By the time you get to read this, the fate of India’s continuance in the World Cup would be known as they battle it out in a humdinger against Sri Lanka for a place in the super 8.

MUMBAI: By the time you get to read this, the fate of India’s continuance in the World Cup would be known as they battle it out in a humdinger against Sri Lanka for a place in the super 8.

Closer home, there’s war raging in the direct-to-home (DTH) segment. Dish TV and Tata Sky are fighting another thriller to ensnare as many customers as possible from cable networks as the cricket fever reaches a crescendo. Their prayer is that India win, as a win could help them garner more customers while a loss could mar a great opportunity to grow the subscription numbers.

With no strings attached to it, literally, DTH segment is ready to reach for the stratosphere with the entry of new players like Sun TV, Bharti, ADAG Group coupled with aggressive roll out plans of Dish TV, market leader, and its closest competitor, Tata Sky.

For Dish TV, there’s another major event round the corner. Promoted by Essel group, also a co-promoter of this newspaper, the DTH player will make its debut early next week at the stock bourses. Citigroup and ENAM India Research in a curtain raiser have indicated the fair value of the scrip at Rs 120.

ENAM gives an idea of the potential of the nascent DTH sector. It says that the segment will grow at 91% CAGR to reach 30.6 million homes, and will be a $3 billion industry in India by 2011. Dish TV is targeting 7.1 million subscription base with revenues over $696 million by 2011.

Post listing, the company will scout for a strategic partner to fund this ambitious roll out plan worth Rs 1,000 crore over the next two years. These are ambitious numbers as Dish TV now has a current subscriber base of 1.9 million with $18 million in revenues.

Tata Sky, its main rival in the sector, has managed to build up a subscriber base of half a million in six months and has hopped on to the world cup bandwagon to increase its market share further.

But the world cup is not the main trigger for the growth in the customer base of DTH service providers. Industry circles aver that the first phase implementation of CAS (Conditional Access System) in three cities has provided the much-needed impetus to this industry.

“Demand outstripped supply in the first week of January 2007,” says Vikram Mehra, Head-Consumer marketing, Tata Sky, referring to December 31 deadline for CAS implementation. “We had to employ 1,500 engineers on temporary basis to meet the demand,” says Mehra. He cited Tata brand’s strong aspirational value and reliability image as one of the reasons for gaining ready acceptance in the market.

Also the government’s initiative to convert at least two-thirds of TV homes into CAS before Commonwealth Games in 2010 seems to be working in DTH’s favour.

So the multi-million dollar question is whether cable and satellite (C&S) are on the wane? ENAM Research thinks otherwise. The research of the premier stock brokerage puts C&S figure at 110 million for 2011 from 68 million currently, predicting an average growth of 10%.

Anjali Malhotra, V-P, marketing, Dish TV, says, “It is too early to compare. C&S and IPTV are also in growth stage. DTH scores over C&S as it doesn’t need miles of cable for connectivity, it can be installed in hilly and inaccessible areas, repair and maintenance is low, there is an array of channel choices, and it comes with futuristic services such as gaming and interactive sessions. ”

The message is not lost to other industry bigwigs who are fast covering the lost ground to share the spoil with the Dish TV and Tata Sky.

South India media conglomerate Sun TV is expected to launch its DTH operations in calendar year 2007. ADAG (Anil Dhirubhai Ambani group) and Bharti group have recently received their DTH licences and are expected to commence operation by 2008.

Industry watchers predict predatory pricing as competition hots up with entry of such players with a history of working on economies-of-scale model. Currently, the average revenue per user (ARPU) in India is $4 as compared with $65 in the US and £44 in UK. The installation and monthly subscription for the two existing players is Rs 3,990 and Rs 300 respectively. Vikram Mehra sounds defensive on predatory pricing.

“This sector is primarily driven by creative content and fee of these creative minds will only go north in future. This will have a cascading effect on service providers too.

I don’t see the prices going down further. Having said that if competitors lower the price, we will have no choice but to follow suit.” The industry analysts say that funding may not be an issue as all the players have a pedigree in launching new ventures but companies will have to demonstrate execution and customer acquisition skills.

To eat into C&S pie will remain a major challenge for DTH. Emerging technologies like IPTV is also seen as a threat to DTH segment.

![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?

DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?![submenu-img]() 1 dead, many injured after London-Singapore flight hit by severe...

1 dead, many injured after London-Singapore flight hit by severe...![submenu-img]() This film was based on iconic love story, actors and director died midway, was released incomplete 23 years later

This film was based on iconic love story, actors and director died midway, was released incomplete 23 years later![submenu-img]() Meet man who used to go medicine factory in childhood, now runs Rs 109000 crore pharma company, his net worth is...

Meet man who used to go medicine factory in childhood, now runs Rs 109000 crore pharma company, his net worth is...![submenu-img]() Akshay Kumar 'accidently' collided with RTO officer's bike in Bangkok, shares what happened next: 'I immediately...'

Akshay Kumar 'accidently' collided with RTO officer's bike in Bangkok, shares what happened next: 'I immediately...' ![submenu-img]() Maharashtra HSC 12th 2024: Result declared, know how to check

Maharashtra HSC 12th 2024: Result declared, know how to check![submenu-img]() Meet man who topped IIT-JEE, studied at IIT Bombay, then went to MIT, now is...

Meet man who topped IIT-JEE, studied at IIT Bombay, then went to MIT, now is...![submenu-img]() Meet man who once used to sell newspapers at 9, cracked UPSC exam, he is now…

Meet man who once used to sell newspapers at 9, cracked UPSC exam, he is now…![submenu-img]() Meet woman who secured high-paying job, not from IIT, IIM, VIT, her record-breaking package is...

Meet woman who secured high-paying job, not from IIT, IIM, VIT, her record-breaking package is...![submenu-img]() Maharashtra HSC Result 2024: Class 12th result to be released today, know time, steps to check

Maharashtra HSC Result 2024: Class 12th result to be released today, know time, steps to check![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() AI models show bikini style for perfect beach holiday this summer

AI models show bikini style for perfect beach holiday this summer![submenu-img]() Laapataa Ladies actress Chhaya Kadam ditches designer clothes, wears late mother's saree, nose ring on Cannes red carpet

Laapataa Ladies actress Chhaya Kadam ditches designer clothes, wears late mother's saree, nose ring on Cannes red carpet![submenu-img]() Urvashi Rautela mesmerises in blue celestial gown, her dancing fish necklace steals the limelight at Cannes 2024

Urvashi Rautela mesmerises in blue celestial gown, her dancing fish necklace steals the limelight at Cannes 2024![submenu-img]() Kiara Advani attends Women In Cinema Gala in dramatic ensemble, netizens say 'who designs these hideous dresses'

Kiara Advani attends Women In Cinema Gala in dramatic ensemble, netizens say 'who designs these hideous dresses'![submenu-img]() Influencer Diipa Büller-Khosla looks 'drop dead gorgeous' in metallic structured dress at Cannes 2024

Influencer Diipa Büller-Khosla looks 'drop dead gorgeous' in metallic structured dress at Cannes 2024![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?

DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() This film was based on iconic love story, actors and director died midway, was released incomplete 23 years later

This film was based on iconic love story, actors and director died midway, was released incomplete 23 years later![submenu-img]() Akshay Kumar 'accidently' collided with RTO officer's bike in Bangkok, shares what happened next: 'I immediately...'

Akshay Kumar 'accidently' collided with RTO officer's bike in Bangkok, shares what happened next: 'I immediately...' ![submenu-img]() Meet man, his grandfather founded political party, uncle was CM, he ditched it for Bollywood, worked for Bhansali, now..

Meet man, his grandfather founded political party, uncle was CM, he ditched it for Bollywood, worked for Bhansali, now..![submenu-img]() Meet actor who worked with SRK, Salman, Sushmita, gave many flop films, quit acting, married granddaughter of CM..

Meet actor who worked with SRK, Salman, Sushmita, gave many flop films, quit acting, married granddaughter of CM..![submenu-img]() 'Pregnant for sure': Katrina Kaif, Vicky Kaushal's viral video from London sparks pregnancy speculations

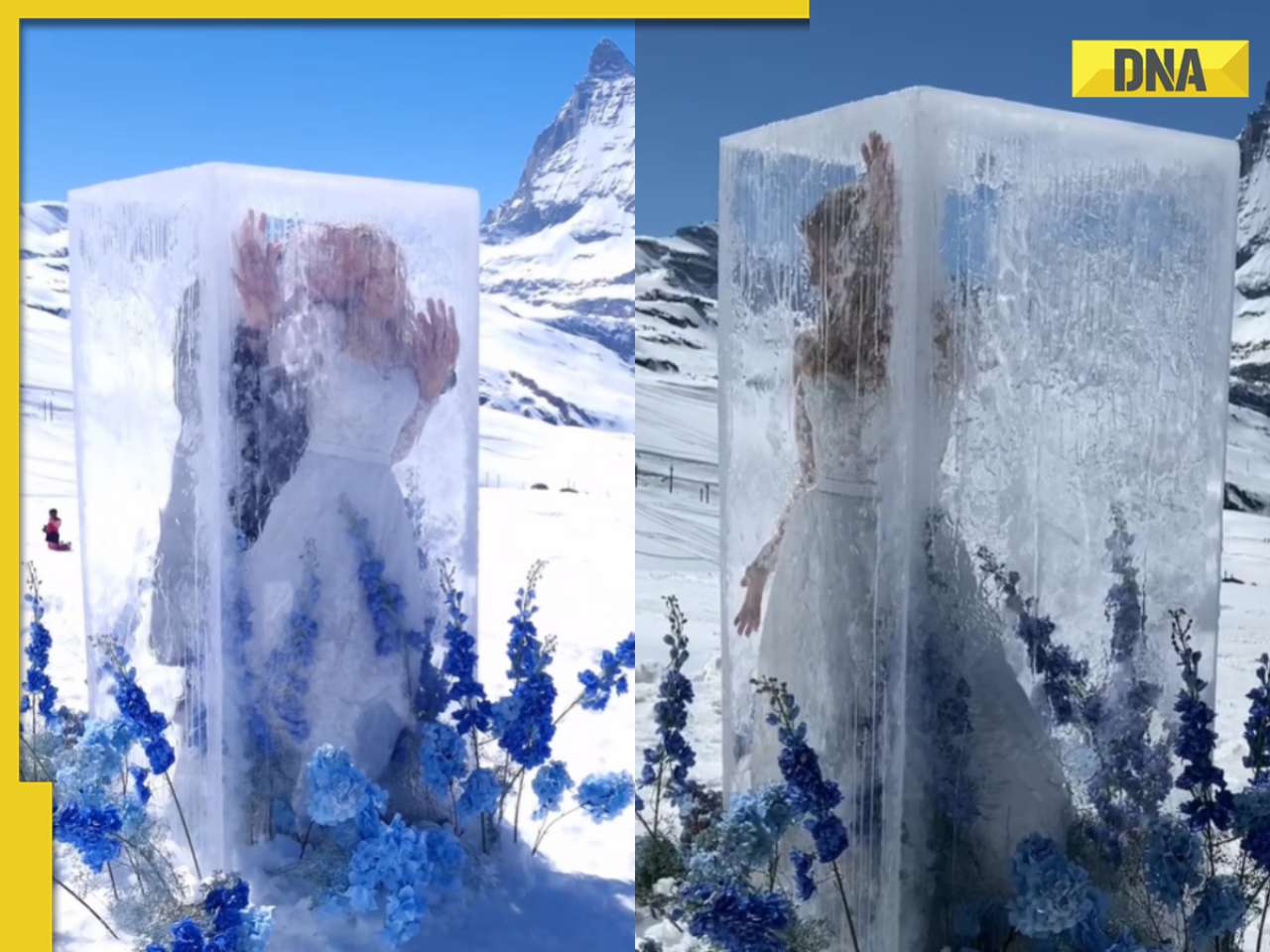

'Pregnant for sure': Katrina Kaif, Vicky Kaushal's viral video from London sparks pregnancy speculations ![submenu-img]() Viral video: Bride makes dramatic entrance from giant ice cube at snowy Alpine wedding in Switzerland

Viral video: Bride makes dramatic entrance from giant ice cube at snowy Alpine wedding in Switzerland![submenu-img]() Elephant lifts safari truck with tourists in shocking viral video, watch

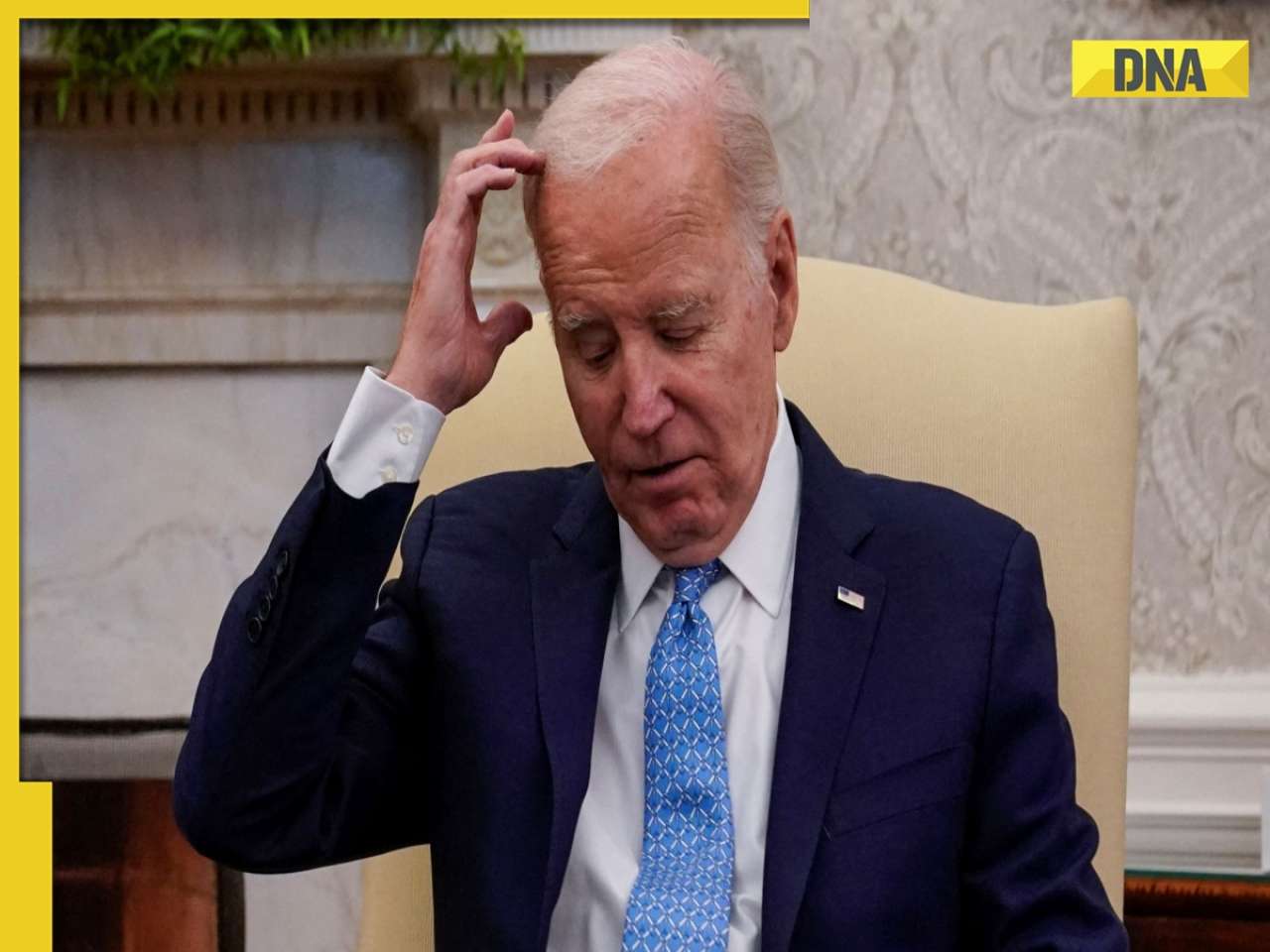

Elephant lifts safari truck with tourists in shocking viral video, watch![submenu-img]() In another gaffe, Joe Biden says he was US 'Vice President' during COVID-19 pandemic, watch viral video

In another gaffe, Joe Biden says he was US 'Vice President' during COVID-19 pandemic, watch viral video![submenu-img]() Meet Nihar Thackeray, lesser-known nephew of Uddhav Thackeray, he is Eknath Shinde's...

Meet Nihar Thackeray, lesser-known nephew of Uddhav Thackeray, he is Eknath Shinde's...![submenu-img]() Heroic buffalo herd rescues one of their own from lion ambush, video is viral

Heroic buffalo herd rescues one of their own from lion ambush, video is viral

)

)

)

)

)

)