Even under normal circumstances, filing and getting insurance claims can be quite painful. To make things easier for those affected in Tamil Nadu, most prominent insurance companies in the state have announced a slew of measures.

As Chennai is getting back to normalcy, one of the gargantuan tasks on hand will now be to claim insurance for lives lost, property, medical treatments, cars damaged and homes destroyed. Even under normal circumstances, filing and getting insurance claims can be quite painful. To make things easier for those affected in Tamil Nadu, most prominent insurance companies in the state have announced a slew of measures.

Most insurance companies that dna spoke to agreed that it was too early to gauge how much they will be paying out in terms of insurance claims in the aftermath of the floods. However, most of them have set up dedicated toll free helpline numbers or email ids to make the process simpler.

Tata AIG:

The company said that it has a sizeable number of clients in the state. In the flood-like situation on November 23, the company received claims to the tune of over Rs 30 crores, while for the second phase, claims were still pouring in.

“In all probability, the claim amount for the second spell of rains would be much more than the earlier event,” M Ravichandran, President - Insurance, TATA AIG General Insurance has said.

To help Chennaites make a claim, TATA AIG customers can SMS “Claim” to 5616181. The company has said that it will call the customers back once the SMS is received. The insurance company also has a 24x7 helpline number (1800-266-7780).

Reliance Life

The company has said that it has over 60,000 customers in the state, covered for a sum assured of over Rs 1,500 crore.

A Reliance Life spokesperson told dna that the company first ensured all its advisors in the state were doing okay, and then urged them to get in touch with the customers. “We have also attempted to call our customers and check about their well-being,” the spokesperson said.

To make things simpler for customers, loan facility on policies can be availed, he said.

Over and above this, it has made the process of claiming insurance in the case of a death, simpler. The company has reduced the number of documents required and waived late payment interest fee on delayed life insurance premiums till February 2016.

Bajaj Allianz General Insurance

One of the most prominent players in Tamil Nadu, Bajaj Allianz General Insurance has received over 1,000 claims pertaining to motor and property insurance, the company's Chief Technical Officer, Sasikumar Adidamu, told dna. The company has said that so far, it has received majority of claims for motor insurance.

Bajaj Allianz has set up a dedicated toll free helpline number (1800-209-7072) for claims related assistance. He said that the company has shared the number with the print media as well as local TV channels.

Moreover, the company has also sent flood advisories to its customers through SMS, informing them about the dos & donts in a flood situation.

The company has also set up a special flood advisory for motor insurance policyholders in Chennai, the company's chief technical officer motor, said. It has simple steps to help customers ensure that no further damage is caused to their motor vehicles. It has also set up a toll free helpline (1800-209-7072)

SBI General Insurance

SBI General Insurance has thus far received over 200 claims for the November 13 and 15 incidents, amounting to nearly Rs 47 crores. “Out of this, SBI General has already processed interim payments towards 26 claims and will continue to provide immediate relief whenever possible to get customers and their businesses back to normal as early as possible,” Bhaskar Jyoti Sarma, managing director and chief executive officer told dna.

For the second incident of December 6 till date, the company has received 360 more claims so far, mostly from business and manufacturing units.

To make claims easy, SBI General has set up a dedicated claims team in Chennai to handle customer queries and assist them in registering their claims in a speedy manner, Sarma said. “We have also stationed additional staff in our Chennai branch from the first week of December to support the claims processing activity, and surveyors have also been appointed in all the reported claims,” he said.

Communication has been circulated to all intermediaries in flood affected locations of Tamil Nadu outlying the actions required to be followed by the customers in the event of a claim. SBI General is also proactively communicating to the policy holders through its website, SMS, automated voice calls, online and radio broadcasts informing them on the status of the local branch and the toll free numbers, he added.

Star Health Insurance

Star Health Insurance chairman and managing director, Jagannathan has said that it will take a few days to know the full impact of the damage caused as it was too early now to say anything. The company has a 6% exposure in the state out of the total number of lives insured.

To make claims easier, he said that the company's call centre personnel are trained to guide the policyholders on the claims procedure. In addition, we have our doctor team for attending to any queries from customers and non-customers as well, he added. Star Health has also advertised in the local dailies about this.

IDBI Federal Life Insurance

The company has said that it will not insist on the original policy document in case the person filing for a claim has lost it during the floods. Claims will be based on the claim form and on the death certificate, the company said.

Meanwhile, in the absence of a death certificate, the company said that the claimant can register the claim basis certificate of death from any local government authority, hospitals or post-mortem reports. The company will also refer to the list of missing persons or deaths as issued by the government during such situations.

All IDBI Federal Life Insurance branches in the states of Tamil Nadu and Andhra Pradesh can be mentioned for filing of claims. The company said that branch staff will guide the claimants on the process and expedite it.

It has also set up a toll free number (1800-209-0502) and a dedicated email id – claims@idbifederal.com.

Future Generali India Life Insurance

In accordance with the Insurance Regulatory and Development Authority of India (IRDAI) communication, Future Generali India Life Insurance Company Limited (FGILI), has set up a special helpdesk to expedite the claim settlement process for the victims of the Tamil Nadu and Andhra Pradesh floods.

The company has set up a dedicated helpline number and email id (1800-102-2355 / 022-41514841/ claimsrelief@futuregenerali.in) for any queries and clarifications.

The company has also assigned dedicated branch representatives who will assist the claimants in this process.

For Chennai and Puducherry and Andhra Pradesh, thec ompany has given the following details.

|

For Chennai and Puducherry

|

For Andhra Pradesh

|

|

Name: N.Prabu Email: prabu.n@futuregenerali.in Mobile: +91 9843335789 Landline: 044-33507100 – Extn - 7138 Future Generali India Life Insurance

1st floor, No 55, Vijaya Ragava Road

T.Nagar, Chennai – 600017

|

Name: G.V.S. Chandra Sekhar EMail: chandrasekhar.gundala@futuregenerali.in Mobile: +91 8374448831 Landline: 040-66038600 Future Generali India Life Insurance Co Ltd

Door No:-7-1-21A, APDL Estates

1st Floor, Opp Hotel Country Club

Begumpet, Hyderabad – 500016

|

![submenu-img]() 'They unilaterally took some measures': EAM Jaishankar on new Nepal 100 rupee currency

'They unilaterally took some measures': EAM Jaishankar on new Nepal 100 rupee currency![submenu-img]() Meet Ice Cream Lady of India, who built Rs 6000 crore company, started with small investment of Rs…

Meet Ice Cream Lady of India, who built Rs 6000 crore company, started with small investment of Rs…![submenu-img]() ‘Canada a rule-of-law country’: PM Trudeau after 3 Indian arrested over Hardeep Nijjar's murder

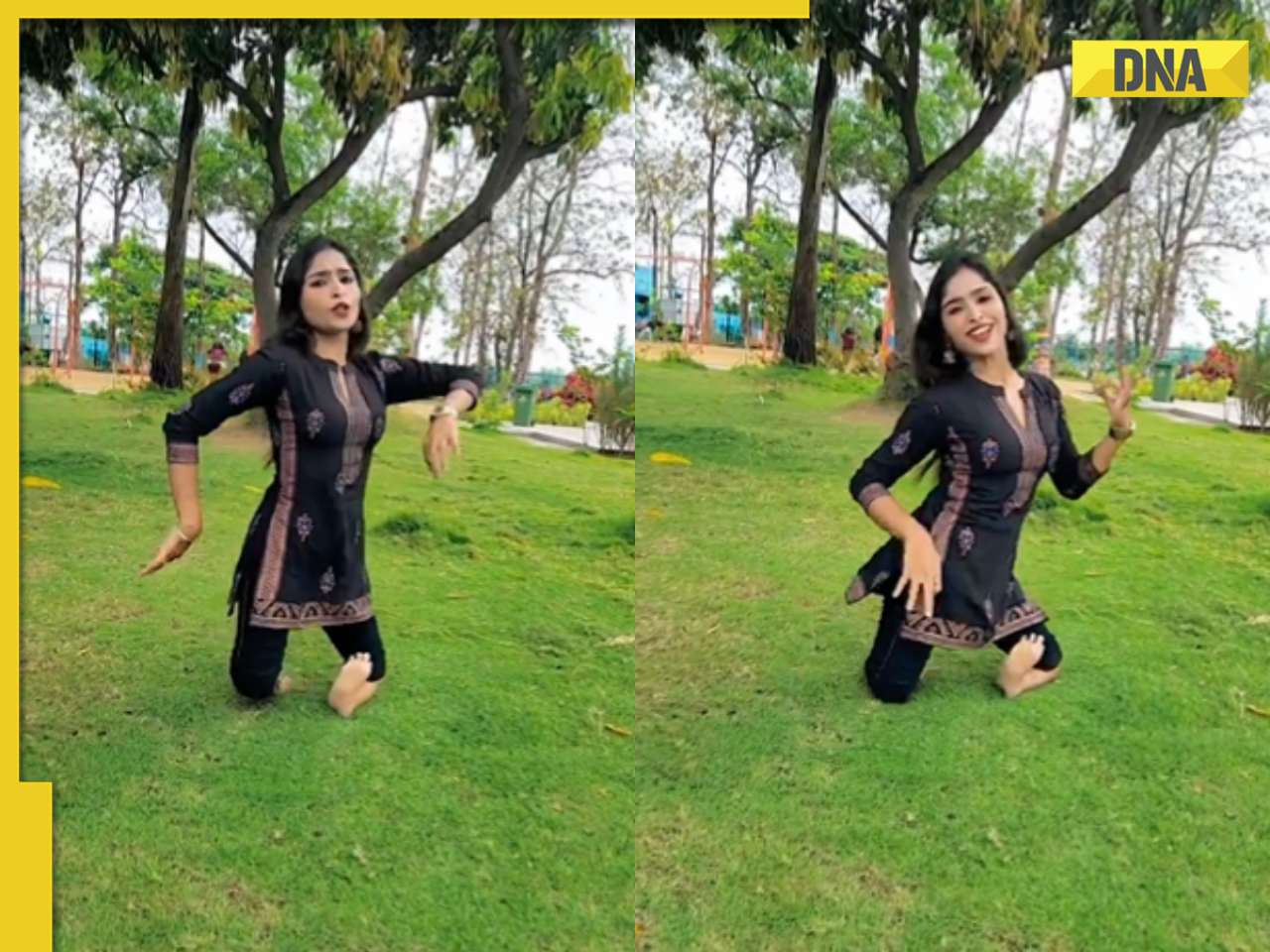

‘Canada a rule-of-law country’: PM Trudeau after 3 Indian arrested over Hardeep Nijjar's murder![submenu-img]() Viral video: Specially-abled girl’s energetic dance to Bollywood song wows internet, watch

Viral video: Specially-abled girl’s energetic dance to Bollywood song wows internet, watch![submenu-img]() 'Baap re baap': Imtiaz Ali reveals Diljit Dosanjh was scandalised by old women's 'vulgar' improvisation on Chamkila set

'Baap re baap': Imtiaz Ali reveals Diljit Dosanjh was scandalised by old women's 'vulgar' improvisation on Chamkila set![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

Actors who died due to cosmetic surgeries![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() 'Baap re baap': Imtiaz Ali reveals Diljit Dosanjh was scandalised by old women's 'vulgar' improvisation on Chamkila set

'Baap re baap': Imtiaz Ali reveals Diljit Dosanjh was scandalised by old women's 'vulgar' improvisation on Chamkila set![submenu-img]() This actor, who worked with Karan Johar and Farhan Akhtar, gave superhit shows, saw failed marriage, killed himself at..

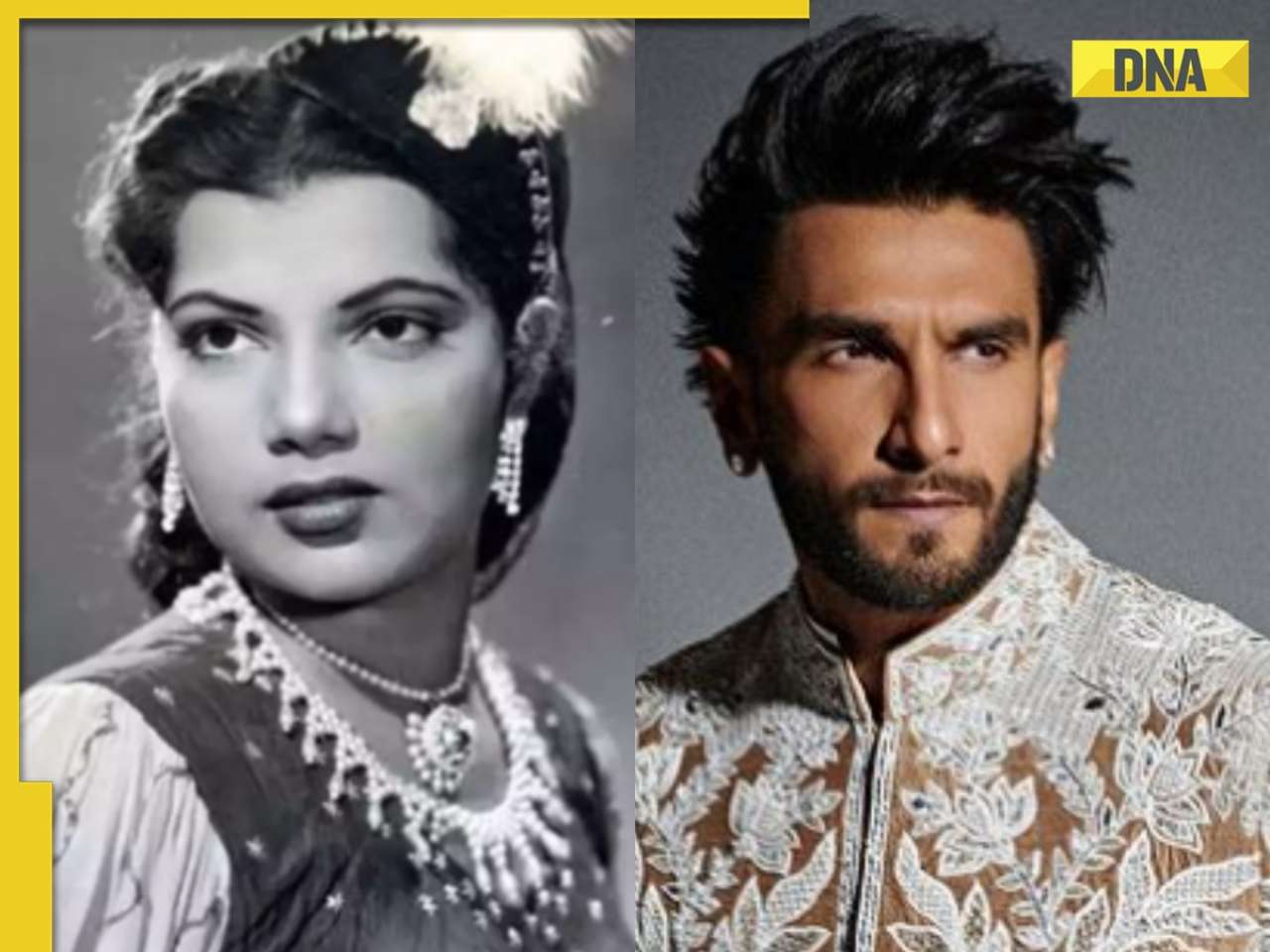

This actor, who worked with Karan Johar and Farhan Akhtar, gave superhit shows, saw failed marriage, killed himself at..![submenu-img]() Did you know Ranveer Singh's grandmother was popular actress? Worked with Raj Kapoor; her career affected due to...

Did you know Ranveer Singh's grandmother was popular actress? Worked with Raj Kapoor; her career affected due to...![submenu-img]() India's highest-paid TV actress began working at 8, her Bollywood films flopped, was seen in Bigg Boss 1, now charges...

India's highest-paid TV actress began working at 8, her Bollywood films flopped, was seen in Bigg Boss 1, now charges...![submenu-img]() Shreyas Talpade wonders if his heart attack was due to Covid vaccine: 'We don’t know what we have taken inside...'

Shreyas Talpade wonders if his heart attack was due to Covid vaccine: 'We don’t know what we have taken inside...'![submenu-img]() IPL 2024: Faf du Plessis, Virat Kohli help Royal Challengers Bengaluru defeat Gujarat Titans by 4 wickets

IPL 2024: Faf du Plessis, Virat Kohli help Royal Challengers Bengaluru defeat Gujarat Titans by 4 wickets![submenu-img]() IPL 2024: Why is Sai Kishore not playing today's RCB vs GT match?

IPL 2024: Why is Sai Kishore not playing today's RCB vs GT match?![submenu-img]() 'Mumbai Indians ki kahani khatam': Ex-India star slams Hardik Pandya after MI's loss to KKR at Wankhede

'Mumbai Indians ki kahani khatam': Ex-India star slams Hardik Pandya after MI's loss to KKR at Wankhede![submenu-img]() LSG vs KKR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

LSG vs KKR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() LSG vs KKR IPL 2024 Dream11 prediction: Fantasy cricket tips for Lucknow Super Giants vs Kolkata Knight Riders

LSG vs KKR IPL 2024 Dream11 prediction: Fantasy cricket tips for Lucknow Super Giants vs Kolkata Knight Riders![submenu-img]() Viral video: Specially-abled girl’s energetic dance to Bollywood song wows internet, watch

Viral video: Specially-abled girl’s energetic dance to Bollywood song wows internet, watch![submenu-img]() Viral video: Man educates younger brother about mensuration, internet is highly impressed

Viral video: Man educates younger brother about mensuration, internet is highly impressed![submenu-img]() Girl's wedding dance to Haryanvi song interrupted by mother in viral video, internet reacts

Girl's wedding dance to Haryanvi song interrupted by mother in viral video, internet reacts![submenu-img]() Viral video: Man fearlessly grabs dozens of snakes, internet is scared

Viral video: Man fearlessly grabs dozens of snakes, internet is scared![submenu-img]() This mysterious mobile phone number was suspended after three users...

This mysterious mobile phone number was suspended after three users...

)

)

)

)

)

)

)