Bangalore-based Rajesh Exports posted a 10.4% revenue growth of Rs 2,067.23 crore for the quarter ended December 2007 (Q3) over the same period last year.

Bangalore-based Rajesh Exports posted a 10.4% revenue growth of Rs 2,067.23 crore for the quarter ended December 2007 (Q3) over the same period last year.

The company’s net profit increased by 117.8% to Rs 61.24 crore. Post results, its stock was marginally down by 0.40% on a day when the mid-cap index declined by 3.37%.

Rajesh Exports is a leading manufacturer, exporter and wholesaler of gold jewellery and accounts for 25% of all gold jewellery in India.

Its Q3 operating margins improved to 5.07% from 2.12% in last year’s Q3, which is commendable. This seems to be in line with the company’s intention of expanding its margins after consistently improving revenues in the last few years.

Rajesh exports launched nine international diamond jewellery brands during the quarter. The first phase of its new retail venture, Shubh Jewellers, was also launched in Karnataka. To some extent, expansion in operating margins and improvement in the overall profitability can be attributed to these launches, as they are high margins businesses.

An increase of 226.28% in interest cost, 11% in depreciation expenses and a tax outgo of Rs 3.9 crore translated into a net profit of Rs 61.24 crore. The company’s order book, as on December 2007, stands at Rs 2,132 crore.

Meanwhile, its stock has appreciated by 117.4% since May 2007 and has outperformed the BSE mid-cap index and the broader Sensex during the same period. At Rs 872.25, the stock trades at 14.3 times and 9.4 times its estimated earnings for 2009 and 2010, respectively.

The company is well placed in the industry it operates in. One of the reasons include its hedging strategies. For a specified order of gold, the company settles for gold price on a particular date or hedges through MCX trading.

Similarly, currency fluctuation is hedged for the time gap between receipt and payment. This augurs well for Rajesh Exports as profit margins remain unaffected by volatility.

Further, the company is also planning to develop about 4 million sq ft of land in Bangalore and Kerala. This is likely to unlock value for shareholders. Analysts maintain that Rajesh Exports may also consider entering into property development as a separate business in future.

Going forward, Rajesh Exports is also looking at improving its product mix. It aims to reduce the contribution from the low margin (3-4%) bulk exports business to revenues to 25% over the next five years.

Share of bulk exports in revenues currently stand at 93%. The company plans to gradually increase the share of higher margins businesses in revenues like retail (margins at 14%), private label exports (20%) and diamond jewellery (35%). This is likely to improve the company’s profitability in the long run. The stock is a good bet in the space.

On a sound note

The Indian Seamless group-promoted Taneja Aerospace & Aviation Ltd (TAAL) has entered into maintenance, repairs and over-hauling (MRO) agreement with Air Works Commercial MRO Services Pvt Ltd (AWACS).

TAAL is perhaps the only listed company in the aviation sector with a DGCA-approved airport on its books in one of the most active business cities in the country, Bangalore.

The 230-acre airport which is only 20 minutes away from the software city is ideally placed to tap the business air traffic in the area.

It has a potential to become the alternate airport for executive jets, and also act as a base for a very lucrative segment of MRO. MRO is a labour-intensive $90 billion industry and has huge outsourcing opportunities.

Migration of the industry has already commenced from developed countries to developing ones and TAAL is enviably placed to exploit this opportunity.

MRO business is all set to gain momentum as many overseas companies are looking at opportunities for setting up shops.

An Ernst & Young report has said that MRO can absorb up to $120 billion by 2020. Boeing has already tied up with Air India and is said to invest $185 million in this joint venture. Airbus seems to be on the look out for setting up an MRO facility in India. Kingfisher-Air Deccan and GoAir have also evinced interest in setting up MRO facilities.

The Centre for Asia Pacific Aviation (CAPA) says there are significant investment opportunities in the MRO sector in India. It has estimated that the country has the potential to service a fleet of 1,000 commercial and 500 general aviation aircraft.

This agreement consists of licensing 7 acres of land and up to 5 hanger spaces on a long-term basis.

TAAL would initially license two hanger spaces which would result in a cash inflow of around Rs.7.50 crore per annum. The stock is hovering around Rs 237.10 and is trading at a PE multiple of 194x its FY08 annualised earnings.

Though the stock looks steeply valued the opportunity in the sector over-weighs the valuations.

Pallavi Pengonda (p_pallavi@dnaindia.net) & Sunder Subramaniam

![submenu-img]() Bigg Boss OTT 3: Anil Kapoor confirmed as new host, says 'jhakaas nahi kuch khaas karte hai', leaves netizens divided

Bigg Boss OTT 3: Anil Kapoor confirmed as new host, says 'jhakaas nahi kuch khaas karte hai', leaves netizens divided![submenu-img]() Felony charges and political ambitions: Donald Trump at the legal and electoral crossroads

Felony charges and political ambitions: Donald Trump at the legal and electoral crossroads![submenu-img]() This actor left UPSC dreams for Bollywood, was launched by Amitabh, fought Shah Rukh, then disappeared for years, now...

This actor left UPSC dreams for Bollywood, was launched by Amitabh, fought Shah Rukh, then disappeared for years, now...![submenu-img]() Data-Driven Decision Making: Leveraging KPI Metrics for Strategic Insight

Data-Driven Decision Making: Leveraging KPI Metrics for Strategic Insight![submenu-img]() Exploring transformative potential of application modernisation for sustainable solutions in future

Exploring transformative potential of application modernisation for sustainable solutions in future![submenu-img]() Meet Indian genius who won National Spelling Bee contest in US at age 12, he is from…

Meet Indian genius who won National Spelling Bee contest in US at age 12, he is from…![submenu-img]() Meet man who became IIT Bombay professor at just 22, got sacked from IIT after some years because..

Meet man who became IIT Bombay professor at just 22, got sacked from IIT after some years because..![submenu-img]() Meet Indian genius, son of constable, worked with IIT, NASA, then went missing, was found after years in...

Meet Indian genius, son of constable, worked with IIT, NASA, then went missing, was found after years in...![submenu-img]() Meet IAS officer who was victim of domestic violence, mother of two, cracked UPSC exam in first attempt, she's posted in

Meet IAS officer who was victim of domestic violence, mother of two, cracked UPSC exam in first attempt, she's posted in![submenu-img]() RBSE Class 5th, 8th Result 2024 Date, Time: Rajasthan board to announce results today, get direct link here

RBSE Class 5th, 8th Result 2024 Date, Time: Rajasthan board to announce results today, get direct link here![submenu-img]() DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo

DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo![submenu-img]() DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here

DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() Streaming This Week: Panchayat season 3, Swatantrya Veer Savarkar, Illegal season 3, latest OTT releases to binge-watch

Streaming This Week: Panchayat season 3, Swatantrya Veer Savarkar, Illegal season 3, latest OTT releases to binge-watch![submenu-img]() Avneet Kaur shines in navy blue gown with shimmery trail at Cannes 2024, fans say 'she is unstoppable now'

Avneet Kaur shines in navy blue gown with shimmery trail at Cannes 2024, fans say 'she is unstoppable now'![submenu-img]() Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes

Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes ![submenu-img]() Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'

Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'![submenu-img]() AI models play volley ball on beach in bikini

AI models play volley ball on beach in bikini![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?

DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() Bigg Boss OTT 3: Anil Kapoor confirmed as new host, says 'jhakaas nahi kuch khaas karte hai', leaves netizens divided

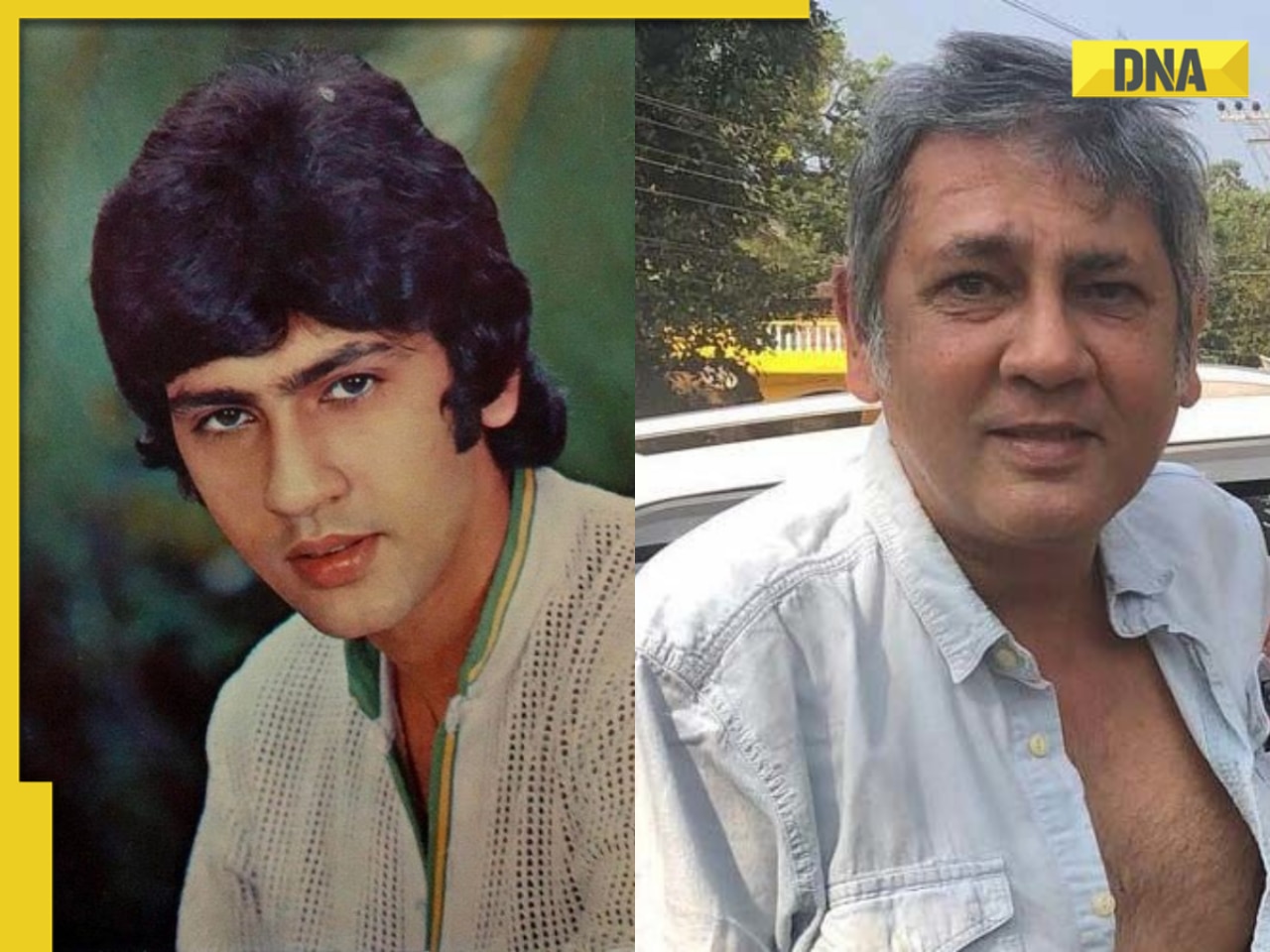

Bigg Boss OTT 3: Anil Kapoor confirmed as new host, says 'jhakaas nahi kuch khaas karte hai', leaves netizens divided![submenu-img]() This actor left UPSC dreams for Bollywood, was launched by Amitabh, fought Shah Rukh, then disappeared for years, now...

This actor left UPSC dreams for Bollywood, was launched by Amitabh, fought Shah Rukh, then disappeared for years, now...![submenu-img]() Bujii and Bhairava review: Prabhas' futuristic Baahubali-type Kalki 2898 prelude AD is fun, AI Keerthy steals the show

Bujii and Bhairava review: Prabhas' futuristic Baahubali-type Kalki 2898 prelude AD is fun, AI Keerthy steals the show![submenu-img]() This actress gave no hits in 9 years, no Bollywood releases in 5 years, charges Rs 40 crore per film, net worth is..

This actress gave no hits in 9 years, no Bollywood releases in 5 years, charges Rs 40 crore per film, net worth is..![submenu-img]() Mr & Mrs Mahi review: Janhvi, Rajkummar's earnest performances can't save film that doesn't really get cricket or women

Mr & Mrs Mahi review: Janhvi, Rajkummar's earnest performances can't save film that doesn't really get cricket or women![submenu-img]() Viral video: Little girl’s adorable dance to 'Ruki Sukhi Roti' will melt your heart, watch

Viral video: Little girl’s adorable dance to 'Ruki Sukhi Roti' will melt your heart, watch![submenu-img]() Groom jumps off stage for impromptu dance with friends, viral video leaves netizens in splits

Groom jumps off stage for impromptu dance with friends, viral video leaves netizens in splits![submenu-img]() Viral video: Chinese man stuns internet by balancing sewing machine on glass bottles, watch

Viral video: Chinese man stuns internet by balancing sewing machine on glass bottles, watch![submenu-img]() Watch: First video of Mukesh Ambani's son Anant Ambani-Radhika Merchant's 2nd pre-wedding bash goes viral

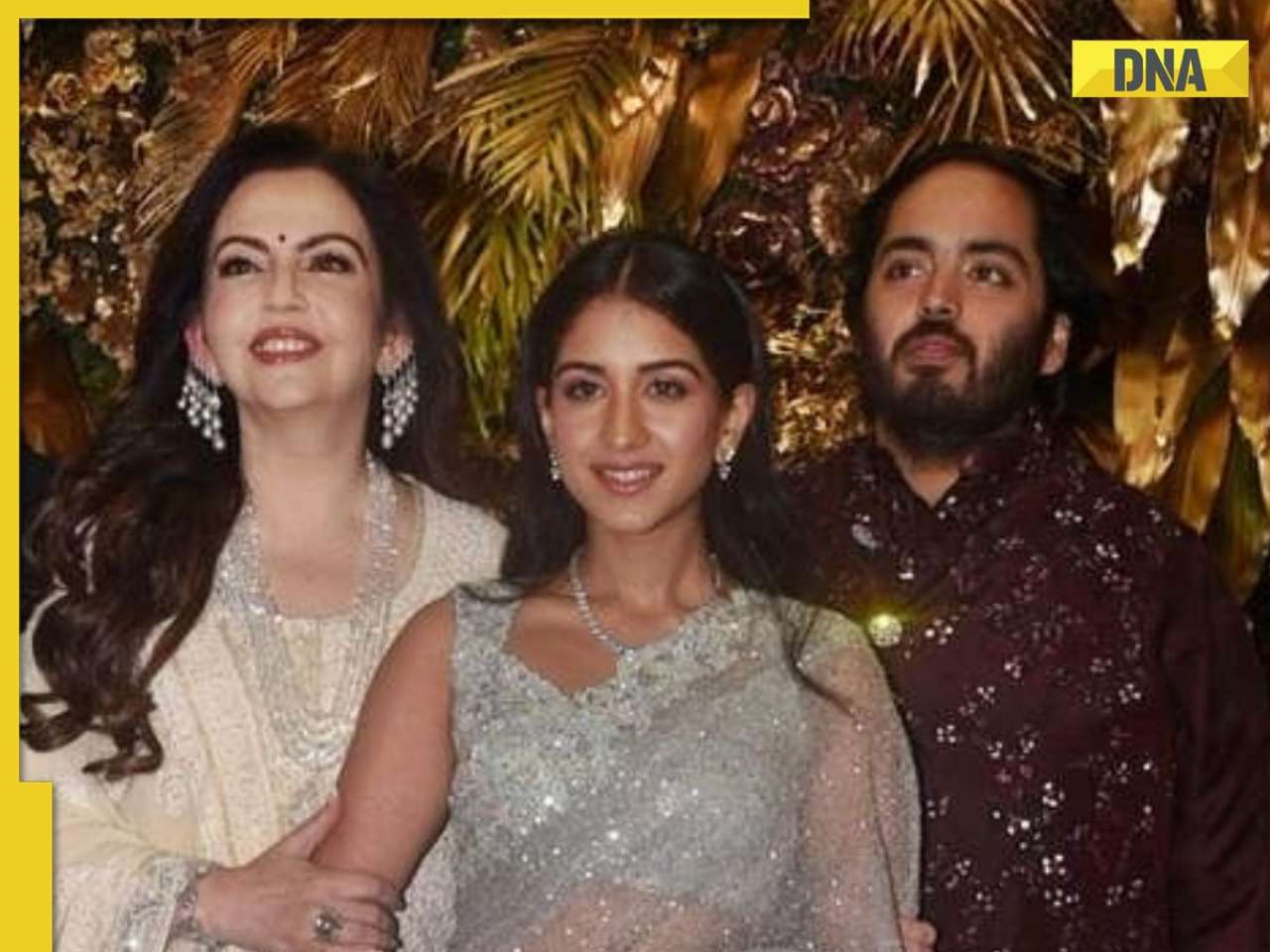

Watch: First video of Mukesh Ambani's son Anant Ambani-Radhika Merchant's 2nd pre-wedding bash goes viral![submenu-img]() Viral video: Outrage over woman's dance at Mumbai airport sparks calls for action, watch

Viral video: Outrage over woman's dance at Mumbai airport sparks calls for action, watch

)

)

)

)

)

)