Since the Union Cabinet gave its nod to amend the SBI (Subsidiary Banks) Act, 1959, analysts feel it is just a matter of time before the merger takes place.

MUMBAI: The merger of seven associate banks with SBI is a matter of intense speculation in banking sector. Since the Union Cabinet gave its nod to amend the SBI (Subsidiary Banks) Act, 1959, analysts feel it is just a matter of time before the merger takes place.

Currently, three of the associate banks —State Bank of Patiala, State Bank of Indore and State Bank of Hyderabad— in which SBI holds a 100% stake, are not listed.

If the seven associate banks of SBI are merged with SBI, it will significantly enhance the operations of the country’s largest bank. The seven associate banks have a combined branch network of 4,755, which means SBI’s branch strength would rise by 51% to 14,061, based on September 2006 figures. All the group’s branches are fully computerised and of that, 8,952 branches (including 4,169 of SBI) are now on the Core Banking Platform.

In other words, as much as 70% of the total business and 100.86 million accounts of the SBI group are on Core Banking. Interestingly, the associate banks are the only public sector banks to be fully networked.

The combined operations would have the largest ATM network of 5,624 (a base of 19.55 million cards), which is being expanded further by another 3,000 ATMs in 2007 alone. The credit card base would stand at over 3 million. In short, there is little effort and investment that SBI will have to do in order to integrate the operations completely.

On the financial front also, it is a boost for SBI. For instance, on a consolidated basis, SBI’s net profit for 2005-06 would be 35% higher at Rs 6,000 crore, as compared to its standalone profits.

For the first half year ended September 30, 2006, too, net profit would be higher by 36% at Rs 2,697.5 crore.

Likewise, its net worth will enhance by 35% to Rs 41,402 crore. And since the associate banks have delivered better return on equity (16.01%), as against SBI’s 13.39% for the period, the merger should result in increased return on equity on a consolidated basis.

Based on pure arithmetic calculations, if the seven associate banks were to be merged with SBI and assuming that SBI’s holding in these subsidiaries is cancelled, the net equity dilution will be just 2.53% for SBI, taking its equity capital higher to Rs 539.30 crore, while substantially increasing its book value per share.

But, does that serve the government’s intention to maintain its stake in SBI? Not really! The other possibility could be that these seven banks are valued and SBI’s stake is sold to the government for cash. Thereafter, these seven banks are merged with SBI, wherein the government’s stake automatically rises. And for SBI, it also gets cash, which it can use to fund expansion.

What valuation one should expect for SBI post-merger? Here is the arithmetic. SBI’s current book value is Rs 525. Add to this the book value of the banks merged (only three of them). At Rs 114 for a 100% merger, what should be added to Rs 525 is Rs 57 for a 51% stake.

Add SBI’s earnings per share for FY07, which is an estimated Rs 81.70. Then deduct the dividend payout of Rs 14 for the year. That would give you a book value figure of Rs 650.

At 1.8 times this book value, SBI’s share post-merger should quote around Rs 1,170. But, this is considering the merger of only the three currently unlisted banks. However, if you consider the merger of all the seven associates, SBI’s share should quote between Rs 1,250 and Rs 1,300.

If the conventional price-earning multiple is considered, you can expect a PE of 13, based on FY08 earnings post-merger of three banks into SBI. Says Jyoti Khatri, banking analyst with K R Choksey Securities: “Whichever way you look at it, the merger should make SBI a star sector performer in the bourses.”

There are analysts who beg to differ. Says Ashutosh Narker, banking analyst with India Infoline: “SBI is already valued on a consolidated basis. So, post-merger SBI’s valuation may not change much.”

Narker’s logic is simple. The merger would involve just a book entry and SBI’s current valuation already discounts the values of its associates. Concurs Vishal Goel, Edelweiss Securities’ banking analyst: “Currently, as much as 80% of the value of the associate banks is already built into SBI’s value.” Going by that, post-merger, expect SBI’s valuation to move up just by 5 or 10%. Adds Narkar: “Most PSU banks are trading in the range of 1.2 to 1.4 times their respective price-to-book-values, a few at 1.7 times. Thus, I do not see any significant deviation for SBI from the current levels.”

Going by this, SBI’s current price to book value at 2.05 times seems to have already factored in the gains from consolidation, at least when compared to PSU banks. However, considering valuations of 3.5 to 6 times price-to-book-value that some key private sector banks enjoy, then there is ample scope. However, again, it is not as easy at it seems though the gap between SBI and private sector banks can narrow in future.

Thus, the merger is expected to be largely on paper or for accounting purposes. Says Narkar: “Everybody values SBI on a consolidated basis and not just as a standalone entity. Although SBI has forayed into businesses like mutual funds and insurance, these are relatively smaller. Thus, greater focus should be on valuation of the banking business.”

All said and done, there are areas where the associate banks lag behind. For instance, except for State Bank of Bikaner & Jaipur, all other associates have a lower spread ranging between 2.96% and 3.77%, compared to SBI’s 4.04%. Likewise, the cost to income ratio for State Bank of Indore and State Bank of Mysore are visibly higher at 58.2% and 55.2% respectively as against 51.6% for SBI. So, there are areas where SBI will have to work harder in order to improve profitability.

So far so good! In fact, SBI and its associate banks have already achieved synergies in many operational areas. For instance, customers of every bank have access to the ATM network of the group. Says Kanan Shah, senior analyst, Networth Stock Broking: “Right now, only the technology aspect of the group is fully integrated.”

Upon merger, the need of the hour would be ‘real freedom’ for SBI, which means more leeway to manage operational costs, especially labour. Says Narkar: “SBI has not been able to cut costs even now. So, if it is able to manage the workforce, then that could act as the trigger. Currently, most PSU banks enjoy a margin of 3 to 3.5% and the biggest cost centre is the employee cost. Hence, that has to be reduced and only then profits would increase.”

For SBI, staff expenses accounted for 35% of the total operating income or 69% of the operating expenses for nine months ended December 31, 2006. Explains Quantum Mutual Fund’s Director I V Subramaniam: “With regards financials, it will look good. However, unless you give power to close down branches and rationalise employee base in areas of duplication, it won’t help. It should not be a book merger.”

The final question: will the valuation gap reduce? Says Shah: “The valuation gap between SBI and private banks would narrow only after 2009, when the banking space is truly opened up for competition. Right now, SBI cannot even dilute its equity beyond the 51% limit.” It is true that SBI now faces too much of regulation and policy issues.

The merger would mean a stronger and hopefully a more efficient SBI. That is besides better valuation and handsome gains for SBI shareholders. However, for the merger to become a big success, what you need is political will. And of course, co-operation from labour unions.

![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() Hassan horror: Sex scandal Prajwal Revanna breaks silence, to appear before SIT on...

Hassan horror: Sex scandal Prajwal Revanna breaks silence, to appear before SIT on...![submenu-img]() Shakira likely to perform at Anant Ambani-Radhika Merchant’s 2nd pre-wedding bash; she will charge…

Shakira likely to perform at Anant Ambani-Radhika Merchant’s 2nd pre-wedding bash; she will charge…![submenu-img]() Divya Agarwal sparks divorce rumours with Apurva Padgaonkar three months after marriage, deletes...

Divya Agarwal sparks divorce rumours with Apurva Padgaonkar three months after marriage, deletes...![submenu-img]() Noida news: IRS officer arrested for allegedly killing woman whom he met on dating app

Noida news: IRS officer arrested for allegedly killing woman whom he met on dating app![submenu-img]() Meet man who was hired for record-breaking pay package, not from IIT or IIM, his salary is…

Meet man who was hired for record-breaking pay package, not from IIT or IIM, his salary is…![submenu-img]() IIT graduate got job with Rs 100 crore salary, fired within a year, replaced by woman with Rs 33 crore pay, she is...

IIT graduate got job with Rs 100 crore salary, fired within a year, replaced by woman with Rs 33 crore pay, she is...![submenu-img]() Meet youngest IAS officer of her batch, who cracked UPSC exam in first attempt, secured AIR...

Meet youngest IAS officer of her batch, who cracked UPSC exam in first attempt, secured AIR...![submenu-img]() Maharashtra SSC Result 2024: MSBSHSE Class 10 results to be out today; check time, direct link here

Maharashtra SSC Result 2024: MSBSHSE Class 10 results to be out today; check time, direct link here![submenu-img]() Meet IAS officer, son of grocery store owner, who left Rs 25 lakh job to crack UPSC exam in first attempt, secured AIR..

Meet IAS officer, son of grocery store owner, who left Rs 25 lakh job to crack UPSC exam in first attempt, secured AIR..![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() Avneet Kaur shines in navy blue gown with shimmery trail at Cannes 2024, fans say 'she is unstoppable now'

Avneet Kaur shines in navy blue gown with shimmery trail at Cannes 2024, fans say 'she is unstoppable now'![submenu-img]() Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes

Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes ![submenu-img]() Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'

Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'![submenu-img]() AI models play volley ball on beach in bikini

AI models play volley ball on beach in bikini![submenu-img]() AI models set goals for pool parties in sizzling bikinis this summer

AI models set goals for pool parties in sizzling bikinis this summer![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?

DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() Divya Agarwal sparks divorce rumours with Apurva Padgaonkar three months after marriage, deletes...

Divya Agarwal sparks divorce rumours with Apurva Padgaonkar three months after marriage, deletes...![submenu-img]() 'Felt bad for...': Amitabh Bachchan reacts to 'most touching' moment from IPL 2024 KKR vs SRH final

'Felt bad for...': Amitabh Bachchan reacts to 'most touching' moment from IPL 2024 KKR vs SRH final![submenu-img]() Karan V Grover talks about playing Suryapratap in Dhruv Tara, says he enjoys challenging roles | Exclusive

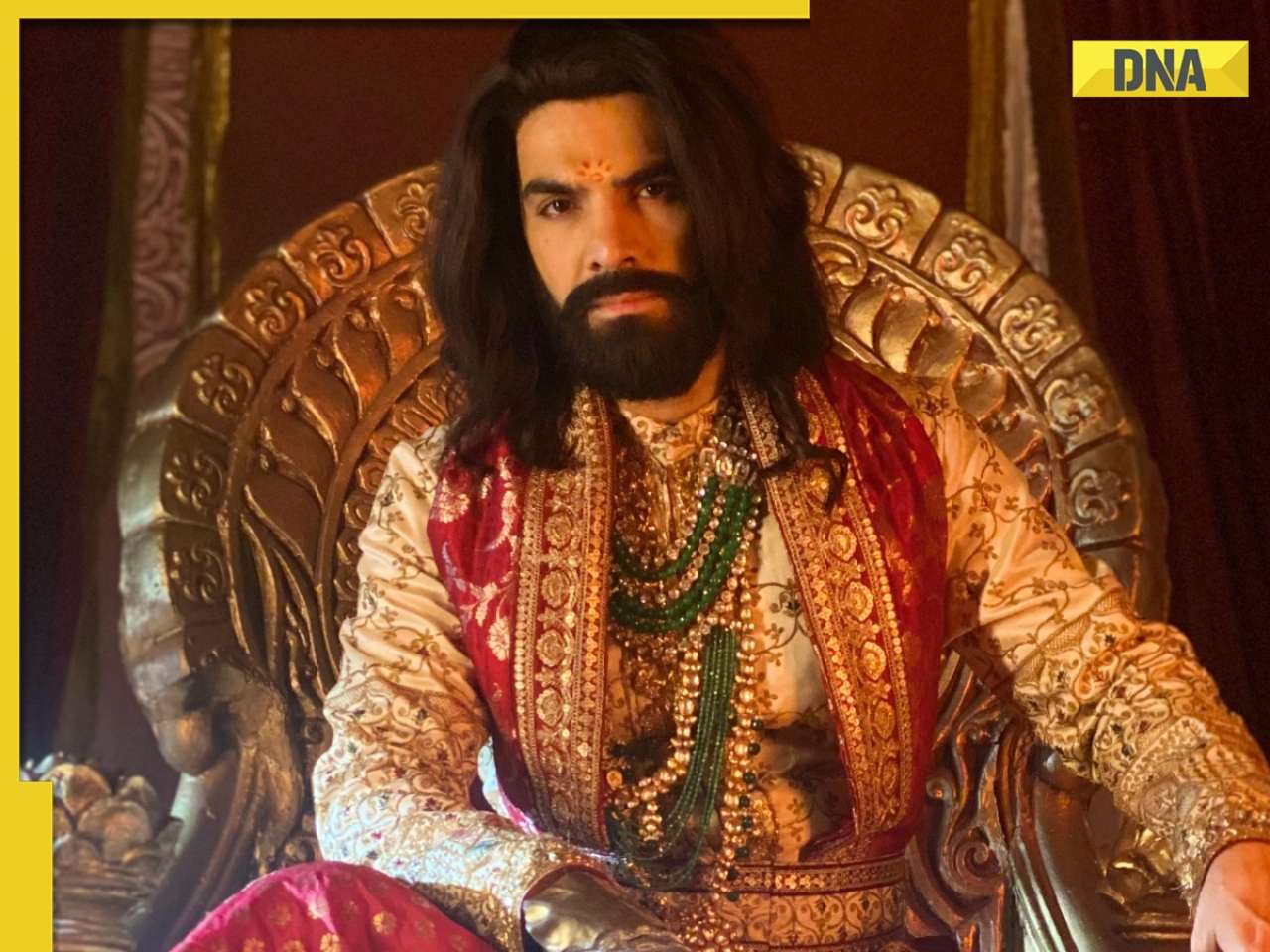

Karan V Grover talks about playing Suryapratap in Dhruv Tara, says he enjoys challenging roles | Exclusive![submenu-img]() Dhadak 2: Karan Johar announces sequel, reveals cast; film to release on...

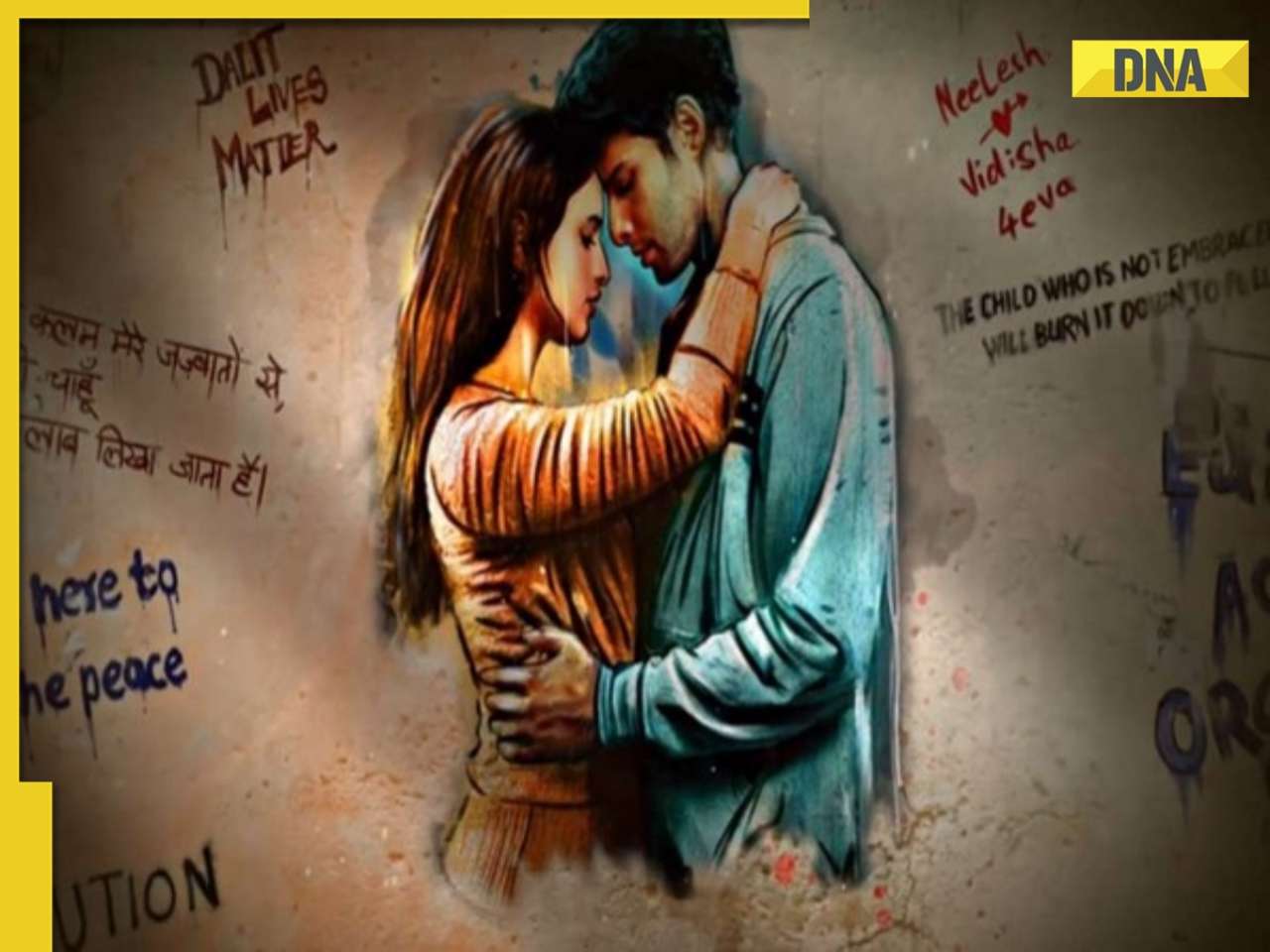

Dhadak 2: Karan Johar announces sequel, reveals cast; film to release on...![submenu-img]() Munawar Faruqui gets married for second time? Viral inside photo from ceremony has fans puzzled

Munawar Faruqui gets married for second time? Viral inside photo from ceremony has fans puzzled![submenu-img]() Shakira likely to perform at Anant Ambani-Radhika Merchant’s 2nd pre-wedding bash; she will charge…

Shakira likely to perform at Anant Ambani-Radhika Merchant’s 2nd pre-wedding bash; she will charge…![submenu-img]() Mukesh Ambani hosting massive birthday party on cruise for Akash Ambani’s daughter, to be followed by Cannes...

Mukesh Ambani hosting massive birthday party on cruise for Akash Ambani’s daughter, to be followed by Cannes...![submenu-img]() This island has more cats than humans, it is located in...

This island has more cats than humans, it is located in...![submenu-img]() Rapper bets big on Shah Rukh Khan’s KKR, wins over Rs 35000000 after easy IPL 2024 final win

Rapper bets big on Shah Rukh Khan’s KKR, wins over Rs 35000000 after easy IPL 2024 final win![submenu-img]() Hijab, beard is banned in this country with 96% Muslim population

Hijab, beard is banned in this country with 96% Muslim population

)

)

)

)

)

)