The absence of follow-up buying during the week was quite apparent, with index heavyweights wilting under selling pressure.

Sensex (14,063.81): The absence of follow-up buying during the week was quite apparent, with index heavyweights wilting under selling pressure. The carnage witnessed across global markets took a toll on the domestic markets as well. As a result, the index drifted below the positive trigger level of 14,500 that was pierced the week before.

The inability of the index to hold above this level is a cause of concern. Technically, there is no reason to initiate fresh long positions, especially in frontline stocks. The trend would turn bullish only on a close past 14,500. A quick and decisive overhaul of this level is crucial for the resumption of the uptrend. Else, there would be a strong case for the Sensex to drift lower or get into a prolonged sideways corrective phase.

A weekly close below 13,600 would indicate that the index is bracing for a deeper corrective phase. As long as the index holds above 13,600, there would be a case for the index to move to the target zone of 15,500-16,000 mentioned in earlier weeks. Investors may wait for more clarity to emerge before committing fresh funds.

Nifty (4,145): As observed last week, there are adequate warning signs to suggest that the market is ripe for a correction. The close below the bearish trigger level of 4,240 is the first confirmation of the onset of the corrective phase. Though there is no reason to press the panic button as yet, there is enough evidence to suggest that long positions should be pruned.

The Nifty has to close above 4,300 for the resumption of the uptrend. On the other hand, a close below 3,980 would indicate that the index could see a sharp corrective phase. At the moment, the recent price action suggests that the index could remain in trading zone marked by 4,300 on the upside and 3,980 on the way down. Only a decisive break of either of these levels would impart a clear-cut directional move in the Nifty.

CNX Bank Index (61,77.7): The expectation of another interest rate hike has checked the recent rally in the banking stocks. The banking index has taken a knock in the process. The short-term outlook is bearish and a drop to 5,850-5,900 appears likely. A close below 5,700 would indicate that the index is headed for a much deeper correction. The trend would turn bullish only on a close above 6,360.

Key pivotals:

Infosys Technologies (Rs 1,951): Despite the underlying market weakness, technology stocks displayed resilience during the week. The short-term outlook for the stock remains bullish and a move to Rs 2,130-2,140 appears likely. As observed last week, the short-term positive view would be negated only on a close below Rs 1,900. Long positions may be considered with a stop loss at Rs 1,900.

BHEL (Rs 1,311): Contrary to expectations, the stock ruled weak and also dropped below the bearish trigger level of Rs1,330. This has negated the earlier bullish view and the stock is likely to test the immediate support at Rs 1,250-1,260. A close below Rs 1,250 would indicate that the stock is headed to Rs 1,150-1,175.

Reliance Industries (Rs 1,657): The weakness in the stock played a major role in pulling down the indices during the week. Though the stock is still ruling above the stop loss- cum-bearish trigger level of Rs 1,520, the recent price patterns do not portray a bullish picture. The stock has to close past Rs 1,760 for the bullish trend to resume.

Stock of the week:

Balaji Telefilms (Rs 224): The stock has managed to weather bearish market conditions that prevailed over the last couple of trading days. Market interest towards the stock is evident from the pick-up in volume and the stock’s rise over the last couple of trading sessions. The short-term outlook is bullish and a move to Rs 255-260 appears likely.

(Note: The analysis and views expressed in this column are based on the technical analysis of historical share price action. There is a risk of loss in trading. Views and targets are arrived at by using the Elliott Wave Theory and Point & Figure technique. The author does not have investment exposure in the stocks discussed above. Comments and feedback may be sent to bkrish@gmail.com)

![submenu-img]() 'They unilaterally took some measures': EAM Jaishankar on new Nepal 100 rupee currency

'They unilaterally took some measures': EAM Jaishankar on new Nepal 100 rupee currency![submenu-img]() Meet Ice Cream Lady of India, who built Rs 6000 crore company, started with small investment of Rs…

Meet Ice Cream Lady of India, who built Rs 6000 crore company, started with small investment of Rs…![submenu-img]() ‘Canada a rule-of-law country’: PM Trudeau after 3 Indian arrested over Hardeep Nijjar's murder

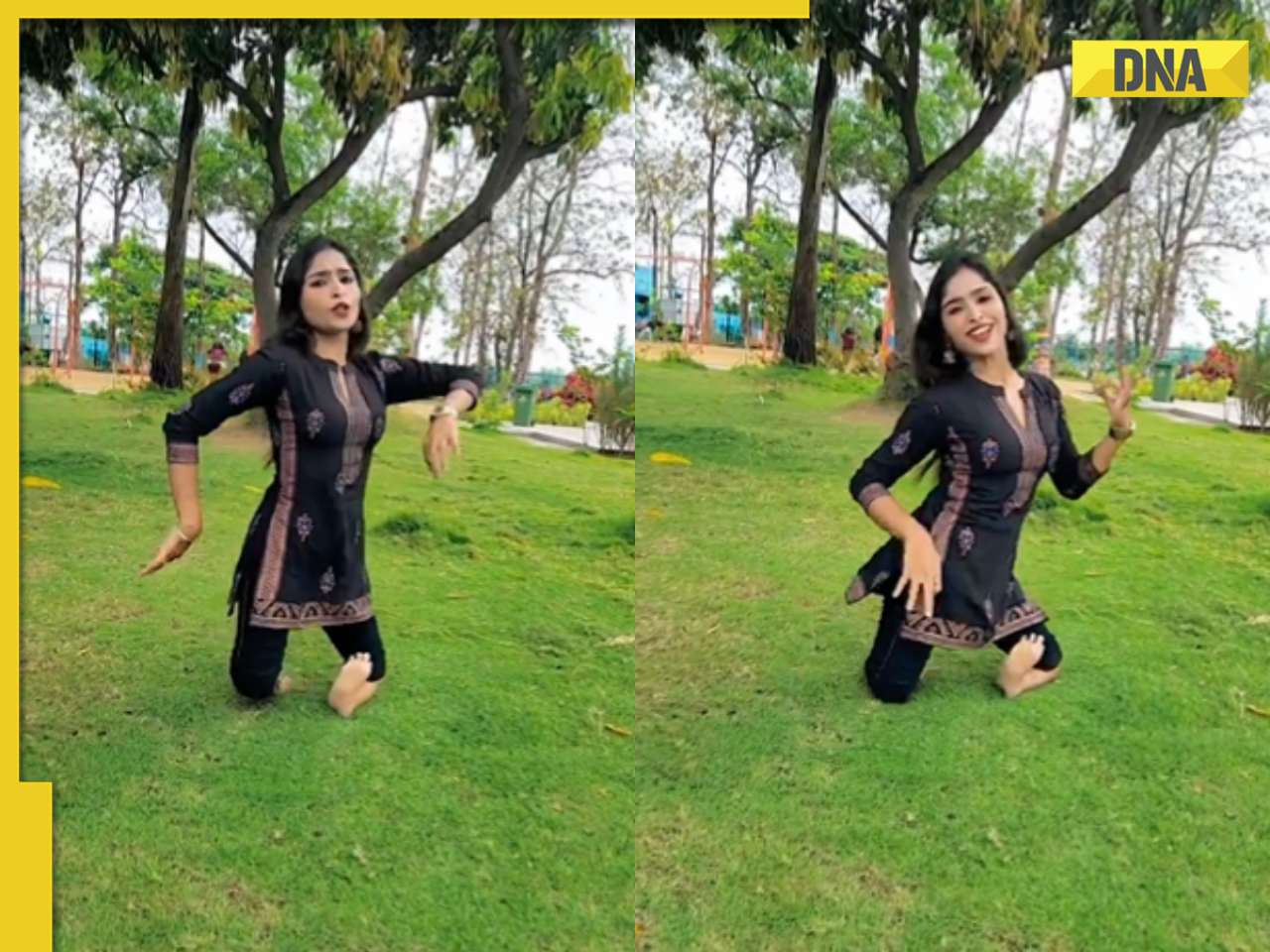

‘Canada a rule-of-law country’: PM Trudeau after 3 Indian arrested over Hardeep Nijjar's murder![submenu-img]() Viral video: Specially-abled girl’s energetic dance to Bollywood song wows internet, watch

Viral video: Specially-abled girl’s energetic dance to Bollywood song wows internet, watch![submenu-img]() 'Baap re baap': Imtiaz Ali reveals Diljit Dosanjh was scandalised by old women's 'vulgar' improvisation on Chamkila set

'Baap re baap': Imtiaz Ali reveals Diljit Dosanjh was scandalised by old women's 'vulgar' improvisation on Chamkila set![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

Actors who died due to cosmetic surgeries![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() 'Baap re baap': Imtiaz Ali reveals Diljit Dosanjh was scandalised by old women's 'vulgar' improvisation on Chamkila set

'Baap re baap': Imtiaz Ali reveals Diljit Dosanjh was scandalised by old women's 'vulgar' improvisation on Chamkila set![submenu-img]() This actor, who worked with Karan Johar and Farhan Akhtar, gave superhit shows, saw failed marriage, killed himself at..

This actor, who worked with Karan Johar and Farhan Akhtar, gave superhit shows, saw failed marriage, killed himself at..![submenu-img]() Did you know Ranveer Singh's grandmother was popular actress? Worked with Raj Kapoor; her career affected due to...

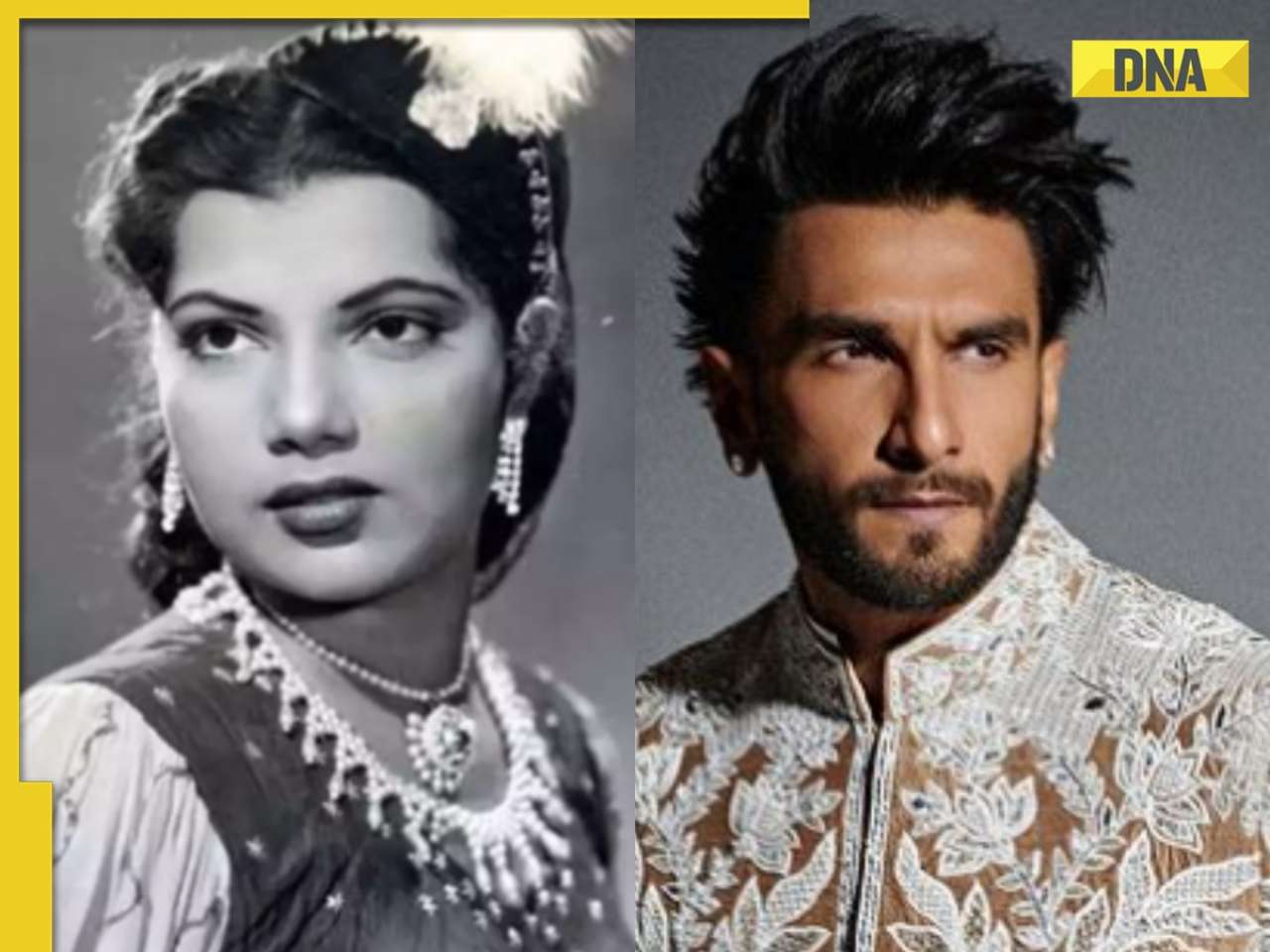

Did you know Ranveer Singh's grandmother was popular actress? Worked with Raj Kapoor; her career affected due to...![submenu-img]() India's highest-paid TV actress began working at 8, her Bollywood films flopped, was seen in Bigg Boss 1, now charges...

India's highest-paid TV actress began working at 8, her Bollywood films flopped, was seen in Bigg Boss 1, now charges...![submenu-img]() Shreyas Talpade wonders if his heart attack was due to Covid vaccine: 'We don’t know what we have taken inside...'

Shreyas Talpade wonders if his heart attack was due to Covid vaccine: 'We don’t know what we have taken inside...'![submenu-img]() IPL 2024: Faf du Plessis, Virat Kohli help Royal Challengers Bengaluru defeat Gujarat Titans by 4 wickets

IPL 2024: Faf du Plessis, Virat Kohli help Royal Challengers Bengaluru defeat Gujarat Titans by 4 wickets![submenu-img]() IPL 2024: Why is Sai Kishore not playing today's RCB vs GT match?

IPL 2024: Why is Sai Kishore not playing today's RCB vs GT match?![submenu-img]() 'Mumbai Indians ki kahani khatam': Ex-India star slams Hardik Pandya after MI's loss to KKR at Wankhede

'Mumbai Indians ki kahani khatam': Ex-India star slams Hardik Pandya after MI's loss to KKR at Wankhede![submenu-img]() LSG vs KKR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

LSG vs KKR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() LSG vs KKR IPL 2024 Dream11 prediction: Fantasy cricket tips for Lucknow Super Giants vs Kolkata Knight Riders

LSG vs KKR IPL 2024 Dream11 prediction: Fantasy cricket tips for Lucknow Super Giants vs Kolkata Knight Riders![submenu-img]() Viral video: Specially-abled girl’s energetic dance to Bollywood song wows internet, watch

Viral video: Specially-abled girl’s energetic dance to Bollywood song wows internet, watch![submenu-img]() Viral video: Man educates younger brother about mensuration, internet is highly impressed

Viral video: Man educates younger brother about mensuration, internet is highly impressed![submenu-img]() Girl's wedding dance to Haryanvi song interrupted by mother in viral video, internet reacts

Girl's wedding dance to Haryanvi song interrupted by mother in viral video, internet reacts![submenu-img]() Viral video: Man fearlessly grabs dozens of snakes, internet is scared

Viral video: Man fearlessly grabs dozens of snakes, internet is scared![submenu-img]() This mysterious mobile phone number was suspended after three users...

This mysterious mobile phone number was suspended after three users...

)

)

)

)

)

)