VSNL shares have jumped by over 10% since its results were announced this Monday.

VSNL shares have jumped by over 10% since its results were announced this Monday. But that doesn’t necessarily mean that the markets were excited about the results. Analysts point out that the rise in share price is probably because of rumours that the value of surplus land in the company may finally get unlocked.

The results, actually, weren’t very encouraging. The highlight of last quarter’s results announcement was that the company shared financial details of its international operations for the first time. On a cumulative basis, international operations (mainly consisting of Tyco Global Network and Teleglobe International) posted a loss of Rs 410 crore for the year ended March 2006. On a standalone basis, the Indian operations reported a net profit of Rs 524 crore after excluding exceptional items. The losses on the international operations, therefore, have wiped away nearly 80% of the company’s profit. Consolidated net profit (adjusted for exceptionals) stood at Rs 114 crore, or just 2.5% of the company’s total turnover of Rs 4,562 crore. For the standalone business, net profit margin was as high as 14%.

Also note that Tyco’s results have been consolidated only for a nine-month period commencing, while Teleglobe’s results are for just 46 days starting February 14, 2006.

Considering that these loss-making companies will be part of consolidated accounts for the whole year in fiscal 2006-07, profit growth could be under pressure. But the company is confident that profits would grow thanks to benefits of scale and better utilisation of networks and other assets of various group companies. Currently, there’s a duplication of networks, which if rectified would result in significant cost savings.

VSNL would also see the full benefit of the cut in annual license fee announced by the government earlier this year. In financial year 2005-06, the benefit accrued only in the March quarter. The wholesale voice segment (57% of revenues) saw a 75% jump in profit in the March quarter thanks to the fee cut. But analysts said the extent of savings on this account may whittle down owing to competitive pressures this year. The data business is already witnessing pressure on margins owing to a drop in IPLC (international private leased circuits) prices. With realisations expected to be under pressure, much depends on volume growth and the resultant benefits of scale.

On the valuation front, it needs to be noted that VSNL’s land holdings and its stake in Tata Teleservices are together valued at about Rs 160-170 per VSNL share. Excluding this, the core business is valued at a little over Rs 200 per share. This seems high based on last year’s consolidated EPS of Rs 4, but the markets seem to be hoping that once the synergies from the acquisitions kick in, earnings would be much higher.

Pfizer riser

Pfizer has reported strong operating profit growth for the second quarter in a row. Profit grew by 50% last quarter, more or less in line with the 56% jump in profit in the preceding quarter. Analysts said the improvement in profit margins is on account of the restructuring of the company’s sales force.

Revenues, too, grew at an impressive rate of 24% last quarter. The pharmaceutical business accounted for a major portion (about 88%) of the revenues while the remaining was brought in by the animal health and service clinical development operations.

Operating margins for the quarter improved by 380 basis points to 22%, which resulted in a 50% jump in operating profit. But net profit grew at a much higher rate of 132%, thanks to an exceptional gain of Rs 12 crore arising out of the sale of a property in Hyderabad.

Thanks to the jump in profit, analysts may have to revise earnings estimates for the year. Consensus estimates put core earnings growth at about 12% for this year. But core earnings have grown by over 40% in the first-half period.

Also, thanks to strong earnings growth and correction in the markets, PE valuations have come down significantly to less than 20 times trailing earnings, from about 30 times just last quarter.

Interestingly, Pfizer’s shares haven’t risen since the results were announced, which indicates that the markets still need convincing that growth rates would be high even going forward.

Contributed by Mobis Philipose and Pallavi Pengonda

![submenu-img]() Mukesh Ambani’s daughter Isha Ambani’s firm launches new brand, Reliance’s Rs 8200000000000 company to…

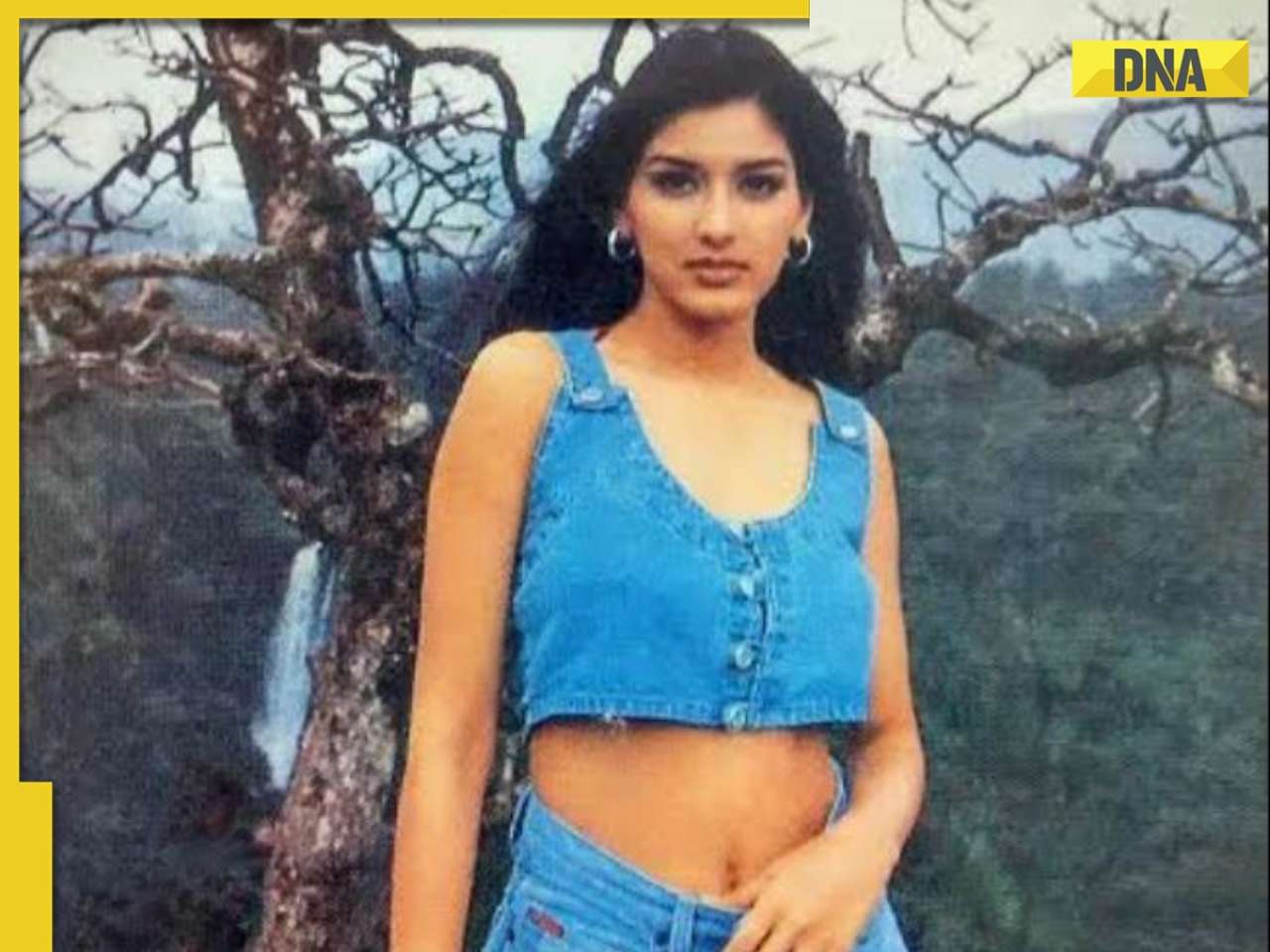

Mukesh Ambani’s daughter Isha Ambani’s firm launches new brand, Reliance’s Rs 8200000000000 company to…![submenu-img]() Sonali Bendre says producers called her 'too thin', tried to ‘fatten her up' during the 90s: ‘They'd just tell me...'

Sonali Bendre says producers called her 'too thin', tried to ‘fatten her up' during the 90s: ‘They'd just tell me...'![submenu-img]() Heavy rains in UAE again: Dubai flights cancelled, schools and offices shut

Heavy rains in UAE again: Dubai flights cancelled, schools and offices shut![submenu-img]() When 3 Bollywood films with same story released together, two even had same hero, all were hits, one launched star kid

When 3 Bollywood films with same story released together, two even had same hero, all were hits, one launched star kid![submenu-img]() Gautam Adani’s firm gets Rs 33350000000 from five banks, to use money for…

Gautam Adani’s firm gets Rs 33350000000 from five banks, to use money for…![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

Actors who died due to cosmetic surgeries![submenu-img]() See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol

See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol ![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() Sonali Bendre says producers called her 'too thin', tried to ‘fatten her up' during the 90s: ‘They'd just tell me...'

Sonali Bendre says producers called her 'too thin', tried to ‘fatten her up' during the 90s: ‘They'd just tell me...'![submenu-img]() When 3 Bollywood films with same story released together, two even had same hero, all were hits, one launched star kid

When 3 Bollywood films with same story released together, two even had same hero, all were hits, one launched star kid![submenu-img]() Salman Khan house firing case: Family of deceased accused claims police 'murdered' him, says ‘He was not the kind…’

Salman Khan house firing case: Family of deceased accused claims police 'murdered' him, says ‘He was not the kind…’![submenu-img]() Meet actor banned by entire Bollywood, was sent to jail for years, fought cancer, earned Rs 3000 crore on comeback

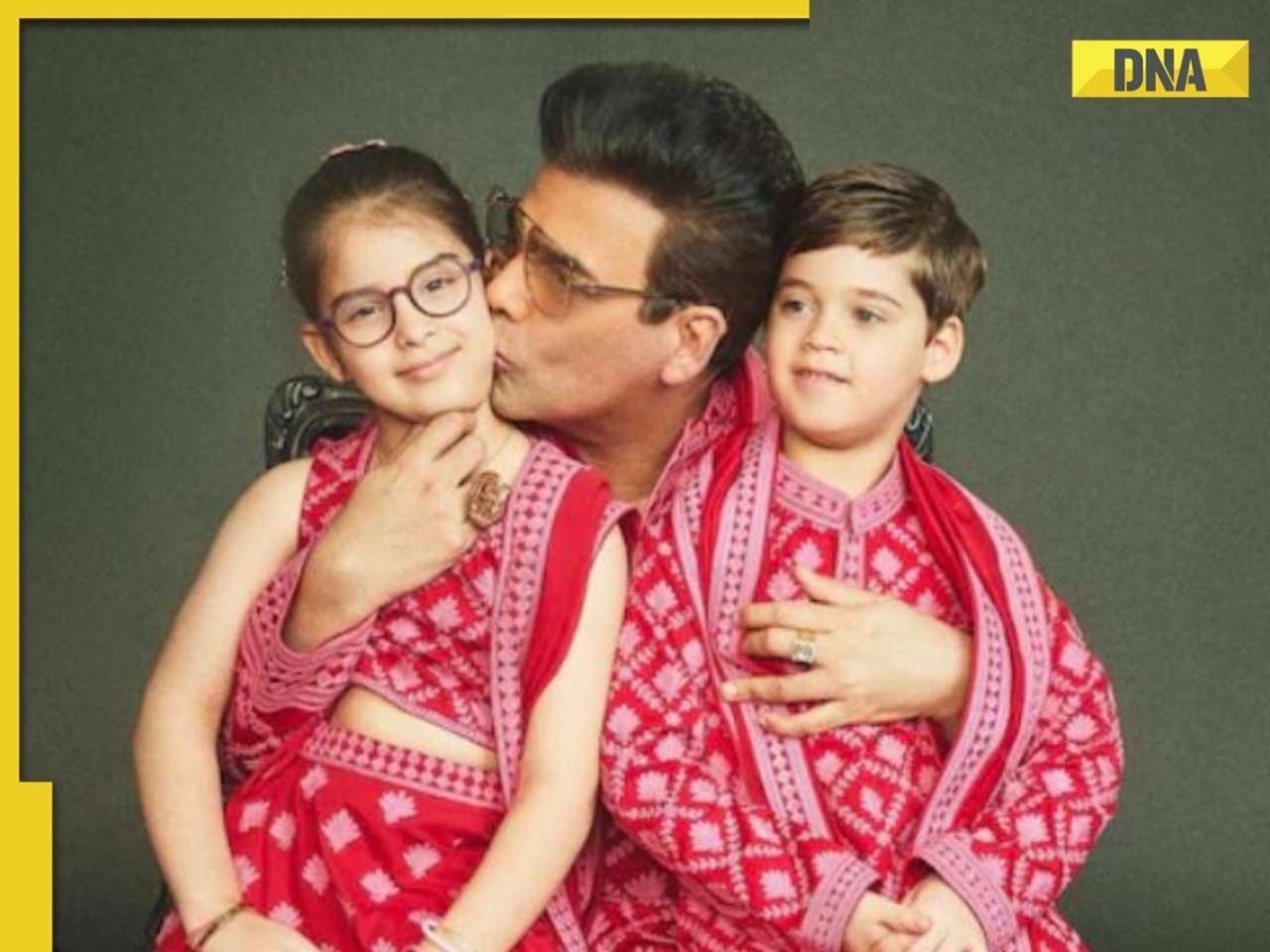

Meet actor banned by entire Bollywood, was sent to jail for years, fought cancer, earned Rs 3000 crore on comeback ![submenu-img]() Karan Johar wants to ‘disinherit’ son Yash after his ‘you don’t deserve anything’ remark: ‘Roohi will…’

Karan Johar wants to ‘disinherit’ son Yash after his ‘you don’t deserve anything’ remark: ‘Roohi will…’![submenu-img]() IPL 2024: Bhuvneshwar Kumar's last ball wicket power SRH to 1-run win against RR

IPL 2024: Bhuvneshwar Kumar's last ball wicket power SRH to 1-run win against RR![submenu-img]() BCCI reacts to Rinku Singh’s exclusion from India T20 World Cup 2024 squad, says ‘he has done…’

BCCI reacts to Rinku Singh’s exclusion from India T20 World Cup 2024 squad, says ‘he has done…’![submenu-img]() MI vs KKR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

MI vs KKR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() IPL 2024: How can RCB and MI still qualify for playoffs?

IPL 2024: How can RCB and MI still qualify for playoffs?![submenu-img]() MI vs KKR IPL 2024 Dream11 prediction: Fantasy cricket tips for Mumbai Indians vs Kolkata Knight Riders

MI vs KKR IPL 2024 Dream11 prediction: Fantasy cricket tips for Mumbai Indians vs Kolkata Knight Riders ![submenu-img]() '25 virgin girls' are part of Kim Jong un's 'pleasure squad', some for sex, some for dancing, some for...

'25 virgin girls' are part of Kim Jong un's 'pleasure squad', some for sex, some for dancing, some for...![submenu-img]() Man dances with horse carrying groom in viral video, internet loves it

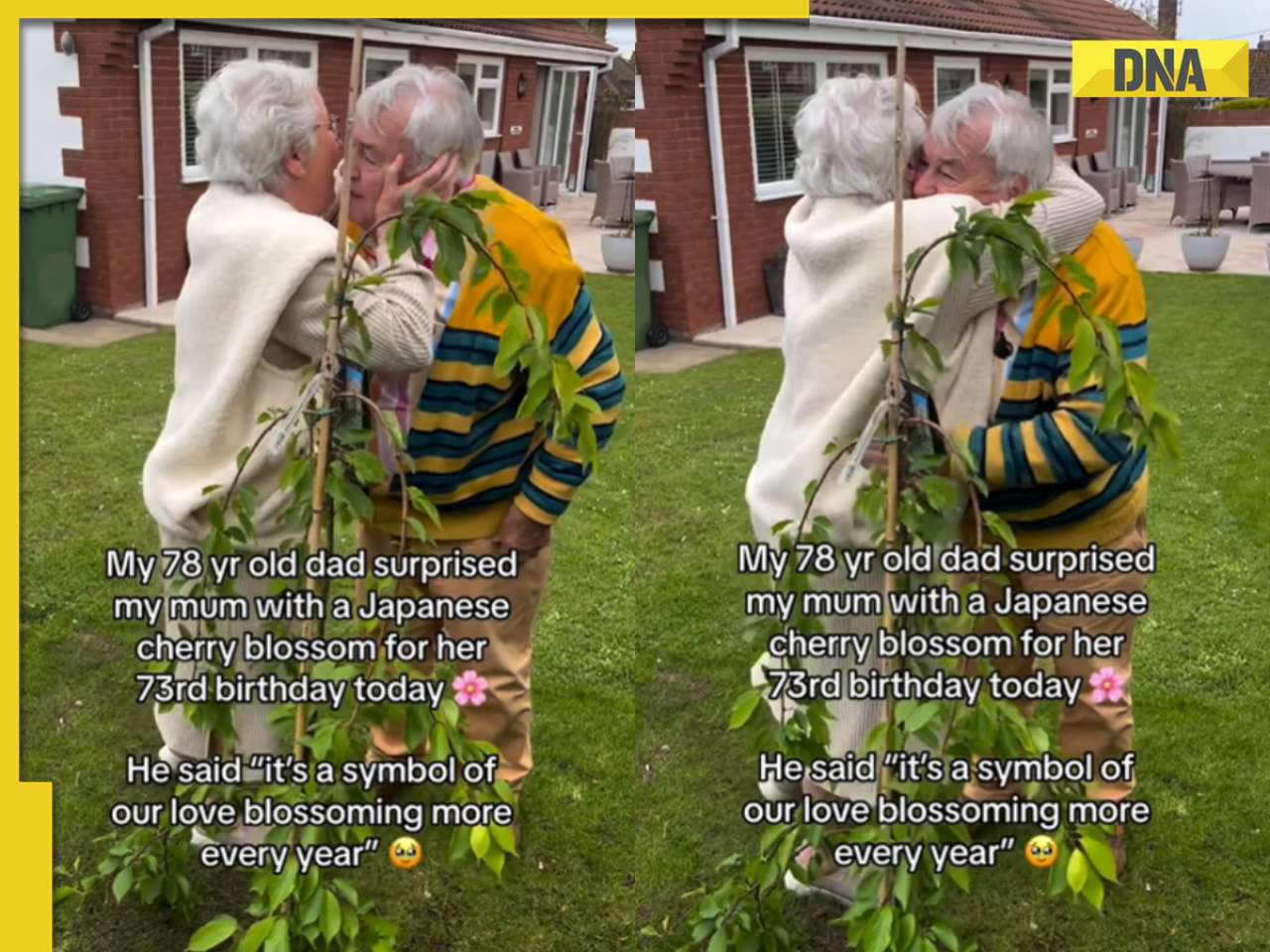

Man dances with horse carrying groom in viral video, internet loves it ![submenu-img]() Viral video: 78-year-old man's heartwarming surprise for wife sparks tears of joy

Viral video: 78-year-old man's heartwarming surprise for wife sparks tears of joy![submenu-img]() Man offers water to thirsty camel in scorching desert, viral video wins hearts

Man offers water to thirsty camel in scorching desert, viral video wins hearts![submenu-img]() Pakistani groom gifts framed picture of former PM Imran Khan to bride, her reaction is now a viral video

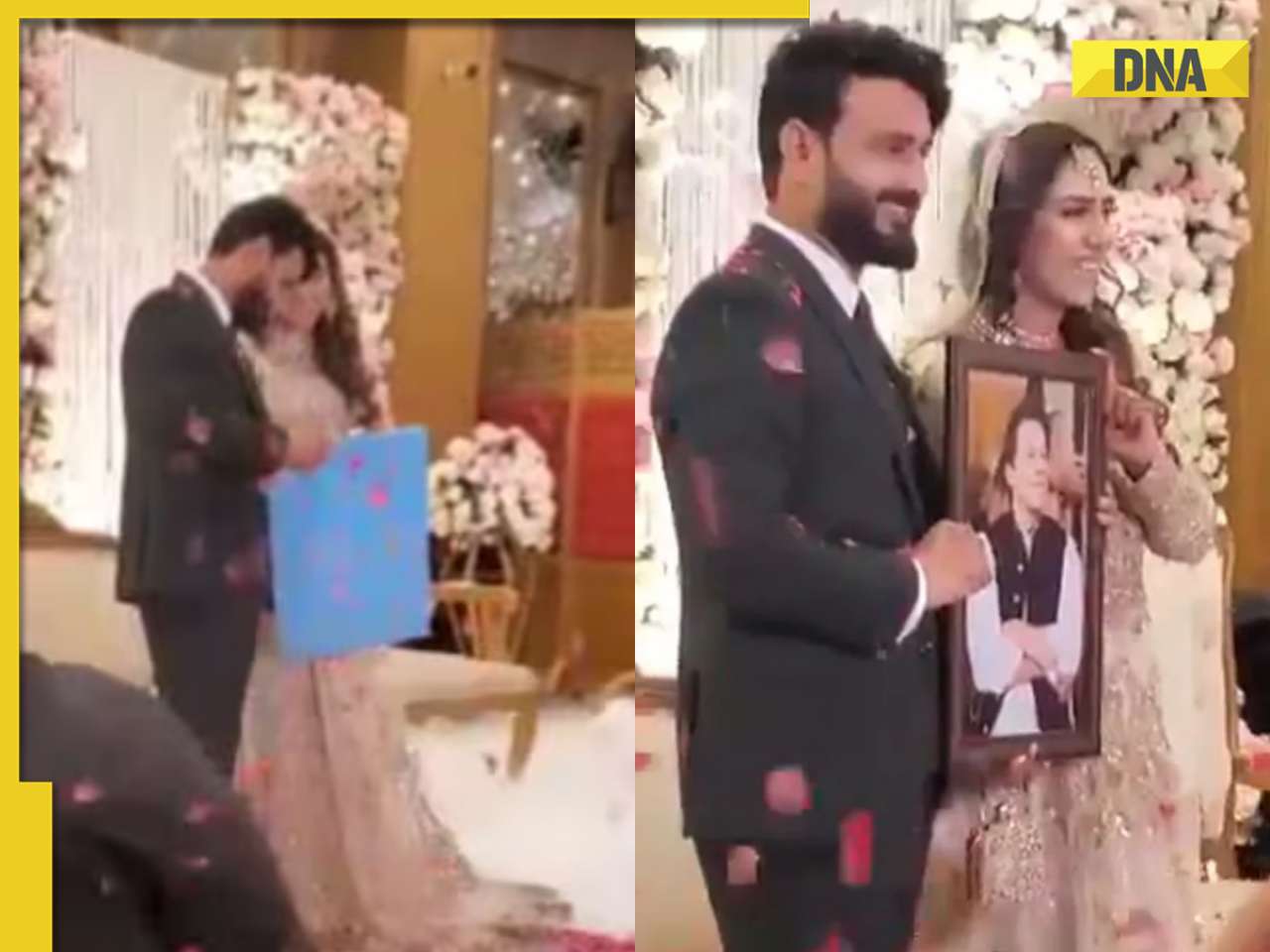

Pakistani groom gifts framed picture of former PM Imran Khan to bride, her reaction is now a viral video

)

)

)

)

)

)