Retaining the 8.8% interest rate would have left a deficit of Rs 383 crore.

Retirement fund body Employees' Provident Fund Organisation (EPFO) decided to lower the interest on Employee Provident Fund (EPF) deposits for the current fiscal to 8.65%, from 8.8 provided in 2015-16, for its over four crore subscribers. "The Employees Provident Fund Organisation's apex decision making body, the Central Board of Trustees (CBT), has taken a decision to lower the interest rate to 8.65% for the current fiscal from 8.8 in 2015-16," Indian National Trade Union Congress Vice-President Ashok Singh told PTI after the meeting at Bengaluru.

Bharatiya Mazdoor Sangh General Secretary Virjesh Upadhyay also said that 8.65% rate of interest is fixed on EPF deposits for 2016-17. As per the EPFO income projections, retaining 8.8% rate of interest for the current fiscal would have left a deficit of Rs 383 crore. However, the body could have utilised about Rs 409 crore surplus with it, which accrued after providing 8.8% rate of interest for 2015-16, to retain the same rate of return for the current fiscal.

A surplus of about Rs 69.34 crore was stipulated if interest rate was to be lowered to 8.7%. EPFO has projected income of Rs 39,084 crore for the current fiscal. As per sources, the Finance Ministry has been asking the Labour Ministry to align the EPF interest rate with other small saving schemes of the government like Public Provident Fund (PPF). In September, the government reduced interest rates on small savings schemes marginally by 0.1% for the October-December quarter of 2016-17, which resulted in lower returns on PPF, Kisan Vikas Patra, Sukanya Samriddhi Account, among others. The Labour Ministry however wanted to retain 8.8% for the current fiscal as well, a source said.

![submenu-img]() Mukesh Ambani’s daughter Isha Ambani’s firm launches new brand, Reliance’s Rs 8200000000000 company to…

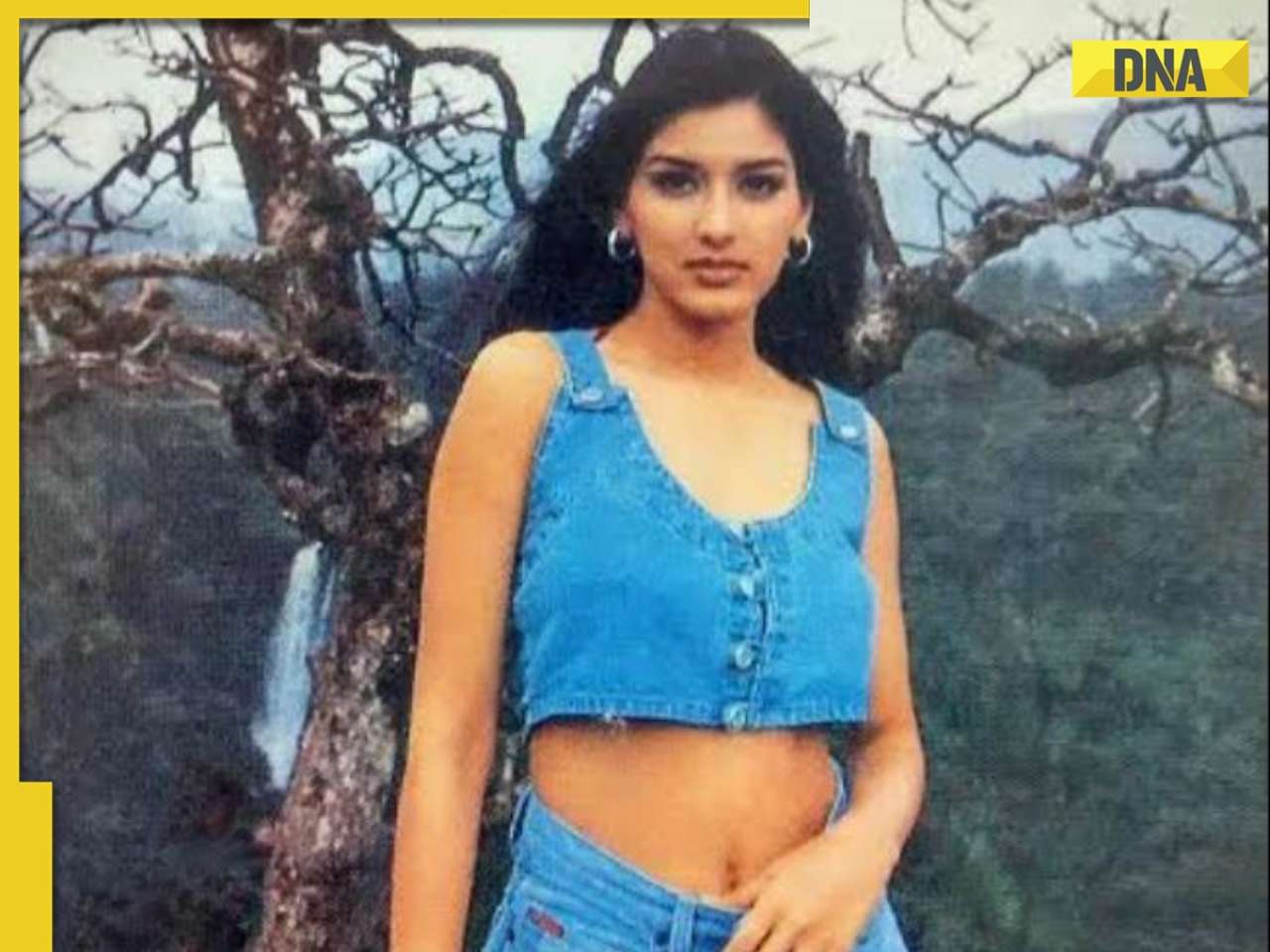

Mukesh Ambani’s daughter Isha Ambani’s firm launches new brand, Reliance’s Rs 8200000000000 company to…![submenu-img]() Sonali Bendre says producers called her 'too thin', tried to ‘fatten her up' during the 90s: ‘They'd just tell me...'

Sonali Bendre says producers called her 'too thin', tried to ‘fatten her up' during the 90s: ‘They'd just tell me...'![submenu-img]() Heavy rains in UAE again: Dubai flights cancelled, schools and offices shut

Heavy rains in UAE again: Dubai flights cancelled, schools and offices shut![submenu-img]() When 3 Bollywood films with same story released together, two even had same hero, all were hits, one launched star kid

When 3 Bollywood films with same story released together, two even had same hero, all were hits, one launched star kid![submenu-img]() Gautam Adani’s firm gets Rs 33350000000 from five banks, to use money for…

Gautam Adani’s firm gets Rs 33350000000 from five banks, to use money for…![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

Actors who died due to cosmetic surgeries![submenu-img]() See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol

See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol ![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() Sonali Bendre says producers called her 'too thin', tried to ‘fatten her up' during the 90s: ‘They'd just tell me...'

Sonali Bendre says producers called her 'too thin', tried to ‘fatten her up' during the 90s: ‘They'd just tell me...'![submenu-img]() When 3 Bollywood films with same story released together, two even had same hero, all were hits, one launched star kid

When 3 Bollywood films with same story released together, two even had same hero, all were hits, one launched star kid![submenu-img]() Salman Khan house firing case: Family of deceased accused claims police 'murdered' him, says ‘He was not the kind…’

Salman Khan house firing case: Family of deceased accused claims police 'murdered' him, says ‘He was not the kind…’![submenu-img]() Meet actor banned by entire Bollywood, was sent to jail for years, fought cancer, earned Rs 3000 crore on comeback

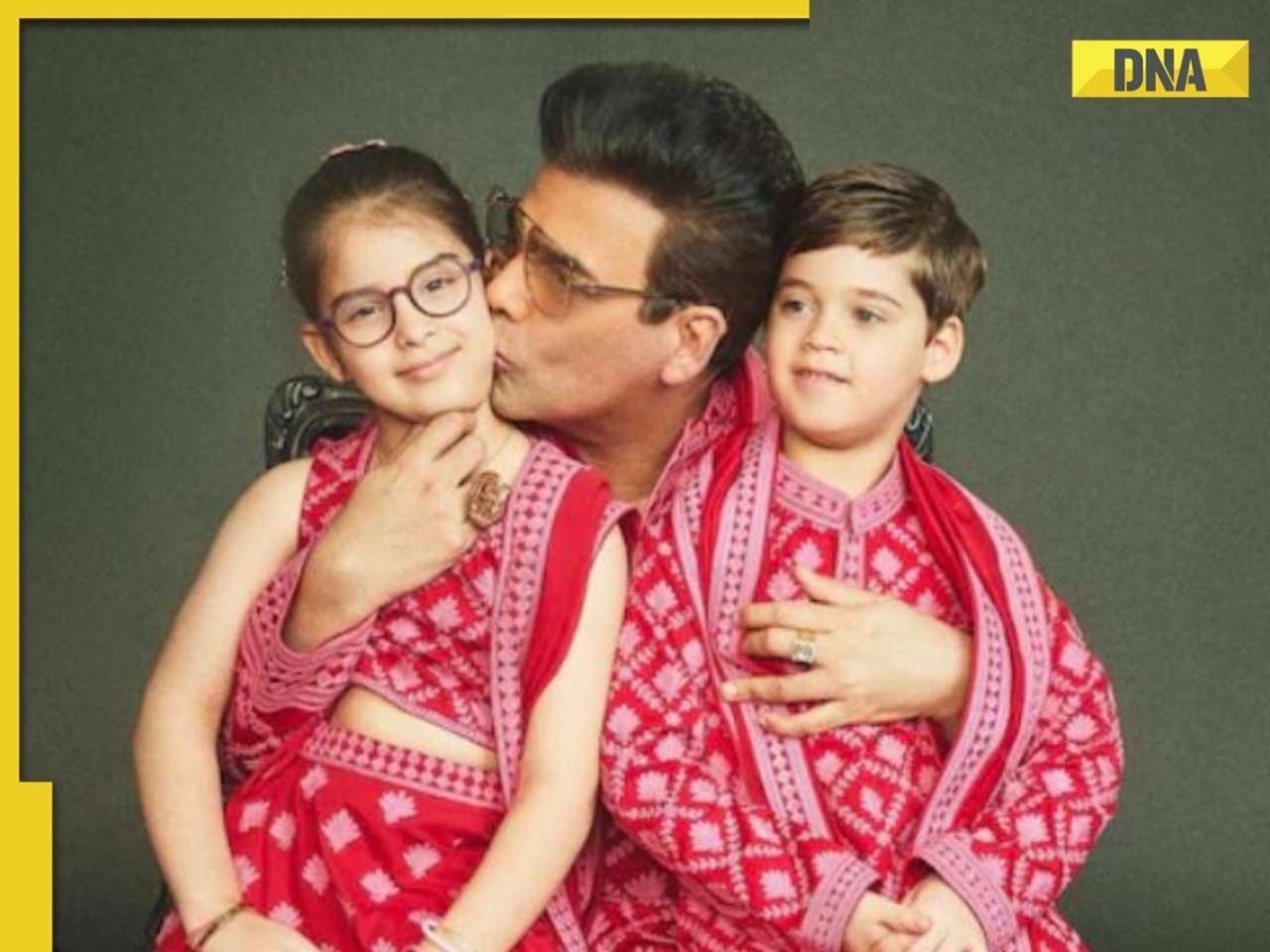

Meet actor banned by entire Bollywood, was sent to jail for years, fought cancer, earned Rs 3000 crore on comeback ![submenu-img]() Karan Johar wants to ‘disinherit’ son Yash after his ‘you don’t deserve anything’ remark: ‘Roohi will…’

Karan Johar wants to ‘disinherit’ son Yash after his ‘you don’t deserve anything’ remark: ‘Roohi will…’![submenu-img]() IPL 2024: Bhuvneshwar Kumar's last ball wicket power SRH to 1-run win against RR

IPL 2024: Bhuvneshwar Kumar's last ball wicket power SRH to 1-run win against RR![submenu-img]() BCCI reacts to Rinku Singh’s exclusion from India T20 World Cup 2024 squad, says ��‘he has done…’

BCCI reacts to Rinku Singh’s exclusion from India T20 World Cup 2024 squad, says ��‘he has done…’![submenu-img]() MI vs KKR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

MI vs KKR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() IPL 2024: How can RCB and MI still qualify for playoffs?

IPL 2024: How can RCB and MI still qualify for playoffs?![submenu-img]() MI vs KKR IPL 2024 Dream11 prediction: Fantasy cricket tips for Mumbai Indians vs Kolkata Knight Riders

MI vs KKR IPL 2024 Dream11 prediction: Fantasy cricket tips for Mumbai Indians vs Kolkata Knight Riders ![submenu-img]() '25 virgin girls' are part of Kim Jong un's 'pleasure squad', some for sex, some for dancing, some for...

'25 virgin girls' are part of Kim Jong un's 'pleasure squad', some for sex, some for dancing, some for...![submenu-img]() Man dances with horse carrying groom in viral video, internet loves it

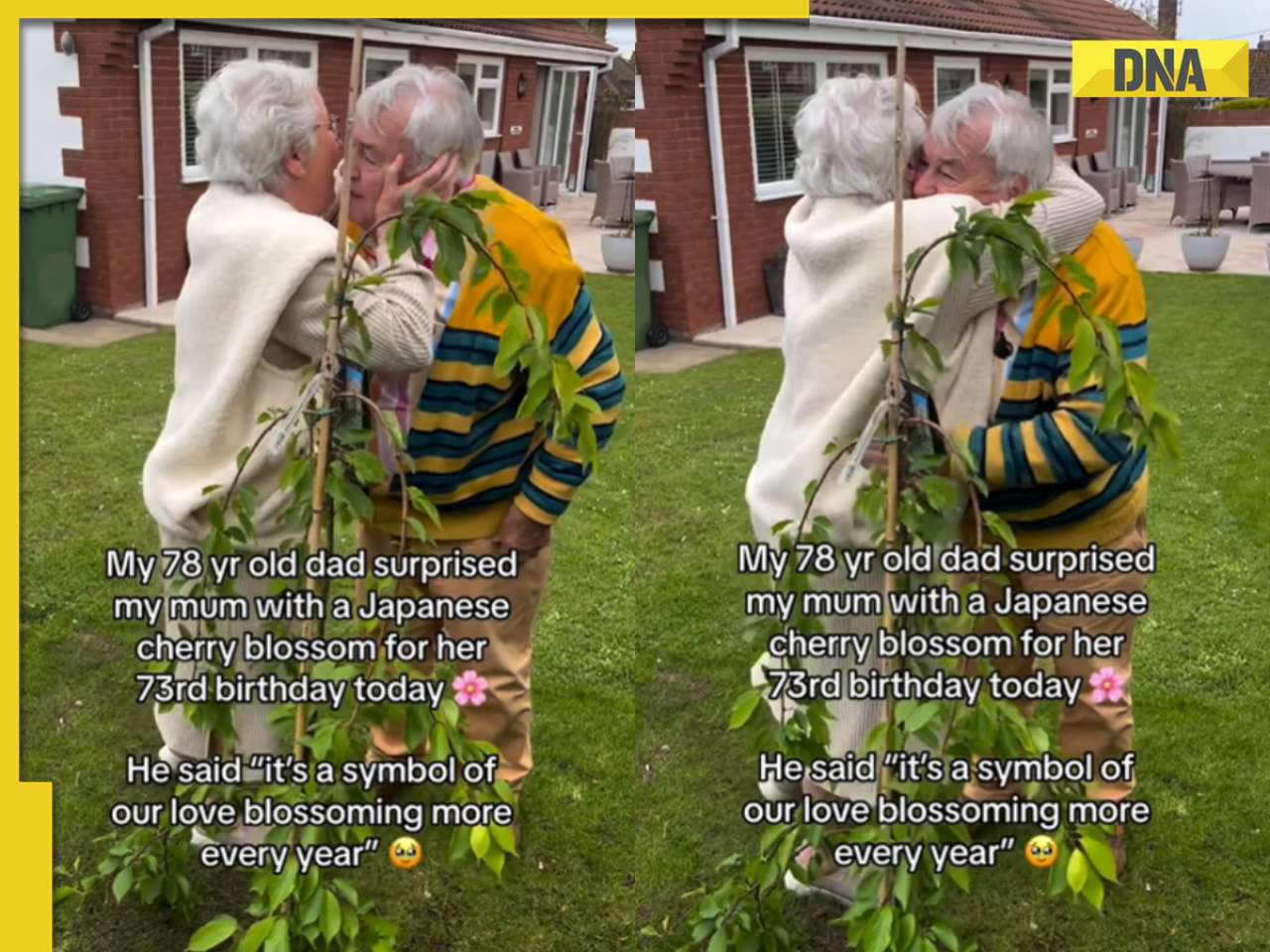

Man dances with horse carrying groom in viral video, internet loves it ![submenu-img]() Viral video: 78-year-old man's heartwarming surprise for wife sparks tears of joy

Viral video: 78-year-old man's heartwarming surprise for wife sparks tears of joy![submenu-img]() Man offers water to thirsty camel in scorching desert, viral video wins hearts

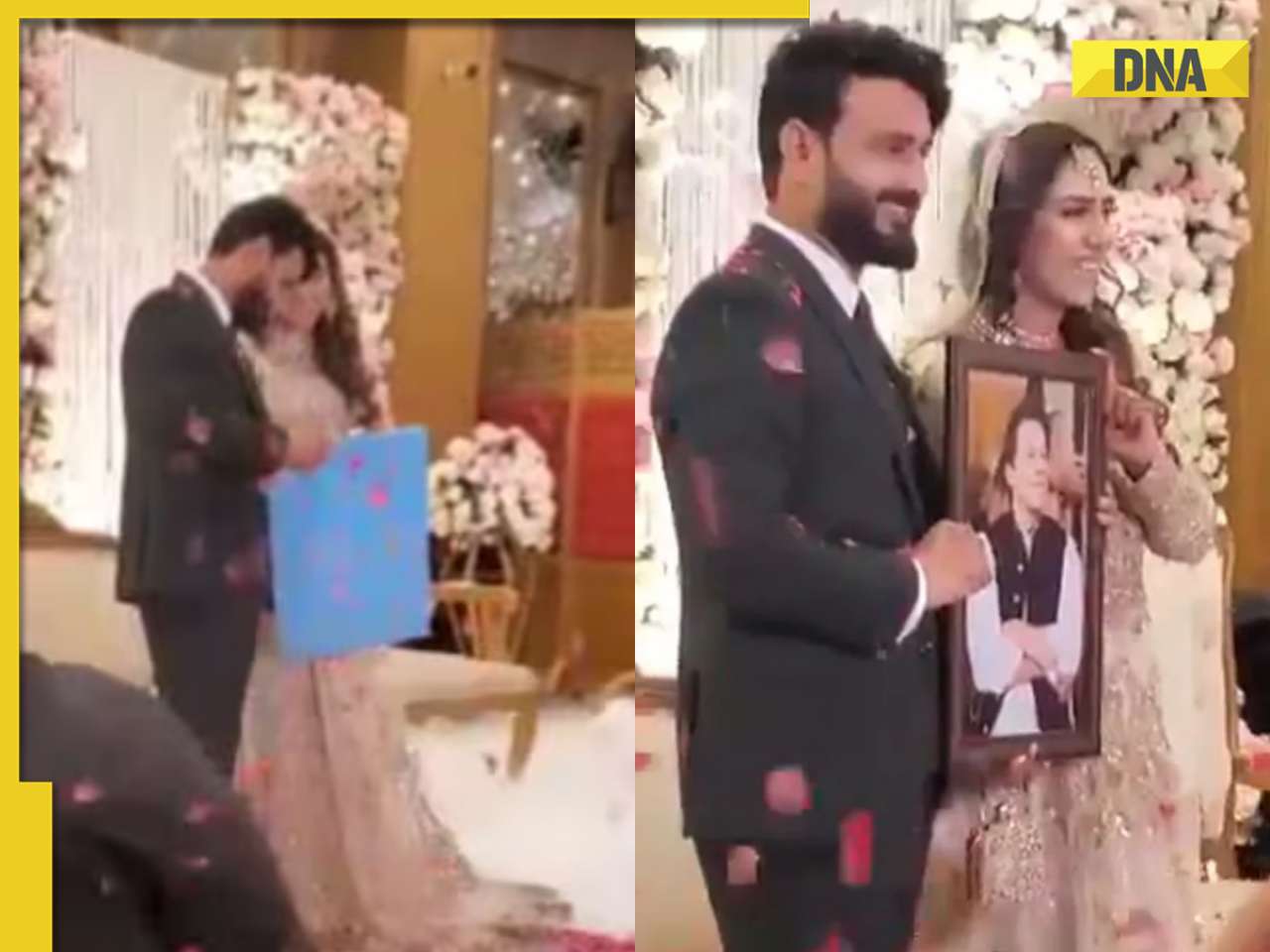

Man offers water to thirsty camel in scorching desert, viral video wins hearts![submenu-img]() Pakistani groom gifts framed picture of former PM Imran Khan to bride, her reaction is now a viral video

Pakistani groom gifts framed picture of former PM Imran Khan to bride, her reaction is now a viral video

)

)

)

)

)

)

)