Industrial unrest in distant Chile seems to spell good times for Indian copper exports and provide the much needed fundamental support.

KOLKATA: Industrial unrest in distant Chile seems to spell good times for Indian copper exports and provide the much needed fundamental support after the global meltdown in base metal markets on Monday.

Scenarios of a global shortage, sparked by industrial strike at BHP Billiton’s Escondida copper mines in Chile, fuelled a fierce bull run in prices of the commodity and its subsequent resolution last month weakened the market following profit bookings by hedge funds. But news trickling in of fresh industrial unrest, once again at Billiton’s Spence copper mines in Chile, may be able to boost sagging copper prices at the London Metal Exchange (LME).

This can only be good portent for Indian copper producers like Sterlite Industries and Hindalco Industries, with the country for the first time poised to export around 4.5 to 5 lakh tonne of copper in 2006-07, outstripping total domestic consumption forecast at 4 lakh tonne.

Sterlite Industries, which has converted its smelter at Tuticorin into a 100% export oriented unit, is expected to ship its entire production of around 3 lakh tonnes overseas .

On Monday, spot cash price of copper at LME crashed to $7,520 per tonne after opening at $7,820 and hit the entire base metal market hard, pulling down aluminium to $2,535 per tonne after opening at $2,637, as hedge funds booked profits.

But, officials at Hindustan Copper Ltd, which is a pure domestic player, and Sterlite Industries said that global copper stocks at LME warehouses also fell by 3,625 tonne to 121,525 tonne, equivalent to just three days of global consumption. This, along with news of fresh workers’ strike at Spence mines, was expected to provide support to the short-term weak copper markets.

Of course, BHP Billiton’s Spence mines are not yet operational, but analysts said that a strike would affect long-term fundamentals on the global supply side, and in turn fuel prices.

Analyst William Adams has been quoted as saying, “given that funds jumped in last week, and consumers too are getting active, we can expect metals to remain well underpinned, if anything head higher.”

“Although the Spence mines are not operational, a strike can delay production and hence tighten up fundamentals,” Adams said.

Fears of global shortage in copper, coupled with rising demand in Asia, sent prices spiralling from an average of $4,734 per tonne in January 2006 to $8,021 per tonne in May 2006 when workers at the Escondida mines struck work. It peaked at $8,070 per tonne at the LME on August 10 but thereafter weakened steadily to $7,595 per tonne as BHP Billiton reached a settlement with the mine workers.

Subsequently, as hedge funds booked profits at the peaks, copper prices started consolidating at lower levels, hinting at end of party for Indian exports as export realisations in 2006-07 threatened to lose momentum of the earlier months.

But, after news of another strike at Spence came in on Monday, integrated copper producers anticipate a renewed bull charge that can protect export realisations in the next few months.

![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?

DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?![submenu-img]() 1 dead, many injured after London-Singapore flight hit by severe...

1 dead, many injured after London-Singapore flight hit by severe...![submenu-img]() This film was based on iconic love story, actors and director died midway, was released incomplete 23 years later

This film was based on iconic love story, actors and director died midway, was released incomplete 23 years later![submenu-img]() Meet man who used to go medicine factory in childhood, now runs Rs 109000 crore pharma company, his net worth is...

Meet man who used to go medicine factory in childhood, now runs Rs 109000 crore pharma company, his net worth is...![submenu-img]() Akshay Kumar 'accidently' collided with RTO officer's bike in Bangkok, shares what happened next: 'I immediately...'

Akshay Kumar 'accidently' collided with RTO officer's bike in Bangkok, shares what happened next: 'I immediately...' ![submenu-img]() Maharashtra HSC 12th 2024: Result declared, know how to check

Maharashtra HSC 12th 2024: Result declared, know how to check![submenu-img]() Meet man who topped IIT-JEE, studied at IIT Bombay, then went to MIT, now is...

Meet man who topped IIT-JEE, studied at IIT Bombay, then went to MIT, now is...![submenu-img]() Meet man who once used to sell newspapers at 9, cracked UPSC exam, he is now…

Meet man who once used to sell newspapers at 9, cracked UPSC exam, he is now…![submenu-img]() Meet woman who secured high-paying job, not from IIT, IIM, VIT, her record-breaking package is...

Meet woman who secured high-paying job, not from IIT, IIM, VIT, her record-breaking package is...![submenu-img]() Maharashtra HSC Result 2024: Class 12th result to be released today, know time, steps to check

Maharashtra HSC Result 2024: Class 12th result to be released today, know time, steps to check![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() AI models show bikini style for perfect beach holiday this summer

AI models show bikini style for perfect beach holiday this summer![submenu-img]() Laapataa Ladies actress Chhaya Kadam ditches designer clothes, wears late mother's saree, nose ring on Cannes red carpet

Laapataa Ladies actress Chhaya Kadam ditches designer clothes, wears late mother's saree, nose ring on Cannes red carpet![submenu-img]() Urvashi Rautela mesmerises in blue celestial gown, her dancing fish necklace steals the limelight at Cannes 2024

Urvashi Rautela mesmerises in blue celestial gown, her dancing fish necklace steals the limelight at Cannes 2024![submenu-img]() Kiara Advani attends Women In Cinema Gala in dramatic ensemble, netizens say 'who designs these hideous dresses'

Kiara Advani attends Women In Cinema Gala in dramatic ensemble, netizens say 'who designs these hideous dresses'![submenu-img]() Influencer Diipa Büller-Khosla looks 'drop dead gorgeous' in metallic structured dress at Cannes 2024

Influencer Diipa Büller-Khosla looks 'drop dead gorgeous' in metallic structured dress at Cannes 2024![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?

DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() This film was based on iconic love story, actors and director died midway, was released incomplete 23 years later

This film was based on iconic love story, actors and director died midway, was released incomplete 23 years later![submenu-img]() Akshay Kumar 'accidently' collided with RTO officer's bike in Bangkok, shares what happened next: 'I immediately...'

Akshay Kumar 'accidently' collided with RTO officer's bike in Bangkok, shares what happened next: 'I immediately...' ![submenu-img]() Meet man, his grandfather founded political party, uncle was CM, he ditched it for Bollywood, worked for Bhansali, now..

Meet man, his grandfather founded political party, uncle was CM, he ditched it for Bollywood, worked for Bhansali, now..![submenu-img]() Meet actor who worked with SRK, Salman, Sushmita, gave many flop films, quit acting, married granddaughter of CM..

Meet actor who worked with SRK, Salman, Sushmita, gave many flop films, quit acting, married granddaughter of CM..![submenu-img]() 'Pregnant for sure': Katrina Kaif, Vicky Kaushal's viral video from London sparks pregnancy speculations

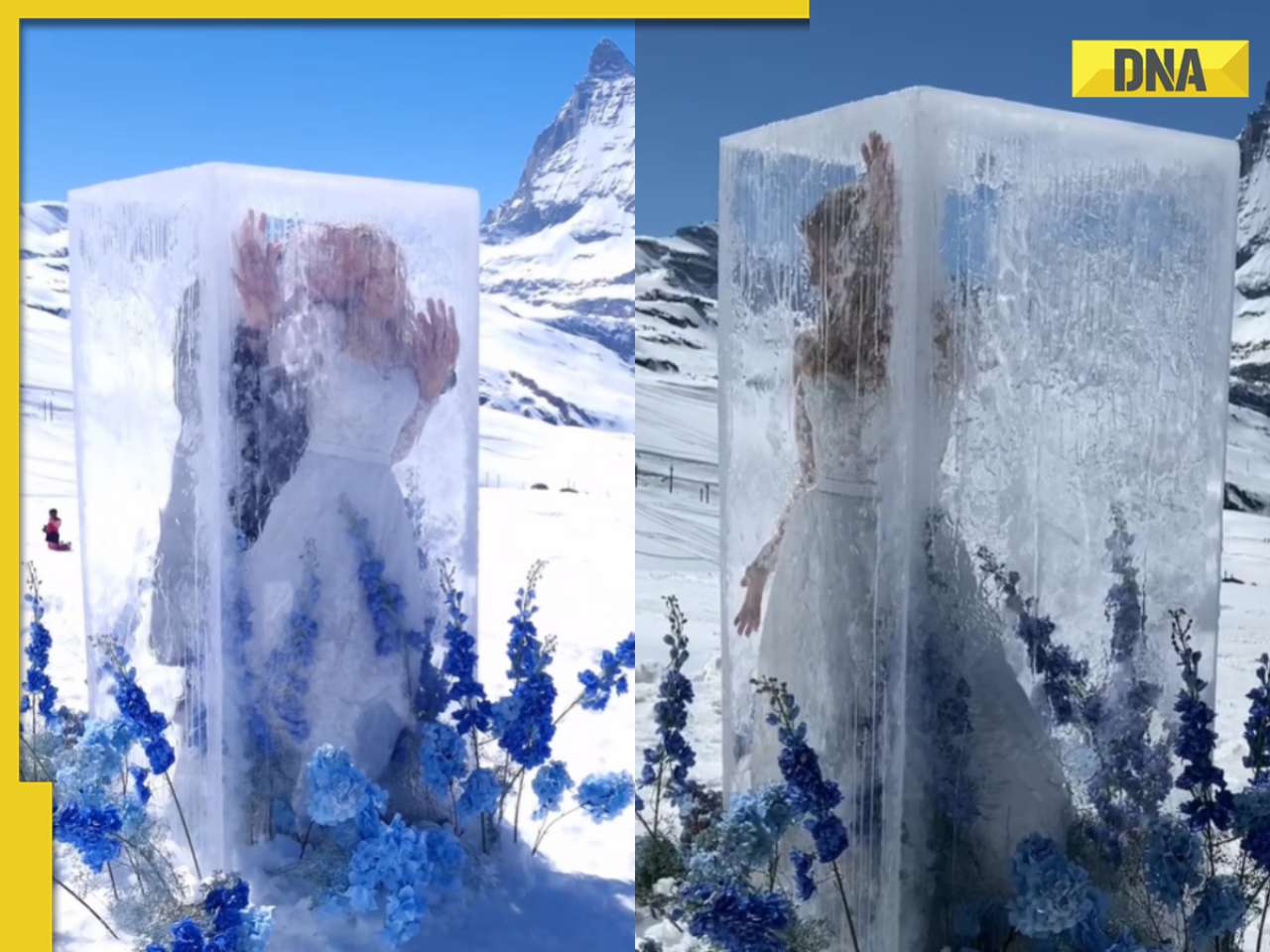

'Pregnant for sure': Katrina Kaif, Vicky Kaushal's viral video from London sparks pregnancy speculations ![submenu-img]() Viral video: Bride makes dramatic entrance from giant ice cube at snowy Alpine wedding in Switzerland

Viral video: Bride makes dramatic entrance from giant ice cube at snowy Alpine wedding in Switzerland![submenu-img]() Elephant lifts safari truck with tourists in shocking viral video, watch

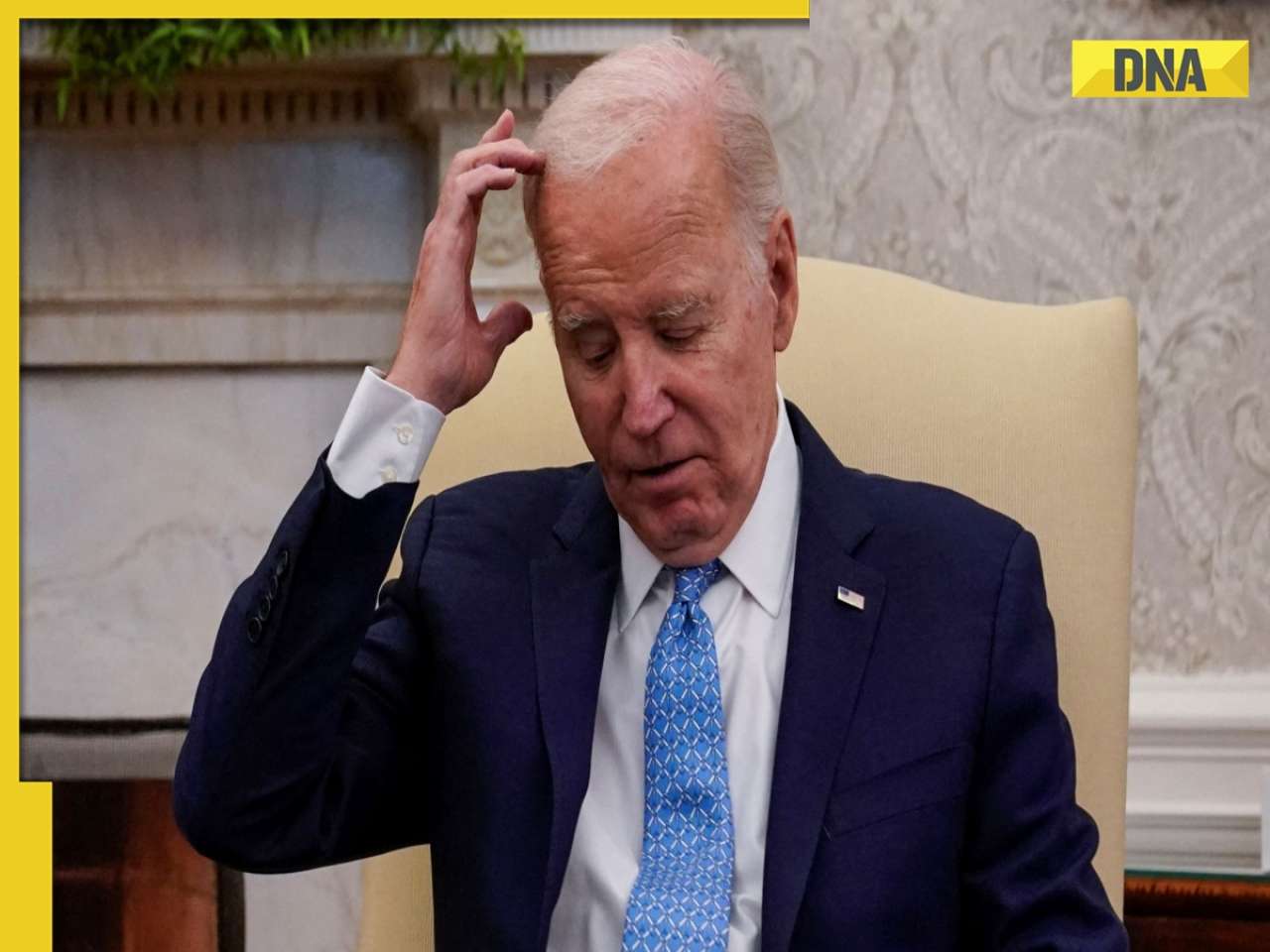

Elephant lifts safari truck with tourists in shocking viral video, watch![submenu-img]() In another gaffe, Joe Biden says he was US 'Vice President' during COVID-19 pandemic, watch viral video

In another gaffe, Joe Biden says he was US 'Vice President' during COVID-19 pandemic, watch viral video![submenu-img]() Meet Nihar Thackeray, lesser-known nephew of Uddhav Thackeray, he is Eknath Shinde's...

Meet Nihar Thackeray, lesser-known nephew of Uddhav Thackeray, he is Eknath Shinde's...![submenu-img]() Heroic buffalo herd rescues one of their own from lion ambush, video is viral

Heroic buffalo herd rescues one of their own from lion ambush, video is viral

)

)

)

)

)

)