The need for retirement planning dawns upon several individuals and families only when they are in their early 40s. For others, it starts only in the 50’s.

The need for retirement planning dawns upon several individuals and families only when they are in their early 40s. For others, it starts only in the 50’s.

Depending on the context, these might be appropriate times to start planning for retirement. However, we believe that retirement planning should start fairly early in life.

There are two reasons for this:

- The power of compounding works in your favour if you start saving early - and the effects are really dramatic over a 20-25 year horizon. In other words, the cost of retirement in terms of foregone consumption (money you cannot spend today) is much lower if you save early.

- You have the benefit of mental accounting. When you create an asset pool targeted at retirement, your thoughts and actions become lot more refined in the matter of retirement planning. This is useful in taking retirement planning to the next stage where instead of passively saving money for retirement, you can actually think of retiring early, switch jobs if required and so on.

Asset allocation

What is the appropriate asset class for retirement planning investments?

The common mistake made by many individuals is that they do not plan for retirement early enough. The less common mistake made by those who do start the investment is that they choose fairly conservative debt instruments for their retirement fund.

The issue with this approach is that the returns on debt instruments are only 2-3% above the inflation rate. Hence, the real value of the savings grows rather slowly. The reasoning investors follow is that the retirement corpus is something they do not want to take risks with. However, portfolio risk is driven as much by volatility of the assets as it is by the tenure of investments.

Over periods of time as long as 20-25 years, the risks in equity or such riskier asset classes are more than offset by the superior long-term returns.

Hence, one can expect a 15% average return from equity investments over a long period with much lower risk than that in the expectation of 15% equity return in a 1-2 year horizon.

This, in turn, means you can manage to get ~10% growth in the inflation adjusted value of your retirement savings through equity investments.

The impact is shown in the table (see table: assuming the investor is trying to build a corpus of Rs 50 lakh for retirement in the next 20 years).

He will grow his contribution every year by 10%. Depending on the instrument chosen by the investor, the monthly contribution required for the retirement corpus varies widely.

A word of caution here: as retirement approaches, the corpus should be gradually moved into debt assets over last 3 years. Also, if retirement is less than 5 years away, 100% equity investments are not a good option.

Instrument selection

Now that we have chosen equity for building a long-term retirement corpus, the next question is which specific instruments suits the purpose. Here are the attributes our preferred instrument should have:

- It should be easy to invest in

- It should enable regular investing

- It should minimise the efforts required in tracking

- It should match our long-term investing approach

- Given these, among the wide variety of option within equity investing, index funds fit the bill quite well. They are as easy to invest in as any other mutual fund.

Regular investing can be enabled by 3-4-year-long SIPs.

Index funds by definition invest in the broad market index and mimic its behavior in terms of risk and returns. Hence, you do not need to track them anymore than knowing the performance of the market index itself. Unlike active mutual funds, there are no stars or laggards in index investing. This eliminates the need to actively track the performance of the fund and switching to a better performing fund.

Also, the long-term investing approach is more in sync with index investing than active investing.

Thus, index funds get your retirement corpus exactly what you need — equity exposure without the hassles of active management.

The metrics to evaluate an index fund are different from those used in case of actively managed mutual funds.

For index funds, tracking error (how much their performance differs from that of the index) is most important, followed by expense ratio and entry/exit load structure.

Unfortunately, the choice is limited in terms index funds in India. One of the better performing index funds is ICICI Prudential Index Fund, which has a low tracking error, 1% entry load and no exit load. Hence for a long-term investor, the costs of index investing would be fairly low.

The author is an MBA from IIM Ahmedabad and director, PARK Financial Advisors (www.parkfinadvisors.com), Mumbai. He can be reached at info@parkfa.com.

![submenu-img]() Mukesh Ambani’s daughter Isha Ambani’s firm launches new brand, Reliance’s Rs 8200000000000 company to…

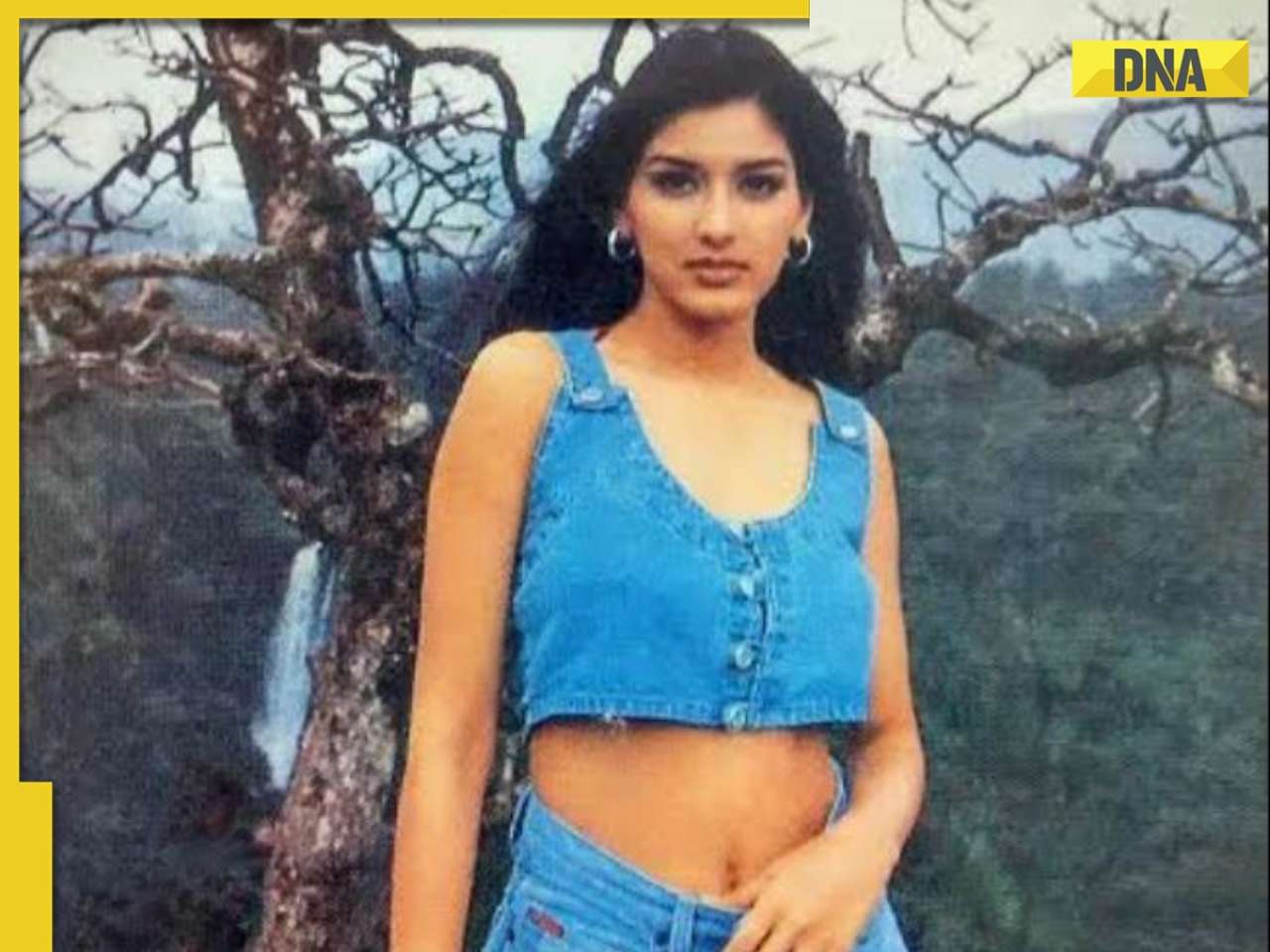

Mukesh Ambani’s daughter Isha Ambani’s firm launches new brand, Reliance’s Rs 8200000000000 company to…![submenu-img]() Sonali Bendre says producers called her 'too thin', tried to ‘fatten her up' during the 90s: ‘They'd just tell me...'

Sonali Bendre says producers called her 'too thin', tried to ‘fatten her up' during the 90s: ‘They'd just tell me...'![submenu-img]() Heavy rains in UAE again: Dubai flights cancelled, schools and offices shut

Heavy rains in UAE again: Dubai flights cancelled, schools and offices shut![submenu-img]() When 3 Bollywood films with same story released together, two even had same hero, all were hits, one launched star kid

When 3 Bollywood films with same story released together, two even had same hero, all were hits, one launched star kid![submenu-img]() Gautam Adani’s firm gets Rs 33350000000 from five banks, to use money for…

Gautam Adani’s firm gets Rs 33350000000 from five banks, to use money for…![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

Actors who died due to cosmetic surgeries![submenu-img]() See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol

See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol ![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() Sonali Bendre says producers called her 'too thin', tried to ‘fatten her up' during the 90s: ‘They'd just tell me...'

Sonali Bendre says producers called her 'too thin', tried to ‘fatten her up' during the 90s: ‘They'd just tell me...'![submenu-img]() When 3 Bollywood films with same story released together, two even had same hero, all were hits, one launched star kid

When 3 Bollywood films with same story released together, two even had same hero, all were hits, one launched star kid![submenu-img]() Salman Khan house firing case: Family of deceased accused claims police 'murdered' him, says ‘He was not the kind…’

Salman Khan house firing case: Family of deceased accused claims police 'murdered' him, says ‘He was not the kind…’![submenu-img]() Meet actor banned by entire Bollywood, was sent to jail for years, fought cancer, earned Rs 3000 crore on comeback

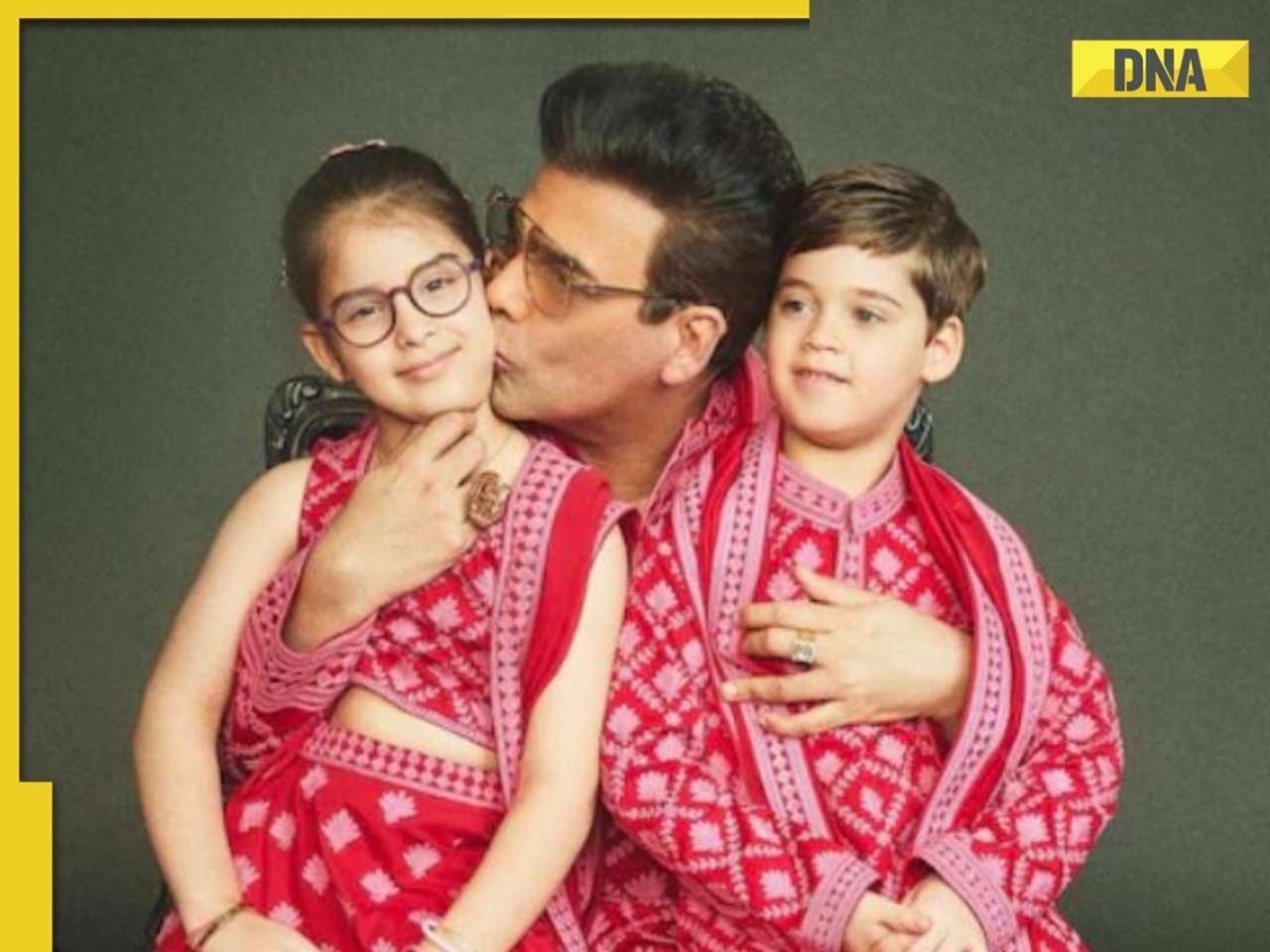

Meet actor banned by entire Bollywood, was sent to jail for years, fought cancer, earned Rs 3000 crore on comeback ![submenu-img]() Karan Johar wants to ‘disinherit’ son Yash after his ‘you don’t deserve anything’ remark: ‘Roohi will…’

Karan Johar wants to ‘disinherit’ son Yash after his ‘you don’t deserve anything’ remark: ‘Roohi will…’![submenu-img]() IPL 2024: Bhuvneshwar Kumar's last ball wicket power SRH to 1-run win against RR

IPL 2024: Bhuvneshwar Kumar's last ball wicket power SRH to 1-run win against RR![submenu-img]() BCCI reacts to Rinku Singh’s exclusion from India T20 World Cup 2024 squad, says ‘he has done…’

BCCI reacts to Rinku Singh’s exclusion from India T20 World Cup 2024 squad, says ‘he has done…’![submenu-img]() MI vs KKR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

MI vs KKR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() IPL 2024: How can RCB and MI still qualify for playoffs?

IPL 2024: How can RCB and MI still qualify for playoffs?![submenu-img]() MI vs KKR IPL 2024 Dream11 prediction: Fantasy cricket tips for Mumbai Indians vs Kolkata Knight Riders

MI vs KKR IPL 2024 Dream11 prediction: Fantasy cricket tips for Mumbai Indians vs Kolkata Knight Riders ![submenu-img]() '25 virgin girls' are part of Kim Jong un's 'pleasure squad', some for sex, some for dancing, some for...

'25 virgin girls' are part of Kim Jong un's 'pleasure squad', some for sex, some for dancing, some for...![submenu-img]() Man dances with horse carrying groom in viral video, internet loves it

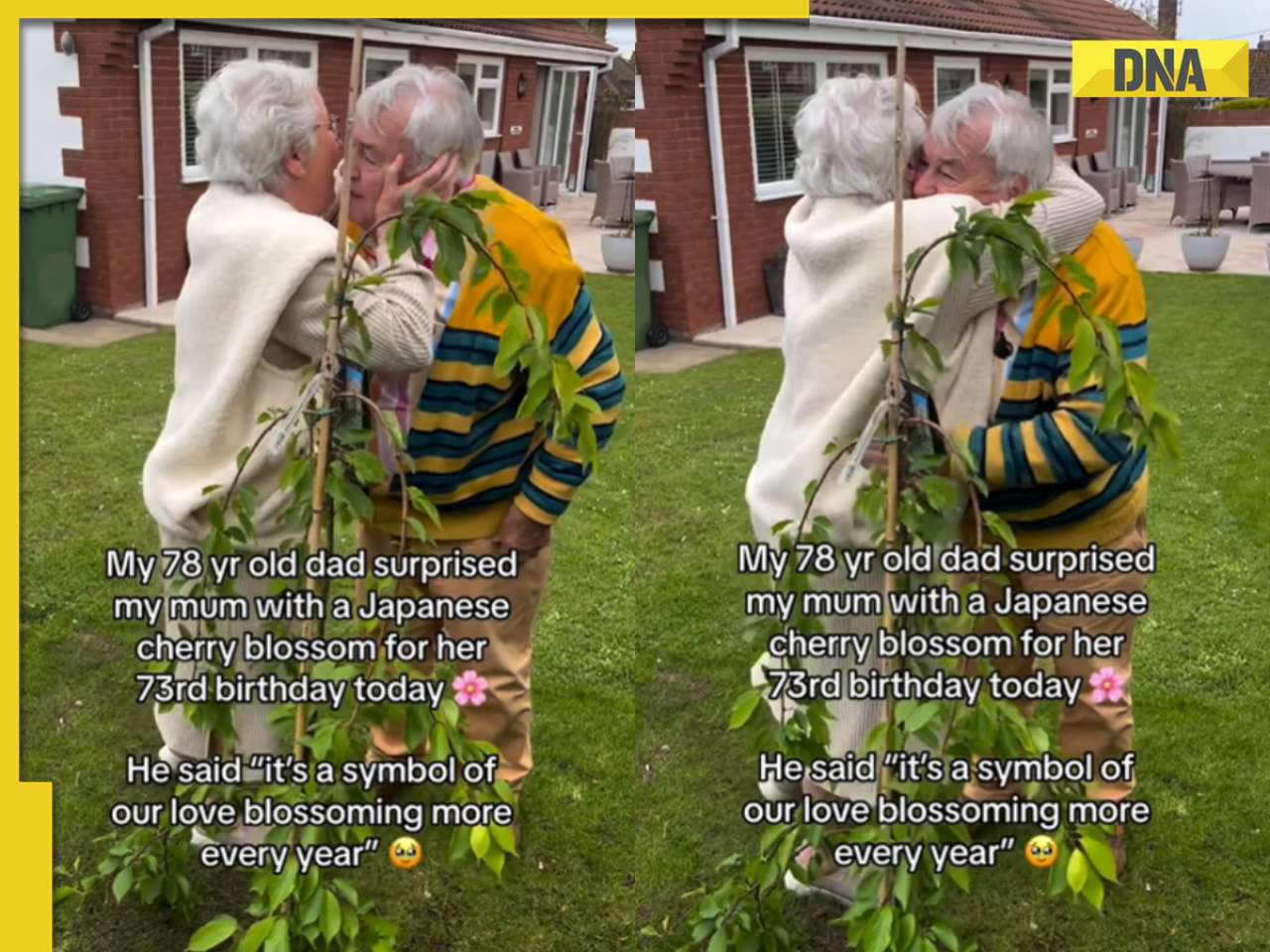

Man dances with horse carrying groom in viral video, internet loves it ![submenu-img]() Viral video: 78-year-old man's heartwarming surprise for wife sparks tears of joy

Viral video: 78-year-old man's heartwarming surprise for wife sparks tears of joy![submenu-img]() Man offers water to thirsty camel in scorching desert, viral video wins hearts

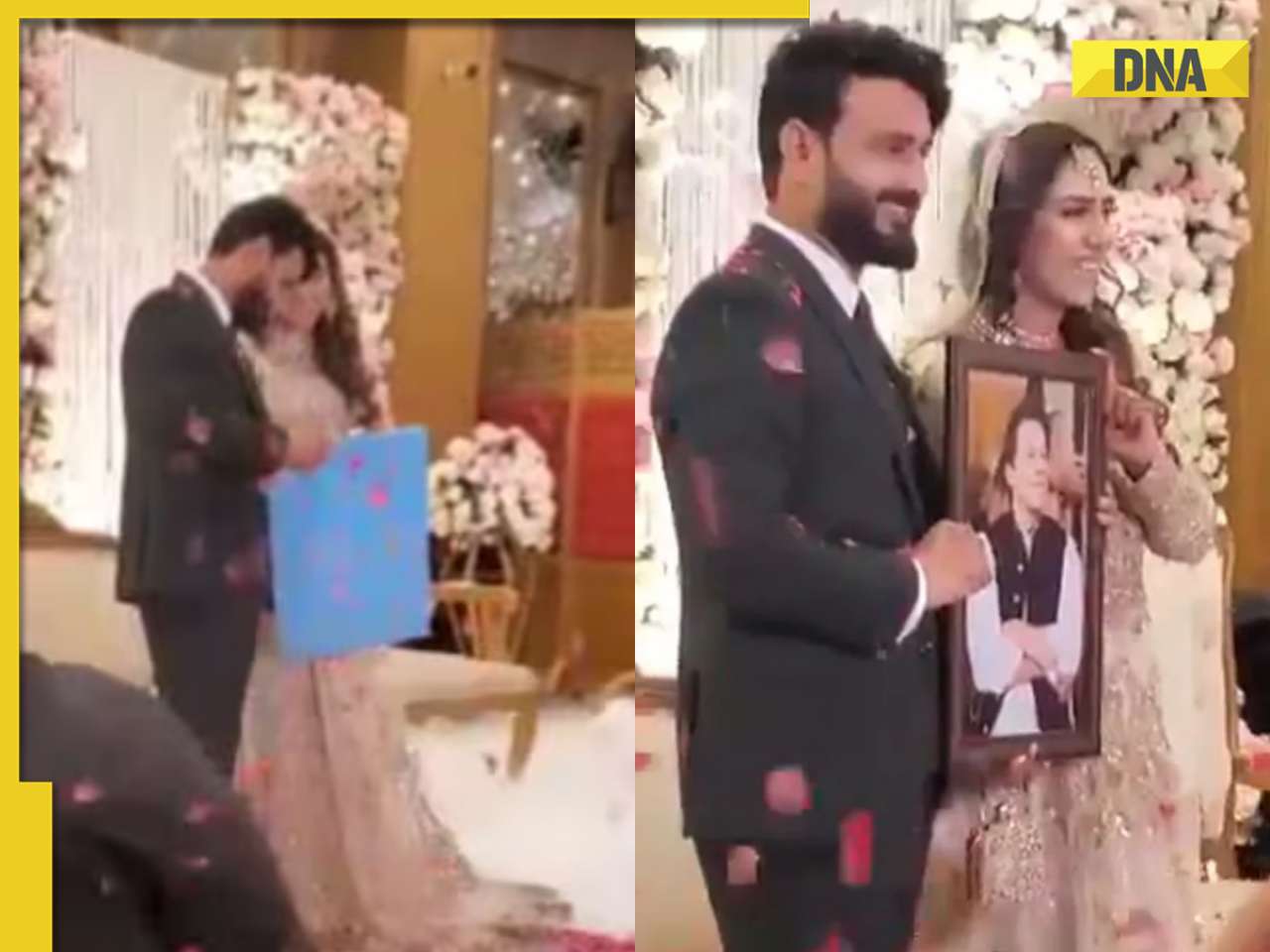

Man offers water to thirsty camel in scorching desert, viral video wins hearts![submenu-img]() Pakistani groom gifts framed picture of former PM Imran Khan to bride, her reaction is now a viral video

Pakistani groom gifts framed picture of former PM Imran Khan to bride, her reaction is now a viral video

)

)

)

)

)

)