The world’s great religions are as global as multinational corporations, with congregations on all continents and name-recognition matching that of the largest companies.

The world’s great religions are realising the clout they have as multinational corporations

PARIS: The world’s great religions are as global as multinational corporations, with congregations on all continents, polyglot leaders and name-recognition matching that of the largest companies.

With their finances, though, many faith groups act as if that outside world hardly existed, but a new group of activist investors want to change that.

Apart from rejecting “sin stocks” and firms exploiting poor countries, most managers of church-held assets invest conservatively in their own countries.

Taken together, faith groups control a huge variety of financial holdings that could be used to nudge multinationals to invest in ways that support the religions’ ethical concerns.

“It’s time that the world’s first multinationals — the major faiths — flexed their full financial muscle,” said Michiel Hardon, a board member of the Amsterdam-based International Interfaith Investment Group (3iG).

“Until now, faith organisations have consistently failed to use their investment power to the full,” added group secretary-general Joost Douma.

“They have focused solely on what not to invest in — guns, pornography and so on. “Now 3iG is asking faiths to focus on positive action, using investment to promote good activities rather than merely avoid bad ones,” he said.

The two-year-old group brings together 15 Christian, Jewish and Buddhist funds whose assets, Douma said, add up to more than the Bank of England’s entire foreign currency and gold reserves.

It aims to link faith-based funds and investors in projects that promote ethical goals. Now, only about five per cent of faith-based funds are invested in this way, Douma said.

This concern for ethical investment on a global scale grew out of faith groups’ concern with the environment, said Rabbi Mark Goldsmith from London’s North Western Reform Synagogue.

“We realised one of the biggest places to act was on relationships with business,” he said.

In one recent project backed by 3iG, the Dutch pension fund ABP invested $60 million in a $100 million reforestation project in Angola and Mozambique run by the Swedish and Norwegian Lutheran churches and a Japanese Shinto group.

ABP is one of the world’s largest pension funds, managing about $307 billion at the end of 2006. “3iG gives us a perspective of what’s happening in the religious world, where things are changing fast,” ABP Chief Investment Officer Roderick Munsters said.

“These environmental and social issues are important. If you don’t take these into account as a company, you risk alienating yourselves from your consumers and stakeholders, of missing business opportunities, maybe of getting fined for polluting.”

![submenu-img]() British TV host calls Priyanka Chopra 'Chianca Chop Free', angry fans say 'this is huge disrespect'; video goes viral

British TV host calls Priyanka Chopra 'Chianca Chop Free', angry fans say 'this is huge disrespect'; video goes viral![submenu-img]() Meme dog Kabosu, that inspired Dogecoin, dies

Meme dog Kabosu, that inspired Dogecoin, dies![submenu-img]() Deepika Padukone radiates 'mummy glow', spotted with baby bump in new video, netizens call her 'prettiest mom'

Deepika Padukone radiates 'mummy glow', spotted with baby bump in new video, netizens call her 'prettiest mom'![submenu-img]() India's biggest action film, had 1 hero, 7 villains, became superhit, made for Rs 6 crore, earned over Rs..

India's biggest action film, had 1 hero, 7 villains, became superhit, made for Rs 6 crore, earned over Rs..![submenu-img]() Will your Aadhaar Card become invalid after June 14 if not updated? Here's what UIDAI has to say

Will your Aadhaar Card become invalid after June 14 if not updated? Here's what UIDAI has to say![submenu-img]() Meet man, IIT Delhi, IIM Calcutta alumnus who quit high-paying job, became a monk due to..

Meet man, IIT Delhi, IIM Calcutta alumnus who quit high-paying job, became a monk due to..![submenu-img]() TBSE Result 2024: Tripura Board Class 10, 12 results DECLARED, direct link here

TBSE Result 2024: Tripura Board Class 10, 12 results DECLARED, direct link here![submenu-img]() Meghalaya Board Result 2024 DECLARED: MBOSE HSSLC Arts results available at megresults.nic.in, direct link here

Meghalaya Board Result 2024 DECLARED: MBOSE HSSLC Arts results available at megresults.nic.in, direct link here![submenu-img]() Meghalaya Board 10th, 12th Results 2024: MBOSE SSLC, HSSLC Arts results releasing today at megresults.nic.in

Meghalaya Board 10th, 12th Results 2024: MBOSE SSLC, HSSLC Arts results releasing today at megresults.nic.in![submenu-img]() Tripura TBSE 2024: Class 10th, 12th results to announce today; know timing, steps to check

Tripura TBSE 2024: Class 10th, 12th results to announce today; know timing, steps to check![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes

Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes ![submenu-img]() Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'

Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'![submenu-img]() AI models play volley ball on beach in bikini

AI models play volley ball on beach in bikini![submenu-img]() AI models set goals for pool parties in sizzling bikinis this summer

AI models set goals for pool parties in sizzling bikinis this summer![submenu-img]() In pics: Aditi Rao Hydari being 'pocket full of sunshine' at Cannes in floral dress, fans call her 'born aesthetic'

In pics: Aditi Rao Hydari being 'pocket full of sunshine' at Cannes in floral dress, fans call her 'born aesthetic'![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?

DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

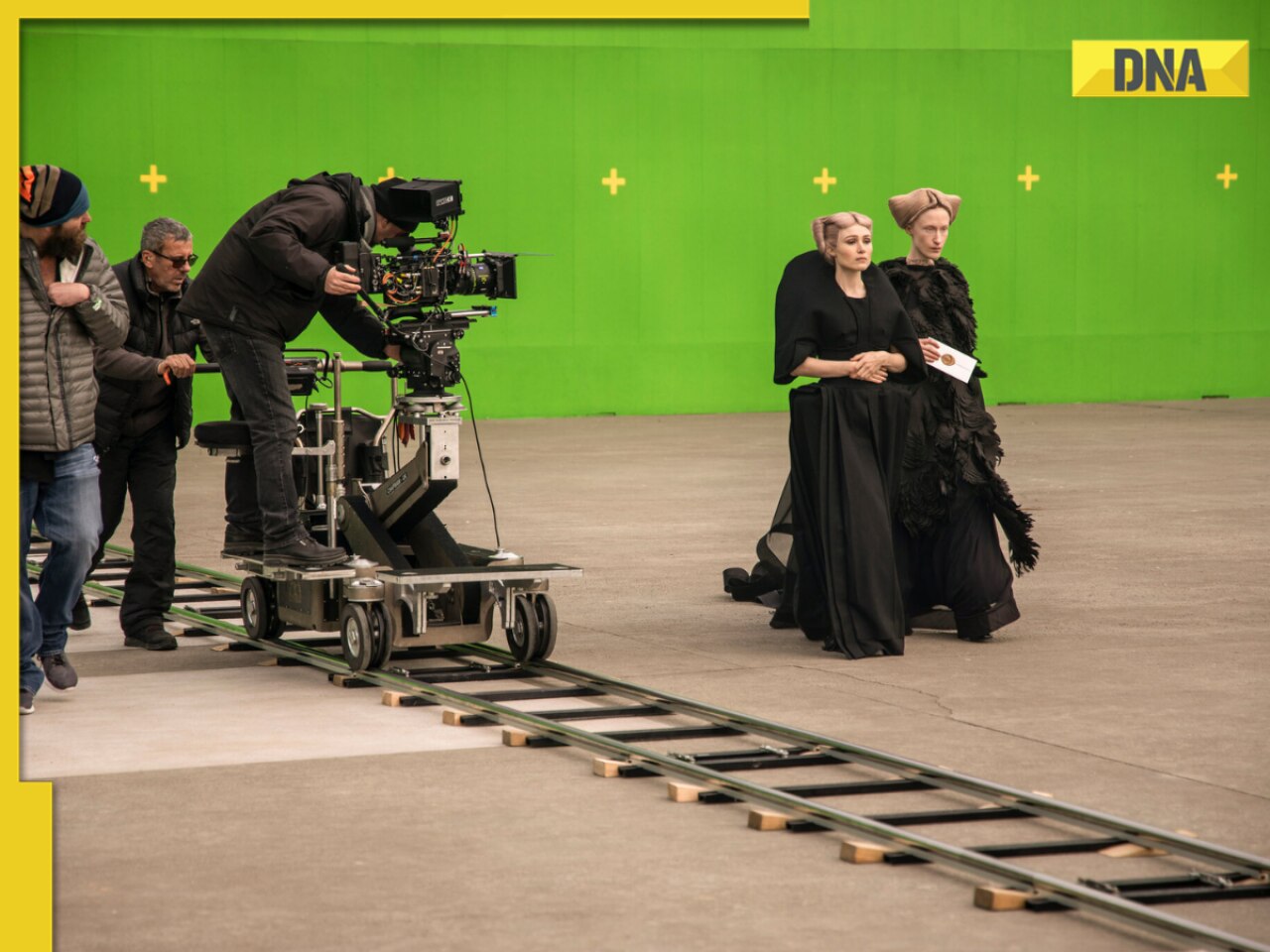

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() British TV host calls Priyanka Chopra 'Chianca Chop Free', angry fans say 'this is huge disrespect'; video goes viral

British TV host calls Priyanka Chopra 'Chianca Chop Free', angry fans say 'this is huge disrespect'; video goes viral![submenu-img]() Deepika Padukone radiates 'mummy glow', spotted with baby bump in new video, netizens call her 'prettiest mom'

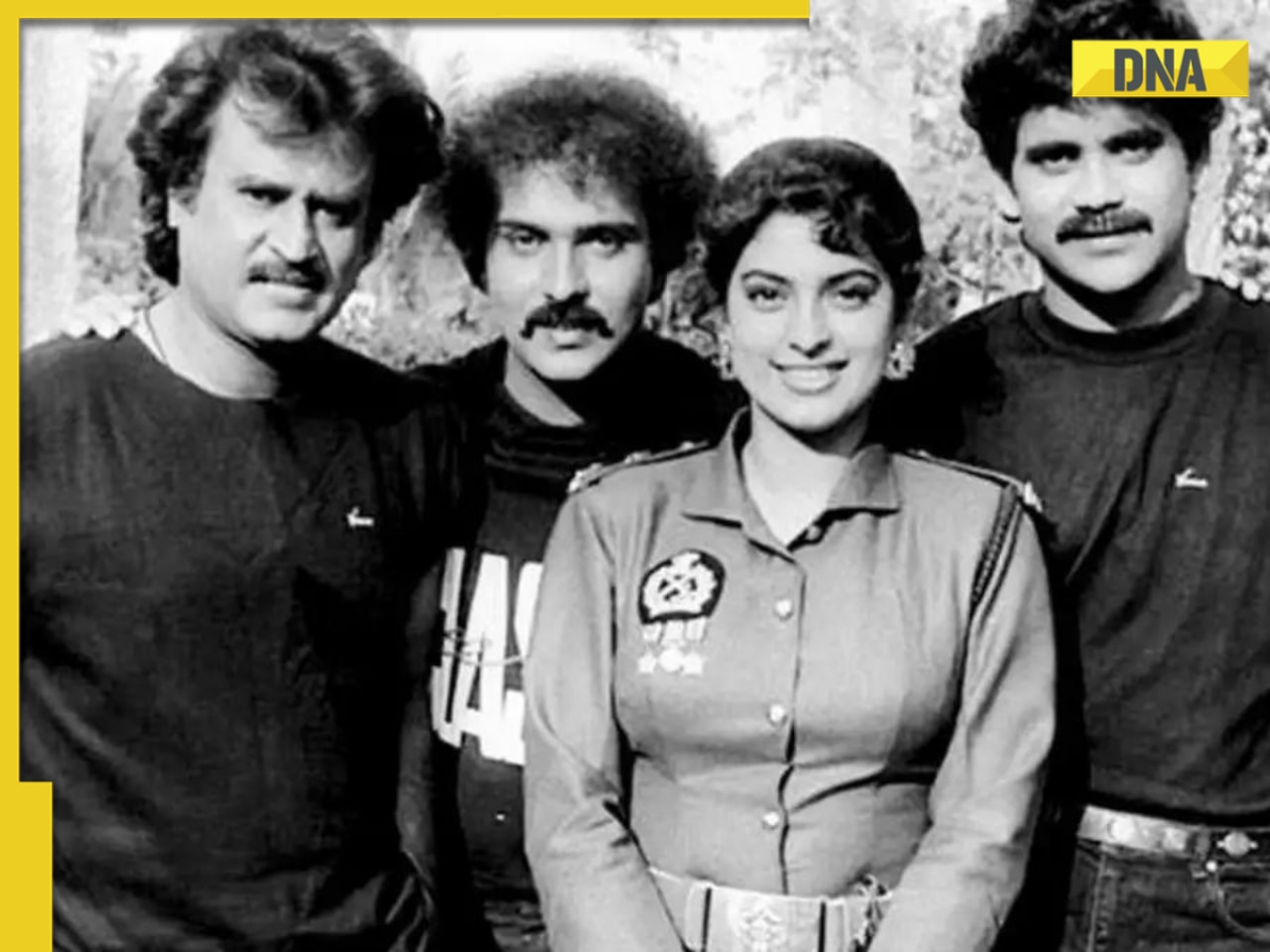

Deepika Padukone radiates 'mummy glow', spotted with baby bump in new video, netizens call her 'prettiest mom'![submenu-img]() India's biggest action film, had 1 hero, 7 villains, became superhit, made for Rs 6 crore, earned over Rs..

India's biggest action film, had 1 hero, 7 villains, became superhit, made for Rs 6 crore, earned over Rs..![submenu-img]() Neha Sharma says having morals 'doesn't take you very far' in Bollywood: 'Clearly why I am not...' | Exclusive

Neha Sharma says having morals 'doesn't take you very far' in Bollywood: 'Clearly why I am not...' | Exclusive![submenu-img]() This iconic film was made on suggestion by former Prime Minister, was rejected by Rajesh Khanna, Shashi Kapoor, earned..

This iconic film was made on suggestion by former Prime Minister, was rejected by Rajesh Khanna, Shashi Kapoor, earned..![submenu-img]() Meme dog Kabosu, that inspired Dogecoin, dies

Meme dog Kabosu, that inspired Dogecoin, dies![submenu-img]() Viral Video: Turtles flip over stranded friend in heartwarming rescue, internet hearts it

Viral Video: Turtles flip over stranded friend in heartwarming rescue, internet hearts it![submenu-img]() Shocking! Woman discovers intruder living in her bedroom for four months, details inside

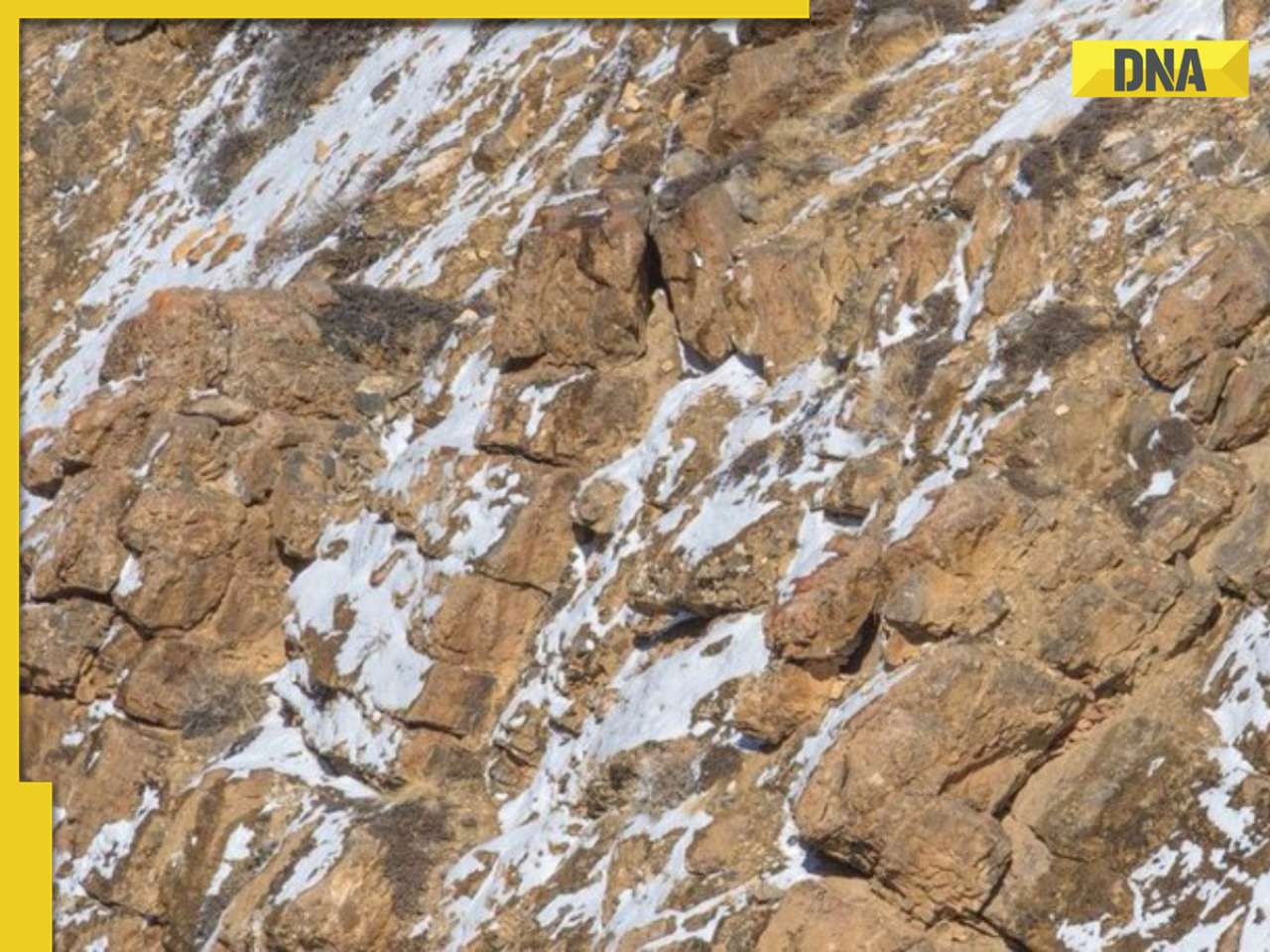

Shocking! Woman discovers intruder living in her bedroom for four months, details inside![submenu-img]() Can you spot 'ghost of the mountain'? Internet stumped by camouflaged snow leopard

Can you spot 'ghost of the mountain'? Internet stumped by camouflaged snow leopard![submenu-img]() Viral video: Women engage in physical altercation over Rs 100 dispute at medical shop

Viral video: Women engage in physical altercation over Rs 100 dispute at medical shop

)

)

)

)

)

)