Tsipras, in an address to the nation after the results of the referendum were announced, said that his first priority is to open the shut banks and bring back normalcy to Greece.

With the Greek referendum resulting in an overwhelming 'no' to accept the creditors' conditions, for the bailout, Greece has officially entered into uncharted territories.

On July 5, over 61% of the Greeks that voted on the referendum called by Prime Minister Alexis Tsipras, voted against accepting the bailout conditions sending the European Union (EU) in a tizzy.

Experts say that this has brought Greece a step closer to exiting the Eurozone. However, the Eurozone agreement has no clause of a member state exiting the union unless it wants to. With Greece making it resoundingly clear that it does not want to exit the Eurozone, road ahead for EU to find an amicable solution to Greek debt issue gets more complicated.

Moreover, with Greeks backing its government against the troika of International Monetary Fund (IMF), European Central Bank (ECB) and its creditors, the government now seems to be in a stronger position to iron out a better deal for itself.

Yanis Varoufakis, Finance Minister, Greece said that this 'no' is majestic and a big yes to a democratic and rational Europe.

He said, "It is a NO to the dystopic vision of a Eurozone that functions like an iron cage for its peoples. It is a loud YES to the vision of a Eurozone offering the prospect of social justice with shared prosperity for all Europeans."

Tsipras, in an address to the nation after the results of the referendum were announced, said that his first priority is to open the shut banks and bring back normalcy to Greece.

Snap referendum was called after Greece walked out of negotiations and to control the flight of capital from Greek banks the government had decided to shut banks and put a limit on the money Greeks could withdraw on a daily basis from cash machines.

The Eurozone leaders are going to hold a special summit on Tuesday to discuss the future course of action.

Greece has defaulted on 1.6 billion euros due to the IMF on June 30. This means that the country has no access to emergency funds until it clears these arrears due to the IMF.

However, a new deal is imperative for Greece as its banks are due to pay 2 billion euros held as short term bonds, followed by 3.5 billion euros to the ECB on July 20.

If Greece and the EU fail to reach a consensus now, the inevitability of the Greece exit from Eurozone gets strengthened.

With European leaders have already said that Greece not accepting creditors' demands will mean its exit from the Eurozone and setting up its own currency to pay back the money.

What many fear is the contagion effect this might have on the rest of the Europe with Spain and Italy likely followers as the two are saddled with loans straining economic recovery greatly.

Noted economist Paul Krugman too in his June 29 column in the New York Times said that Greece should vote 'no' bringing out the ideological war between the Keynesian and the neo-classical school of thought.

He said, "It has been obvious for some time that the creation of the euro was a terrible mistake. Europe never had the preconditions for a successful single currency — above all, the kind of fiscal and banking union that, for example, ensures that when a housing bubble in Florida bursts, Washington automatically protects seniors against any threat to their medical care or their bank deposits."

At a subliminal level, the arguments between Greece and EU, bring out the debate between austerity and spending.

Since the subprime crisis that began in the US and spiraled all over the globe, it is the EU that has not been able to deal with its economies because of the policies it chose.

States were regularly asked to cut spending if they needed money from multilateral institutions like IMF.

A look at Greece's bailout funds will show that since 2010, its economy has dipped over 25% and unemployment is at dizzying heights.

Clearly, the policy of austerity that the EU forced down its throat hasn't worked. Krugman said, "won’t be taken in by claims that troika officials are just technocrats explaining to the ignorant Greeks what must be done. These supposed technocrats are in fact fantasists who have disregarded everything we know about macroeconomics, and have been wrong every step of the way. This isn’t about analysis, it’s about power — the power of the creditors to pull the plug on the Greek economy, which persists as long as euro exit is considered unthinkable."

According to report by the Wall Street Journal, Greece needs an additional 60 billion euros between today and 2018 and doubling of its loan repayment extension to 40 years if EU is serious about sustanability.

With creditors, EU -- led by Germany -- realise that their forced austerity to bring Greece out of an economic crisis is actually a pill that has failed to treat the disease time and again or will EU led to the destruction of the Euro.

More clarity will emerge in the coming weeks as EU leaders begin to come to grips with the road less taken.

![submenu-img]() Mukesh Ambani’s daughter Isha Ambani’s firm launches new brand, Reliance’s Rs 8200000000000 company to…

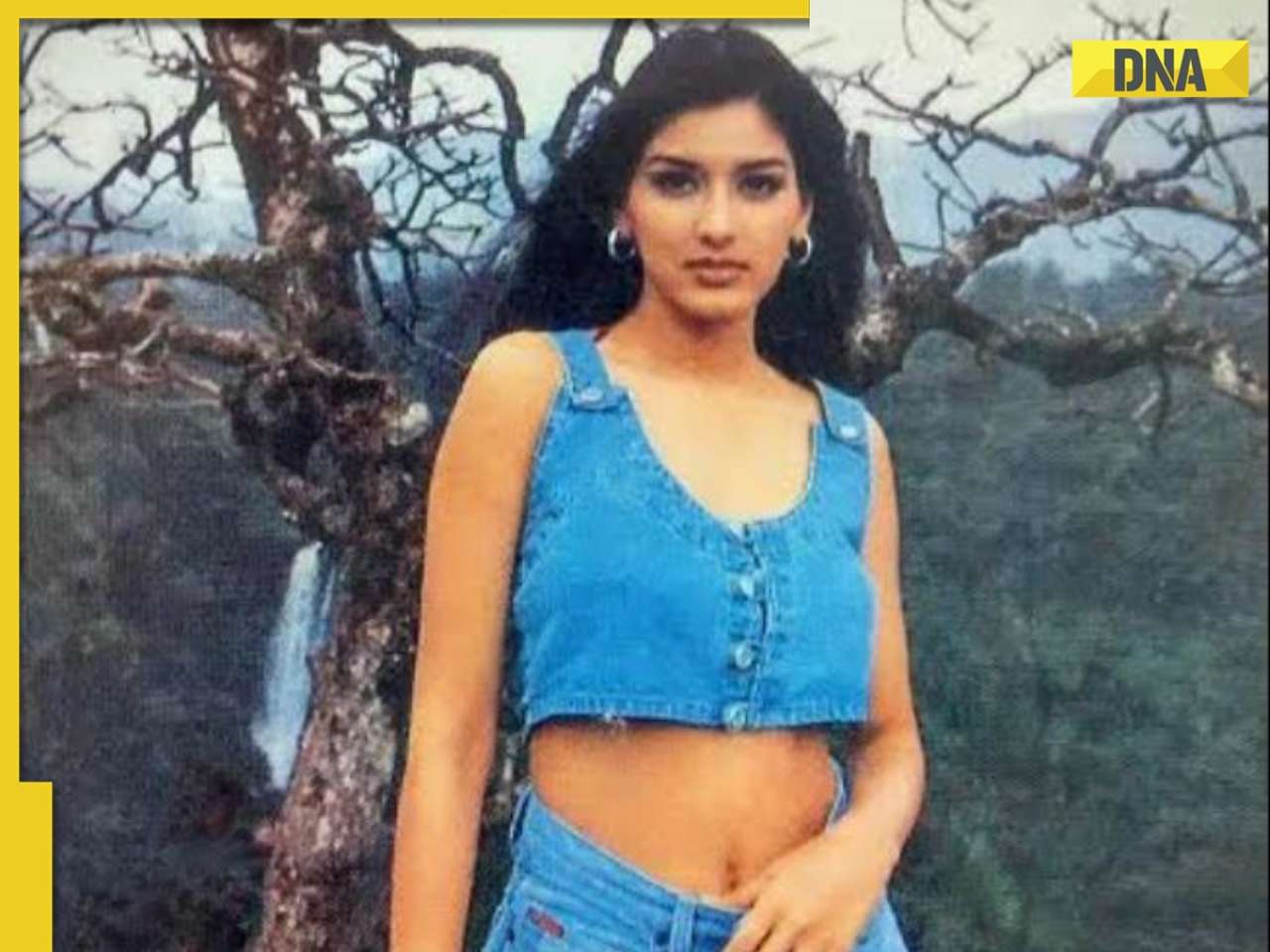

Mukesh Ambani’s daughter Isha Ambani’s firm launches new brand, Reliance’s Rs 8200000000000 company to…![submenu-img]() Sonali Bendre says producers called her 'too thin', tried to ‘fatten her up' during the 90s: ‘They'd just tell me...'

Sonali Bendre says producers called her 'too thin', tried to ‘fatten her up' during the 90s: ‘They'd just tell me...'![submenu-img]() Heavy rains in UAE again: Dubai flights cancelled, schools and offices shut

Heavy rains in UAE again: Dubai flights cancelled, schools and offices shut![submenu-img]() When 3 Bollywood films with same story released together, two even had same hero, all were hits, one launched star kid

When 3 Bollywood films with same story released together, two even had same hero, all were hits, one launched star kid![submenu-img]() Gautam Adani’s firm gets Rs 33350000000 from five banks, to use money for…

Gautam Adani’s firm gets Rs 33350000000 from five banks, to use money for…![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

Actors who died due to cosmetic surgeries![submenu-img]() See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol

See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol ![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() Sonali Bendre says producers called her 'too thin', tried to ‘fatten her up' during the 90s: ‘They'd just tell me...'

Sonali Bendre says producers called her 'too thin', tried to ‘fatten her up' during the 90s: ‘They'd just tell me...'![submenu-img]() When 3 Bollywood films with same story released together, two even had same hero, all were hits, one launched star kid

When 3 Bollywood films with same story released together, two even had same hero, all were hits, one launched star kid![submenu-img]() Salman Khan house firing case: Family of deceased accused claims police 'murdered' him, says ‘He was not the kind…’

Salman Khan house firing case: Family of deceased accused claims police 'murdered' him, says ‘He was not the kind…’![submenu-img]() Meet actor banned by entire Bollywood, was sent to jail for years, fought cancer, earned Rs 3000 crore on comeback

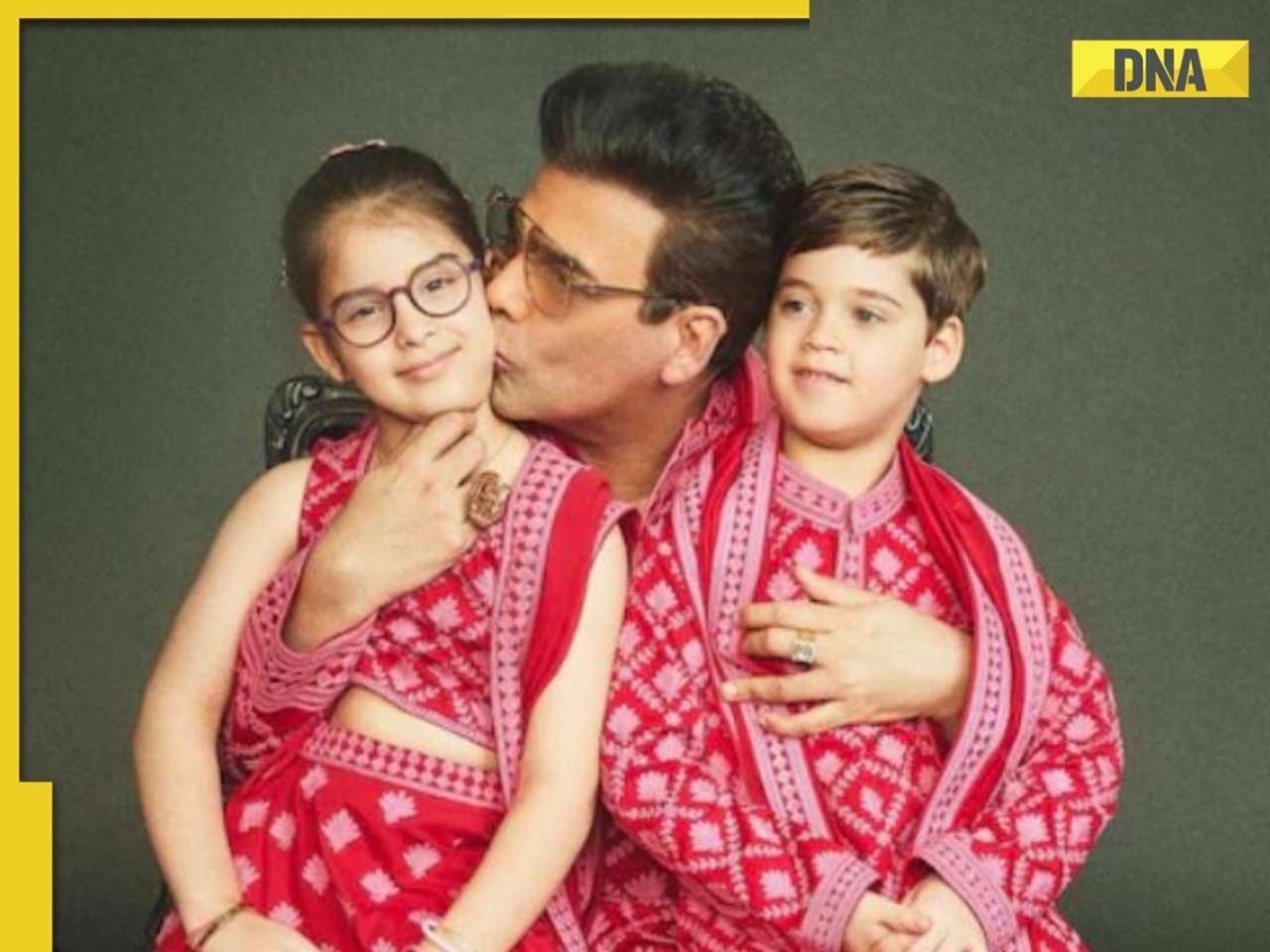

Meet actor banned by entire Bollywood, was sent to jail for years, fought cancer, earned Rs 3000 crore on comeback ![submenu-img]() Karan Johar wants to ‘disinherit’ son Yash after his ‘you don’t deserve anything’ remark: ‘Roohi will…’

Karan Johar wants to ‘disinherit’ son Yash after his ‘you don’t deserve anything’ remark: ‘Roohi will…’![submenu-img]() IPL 2024: Bhuvneshwar Kumar's last ball wicket power SRH to 1-run win against RR

IPL 2024: Bhuvneshwar Kumar's last ball wicket power SRH to 1-run win against RR![submenu-img]() BCCI reacts to Rinku Singh’s exclusion from India T20 World Cup 2024 squad, says ‘he has done…’

BCCI reacts to Rinku Singh’s exclusion from India T20 World Cup 2024 squad, says ‘he has done…’![submenu-img]() MI vs KKR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

MI vs KKR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() IPL 2024: How can RCB and MI still qualify for playoffs?

IPL 2024: How can RCB and MI still qualify for playoffs?![submenu-img]() MI vs KKR IPL 2024 Dream11 prediction: Fantasy cricket tips for Mumbai Indians vs Kolkata Knight Riders

MI vs KKR IPL 2024 Dream11 prediction: Fantasy cricket tips for Mumbai Indians vs Kolkata Knight Riders ![submenu-img]() '25 virgin girls' are part of Kim Jong un's 'pleasure squad', some for sex, some for dancing, some for...

'25 virgin girls' are part of Kim Jong un's 'pleasure squad', some for sex, some for dancing, some for...![submenu-img]() Man dances with horse carrying groom in viral video, internet loves it

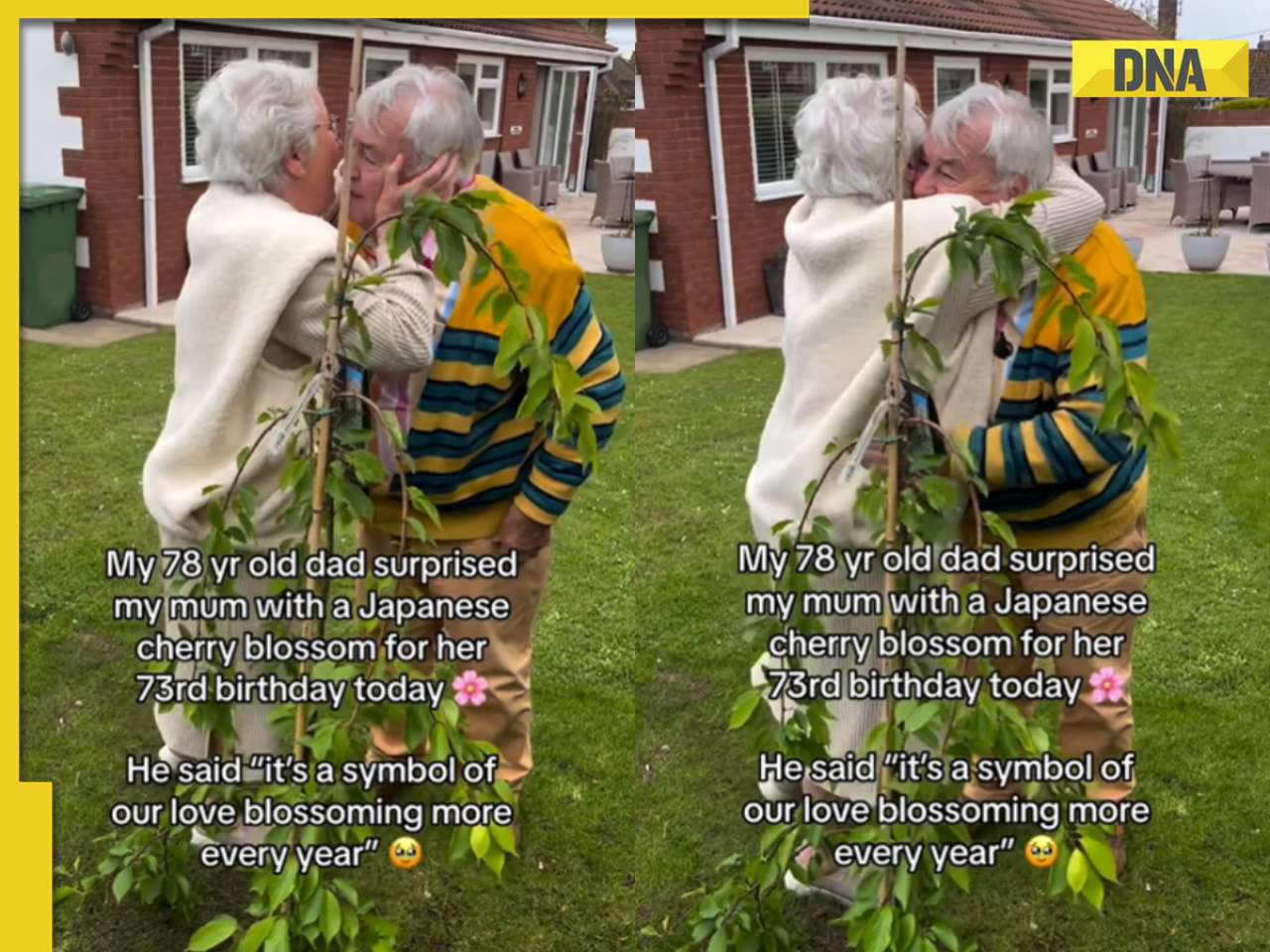

Man dances with horse carrying groom in viral video, internet loves it ![submenu-img]() Viral video: 78-year-old man's heartwarming surprise for wife sparks tears of joy

Viral video: 78-year-old man's heartwarming surprise for wife sparks tears of joy![submenu-img]() Man offers water to thirsty camel in scorching desert, viral video wins hearts

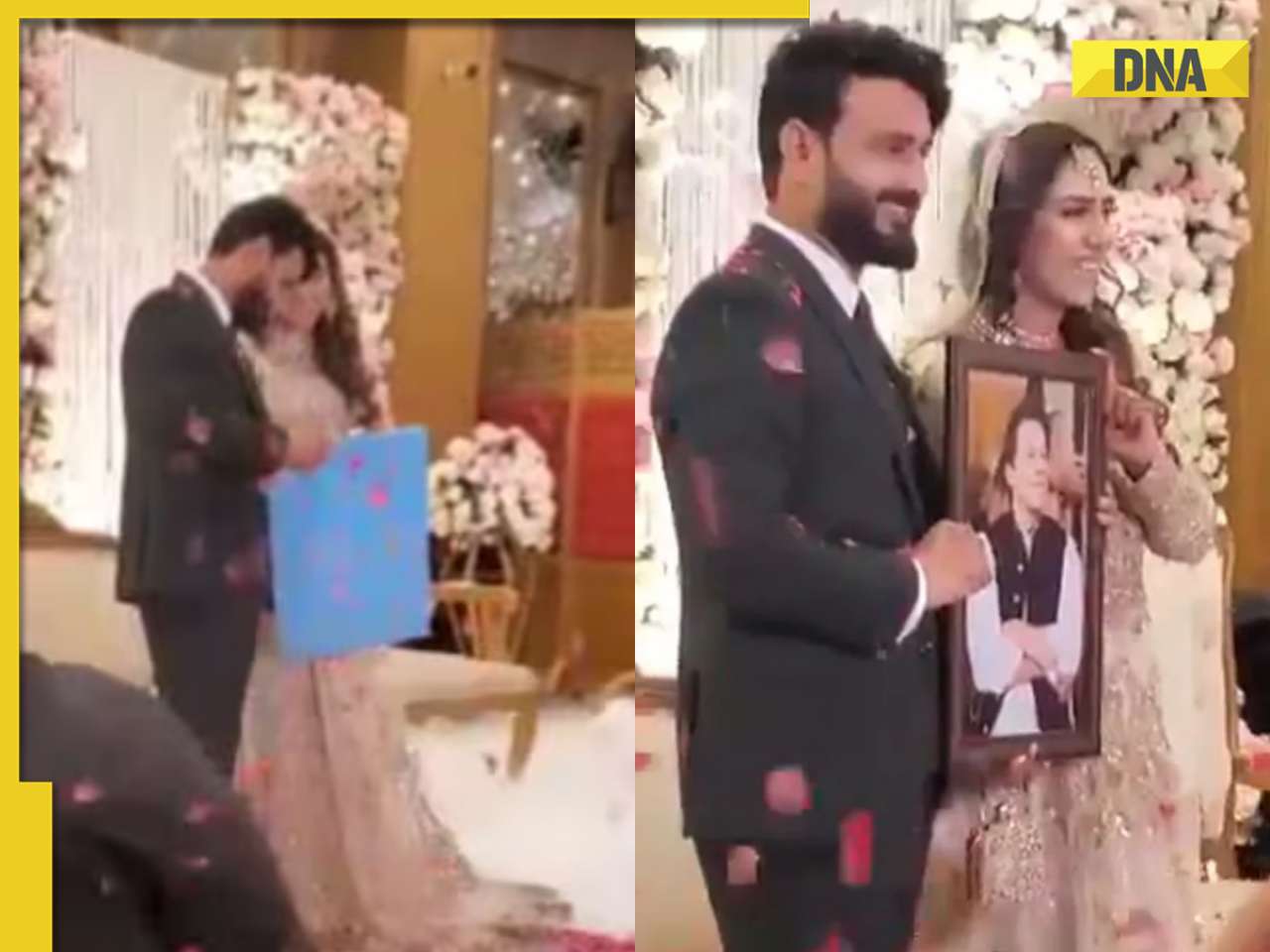

Man offers water to thirsty camel in scorching desert, viral video wins hearts![submenu-img]() Pakistani groom gifts framed picture of former PM Imran Khan to bride, her reaction is now a viral video

Pakistani groom gifts framed picture of former PM Imran Khan to bride, her reaction is now a viral video

)

)

)

)

)

)

)

)