Eight cases of harassment during loan recovery have been registered in the past year. But these are just small fry says Commissioner of Police DN Jadhav.

Eight cases of harassment during loan recovery have been registered in the

past year. But these are just small fry. The main problem lies elsewhere,

says Commissioner of Police DN Jadhav

What steps has the police initiated to ensure there is no harassment by recovery agents from banks?

After the Prakash Sarvankar [suicide] case, I called for a meeting with different private and public sector banks, agents, recovery agencies and about 75 people shortlisted by our Economic Offences Wing.

The idea was to find a solution. I told the gathering on Thursday that we had seen eight cases of harassment during recovery this year — which does not speak well of the banking industry.

I don’t deny the importance of banking in India’s economic sector. The industry is growing fast, and loans have a vital role to play in agriculture, industrial and infrastructure development. But we do need to bring some balance to the system so that banks don’t risk their reputation, or get on the wrong side of the law.

What is the framework of guidelines regarding the cases that have been registered?

I also mentioned in the meeting that loans taken in the eight cases were paltry amounts — all less than Rs50,000. The real defaulters are those whose loans run into crores of rupees. Banks are not hurt by the Rs50,000-defaulters, but by the big fish. But we are more concerned about the small borrower than the big one, which is the real problem.

What action will you take against the three agents who were arrested in the recent loan recovery case? Will they be booked? And if so, under what sections?

The sections will depend on the facts of each case and the nature of the FIR filed. For example, if someone claims the recovery agent confiscated a vehicle, then that might become a case of theft.

If there are complaints of threats, it could come under Section 506 of the IPC. Then there are cognisable and non-cognisable offences. If it’s cognisable, it will come under the purview of the CrPC. If non-cognisable, we will have to proceed as per the court’s directive.

We would like banks to employ only well-known agencies. The agencies should, in turn, make sure their employees have no criminal records. The police can help them select the agency and prospective employees by verifying their antecedents, in return for a nominal charge. The core team is in the process of formulating these norms.

People feel the police have not taken sufficient action against these offenders.

We have registered eight offences. This cannot be termed inadequate. We are not going to shout from the rooftops about the measures taken.

There is also public outrage over the idea that the police do not take action against banks because the top bosses are influential people.

We have urged the banks to be more careful about selecting their recovery agents. But whether or not the top bosses of a bank are to blame, depends on the facts of the case.

There have been instances of over-enthusiastic employees getting carried away, but not every incident involves the top man or calls for his arrest. In one case, we did arrest the bank’s top person. We want to bring some sanity to the system and will be happy if that happens without our intervention.

Are the police sensitised enough to handle such matters?

We refer to the IPC when investigating such cases, and I would say the police are adequately sensitised to this issue. But we do plan to hold workshops on the recovery problem to increase sensitisation.

![submenu-img]() Anant Raj Ventures into tier 2 and tier 3 cities, pioneering growth in India’s real estate sector

Anant Raj Ventures into tier 2 and tier 3 cities, pioneering growth in India’s real estate sector![submenu-img]() Sophie Turner reveals she wanted to terminate her first pregnancy with Joe Jonas: 'Didn't know if I wanted...'

Sophie Turner reveals she wanted to terminate her first pregnancy with Joe Jonas: 'Didn't know if I wanted...'![submenu-img]() Meet outsider who was given no money for first film, battled depression, now charges Rs 20 crore per film

Meet outsider who was given no money for first film, battled depression, now charges Rs 20 crore per film![submenu-img]() This is owner of most land in India, owns land in every state, total value is Rs...

This is owner of most land in India, owns land in every state, total value is Rs...![submenu-img]() Meet man who built Rs 39832 crore company after quitting high-paying job, his net worth is..

Meet man who built Rs 39832 crore company after quitting high-paying job, his net worth is..![submenu-img]() Meet woman who first worked at TCS, then left SBI job, cracked UPSC exam with AIR...

Meet woman who first worked at TCS, then left SBI job, cracked UPSC exam with AIR...![submenu-img]() Meet engineer, IIT grad who left lucrative job to crack UPSC in 1st attempt, became IAS, married to an IAS, got AIR...

Meet engineer, IIT grad who left lucrative job to crack UPSC in 1st attempt, became IAS, married to an IAS, got AIR...![submenu-img]() Meet Indian woman who after completing engineering directly got job at Amazon, then Google, Microsoft by using just...

Meet Indian woman who after completing engineering directly got job at Amazon, then Google, Microsoft by using just...![submenu-img]() Meet man who is 47, aspires to crack UPSC, has taken 73 Prelims, 43 Mains, Vikas Divyakirti is his...

Meet man who is 47, aspires to crack UPSC, has taken 73 Prelims, 43 Mains, Vikas Divyakirti is his...![submenu-img]() IIT graduate gets job with Rs 100 crore salary package, fired within a year, he is now working as…

IIT graduate gets job with Rs 100 crore salary package, fired within a year, he is now working as…![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() In pics: Taarak Mehta Ka Ooltah Chashmah actress Deepti Sadhwani dazzles in orange at Cannes debut, sets new record

In pics: Taarak Mehta Ka Ooltah Chashmah actress Deepti Sadhwani dazzles in orange at Cannes debut, sets new record![submenu-img]() Ananya Panday stuns in unseen bikini pictures in first post amid breakup reports, fans call it 'Aditya Roy Kapur's loss'

Ananya Panday stuns in unseen bikini pictures in first post amid breakup reports, fans call it 'Aditya Roy Kapur's loss'![submenu-img]() Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...

Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...![submenu-img]() Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses

Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses![submenu-img]() Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...

Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Sophie Turner reveals she wanted to terminate her first pregnancy with Joe Jonas: 'Didn't know if I wanted...'

Sophie Turner reveals she wanted to terminate her first pregnancy with Joe Jonas: 'Didn't know if I wanted...'![submenu-img]() Meet outsider who was given no money for first film, battled depression, now charges Rs 20 crore per film

Meet outsider who was given no money for first film, battled depression, now charges Rs 20 crore per film![submenu-img]() Meet actress who quit high-paying job for films, director replaced her with star kid, had no money, now lives in...

Meet actress who quit high-paying job for films, director replaced her with star kid, had no money, now lives in...![submenu-img]() This star kid's last 3 films lost Rs 5000000000 at box office, has no solo hit in 5 years, now has lost four films to...

This star kid's last 3 films lost Rs 5000000000 at box office, has no solo hit in 5 years, now has lost four films to...![submenu-img]() Meet actress viral for just walking on screen, belongs to royal family, has no solo hit in 15 years, but still is…

Meet actress viral for just walking on screen, belongs to royal family, has no solo hit in 15 years, but still is…![submenu-img]() This is owner of most land in India, owns land in every state, total value is Rs...

This is owner of most land in India, owns land in every state, total value is Rs...![submenu-img]() Blinkit now gives free dhaniya with veggie orders, thanks to Mumbai mom

Blinkit now gives free dhaniya with veggie orders, thanks to Mumbai mom![submenu-img]() Meet man, an Indian who entered NASA's Hall of Fame by hacking, earlier worked on Apple's...

Meet man, an Indian who entered NASA's Hall of Fame by hacking, earlier worked on Apple's...![submenu-img]() 14 majestic lions cross highway in Gujarat's Amreli, video goes viral

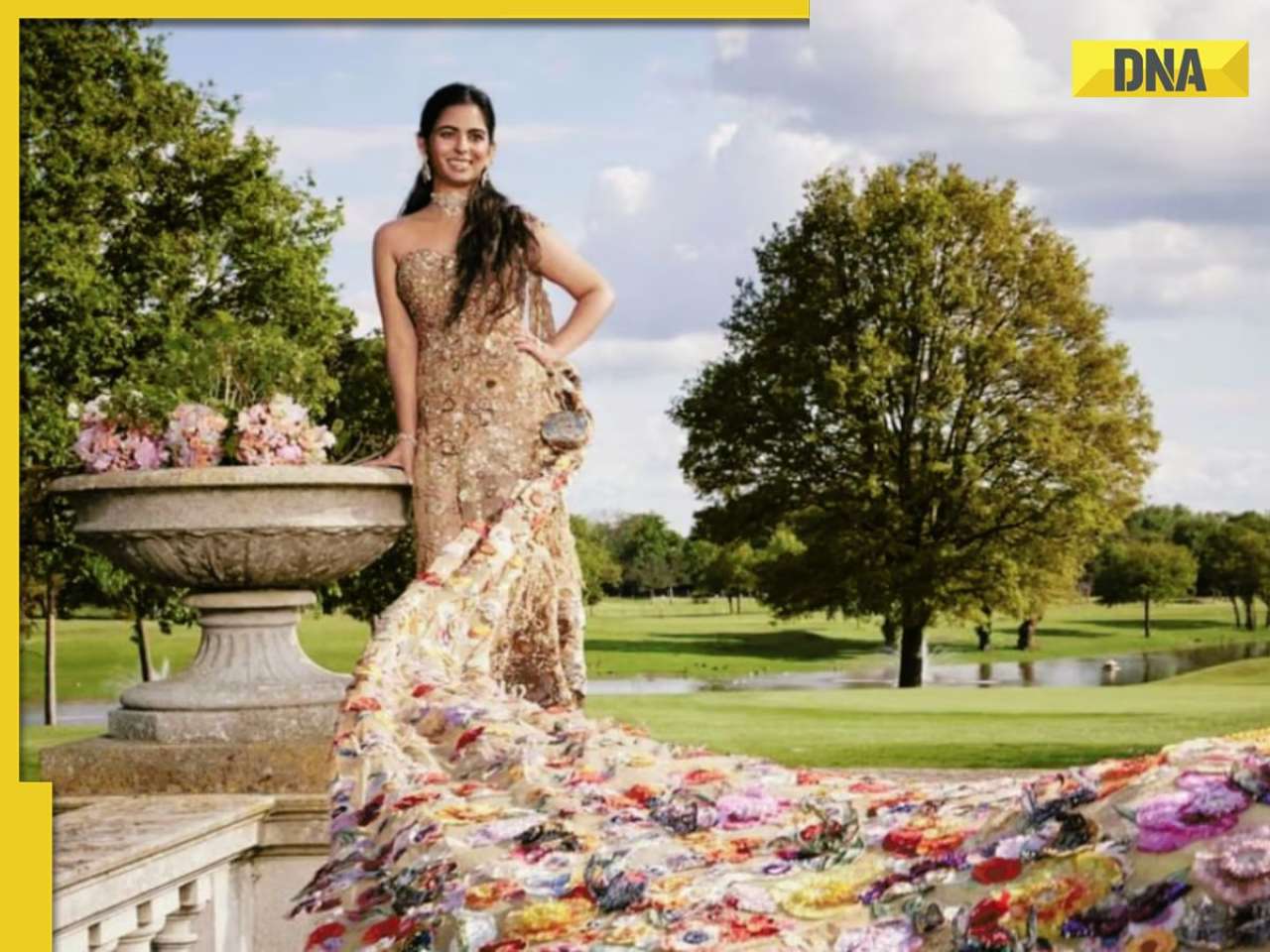

14 majestic lions cross highway in Gujarat's Amreli, video goes viral![submenu-img]() Here's why Isha Ambani was not present during Met Gala 2024 red carpet

Here's why Isha Ambani was not present during Met Gala 2024 red carpet

)

)

)

)

)

)