The red-eyed beast tossed the BSE Sensex up close 14,000 on Friday, and word from the arena is that the mark is just a snorting distance away.

MUMBAI: The bull-ring is throbbing with action once more. The red-eyed beast tossed the Bombay Stock Exchange Sensex up close 14,000 on Friday, and word from the arena is that the mark is just a snorting distance away.

“Sensex 14,000 is on the cards on Monday provided global cues are on our side,” said Pritesh Mehta, market analyst at India Infoline.

That seems to be happening. The global markets are looking good, what with the US stock market benchmark, the Dow Jones, making an all-time intra-day high on Friday, and the tech-heavy Nasdaq, hitting a six-year high in early trades.

The Reserve Bank of India (RBI) could, of course, pour cold water on market momentum next week by raising interest rates, but a section of the market feels that this hike has already been factored in.

“Corporate earnings have been fairly stable, and as long as global liquidity flows and cues from world markets are positive, the RBI raising rates will not impact momentum,” said Dhiraj Sachdev, vice-president and fund manager, portfolio management services, at HSBC.

The inflation numbers released on Friday weren’t too good. The wholesale prices index accelerated for the week ended April 7, 2007, to 6.09%, from 5.74% in the previous week, but the finance minister was quick to discount the spike. He said the next week’s numbers should be below 6%.

Deepak Mohoni, managing director of trendwatchindia.com, feels that we’re driven far more by international markets than local developments.

“With global markets rallying nicely, the only threat right now is whether the Asian markets will continue rising - as they did on Friday after the previous day’s crash,” said Mohoni.

“As long as the Asian markets hold up, there is no reason why we cannot continue climbing for now. Global, rather than local factors, count, as is evident in the strong rally in banking stocks despite the cash reserve ratio (CRR) hike, and the undistinguished show from technology stocks despite stunning results,” he said.

The view from technical analysts is one of extreme optimism. “I’m in a bullish mode, and see the Sensex making a new high in a month or so,” said Upendra Doshi, technical analyst at Doshi Securities. The Sensex’s all-time high was recorded on February 8, 2007, when it closed at 14,652.09. It closed Friday at 13,897.41, a gain of 277.71 points (2.04%) from its previous close.

“The candle shows a shaven head (meaning the Sensex made its all-time closing high this month on Friday), and I see the index making new highs,” said Prem Daga, a technical analyst.

![submenu-img]() Bigg Boss OTT 3: Anil Kapoor confirmed as new host, says 'jhakaas nahi kuch khaas karte hai', leaves netizens divided

Bigg Boss OTT 3: Anil Kapoor confirmed as new host, says 'jhakaas nahi kuch khaas karte hai', leaves netizens divided![submenu-img]() Felony charges and political ambitions: Donald Trump at the legal and electoral crossroads

Felony charges and political ambitions: Donald Trump at the legal and electoral crossroads![submenu-img]() This actor left UPSC dreams for Bollywood, was launched by Amitabh, fought Shah Rukh, then disappeared for years, now...

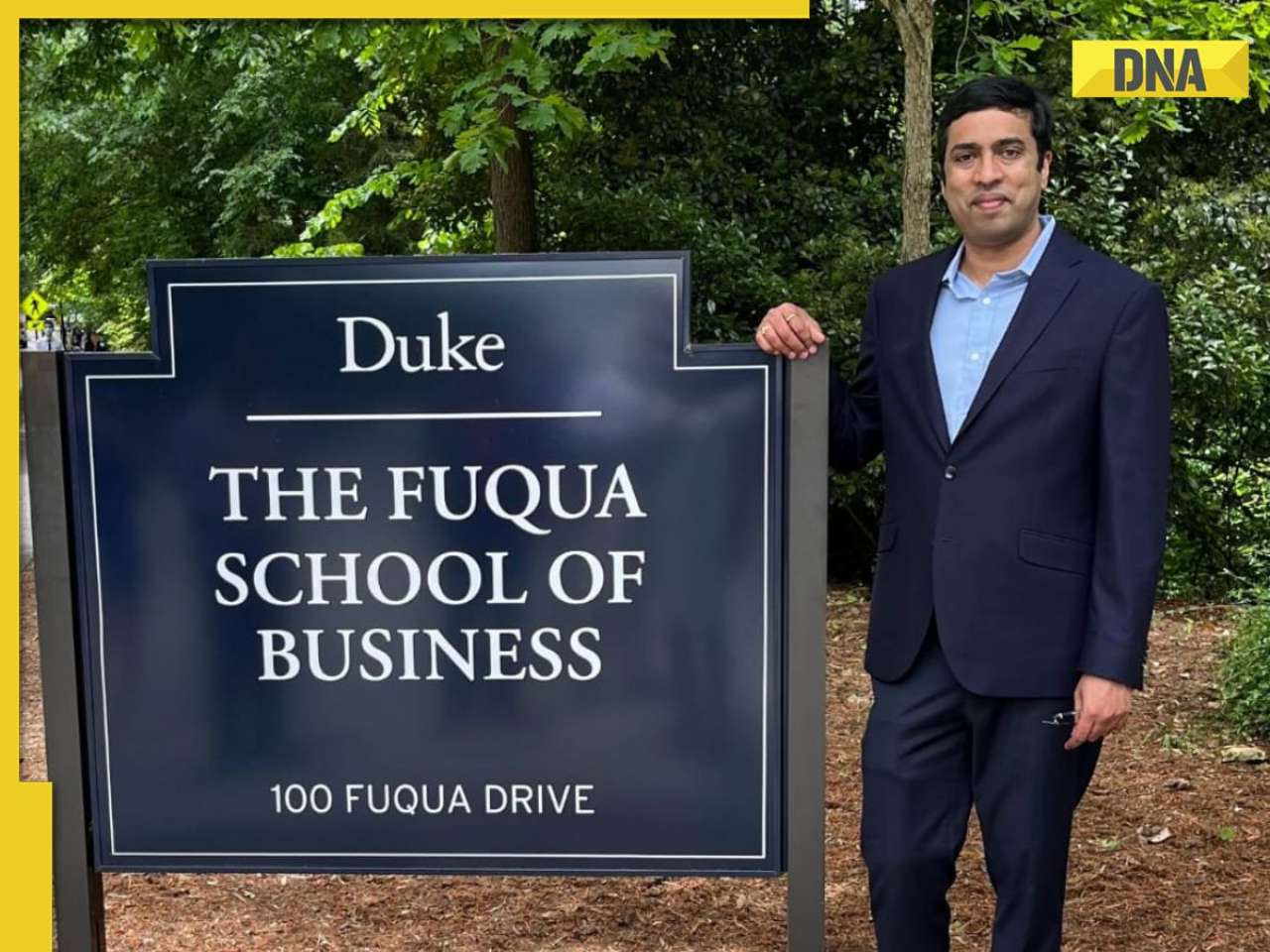

This actor left UPSC dreams for Bollywood, was launched by Amitabh, fought Shah Rukh, then disappeared for years, now...![submenu-img]() Data-Driven Decision Making: Leveraging KPI Metrics for Strategic Insight

Data-Driven Decision Making: Leveraging KPI Metrics for Strategic Insight![submenu-img]() Exploring transformative potential of application modernisation for sustainable solutions in future

Exploring transformative potential of application modernisation for sustainable solutions in future![submenu-img]() Meet Indian genius who won National Spelling Bee contest in US at age 12, he is from…

Meet Indian genius who won National Spelling Bee contest in US at age 12, he is from…![submenu-img]() Meet man who became IIT Bombay professor at just 22, got sacked from IIT after some years because..

Meet man who became IIT Bombay professor at just 22, got sacked from IIT after some years because..![submenu-img]() Meet Indian genius, son of constable, worked with IIT, NASA, then went missing, was found after years in...

Meet Indian genius, son of constable, worked with IIT, NASA, then went missing, was found after years in...![submenu-img]() Meet IAS officer who was victim of domestic violence, mother of two, cracked UPSC exam in first attempt, she's posted in

Meet IAS officer who was victim of domestic violence, mother of two, cracked UPSC exam in first attempt, she's posted in![submenu-img]() RBSE Class 5th, 8th Result 2024 Date, Time: Rajasthan board to announce results today, get direct link here

RBSE Class 5th, 8th Result 2024 Date, Time: Rajasthan board to announce results today, get direct link here![submenu-img]() DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo

DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo![submenu-img]() DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here

DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() Streaming This Week: Panchayat season 3, Swatantrya Veer Savarkar, Illegal season 3, latest OTT releases to binge-watch

Streaming This Week: Panchayat season 3, Swatantrya Veer Savarkar, Illegal season 3, latest OTT releases to binge-watch![submenu-img]() Avneet Kaur shines in navy blue gown with shimmery trail at Cannes 2024, fans say 'she is unstoppable now'

Avneet Kaur shines in navy blue gown with shimmery trail at Cannes 2024, fans say 'she is unstoppable now'![submenu-img]() Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes

Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes ![submenu-img]() Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'

Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'![submenu-img]() AI models play volley ball on beach in bikini

AI models play volley ball on beach in bikini![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?

DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() Bigg Boss OTT 3: Anil Kapoor confirmed as new host, says 'jhakaas nahi kuch khaas karte hai', leaves netizens divided

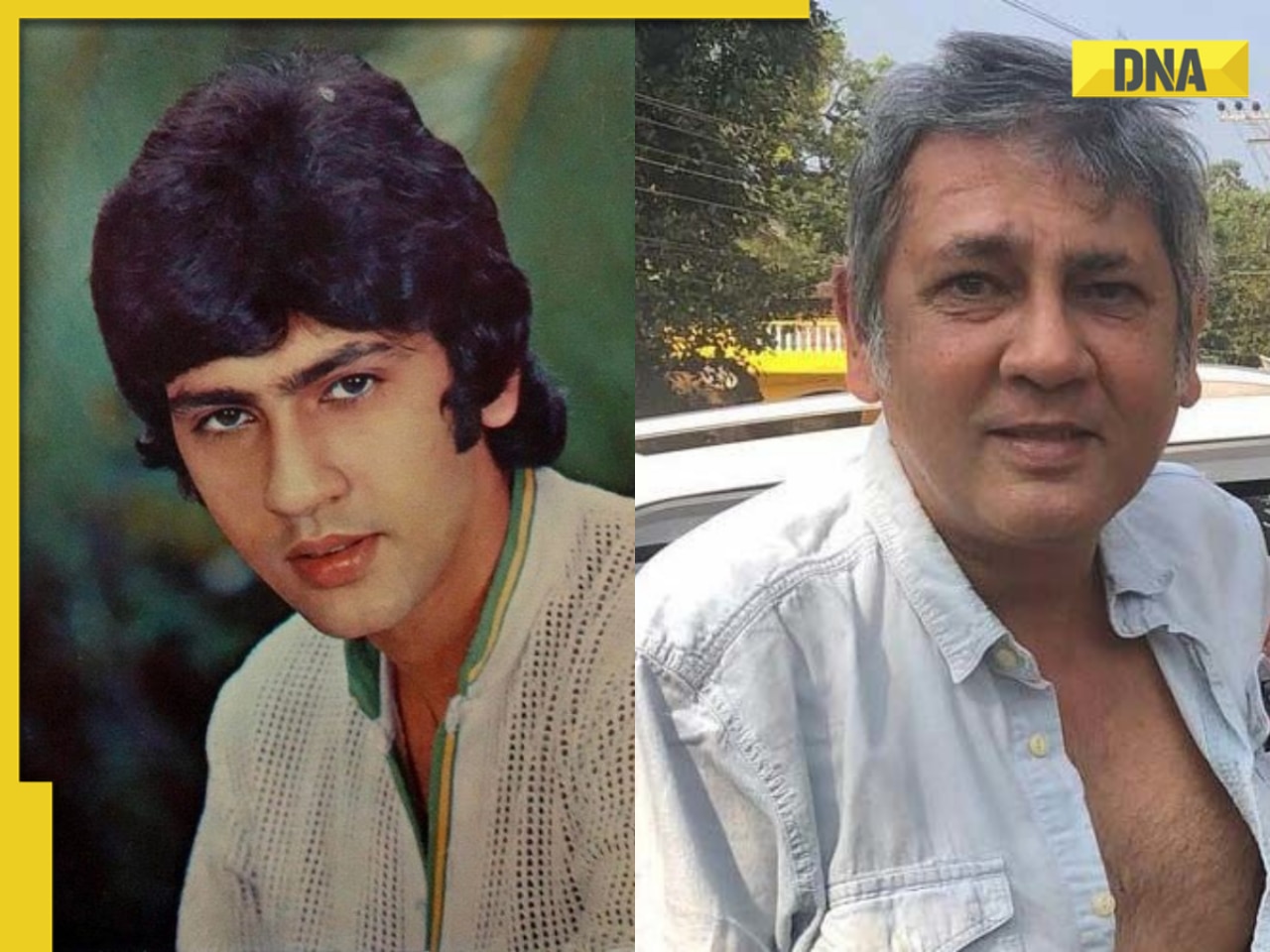

Bigg Boss OTT 3: Anil Kapoor confirmed as new host, says 'jhakaas nahi kuch khaas karte hai', leaves netizens divided![submenu-img]() This actor left UPSC dreams for Bollywood, was launched by Amitabh, fought Shah Rukh, then disappeared for years, now...

This actor left UPSC dreams for Bollywood, was launched by Amitabh, fought Shah Rukh, then disappeared for years, now...![submenu-img]() Bujii and Bhairava review: Prabhas' futuristic Baahubali-type Kalki 2898 prelude AD is fun, AI Keerthy steals the show

Bujii and Bhairava review: Prabhas' futuristic Baahubali-type Kalki 2898 prelude AD is fun, AI Keerthy steals the show![submenu-img]() This actress gave no hits in 9 years, no Bollywood releases in 5 years, charges Rs 40 crore per film, net worth is..

This actress gave no hits in 9 years, no Bollywood releases in 5 years, charges Rs 40 crore per film, net worth is..![submenu-img]() Mr & Mrs Mahi review: Janhvi, Rajkummar's earnest performances can't save film that doesn't really get cricket or women

Mr & Mrs Mahi review: Janhvi, Rajkummar's earnest performances can't save film that doesn't really get cricket or women![submenu-img]() Viral video: Little girl’s adorable dance to 'Ruki Sukhi Roti' will melt your heart, watch

Viral video: Little girl’s adorable dance to 'Ruki Sukhi Roti' will melt your heart, watch![submenu-img]() Groom jumps off stage for impromptu dance with friends, viral video leaves netizens in splits

Groom jumps off stage for impromptu dance with friends, viral video leaves netizens in splits![submenu-img]() Viral video: Chinese man stuns internet by balancing sewing machine on glass bottles, watch

Viral video: Chinese man stuns internet by balancing sewing machine on glass bottles, watch![submenu-img]() Watch: First video of Mukesh Ambani's son Anant Ambani-Radhika Merchant's 2nd pre-wedding bash goes viral

Watch: First video of Mukesh Ambani's son Anant Ambani-Radhika Merchant's 2nd pre-wedding bash goes viral![submenu-img]() Viral video: Outrage over woman's dance at Mumbai airport sparks calls for action, watch

Viral video: Outrage over woman's dance at Mumbai airport sparks calls for action, watch

)

)

)

)

)

)