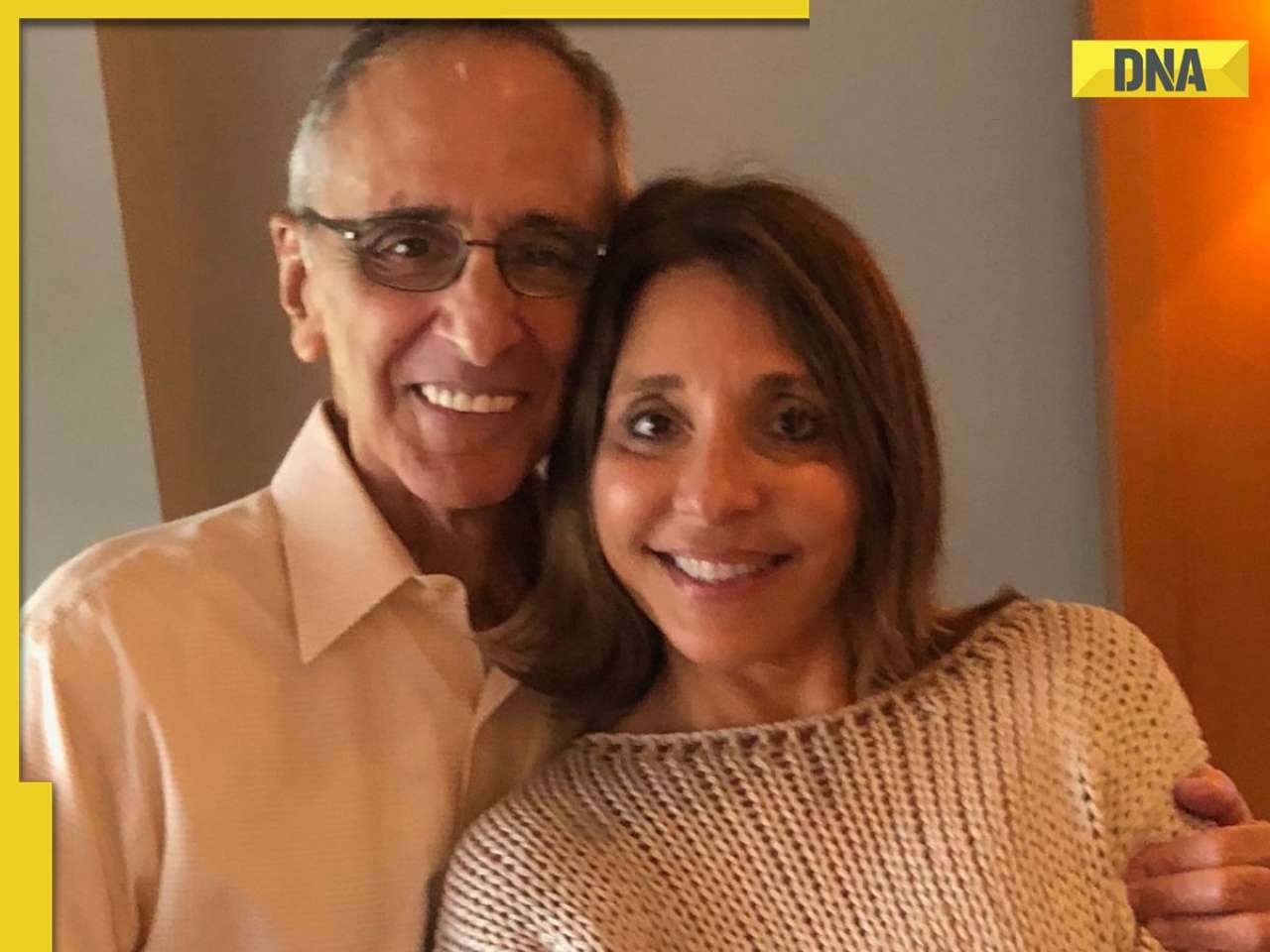

Dalljiet Kaur's husband Nikhil Patel reveals why their relationship ended, breaks silence on extra-marital allegations![submenu-img]() This small-budget blockbuster was rejected by Amitabh Bachchan, attained cult status, made director star; film earned...

This small-budget blockbuster was rejected by Amitabh Bachchan, attained cult status, made director star; film earned...![submenu-img]() ‘They never make it better’: Game of Thrones creator George RR Martin slams film, TV adaptations of books

‘They never make it better’: Game of Thrones creator George RR Martin slams film, TV adaptations of books![submenu-img]() 'No one wanted to...': Billionaire Anil Agarwal’s daughter makes shocking revelation

'No one wanted to...': Billionaire Anil Agarwal’s daughter makes shocking revelation![submenu-img]() 'Humko nahi rahna is gola pe': Heatwave triggers meme fest on social media

'Humko nahi rahna is gola pe': Heatwave triggers meme fest on social media![submenu-img]() 'Ridiculous': Woman claims Swiggy charged Rs 115 for Rs 45 bun butter jam, shares bill

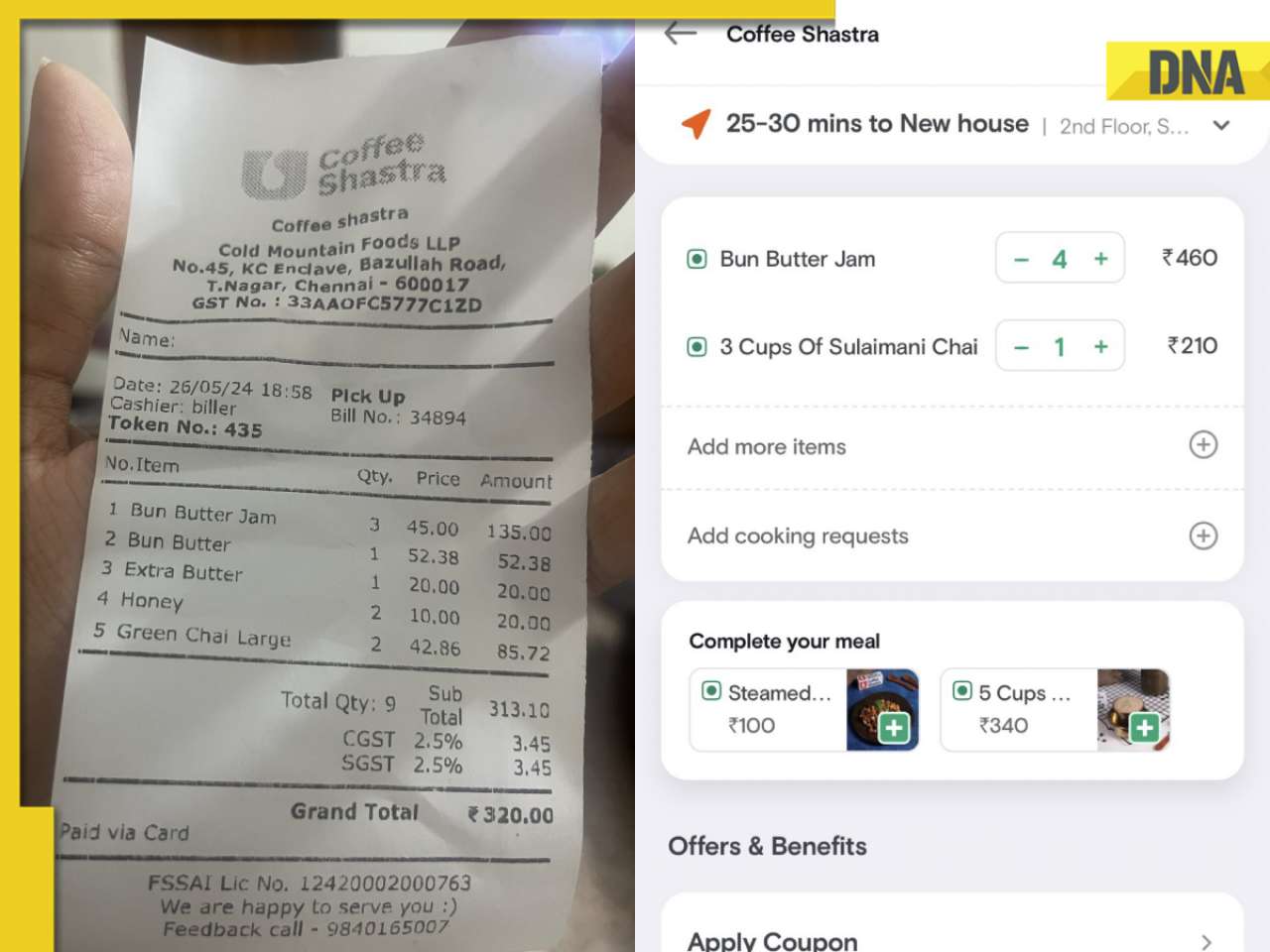

'Ridiculous': Woman claims Swiggy charged Rs 115 for Rs 45 bun butter jam, shares bill![submenu-img]() Man sells replicas of Nita Ambani's necklace for Rs 178, Harsh Goenka reacts

Man sells replicas of Nita Ambani's necklace for Rs 178, Harsh Goenka reacts![submenu-img]() Man dies after being sucked into plane engine in front of passengers at airport

Man dies after being sucked into plane engine in front of passengers at airport

)

)

)

)

)

)