Little wonder, while the stock was up 2.23% post-results, the gains were lower than the 2.66% rise in the BSE Capital Goods index.

Insight...

The performance of Siemens Ltd, a diverse business group with interests in power, automation & drives, industrial solutions & services, healthcare, transport, information technology, etc for the quarter ended September (Q4) has been ahead of street estimates, especially the growth in net profit, to some extent helped by exceptional items.

Little wonder, while the stock was up 2.23% post-results, the gains were lower than the 2.66% rise in the BSE Capital Goods index.

During the quarter, Siemens reported exceptional items including a Rs 128.50 crore forex gain pertaining to the power business (reduced from other costs, which led to a 29.7% year-on-year drop in other costs at Rs 126.14 crore) and profits on sale of the information and communication business worth Rs 52.42 crore.

Excluding the two, profit before tax and exceptional items was up 38% to Rs 259 crore. The profit growth is lower than revenue growth as the company experienced a decline of Rs 25.80 crore in dividend income from subsidiaries, which was partly offset by a Rs 12.30 crore gain from sale of assets.

Standalone revenues in Q4 grew robustly by 46.7% to Rs 2,188.45 crore as compared with the same period last year, led by good growth across all its businesses.

The largest contributor, Siemens’ power business (49% of revenues) grew by 64.6% to Rs 1,143.11 crore on the back of strong order backlog. Analysts maintain that Siemens is executing large power projects in Qatar worth Rs 5,500 crore, which are to be completed by the end of 2008. A good part of these orders seems to be executed in Q4 and hence, the sharp improvement in profit margins (excluding forex gains) to 9.92% from 4.2% a year ago.

While Siemens’ automation & drives business (22.5% of revenues) grew by 36.7% to Rs 530.10 crore, profit margins slipped to 7.27% from 10.01% last year’s Q4 due to higher raw material costs and competition.

The smaller industrial solutions business (12% of revenues) grew faster by 142.4% to Rs 129.78 crore on the back of robust order inflows from existing as well as new customers. Again, profit margins declined to 8.5% from 10.25%. Overall, operating margins (excluding forex gains) improved to 9.7% from 7.83% in Q4 last year, thanks to the power division’s improved profitability.

Consolidated revenues for the year ended September 2007, too, were influenced by the rapid growth in power and industrial solutions businesses, which grew by 117% and 79%, respectively. Other divisions also grew at healthy rates. Overall, annual consolidated revenues were up 55.5% to Rs 9,378.60 crore and operating profit by 32.7% at Rs 816.30 crore.

Meanwhile, the new order inflows continue to remain good and the amount of orders yet to be executed (order backlog) as on September 30, 2007 at Rs 9,407.4 crore (up 25% year-on-year) reflects a healthy trend, particularly considering the high base of last year.

Analysts say Siemens trades at relatively lower valuations compared with peers in the capital goods industry, wherein companies have a good earnings visibility over the next 2-3 years on the back of robust order inflows and backlog. At Rs 1,974.75, the stock trades at 43.5 times its estimated earnings for 2008, and merits attention on declines.

LICHFL, a house in order

The stock of LIC Housing Finance Ltd (LICHFL) which had outperformed the broader BSE Sensex by a small margin since May 2007, has risen 54% since October 19. That’s quite a big gain for the company, 40.5% owned by insurance major Life Insurance Corporation of India (LIC), compared with the mere 7.4% rise in the BSE Sensex during the same period.

For one, the trigger for the stock’s recent sharp rise was the second quarter results. But, that follows a visible improvement in the company’s performance over the past few quarters.

For example, between 1998-99 and 2004-05, the average quarterly growth in topline (revenues) never exceeded 16.1%, whereas average quarterly profit growth was 21.4%. In 2005-06, these improved to 20.8% and 69.8%, respectively due to a low-base effect since profits had fallen by 7.4% during the previous year (2004-05). In 2006-07, sales and profit growth increased further, to 25% and 38%, respectively. Notably, they have inched up further to 36% and 39% during the first two quarters of 2007-08.

Some analysts suggest that the recent RBI guidelines on banks to curtail their retail loan portfolio growth could have helped last quarter. All the same, the growth rate would be healthy even if it were to move back to 2006-07 levels (25-30%).

The market’s attention has certainly caught on to this change in the company’s appetite for higher growth, which is perhaps a reason the market is also willing to give it a higher rating.

Coming to the results for the quarter ended September (Q2), the company had reported a 43% year-on-year rise in net interest income (interest income minus interest expenses) to Rs 150 crore, whereas net profit was up 53.4% at Rs 116.40 crore. Net interest margin improved nearly 50 basis points to 3.2% — the first time it has gone over 3% in many quarters, helped by a higher proportion of floating rate loans (the company had hiked lending rates a few months ago). That, along with better operating efficiencies and higher other income, was responsible for the faster net profit growth, which though was partly restricted on account of a 117% rise in tax outgo to Rs 40.41 crore.

Going forward, given that loan sanctions and disbursements are growing at healthy rates, the foray into segments like reverse mortgage and credit cards, efforts to keep a tab on bad loans and better business environment augur well for LIC Housing Finance. The company’s plan to raise resources (about Rs 500-600 crore) through fresh issue of equity to promoters, institutional investors, etc should provide fuel to sustain growth rates in future.

At Rs 332.15, the stock quotes at a PE of 9.5 times its estimated EPS for 2007-08. Adjusting the price for the value of its holding in LIC Mutual Fund (about Rs 45 per share), the stock merits attention.

Contributed by Pallavi Pengonda & Vishal Chhabria

![submenu-img]() Mukesh Ambani’s daughter Isha Ambani’s firm launches new brand, Reliance’s Rs 8200000000000 company to…

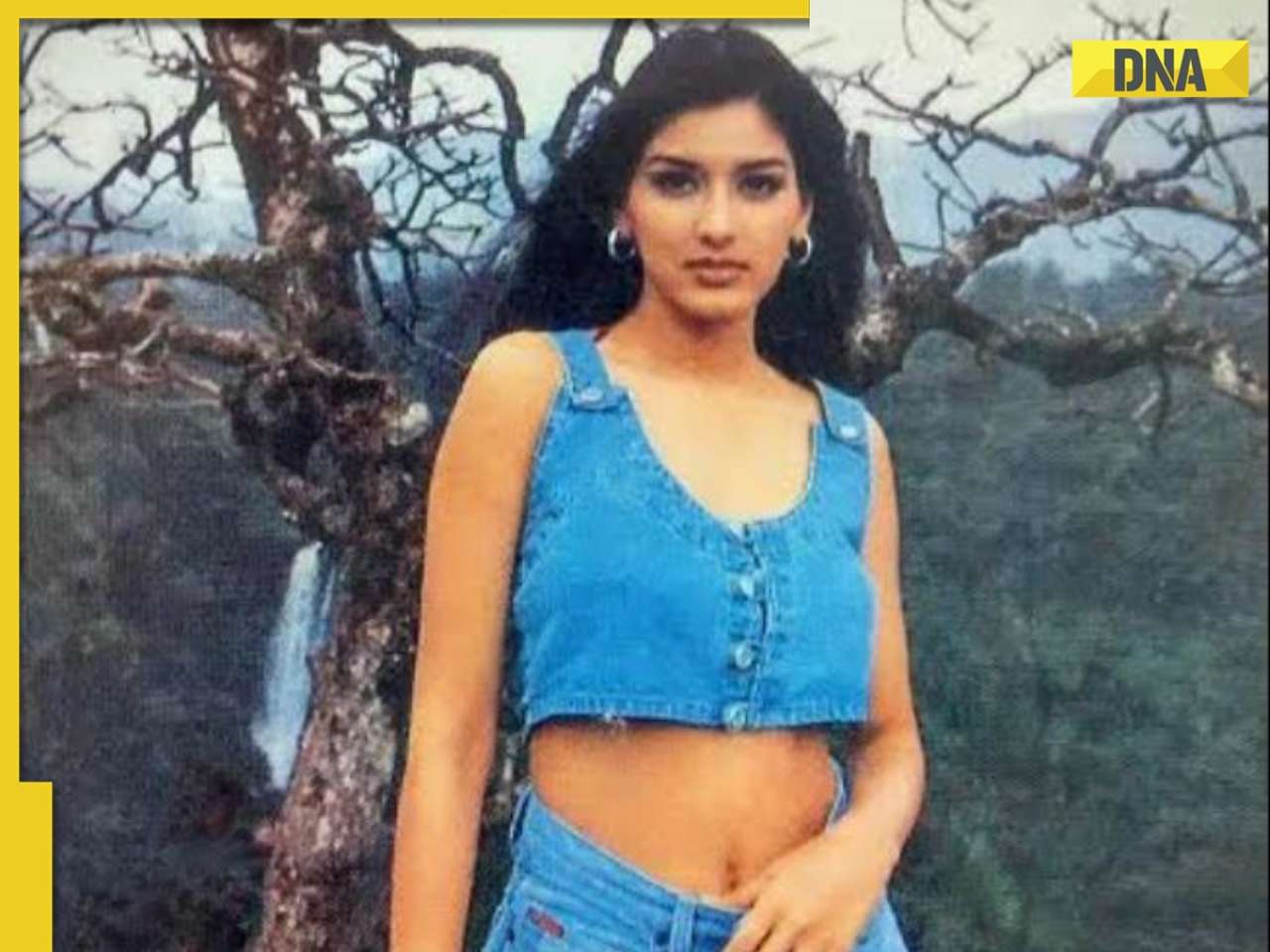

Mukesh Ambani’s daughter Isha Ambani’s firm launches new brand, Reliance’s Rs 8200000000000 company to…![submenu-img]() Sonali Bendre says producers called her 'too thin', tried to ‘fatten her up' during the 90s: ‘They'd just tell me...'

Sonali Bendre says producers called her 'too thin', tried to ‘fatten her up' during the 90s: ‘They'd just tell me...'![submenu-img]() Heavy rains in UAE again: Dubai flights cancelled, schools and offices shut

Heavy rains in UAE again: Dubai flights cancelled, schools and offices shut![submenu-img]() When 3 Bollywood films with same story released together, two even had same hero, all were hits, one launched star kid

When 3 Bollywood films with same story released together, two even had same hero, all were hits, one launched star kid![submenu-img]() Gautam Adani’s firm gets Rs 33350000000 from five banks, to use money for…

Gautam Adani’s firm gets Rs 33350000000 from five banks, to use money for…![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

Actors who died due to cosmetic surgeries![submenu-img]() See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol

See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol ![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() Sonali Bendre says producers called her 'too thin', tried to ‘fatten her up' during the 90s: ‘They'd just tell me...'

Sonali Bendre says producers called her 'too thin', tried to ‘fatten her up' during the 90s: ‘They'd just tell me...'![submenu-img]() When 3 Bollywood films with same story released together, two even had same hero, all were hits, one launched star kid

When 3 Bollywood films with same story released together, two even had same hero, all were hits, one launched star kid![submenu-img]() Salman Khan house firing case: Family of deceased accused claims police 'murdered' him, says ‘He was not the kind…’

Salman Khan house firing case: Family of deceased accused claims police 'murdered' him, says ‘He was not the kind…’![submenu-img]() Meet actor banned by entire Bollywood, was sent to jail for years, fought cancer, earned Rs 3000 crore on comeback

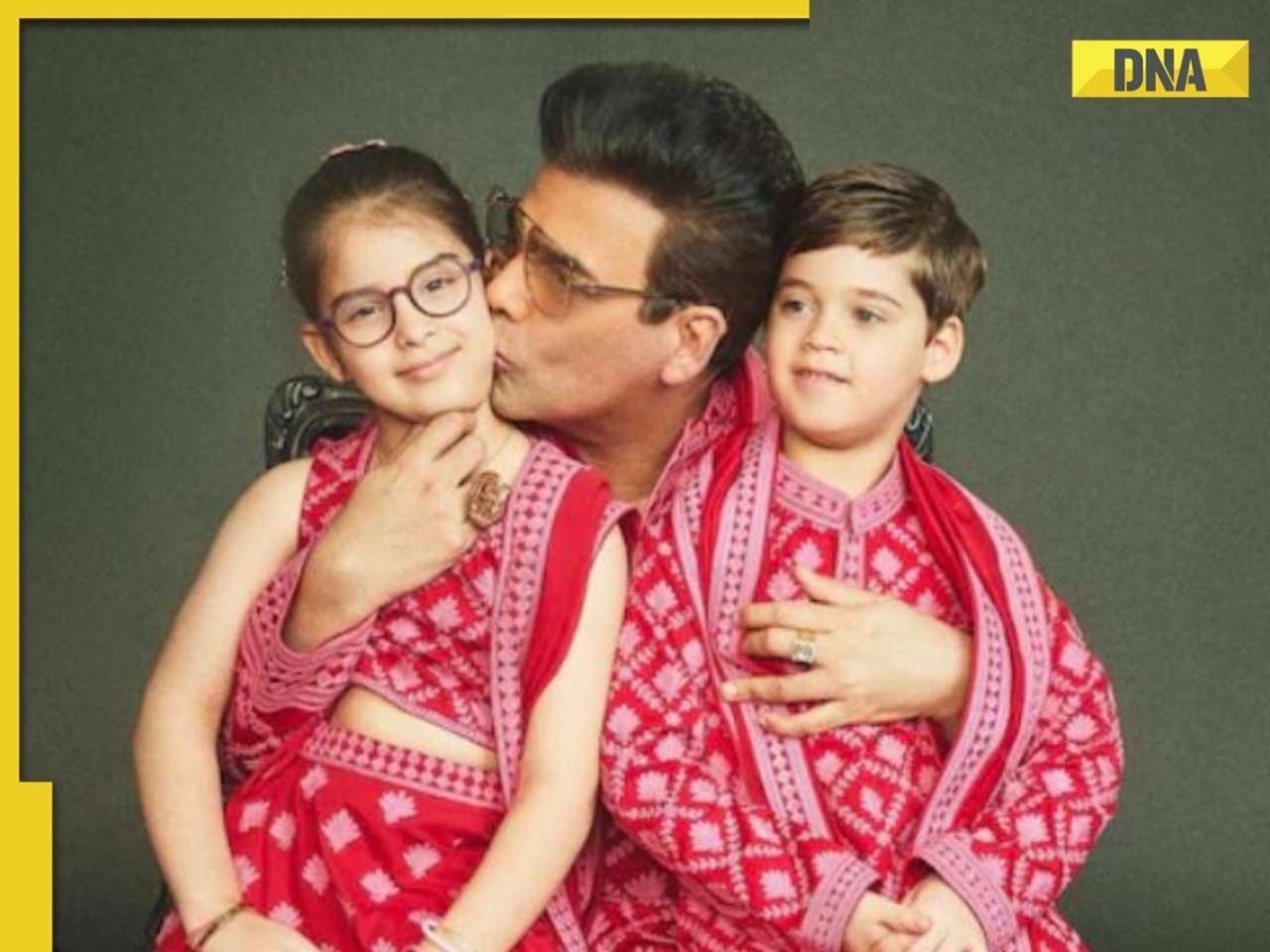

Meet actor banned by entire Bollywood, was sent to jail for years, fought cancer, earned Rs 3000 crore on comeback ![submenu-img]() Karan Johar wants to ‘disinherit’ son Yash after his ‘you don’t deserve anything’ remark: ‘Roohi will…’

Karan Johar wants to ‘disinherit’ son Yash after his ‘you don’t deserve anything’ remark: ‘Roohi will…’![submenu-img]() IPL 2024: Bhuvneshwar Kumar's last ball wicket power SRH to 1-run win against RR

IPL 2024: Bhuvneshwar Kumar's last ball wicket power SRH to 1-run win against RR![submenu-img]() BCCI reacts to Rinku Singh’s exclusion from India T20 World Cup 2024 squad, says ‘he has done…’

BCCI reacts to Rinku Singh’s exclusion from India T20 World Cup 2024 squad, says ‘he has done…’![submenu-img]() MI vs KKR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

MI vs KKR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() IPL 2024: How can RCB and MI still qualify for playoffs?

IPL 2024: How can RCB and MI still qualify for playoffs?![submenu-img]() MI vs KKR IPL 2024 Dream11 prediction: Fantasy cricket tips for Mumbai Indians vs Kolkata Knight Riders

MI vs KKR IPL 2024 Dream11 prediction: Fantasy cricket tips for Mumbai Indians vs Kolkata Knight Riders ![submenu-img]() '25 virgin girls' are part of Kim Jong un's 'pleasure squad', some for sex, some for dancing, some for...

'25 virgin girls' are part of Kim Jong un's 'pleasure squad', some for sex, some for dancing, some for...![submenu-img]() Man dances with horse carrying groom in viral video, internet loves it

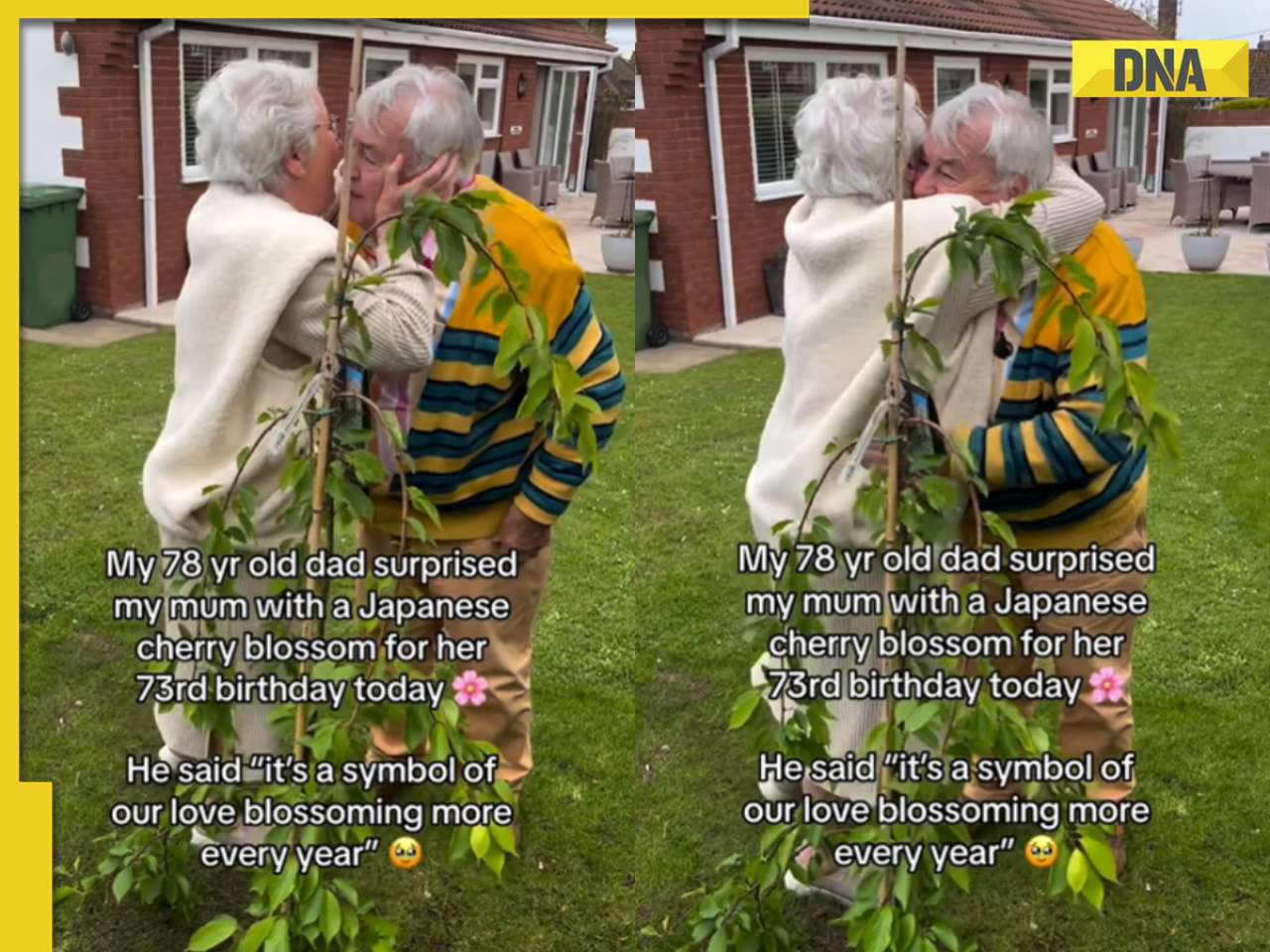

Man dances with horse carrying groom in viral video, internet loves it ![submenu-img]() Viral video: 78-year-old man's heartwarming surprise for wife sparks tears of joy

Viral video: 78-year-old man's heartwarming surprise for wife sparks tears of joy![submenu-img]() Man offers water to thirsty camel in scorching desert, viral video wins hearts

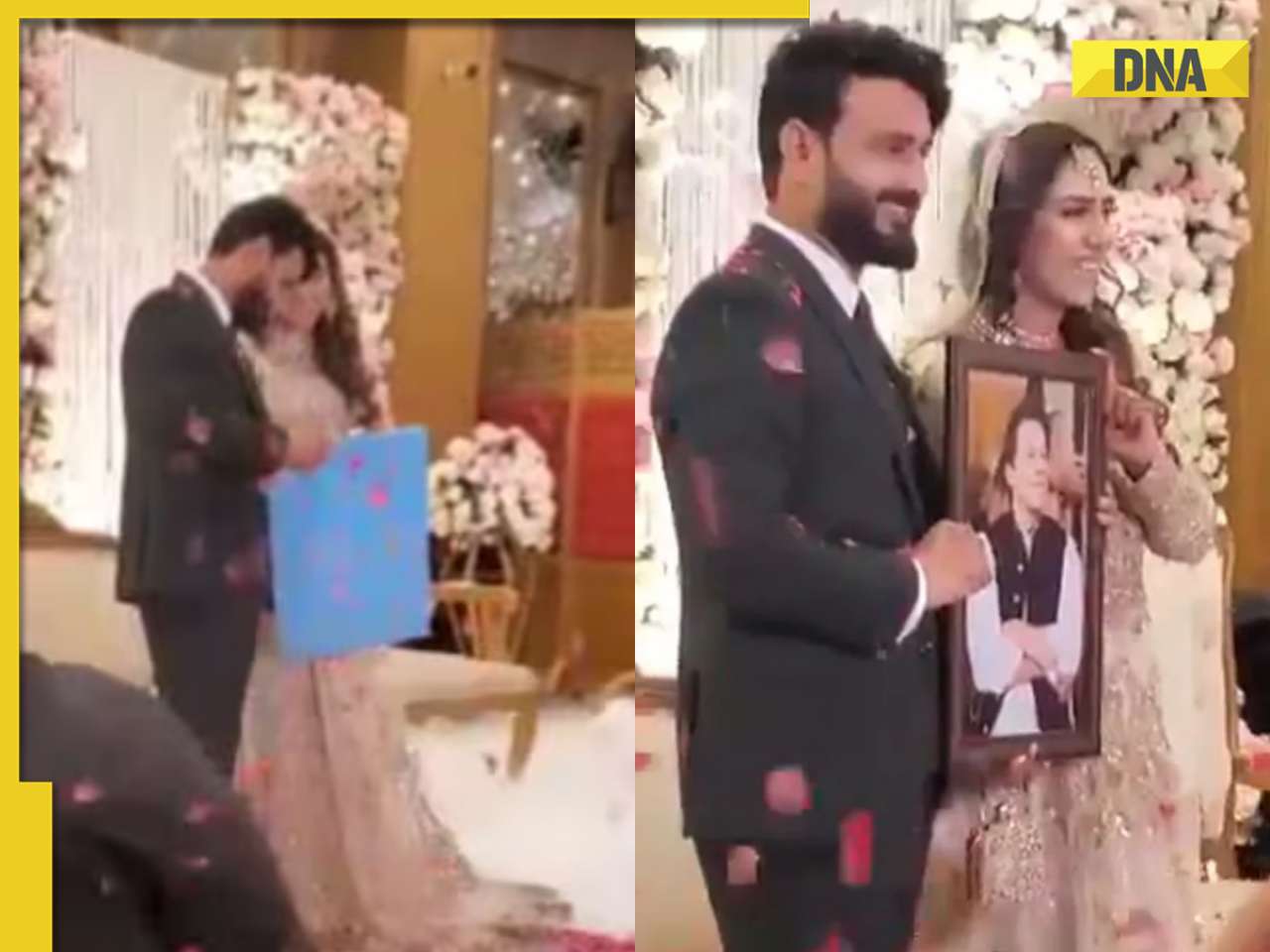

Man offers water to thirsty camel in scorching desert, viral video wins hearts![submenu-img]() Pakistani groom gifts framed picture of former PM Imran Khan to bride, her reaction is now a viral video

Pakistani groom gifts framed picture of former PM Imran Khan to bride, her reaction is now a viral video

)

)

)

)

)

)