Case on loan given by him to RCIL in 2004; tribunal rules loan against pledge of shares wasn’t a transfer of shares.

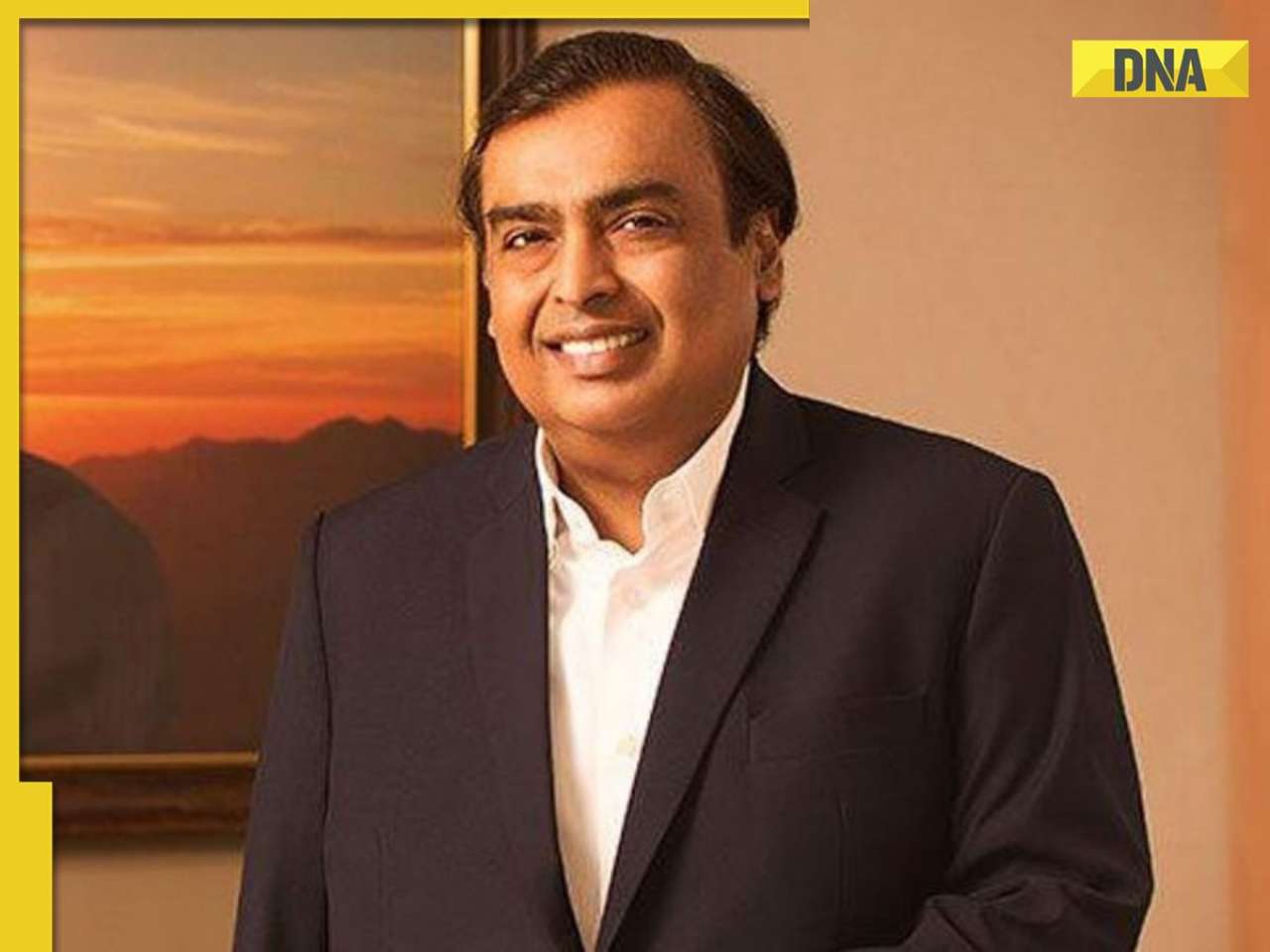

The Income Tax Appellate Tribunal (ITAT) has ruled in favour of Reliance Industries chairman Mukesh Ambani in a tax case involving income of over Rs2,000 crore.

In a significant ruling, the Mumbai bench of ITAT has held that pledge of equity shares of Reliance Infocomm Ltd with Mukesh Ambani as a security for the loan given by him to Reliance Communications Infrastructure Ltd (RCIL) in 2004 does not amount to transfer of shares even though Ambani is treated as “beneficial owner” with the depository participant and appropriate filings as per section 187C of the Companies Act have been filed with the Registrar of Companies.

In March 2004, Mukesh Ambani was appointed director of RCIL and gave a loan of Rs50 crore to the company.

RCIL in turn pledged 50 crore shares of face value Re 1 of its subsidiary Reliance Infocomm with Mukesh Ambani.

In May 2004, Reliance Communications repaid the loan amount and Mukesh Ambani released the shares back to the company.

The income-tax department argued that the shares of the value of Rs2,685 crore were acquired by Mukesh Ambani for just Rs50 crore.

The I-T department contested that transaction of pledge was not grounded on commercial reality because the pledge was taken after disbursement of the loan and the value of security was disproportionate to the amount of loan.

But the ITAT held that these are

matters lying within the realm of consent of parties to an agreement and cannot be the basis to conclude that there was in fact a sale of shares by RCIL to Ambani.

The ITAT also stressed on the fact that after due repayment of the loan RCIL was again recognised as the beneficial owner of the shares. The tribunal observed that all the proceedings relating to loan and pledge were recorded in the board meetings of the companies.

![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() Hassan horror: Sex scandal Prajwal Revanna breaks silence, to appear before SIT on...

Hassan horror: Sex scandal Prajwal Revanna breaks silence, to appear before SIT on...![submenu-img]() Shakira likely to perform at Anant Ambani-Radhika Merchant’s 2nd pre-wedding bash; she will charge…

Shakira likely to perform at Anant Ambani-Radhika Merchant’s 2nd pre-wedding bash; she will charge…![submenu-img]() Divya Agarwal sparks divorce rumours with Apurva Padgaonkar three months after marriage, deletes...

Divya Agarwal sparks divorce rumours with Apurva Padgaonkar three months after marriage, deletes...![submenu-img]() Noida news: IRS officer arrested for allegedly killing woman whom he met on dating app

Noida news: IRS officer arrested for allegedly killing woman whom he met on dating app![submenu-img]() Meet man who was hired for record-breaking pay package, not from IIT or IIM, his salary is…

Meet man who was hired for record-breaking pay package, not from IIT or IIM, his salary is…![submenu-img]() IIT graduate got job with Rs 100 crore salary, fired within a year, replaced by woman with Rs 33 crore pay, she is...

IIT graduate got job with Rs 100 crore salary, fired within a year, replaced by woman with Rs 33 crore pay, she is...![submenu-img]() Meet youngest IAS officer of her batch, who cracked UPSC exam in first attempt, secured AIR...

Meet youngest IAS officer of her batch, who cracked UPSC exam in first attempt, secured AIR...![submenu-img]() Maharashtra SSC Result 2024: MSBSHSE Class 10 results to be out today; check time, direct link here

Maharashtra SSC Result 2024: MSBSHSE Class 10 results to be out today; check time, direct link here![submenu-img]() Meet IAS officer, son of grocery store owner, who left Rs 25 lakh job to crack UPSC exam in first attempt, secured AIR..

Meet IAS officer, son of grocery store owner, who left Rs 25 lakh job to crack UPSC exam in first attempt, secured AIR..![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() Avneet Kaur shines in navy blue gown with shimmery trail at Cannes 2024, fans say 'she is unstoppable now'

Avneet Kaur shines in navy blue gown with shimmery trail at Cannes 2024, fans say 'she is unstoppable now'![submenu-img]() Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes

Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes ![submenu-img]() Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'

Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'![submenu-img]() AI models play volley ball on beach in bikini

AI models play volley ball on beach in bikini![submenu-img]() AI models set goals for pool parties in sizzling bikinis this summer

AI models set goals for pool parties in sizzling bikinis this summer![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?

DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() Divya Agarwal sparks divorce rumours with Apurva Padgaonkar three months after marriage, deletes...

Divya Agarwal sparks divorce rumours with Apurva Padgaonkar three months after marriage, deletes...![submenu-img]() 'Felt bad for...': Amitabh Bachchan reacts to 'most touching' moment from IPL 2024 KKR vs SRH final

'Felt bad for...': Amitabh Bachchan reacts to 'most touching' moment from IPL 2024 KKR vs SRH final![submenu-img]() Karan V Grover talks about playing Suryapratap in Dhruv Tara, says he enjoys challenging roles | Exclusive

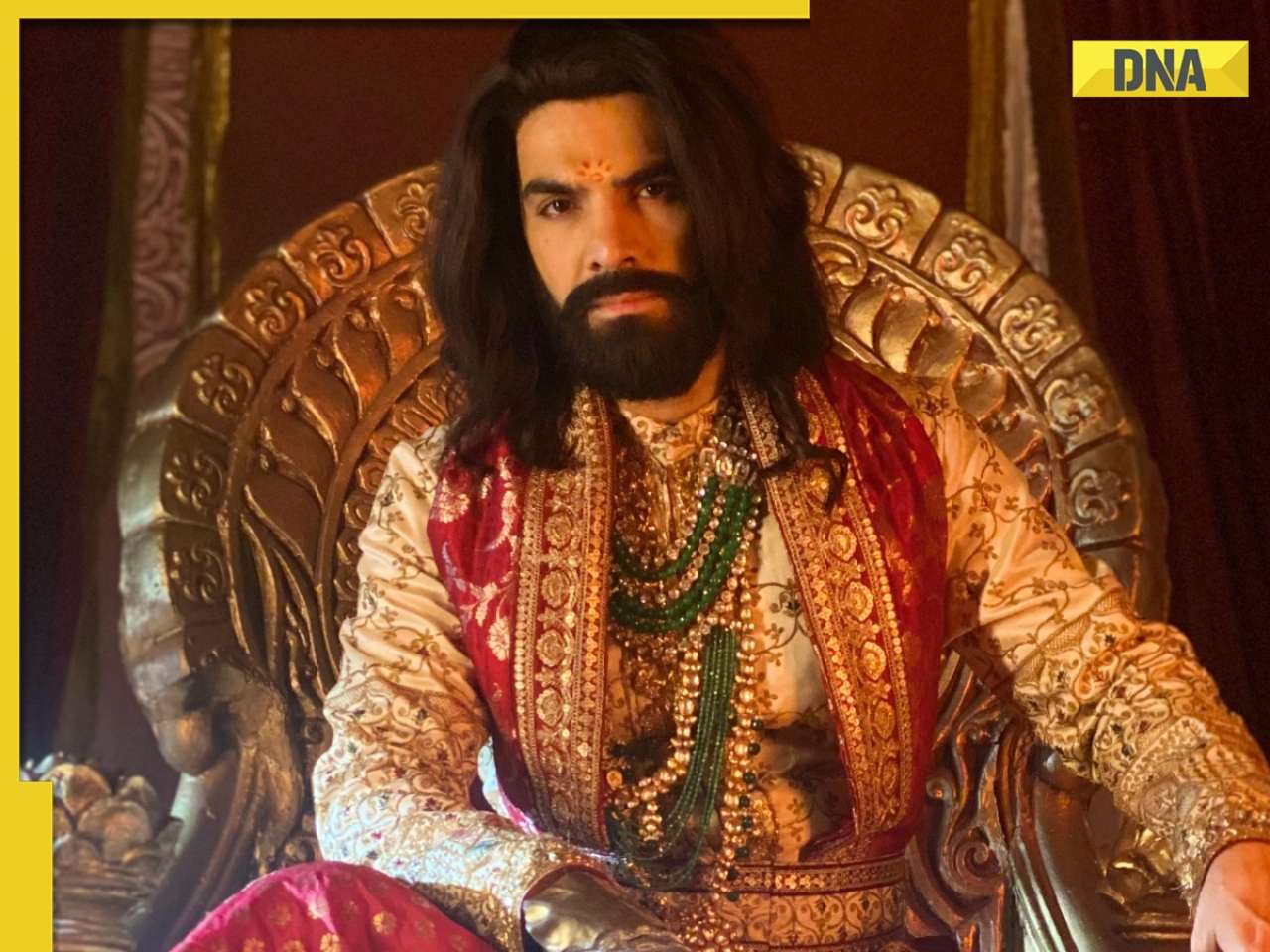

Karan V Grover talks about playing Suryapratap in Dhruv Tara, says he enjoys challenging roles | Exclusive![submenu-img]() Dhadak 2: Karan Johar announces sequel, reveals cast; film to release on...

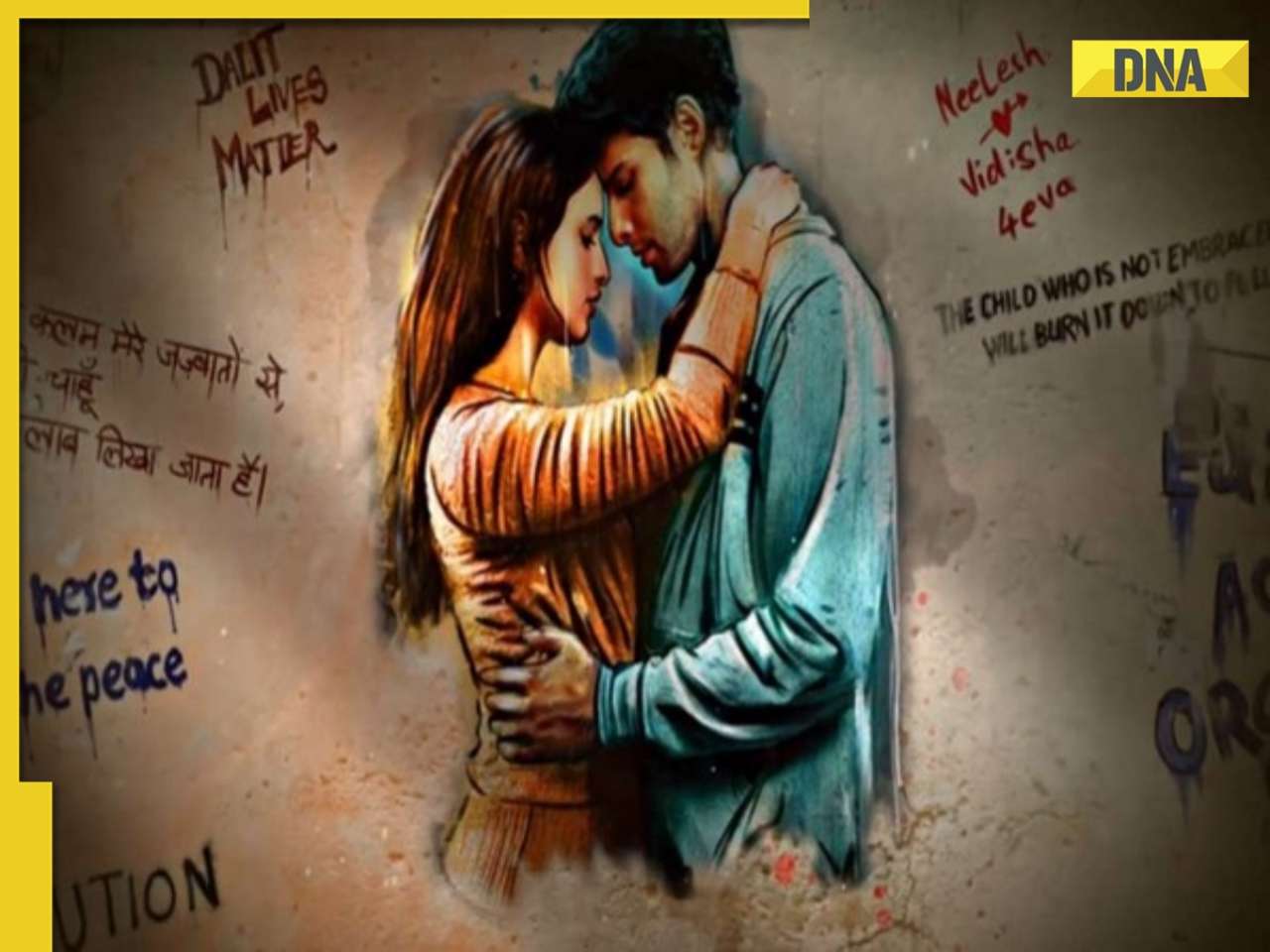

Dhadak 2: Karan Johar announces sequel, reveals cast; film to release on...![submenu-img]() Munawar Faruqui gets married for second time? Viral inside photo from ceremony has fans puzzled

Munawar Faruqui gets married for second time? Viral inside photo from ceremony has fans puzzled![submenu-img]() Shakira likely to perform at Anant Ambani-Radhika Merchant’s 2nd pre-wedding bash; she will charge…

Shakira likely to perform at Anant Ambani-Radhika Merchant’s 2nd pre-wedding bash; she will charge…![submenu-img]() Mukesh Ambani hosting massive birthday party on cruise for Akash Ambani’s daughter, to be followed by Cannes...

Mukesh Ambani hosting massive birthday party on cruise for Akash Ambani’s daughter, to be followed by Cannes...![submenu-img]() This island has more cats than humans, it is located in...

This island has more cats than humans, it is located in...![submenu-img]() Rapper bets big on Shah Rukh Khan’s KKR, wins over Rs 35000000 after easy IPL 2024 final win

Rapper bets big on Shah Rukh Khan’s KKR, wins over Rs 35000000 after easy IPL 2024 final win![submenu-img]() Hijab, beard is banned in this country with 96% Muslim population

Hijab, beard is banned in this country with 96% Muslim population

)

)

)

)

)

)