The board slapped market intermediaries with the largest penalty ever for their involvement in this year’s IPO scam.

MUMBAI: The Securities and Exchange Board of India came down like the proverbial tonne of bricks on market intermediaries, slapping the largest penalty ever for their involvement in this year’s IPO scam.

In a “disgorgement order” — India is seeing such an order for the first time —– SEBI has asked them to pay a collective penalty of Rs115.81 crore.

A disgorgement order pertains to return of illegal gains made by the intermediaries. The money may go into the Investor Protection Fund.

The National Securities Depository Ltd, owned by government-owned financial institutions and the National Stock Exchange, and the Central Depository Services Ltd, also owned by financial institutions and the Bombay Stock Exchange, will have to pay up Rs45 crore and Rs12.89 crore, respectively, to the regulator.

Others, such as Karvy Stock Broking, HDFC Bank, Khandwala Integrated Financial Services, IDBI Bank, Jhaveri Securities, ING Vysya Bank, Pravin Ratilal Share & Stock Broking, and Pratik Stock Vision - have been asked to cough up various amounts (see table) in six months in proportion to their involvement in the scam.

The order said these entities can seek contribution from any party other than the intermediaries involved in the scam. “All parties are at liberty to seek contribution or indemnity from any party that they believe is liable to a greater extent than quantified here, as also from individuals and companies which were involved in the IPO cornering or fraud but are not named, not being intermediaries under section 12 of the SEBI Act 1992,” the order said.

Disgorgement, as defined by SEBI in its order, “is a useful equitable remedy because it strips the perpetrator of the fruits of his unlawful activity and returns him to the position he was in before he broke the law”.

SEBI arrived at the amount to be disgorged by multiplying the shares garnered the wrongful allotment with the difference between the listing price and the issue price. This was done in each of the 21 cases where unfair allotment was made.

The “disgorgement order” is the first of its kind from the market regulator. Disgorgement was first introduced in advanced markets to deter others from committing similar frauds. In the past, SEBI has used its discretion to levy stiff penalties on wrongdoers.

When DNA contacted CB Bhave, chairman of NSDL, for a reaction, he said, “We haven’t seen the order yet, so how can I comment?” He said NSDL’s lawyers haven’t read the order either.

Earlier this year, SEBI found that 24 key operators had cornered large chunks of the retail portion of 21 IPOs between 2003 and 2005 by using benami or fictitious accounts. The operators and their financiers are alleged to have used 58,938 such accounts.

After the IPO allotment, these fictitious allottees transferred shares to their principals, who in turn transferred the shares to the financiers who had originally made the funds available for executing the plan. The financiers sold most of these shares on the first day of listing, making huge gains.

![submenu-img]() Delhi-NCR weather update: Rain in parts of Delhi, Noida after record heat

Delhi-NCR weather update: Rain in parts of Delhi, Noida after record heat![submenu-img]() Hardik Pandya finally breaks silence amid divorce rumours with Natasa Stankovic

Hardik Pandya finally breaks silence amid divorce rumours with Natasa Stankovic![submenu-img]() Watch viral video: 17 cars gutted as fire erupts at parking lot in Delhi

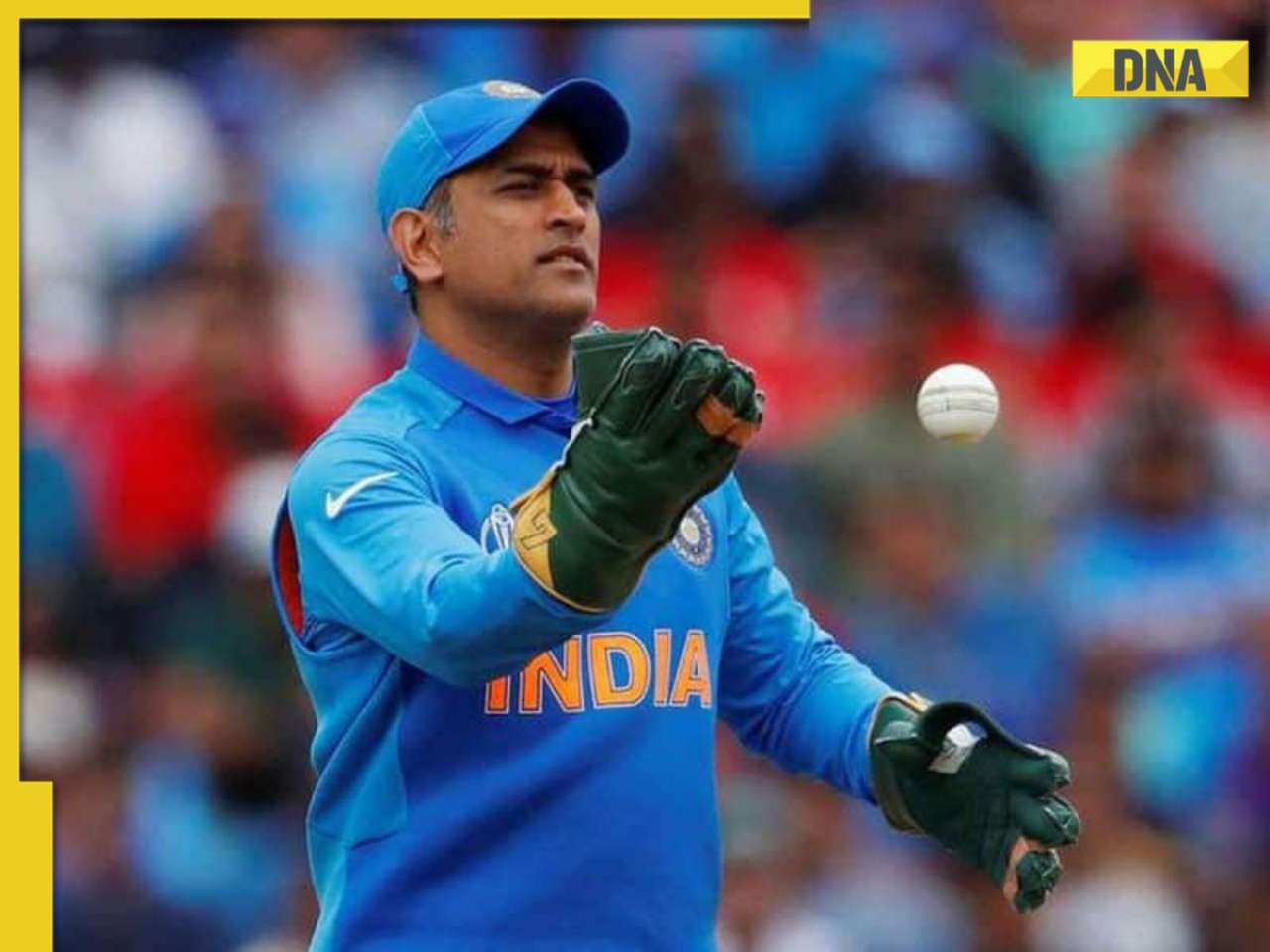

Watch viral video: 17 cars gutted as fire erupts at parking lot in Delhi![submenu-img]() Explained: Why MS Dhoni cannot apply for India head coach job

Explained: Why MS Dhoni cannot apply for India head coach job![submenu-img]() Nargis, Bina Rai, Suraiya rejected this role, chosen actress refused Filmfare Award; film became classic, is based on...

Nargis, Bina Rai, Suraiya rejected this role, chosen actress refused Filmfare Award; film became classic, is based on...![submenu-img]() RBSE 10th Result 2024: Rajasthan Board Class 10 results to be out today; check time, direct link here

RBSE 10th Result 2024: Rajasthan Board Class 10 results to be out today; check time, direct link here![submenu-img]() Meet Indian genius who founded India's first pharma company, he is called 'Father of...

Meet Indian genius who founded India's first pharma company, he is called 'Father of...![submenu-img]() DU Admission 2024: Delhi University launches admission portal to 71000 UG seats; check details

DU Admission 2024: Delhi University launches admission portal to 71000 UG seats; check details![submenu-img]() Meet IAS officer, who became UPSC topper in 1st attempt, sister is also IAS officer, mother cracked UPSC exam, she is...

Meet IAS officer, who became UPSC topper in 1st attempt, sister is also IAS officer, mother cracked UPSC exam, she is...![submenu-img]() Meet student who cleared JEE Advanced with AIR 1, went to IIT Bombay but left after a year due to..

Meet student who cleared JEE Advanced with AIR 1, went to IIT Bombay but left after a year due to..![submenu-img]() DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo

DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo![submenu-img]() DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here

DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() Avneet Kaur shines in navy blue gown with shimmery trail at Cannes 2024, fans say 'she is unstoppable now'

Avneet Kaur shines in navy blue gown with shimmery trail at Cannes 2024, fans say 'she is unstoppable now'![submenu-img]() Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes

Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes ![submenu-img]() Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'

Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'![submenu-img]() AI models play volley ball on beach in bikini

AI models play volley ball on beach in bikini![submenu-img]() AI models set goals for pool parties in sizzling bikinis this summer

AI models set goals for pool parties in sizzling bikinis this summer![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?

DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() Nargis, Bina Rai, Suraiya rejected this role, chosen actress refused Filmfare Award; film became classic, is based on...

Nargis, Bina Rai, Suraiya rejected this role, chosen actress refused Filmfare Award; film became classic, is based on...![submenu-img]() Meet Shah Rukh Khan, Akshay Kumar’s heroine, who gave 19 flops in 14 years, quit films; now runs India’s first…

Meet Shah Rukh Khan, Akshay Kumar’s heroine, who gave 19 flops in 14 years, quit films; now runs India’s first…![submenu-img]() Meet actress, who lost films to star kids, was insulted by on shoot; later worked in biggest Indian film, is worth...

Meet actress, who lost films to star kids, was insulted by on shoot; later worked in biggest Indian film, is worth...![submenu-img]() Jitendra Kumar says there is scope for multiple seasons of Panchayat, opens up on chances of season 4 | Exclusive

Jitendra Kumar says there is scope for multiple seasons of Panchayat, opens up on chances of season 4 | Exclusive![submenu-img]() Randeep Hooda marks Swatantrya Veer Savarkar OTT release with visit to cellular jail in Andaman, sees Savarkar's cell

Randeep Hooda marks Swatantrya Veer Savarkar OTT release with visit to cellular jail in Andaman, sees Savarkar's cell![submenu-img]() Meet Mukesh Ambani's bahu Radhika Merchant's makeup artist, whose client is Alia Bhatt, her fees is...

Meet Mukesh Ambani's bahu Radhika Merchant's makeup artist, whose client is Alia Bhatt, her fees is...![submenu-img]() 'All Eyes On Rafah' campaign goes viral on social media, here's what the image means

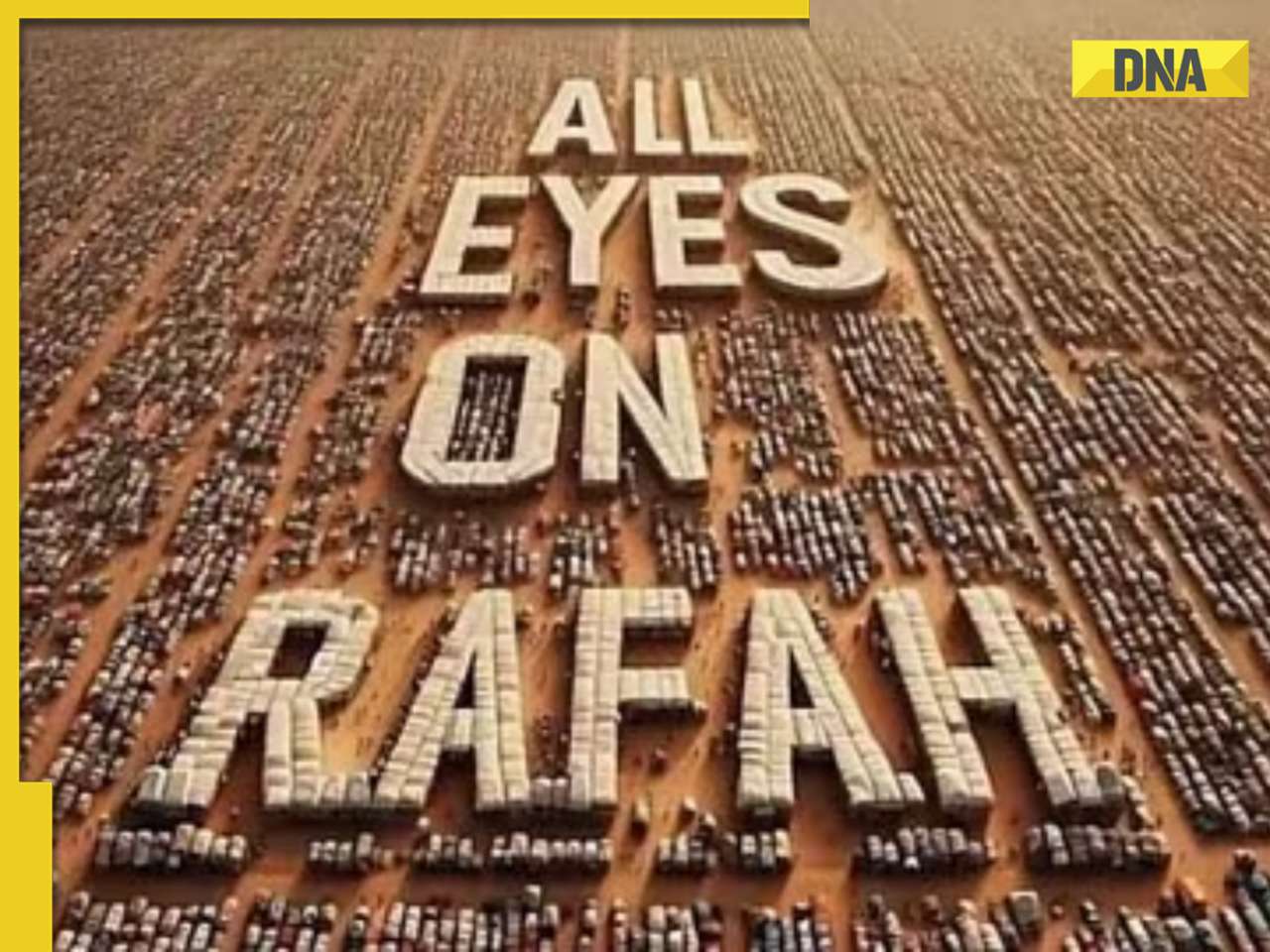

'All Eyes On Rafah' campaign goes viral on social media, here's what the image means![submenu-img]() Mukesh Ambani's son Anant Ambani, Radhika Merchant's 2nd pre-wedding bash begins today: Know all details here

Mukesh Ambani's son Anant Ambani, Radhika Merchant's 2nd pre-wedding bash begins today: Know all details here![submenu-img]() Viral video: Woman takes over streets of London in lungi, here’s how locals reacted

Viral video: Woman takes over streets of London in lungi, here’s how locals reacted![submenu-img]() Which countries are witnessing rapid increase in Muslim population? Where does India stand? Check full list here

Which countries are witnessing rapid increase in Muslim population? Where does India stand? Check full list here

)

)

)

)

)

)