In an interview with Manju AB, he says housing finance companies (HFCs) have no regulatory arbitrage and have to lend competitively even if they do not have a base rate like banks.

Sriram Kalyanaraman took over as managing director and chief executive officer of National Housing Bank (NHB) in July 2015. Preceding this regulatory role, he has worked for Standard Chartered Bank and Deutsche Bank. He also helped set up a credit bureau, Equifax. In an interview with Manju AB, he says housing finance companies (HFCs) have no regulatory arbitrage and have to lend competitively even if they do not have a base rate like banks. "In fact, they have a tougher environment to work in without having access to low-cost deposits like banks," he says.

Q. A number of frauds have emerged in the banking system and a lot of them have been in home loans. How big is the problem for HFCs?

A. There are some frauds, but regulators and the financial institutions are able to check them. The banking system withstood extreme hardships post the financial crisis, but it was able to tide over that due to robust policies of the government and the central bank. Strict prudential norms prevented housing finance companies from lending indiscriminately. We have a system in place to caution HFCs on mortgage frauds. To address the borrower risk, we have mandated credit bureau data submission and usage. And to address the property risk, the central government has set up a central registry, CERSAI, where NHB is one of the promoters.

Q. Banks complain of a regulatory arbitrage as HFCs do not have a base rate and they are excluded from the preview of the guidelines of the wilful defaulters?

A. In the absence of CASA (current accounts and savings accounts), funding costs are normally high for housing finance companies, compared to banks. It is a competitive market, and hence, market forces would drive down the rates. The base rate mechanism assumes CASA and deposit cost based inputs, which is not the case with most HFCs. In line with the recommendations of the Puri Committee Report and concerns emanating from the exclusion of the entities like HFCs from the preview of guidelines of wilful defaulters, NHB has asked HFCs to put in place a system to disseminate credit information pertaining to wilful defaulters of Rs 25 lakh and above.

Q. Any specific measures that you have initiated recently?

A. Earlier, only 19 HFCs were allowed to recover their dues under the Sarfaesi Act (Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act). On December 18, 2015, notifications were issued enabling another 41 HFCs to recover their dues under the Act. So HFCs are getting the rights to recovery like other institutions. Recently for Chennai, we announced a concessional funding for HFCs to finance the home upgradation and improvement for customers whose homes were affected by floods. We have also issued guidelines for extending loan facilities, specifically to specially-abled persons. NHB also reduced risk weight on housing loan on certain segments. We also made it mandatory that all HFCs need to contribute to all the credit bureaus so that HFCs can have access to information. To avoid multiple funding, NHB is examining populating of beneficiary data with credit bureaus. In December 2015, NHB entered into a collaboration with Building Material Technology Promotion Council (BMTPC) for implementation of housing projects with emerging and green technology. Under the scheme, DFID has sanctioned a financial assistance of 50 million pounds. We have also partnered with World Bank to implement low-income finance project under which the borrowers with informal income will be targeted for accessing formal housing finance.

Q. Has the slowdown in the economy impacted the growth in home loans?

A.There are specialised HFCs, which are operating in the most backward regions of the country. The pace of growth has not slowed down greatly. In fact, some of the HFCs are growing in double digits. The year-on-year growth in home loans has been about 18% for the housing finance companies.

Q. But is there any danger of growing unhindered in backward areas where the repayment capacities may not be so strong?

A. Specialised HFCs have sort of factored in the art of underwriting these segments and also imputing income where the cash flows are not so regular. What we have to keep in mind is that it is more difficult to underwrite loans in low value, irregular income and backward areas as it would need a greater understanding of the socio-economic factors of that region. HFCs are better equipped to handle this and are fulfilling a social need towards making the government's goal of 'Housing for All' come true. Also, since the delinquencies in below Rs 10 lakh are higher than normal, they would need some support. The Credit Linked Subsidy Scheme (CLSS) under the Pradhan Mantri Awas Yojana goes a long way in facilitating funding and repayment for this segment with interest subsidy at 6.5% with a maximum subsidy of Rs 2,20,000.

Q. What is NHB doing to address the supply-side issues?

A. There is short supply of housing, in general. On the supply-side, NHB is working with developers' associations such as Credai and MCHI. We are trying to facilitate policy formulation with the central government and various state governments on simplifying approvals.

Q. The Reserve Bank of India has an internal ratings called the CAMELS. Does the NHB also follow a system like this to gauge the health of the HFCs?

A.We also follow the similar CAMELS rating (to test capital adequacy, assets, management capabilities, earnings and liquidity) for HFCs. We also do regular inspections on them to gauge their regulatory compliance practices and governance. We do also have an internal rating system with which the refinancing HFCs are being monitored.

Q. Housing finance companies say that capital is an issue. Does the short supply of capital also force them to lend at higher rates than the banks?

A. It is a mono-line business with long repayment periods. So capital is always an issue. Long-term financing is a constraint. Unlike the banks, HFCs do not have access to lower cost current accounts and savings accounts (CASA). We are trying to facilitate to diversify the funding opportunities. We are in the process of formulating guidelines for new and smaller companies to access our refinance so that smoother flow of funding happens to them.

Q. How many HFCs are registered with NHB and how many would be needed to meet the PM's mission of housing for all?

A. As on date, 72 housing finance companies were granted the certificate of registration under Section 29A of the National Housing Bank Act, 1987. The micro housing finance companies will have the thrust to focus on housing for all. All HFCs will undertake the responsibility for the mission. In my opinion, we could do with some more. But we want committed promoters with long-term view. Based on the business plans submitted by some of the HFCs, our understanding is that these new HFCs are planning to cater to low-income segment borrower.

Q. Has NHB taken any Initiatives?

A. NHB extends direct financial assistance for projects undertaken by public housing agencies for housing construction and development of housing-related infrastructure. We have facilitated the issue of Sarfaesi notification. We are working on methodology to fund the smaller and newer HFCs. We are also working with certain ministries of the government to ease some of the issues that they are facing. We are conducting regional workshops on CLSS under Pradhan Mantri Awas Yojna for banks, HFCs, developers and the state government officers in these workshops. Additionally, customised training programmes are also being conducted for Regional Rural Banks (RRBs) and Urban Co-operative Banks (UCBs) towards rural housing. We have refinancing facilities for both urban and rural housing companies at concessional rates for them to fund the affordable housing. NHB has taken initiatives in promoting rural HFCs and projects like institutional redevelopment in Dharavi (in Mumbai), construction of houses in tsunami relief in Andhra Pradesh. It has also funded housing units for sanitation in urban and rural areas.

Q. What has been the home loan growth rates of housing finance companies and how do they compare with public sector banks? What is the average ticket size of the loans at HFCs?

A. For the financial year 2014-15, home loan disbursements have grown by around 14% and 17% in public sector banks and HFCs, respectively.

Q. Is there any new trend that you see in the home loan market?

A.There seems to be a shift to the bigger ticket loans. The trend indicates that the growth in the slab of above Rs 10 lakh is increasing and this could be due to the cost of increase in flats and reduced new supply in this segment. We are sure the CLSS scheme under Pradhan Mantri Awas Yojana would also give a boost to the low-value loans.

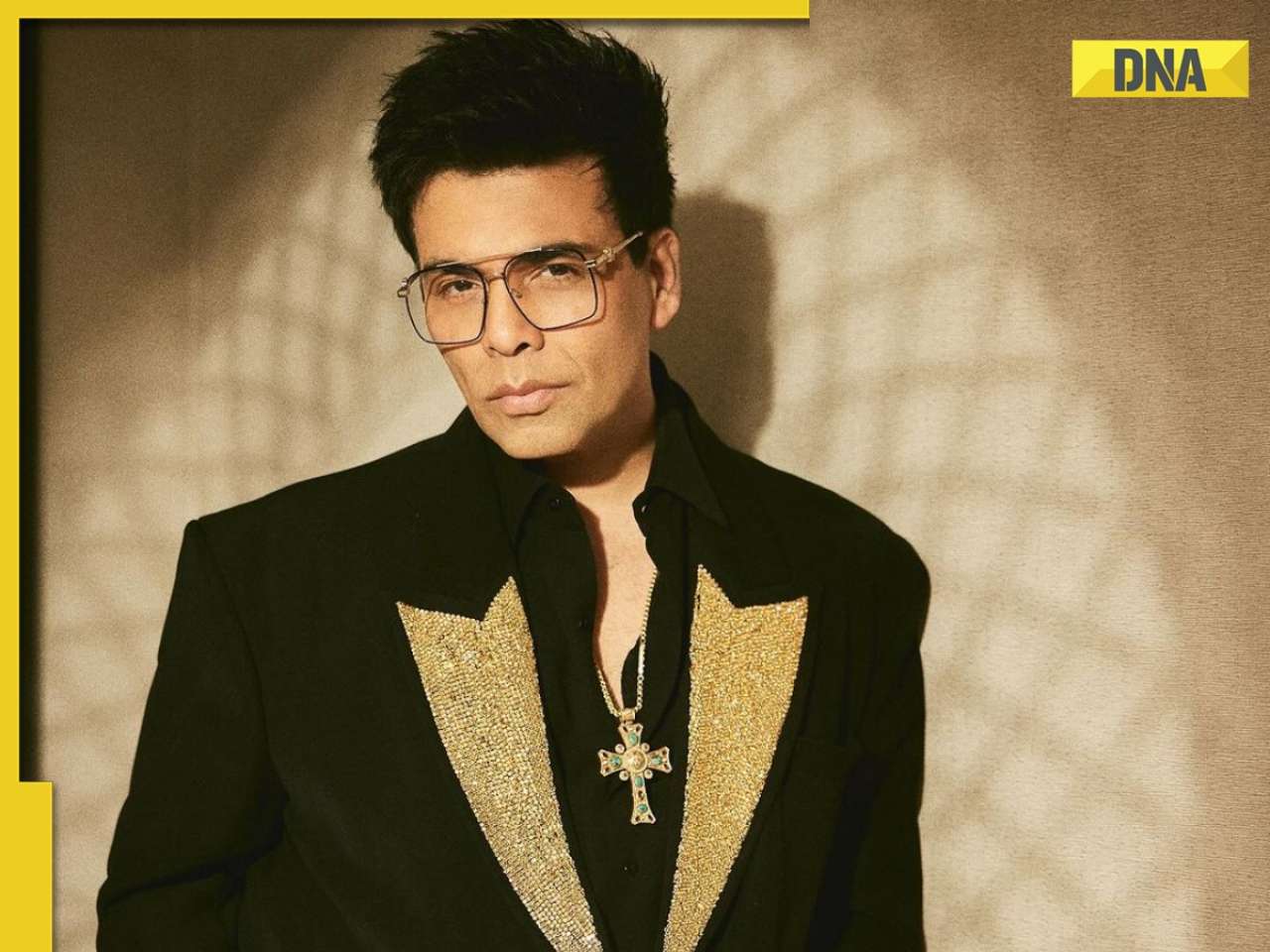

![submenu-img]() Meet India's highest paid director, charges 30 times more than his stars; not Hirani, Rohit Shetty, Atlee, Karan Johar

Meet India's highest paid director, charges 30 times more than his stars; not Hirani, Rohit Shetty, Atlee, Karan Johar![submenu-img]() Indian government issues warning for Google users, sensitive information can be leaked if…

Indian government issues warning for Google users, sensitive information can be leaked if…![submenu-img]() Prajwal Revanna Sex Scandal Case: Several women left home amid fear after clips surfaced, claims report

Prajwal Revanna Sex Scandal Case: Several women left home amid fear after clips surfaced, claims report![submenu-img]() Meet man who studied at IIT, IIM, started his own company, now serving 20-year jail term for…

Meet man who studied at IIT, IIM, started his own company, now serving 20-year jail term for…![submenu-img]() Gautam Adani’s project likely to get Rs 170000000000 push from SBI, making India’s largest…

Gautam Adani’s project likely to get Rs 170000000000 push from SBI, making India’s largest…![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates

Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

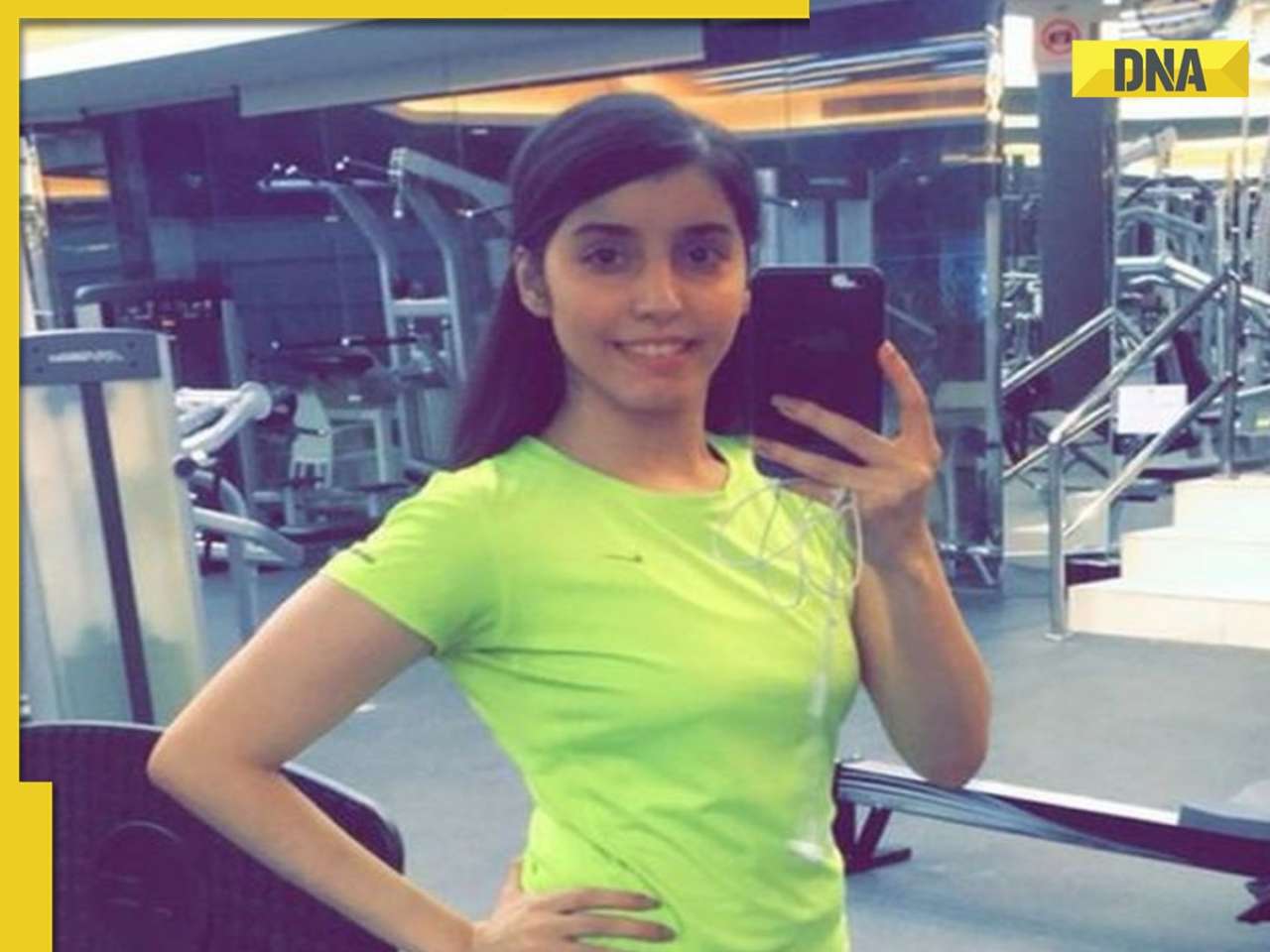

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() Meet India's highest paid director, charges 30 times more than his stars; not Hirani, Rohit Shetty, Atlee, Karan Johar

Meet India's highest paid director, charges 30 times more than his stars; not Hirani, Rohit Shetty, Atlee, Karan Johar![submenu-img]() This superstar worked as clerk, was banned from wearing black, received death threats; later became India's most...

This superstar worked as clerk, was banned from wearing black, received death threats; later became India's most...![submenu-img]() Karan Johar slams comic for mocking him, bashes reality show for 'disrespecting' him: 'When your own industry...'

Karan Johar slams comic for mocking him, bashes reality show for 'disrespecting' him: 'When your own industry...'![submenu-img]() Kapoor family's forgotten hero, highest paid actor, gave more hits than Raj Kapoor, Ranbir, never called star because...

Kapoor family's forgotten hero, highest paid actor, gave more hits than Raj Kapoor, Ranbir, never called star because...![submenu-img]() Meet actress who lost stardom after getting pregnant at 15, husband cheated on her, she sold candles for living, now...

Meet actress who lost stardom after getting pregnant at 15, husband cheated on her, she sold candles for living, now...![submenu-img]() IPL 2024: Kolkata Knight Riders take top spot after 98 runs win over Lucknow Super Giants

IPL 2024: Kolkata Knight Riders take top spot after 98 runs win over Lucknow Super Giants![submenu-img]() ICC Women’s T20 World Cup 2024 schedule announced; India to face Pakistan on....

ICC Women’s T20 World Cup 2024 schedule announced; India to face Pakistan on....![submenu-img]() IPL 2024: Bowlers dominate as CSK beat PBKS by 28 runs

IPL 2024: Bowlers dominate as CSK beat PBKS by 28 runs![submenu-img]() IPL 2024: Big blow to CSK as star pacer returns home due to...

IPL 2024: Big blow to CSK as star pacer returns home due to...![submenu-img]() SRH vs MI IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

SRH vs MI IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() Job applicant offers to pay Rs 40000 to Bengaluru startup founder, here's what happened next

Job applicant offers to pay Rs 40000 to Bengaluru startup founder, here's what happened next![submenu-img]() Viral video: Family fearlessly conducts puja with live black cobra, internet reacts

Viral video: Family fearlessly conducts puja with live black cobra, internet reacts![submenu-img]() Woman demands Rs 50 lakh after receiving chicken instead of paneer

Woman demands Rs 50 lakh after receiving chicken instead of paneer![submenu-img]() Who is Manahel al-Otaibi, Saudi women's rights activist jailed for 11 years over clothing choices?

Who is Manahel al-Otaibi, Saudi women's rights activist jailed for 11 years over clothing choices?![submenu-img]() In candid rapid fire, Rahul Gandhi reveals why white T-shirts are his signature attire, watch

In candid rapid fire, Rahul Gandhi reveals why white T-shirts are his signature attire, watch

)

)

)

)

)

)

)