Mobile revenues, three-fourth of consolidated revenues, provided the boost, thanks to increase in subscriber base, which increased by 5.5 mn Q1 to 42.7mn.

Bharti Airtel’s consolidated profit after tax (before deferred tax) rose 25.2% year-on-year to Rs 1,665.25 crore in the quarter ended June 2007 (Q1) boosted by forex gains of Rs 239 crore. Consolidated revenues grew 9.5% to Rs 5,905 crore.

Mobile revenues, three-fourth of consolidated revenues, provided the boost, thanks to increase in subscriber base, which increased by 5.5 million in Q1 to 42.7 million.

Notably, Bharti has been able to increase its mobile market share to 23.5% at the end of Q1 from 22.9% as at end-March 2007 and 21.1% at end-June 2007.

The growth in subscriber numbers in Q1 was helped by the launch of Rs 495 lifetime validity scheme and network expansion. Bharti now covers 62% of India’s population, up from 59% in Q4 FY 07 and seems on track to achieve the 70% level by 2007-08.

However, the average monthly billing per user declined to Rs 390 in Q1 (against Rs 406) as Bharti earned 4.7% lower for every minute used, while the average minutes per user improved marginally (by 0.6%) to 478 minutes. All the same, the operating profit of the mobile business grew faster (by 15%), helped by the scale advantage.

In the broadband and telephone services business, subscriber base touched 19.7 million, while the average monthly billing per subscriber crawled to Rs 1,121 (against Rs 1,112).

However, profit margin improved sharply by 370 basis points to 32.2% as Bharti was able to spread the fixed costs among the increased subscribers base.

The party pooper was the drop in tariffs, which affected the long-distance calling business (14% of revenues), where revenues declined by 9% and profits by 13%. That, along with a dip in margins impacted profits of the enterprise business.

Overall, profit margin fell by just 10 basis points to 41.43%, even as SG&A expenses rose faster, by 21.4%.

Bharti, though, maintains that the higher SG&A is just a blip and that these expenses are likely to drop in future.

Going forward, the company’s growth prospects continue to be good. The stock, now at Rs 925.25 (up 21% since April 1st 2007), quotes at a PE of 35 based on its trailing 12 months earnings and, can be considered at declines.

All-round show

For Reliance Capital, which has interest across financial services (mutual fund, life & general insurance, retail broking & distribution, consumer finance, investments, etc), consolidated total income in Q1 2007-08 at Rs 1,111.40 crore reflects a jump of 212% as compared to Q1 the previous year.

The net profit at Rs 324.90 crore was up 187% despite a one-time provision of Rs 70.10 crore.

That’s because it was also helped by a sharp rise in profit from sale of investments, which is reflected in the 291% rise in finance and investment division revenues at Rs 517.90 crore.

Notably, all businesses contributed to top-line growth. Broking and distribution division grew on account of competitive pricing and a wide network.

The company offers broking services through the sale of prepaid cards, which it receives as acquisition fee and later a regular fee is charged on renewal basis. Reliance Money is rapidly expanding its reach and had a distribution franchisee network of 4,000 outlets spread across 700 towns/cities; average daily trading volume of Rs 600 crore.

The gross written premium in the general insurance business stood at Rs 529 crore, up by 241%, whereas profit before tax grew 34% to Rs 18 crore.

The premium growth was primarily driven by increased contribution of motor and health insurance products that together constitute 70% (against 57% in March 2007) of total premium written.

Reliance Capital has also strengthened its marketing base taking the number of intermediaries to 36,463 in Q1 and branches to 85. The proportion of unit linked plans constitutes around 96% of the premium written in Q1 FY08.

Since most of these businesses are in the growth phases, expenses tend to be higher. In fact, the company has ramped up its workforce across these businesses, which is one reason for the tripling of staff costs.

But, these businesses are expected to gradually create value for shareholders, as was seen in the case of ICICI Bank.

For Reliance Capital, revenues from the asset management (mutual fund) division at Rs 66.60 crore grew 63%, helped by a 29% rise in the assets under management (AUM) in Q1 to Rs 59,800 crore.

Reliance’s AUMs have grown faster than competition. Its latest fund offering (Reliance Equity Advantage) also collected around Rs 2,700 crore (concluded on July 10 2007) and should only add to the kitty.

No wonder, Reliance Mutual fund has maintained its number one position in terms of AUMs with market share of 15%.

Going ahead, a vast network with a basket of products will help the company to tap higher market share. Also, Reliance Money has plans of rolling out consumer financing business by Q2 2007-08 (now rolled out selectively in some cities) and is targeting to disburse Rs 5,000 crore in 2007-08 in the form of various consumer as well as SME loans.

At Rs 1,293, considering the potential in the businesses and the aggressive growth plans, it may be worth considering at declines.

![submenu-img]() 'They unilaterally took some measures': EAM Jaishankar on new Nepal 100 rupee currency

'They unilaterally took some measures': EAM Jaishankar on new Nepal 100 rupee currency![submenu-img]() Meet Ice Cream Lady of India, who built Rs 6000 crore company, started with small investment of Rs…

Meet Ice Cream Lady of India, who built Rs 6000 crore company, started with small investment of Rs…![submenu-img]() ‘Canada a rule-of-law country’: PM Trudeau after 3 Indian arrested over Hardeep Nijjar's murder

‘Canada a rule-of-law country’: PM Trudeau after 3 Indian arrested over Hardeep Nijjar's murder![submenu-img]() Viral video: Specially-abled girl’s energetic dance to Bollywood song wows internet, watch

Viral video: Specially-abled girl’s energetic dance to Bollywood song wows internet, watch![submenu-img]() 'Baap re baap': Imtiaz Ali reveals Diljit Dosanjh was scandalised by old women's 'vulgar' improvisation on Chamkila set

'Baap re baap': Imtiaz Ali reveals Diljit Dosanjh was scandalised by old women's 'vulgar' improvisation on Chamkila set![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

Actors who died due to cosmetic surgeries![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() 'Baap re baap': Imtiaz Ali reveals Diljit Dosanjh was scandalised by old women's 'vulgar' improvisation on Chamkila set

'Baap re baap': Imtiaz Ali reveals Diljit Dosanjh was scandalised by old women's 'vulgar' improvisation on Chamkila set![submenu-img]() This actor, who worked with Karan Johar and Farhan Akhtar, gave superhit shows, saw failed marriage, killed himself at..

This actor, who worked with Karan Johar and Farhan Akhtar, gave superhit shows, saw failed marriage, killed himself at..![submenu-img]() Did you know Ranveer Singh's grandmother was popular actress? Worked with Raj Kapoor; her career affected due to...

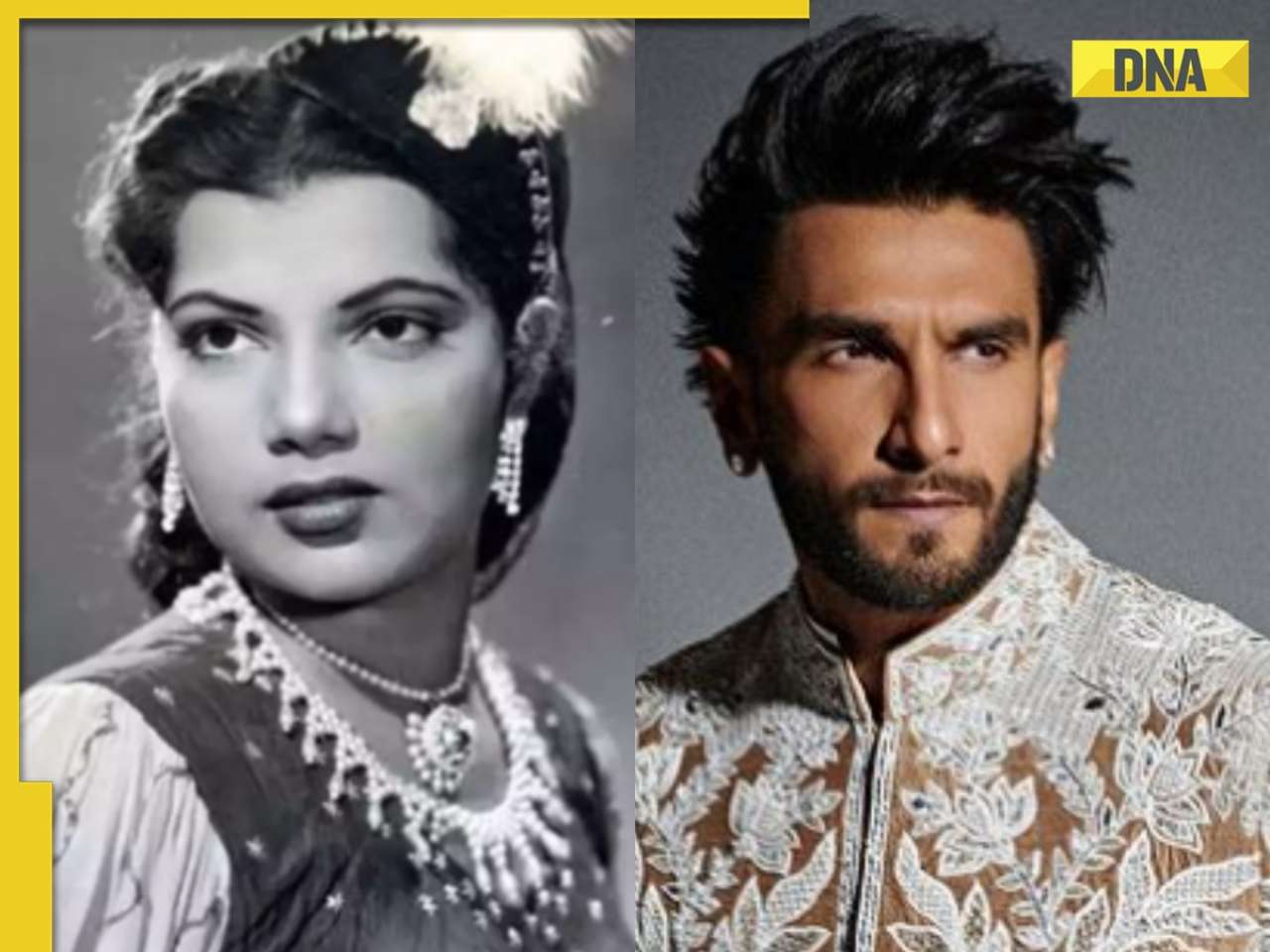

Did you know Ranveer Singh's grandmother was popular actress? Worked with Raj Kapoor; her career affected due to...![submenu-img]() India's highest-paid TV actress began working at 8, her Bollywood films flopped, was seen in Bigg Boss 1, now charges...

India's highest-paid TV actress began working at 8, her Bollywood films flopped, was seen in Bigg Boss 1, now charges...![submenu-img]() Shreyas Talpade wonders if his heart attack was due to Covid vaccine: 'We don’t know what we have taken inside...'

Shreyas Talpade wonders if his heart attack was due to Covid vaccine: 'We don’t know what we have taken inside...'![submenu-img]() IPL 2024: Faf du Plessis, Virat Kohli help Royal Challengers Bengaluru defeat Gujarat Titans by 4 wickets

IPL 2024: Faf du Plessis, Virat Kohli help Royal Challengers Bengaluru defeat Gujarat Titans by 4 wickets![submenu-img]() IPL 2024: Why is Sai Kishore not playing today's RCB vs GT match?

IPL 2024: Why is Sai Kishore not playing today's RCB vs GT match?![submenu-img]() 'Mumbai Indians ki kahani khatam': Ex-India star slams Hardik Pandya after MI's loss to KKR at Wankhede

'Mumbai Indians ki kahani khatam': Ex-India star slams Hardik Pandya after MI's loss to KKR at Wankhede![submenu-img]() LSG vs KKR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

LSG vs KKR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() LSG vs KKR IPL 2024 Dream11 prediction: Fantasy cricket tips for Lucknow Super Giants vs Kolkata Knight Riders

LSG vs KKR IPL 2024 Dream11 prediction: Fantasy cricket tips for Lucknow Super Giants vs Kolkata Knight Riders![submenu-img]() Viral video: Specially-abled girl’s energetic dance to Bollywood song wows internet, watch

Viral video: Specially-abled girl’s energetic dance to Bollywood song wows internet, watch![submenu-img]() Viral video: Man educates younger brother about mensuration, internet is highly impressed

Viral video: Man educates younger brother about mensuration, internet is highly impressed![submenu-img]() Girl's wedding dance to Haryanvi song interrupted by mother in viral video, internet reacts

Girl's wedding dance to Haryanvi song interrupted by mother in viral video, internet reacts![submenu-img]() Viral video: Man fearlessly grabs dozens of snakes, internet is scared

Viral video: Man fearlessly grabs dozens of snakes, internet is scared![submenu-img]() This mysterious mobile phone number was suspended after three users...

This mysterious mobile phone number was suspended after three users...

)

)

)

)

)

)