The Indian luxury market is expected to grow by 20% every year, industry leaders tell Anita Khatri, Mission Delegate-India, Foundation de la Haute Horologerie (FHH)

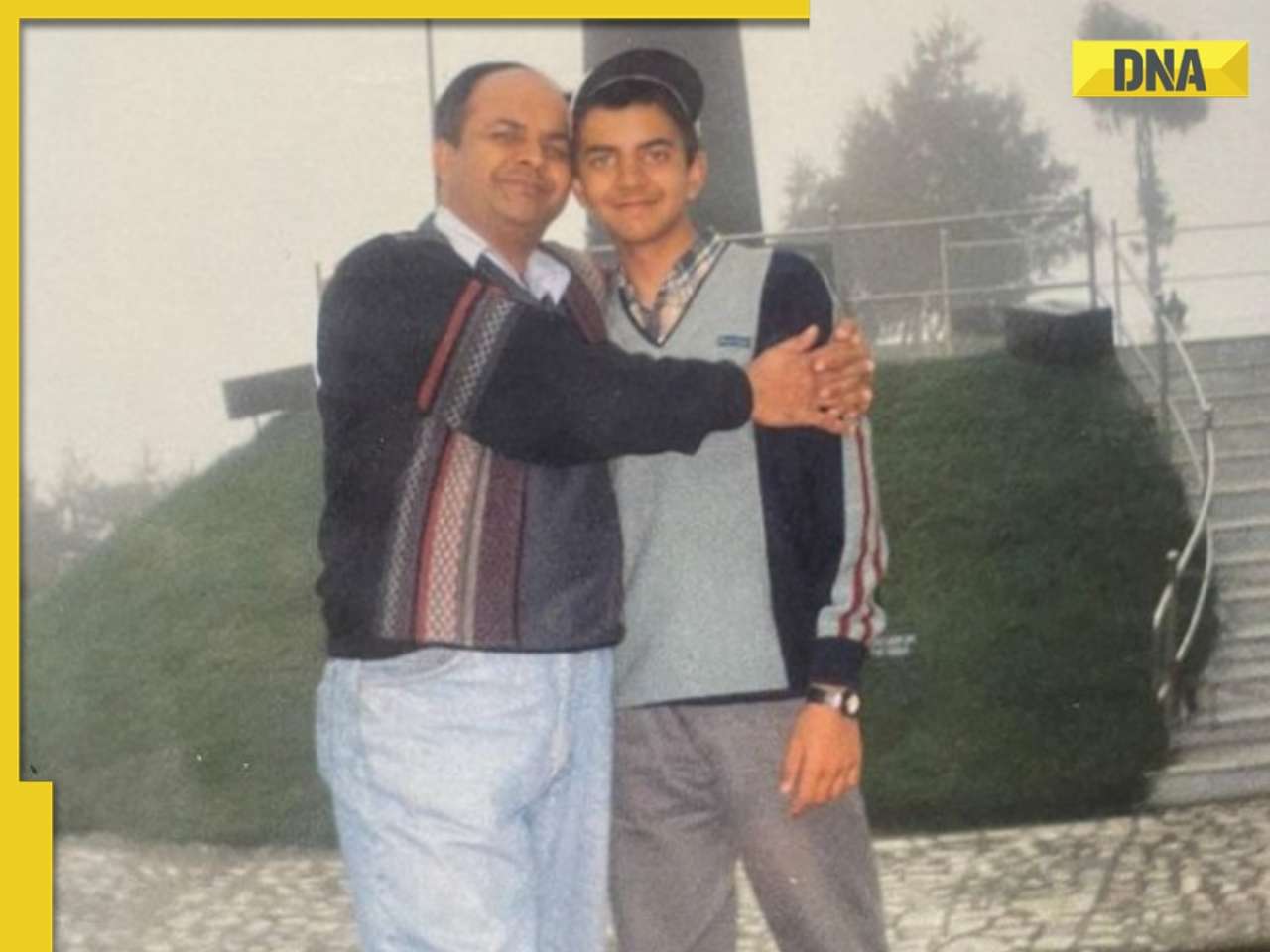

Sanjay Kapoor

MD, Genesis Luxury

1. In the last 3-5 years, has the Indian luxury consumer evolved? If so, how and why?

Yes, the Indian luxury consumer has definitely evolved over the last few years. The initial phase of the badge/logo-conscious consumer has given way to quality and heritage consciousness. The luxury consumer wants to take the next step and engage with brands that are high on quality and craftsmanship. They are also looking for more bespoke experiences than what is just available off the rack. Exclusivity is the new buzz word.

2. Is there a change in the gender category or age category of the luxury watch consumer making demands?

The luxury consumer has definitely become younger and the demographics are becoming wider in all aspects—gender, geography or age.

Media penetration, frequent overseas travel by the upper-middle classes and a wide growth of aspirational consumers has ensured a greater exposure to international luxury brands within the country.

3. The Indian retail industry seems to be evolving. Your comment.

The Indian retail industry has gone through a metamorphosis, in the last decade. Changes have been from both, the consumer as well as the marketeer’s end. The Indian economy has grown and become more self-sustained, which has also increased the viability of FDI. The consumer has more disposable income, which has raised the purchasing power of the population, each year adding more numbers to this consumer market. The presence of global players in the market has given the right competitive impetus to home-grown brands too and both vie with each other to improve the quality of customer experiences.

4. Is there any peculiarity with regards to the Indian luxury consumer as compared to his/her global counterpart?

The Indian luxury consumer is comparatively more quality conscious and definitely more price conscious than his or her global counterpart. He is aware and well-travelled, he does all the necessary research before making a purchase. Brands entering India must therefore bring their best and latest products at competitive prices. The Indian consumer is also used to more attention and hand-holding. Brands have to roll out some additional services to pamper this consumer.

Viraal Rajan

Director, Time Avenue

1. In the last 3-5 years, has the Indian luxury consumer evolved? If so, how and why?

The Indian luxury consumer has been evolving for the last 7-8 years. Readily available and easily accessible information and a thorough market research make it easier for consumers to understand what they want.

2. Is there a change in the gender category or age category of the luxury watch consumer making demands?

Super luxury watches are for a select few, but today even the young audience is spending money. Their awareness is better and they are able to appreciate high-end watches, especially women. The base has become broader and the spending capacity is higher, as people understand the value of luxury.

3. Indian retail industry seems to be evolving. Your comment.

The luxury market has evolved in the past five years and it has benefited the consumer as he gets the best and latest products from across the world, here in his neighbourhood. There is no time lag between the international launch of a watch and it’s availability in India. Also, the access to the entire range of products, the after-sales and service understanding has matured.

4. Is there any peculiarity with regards to the Indian luxury consumer as compared to his / her global counterpart?

The Indian consumer is like a child in a candy shop where these high-end, super-exclusive products and brands, which were not there earlier is now available to our audience. There has also been a surge in the purchasing power.

Anil Madan

Director, Johnson Watch Co. Pvt Ltd

1. In the last 3-5 years, has the Indian luxury consumer evolved? If so, how and why?

The preferences of the Indian consumers of luxury watches has evolved over time. Earlier, luxury was essentially intertwined with foreign trips and luxury watches were generally imported from Europe.

As luxury watches entered India and the number of ‘new rich’ increased, the need for display of wealth and social status increased. Luxury became all about flaunting

the hard-earned wealth and people became extremely

brand conscious.

2. The Indian retail industry seems to be evolving. Your comment.

In less than a decade, the face of retail has changed. With brands opening their subsidiaries, the client prefers to buy locally, where he can see the full range of the brands’ collections.

3. Is there any peculiarity with regards to the Indian luxury consumer as compared to his/her global counterpart?

The Indian luxury consumer prefers to be shown the brands’ range at their offices and residences.

4. What is your advice to global brand owners when it comes to Indian luxury watch market for the next 3-5 years?

The luxury watch retail industry has witnessed a rapid growth in India. While most of the mature markets are undergoing a slowdown in sales, India is being heralded as holding much potential. Although, currently international brands are facing many challenges, most view their venture into India as a long-term investment that will eventually yield massive returns. The Indian luxury watch market is expected to more than double its current size over the next five years. The growth of India as a luxury market and its potential is obvious and there is a positive sentiment towards global watch brands.

Sharjeel Khan

Director, Zimson Times Pvt. Ltd

1. In the last 3-5 years, has the Indian luxury watch consumer evolved? If so, how and why?

The Indian luxury watch consumer has definitely evolved largely due to the increase in high disposable income, lifestyle standards, accessibility and availability of luxury brands in the country (watches and other products). Consumers are more familiar with brands now, because of brand marketing and promotions. We, as retailers, have also been educating the consumers. Now, there is a greater level of acceptance of luxury brands as compared to the earlier years. Consumers have also been travelling extensively and because of the high visibility of luxury brands in the neighbouring countries (Dubai, Singapore, Hong Kong, etc), consumers are showing more confidence while buying luxury brands.

2. Is there a change in the gender category or age category of the luxury watch consumer making demands?

Not much has changed in the gender category (especially in South India), but there is a slight improvement. Even today, majority of the luxury watch consumers are men. In South India, women still prefer jewellery and other accessories over watches. The age category, however, has seen a huge expansion. The youth form a large part of the luxury watch consumers. We have seen a lot of young men (even college-goers), who indulge in luxury watches. Today, the target age of luxury watch consumers is

20-50 years.

3. The Indian watch retail industry seems to be evolving. Your comment.

Yes, the industry seems to be growing at an average rate of about 20-25% every year. One reason is that the base is very small (especially luxury watches). When the brands weren’t available in India, Indian consumers would still buy watches abroad. Now with their growing availability in India, the consumer buying phenomenon has seen a huge growth. Earlier, after-sales service was a problem many consumers faced, when they shopped abroad.

4. Is there any peculiarity with regards to the Indian luxury watch consumer as compared to his/her global counterpart?

Indian luxury watch buyers are highly price sensitive when compared to global buyers. Looks and brand recognition are two important factors rather than watch-making or features of the watches. Indian consumers are mostly open-minded and are willing to try different brands. Whereas, global consumers are pre-determined on what they want to buy. Indian consumers prefer to be exclusive and exclusive timepieces always grab their attention. They mostly go by word-of-mouth.

![submenu-img]() Anant Raj Ventures into tier 2 and tier 3 cities, pioneering growth in India’s real estate sector

Anant Raj Ventures into tier 2 and tier 3 cities, pioneering growth in India’s real estate sector![submenu-img]() Sophie Turner reveals she wanted to terminate her first pregnancy with Joe Jonas: 'Didn't know if I wanted...'

Sophie Turner reveals she wanted to terminate her first pregnancy with Joe Jonas: 'Didn't know if I wanted...'![submenu-img]() Meet outsider who was given no money for first film, battled depression, now charges Rs 20 crore per film

Meet outsider who was given no money for first film, battled depression, now charges Rs 20 crore per film![submenu-img]() This is owner of most land in India, owns land in every state, total value is Rs...

This is owner of most land in India, owns land in every state, total value is Rs...![submenu-img]() Meet man who built Rs 39832 crore company after quitting high-paying job, his net worth is..

Meet man who built Rs 39832 crore company after quitting high-paying job, his net worth is..![submenu-img]() Meet woman who first worked at TCS, then left SBI job, cracked UPSC exam with AIR...

Meet woman who first worked at TCS, then left SBI job, cracked UPSC exam with AIR...![submenu-img]() Meet engineer, IIT grad who left lucrative job to crack UPSC in 1st attempt, became IAS, married to an IAS, got AIR...

Meet engineer, IIT grad who left lucrative job to crack UPSC in 1st attempt, became IAS, married to an IAS, got AIR...![submenu-img]() Meet Indian woman who after completing engineering directly got job at Amazon, then Google, Microsoft by using just...

Meet Indian woman who after completing engineering directly got job at Amazon, then Google, Microsoft by using just...![submenu-img]() Meet man who is 47, aspires to crack UPSC, has taken 73 Prelims, 43 Mains, Vikas Divyakirti is his...

Meet man who is 47, aspires to crack UPSC, has taken 73 Prelims, 43 Mains, Vikas Divyakirti is his...![submenu-img]() IIT graduate gets job with Rs 100 crore salary package, fired within a year, he is now working as…

IIT graduate gets job with Rs 100 crore salary package, fired within a year, he is now working as…![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() In pics: Taarak Mehta Ka Ooltah Chashmah actress Deepti Sadhwani dazzles in orange at Cannes debut, sets new record

In pics: Taarak Mehta Ka Ooltah Chashmah actress Deepti Sadhwani dazzles in orange at Cannes debut, sets new record![submenu-img]() Ananya Panday stuns in unseen bikini pictures in first post amid breakup reports, fans call it 'Aditya Roy Kapur's loss'

Ananya Panday stuns in unseen bikini pictures in first post amid breakup reports, fans call it 'Aditya Roy Kapur's loss'![submenu-img]() Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...

Remember Harsh Lunia? Just Mohabbat child star, here's how former actor looks now, his wife is Bollywood's popular...![submenu-img]() Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses

Mother's Day 2024: Bollywood supermoms who balance motherhood, acting, and run multi-crore businesses![submenu-img]() Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...

Rocky Aur Rani's Golu aka Anjali Anand shocks fans with drastic weight loss without gym, says fitness secret is...![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Sophie Turner reveals she wanted to terminate her first pregnancy with Joe Jonas: 'Didn't know if I wanted...'

Sophie Turner reveals she wanted to terminate her first pregnancy with Joe Jonas: 'Didn't know if I wanted...'![submenu-img]() Meet outsider who was given no money for first film, battled depression, now charges Rs 20 crore per film

Meet outsider who was given no money for first film, battled depression, now charges Rs 20 crore per film![submenu-img]() Meet actress who quit high-paying job for films, director replaced her with star kid, had no money, now lives in...

Meet actress who quit high-paying job for films, director replaced her with star kid, had no money, now lives in...![submenu-img]() This star kid's last 3 films lost Rs 5000000000 at box office, has no solo hit in 5 years, now has lost four films to...

This star kid's last 3 films lost Rs 5000000000 at box office, has no solo hit in 5 years, now has lost four films to...![submenu-img]() Meet actress viral for just walking on screen, belongs to royal family, has no solo hit in 15 years, but still is…

Meet actress viral for just walking on screen, belongs to royal family, has no solo hit in 15 years, but still is…![submenu-img]() This is owner of most land in India, owns land in every state, total value is Rs...

This is owner of most land in India, owns land in every state, total value is Rs...![submenu-img]() Blinkit now gives free dhaniya with veggie orders, thanks to Mumbai mom

Blinkit now gives free dhaniya with veggie orders, thanks to Mumbai mom![submenu-img]() Meet man, an Indian who entered NASA's Hall of Fame by hacking, earlier worked on Apple's...

Meet man, an Indian who entered NASA's Hall of Fame by hacking, earlier worked on Apple's...![submenu-img]() 14 majestic lions cross highway in Gujarat's Amreli, video goes viral

14 majestic lions cross highway in Gujarat's Amreli, video goes viral![submenu-img]() Here's why Isha Ambani was not present during Met Gala 2024 red carpet

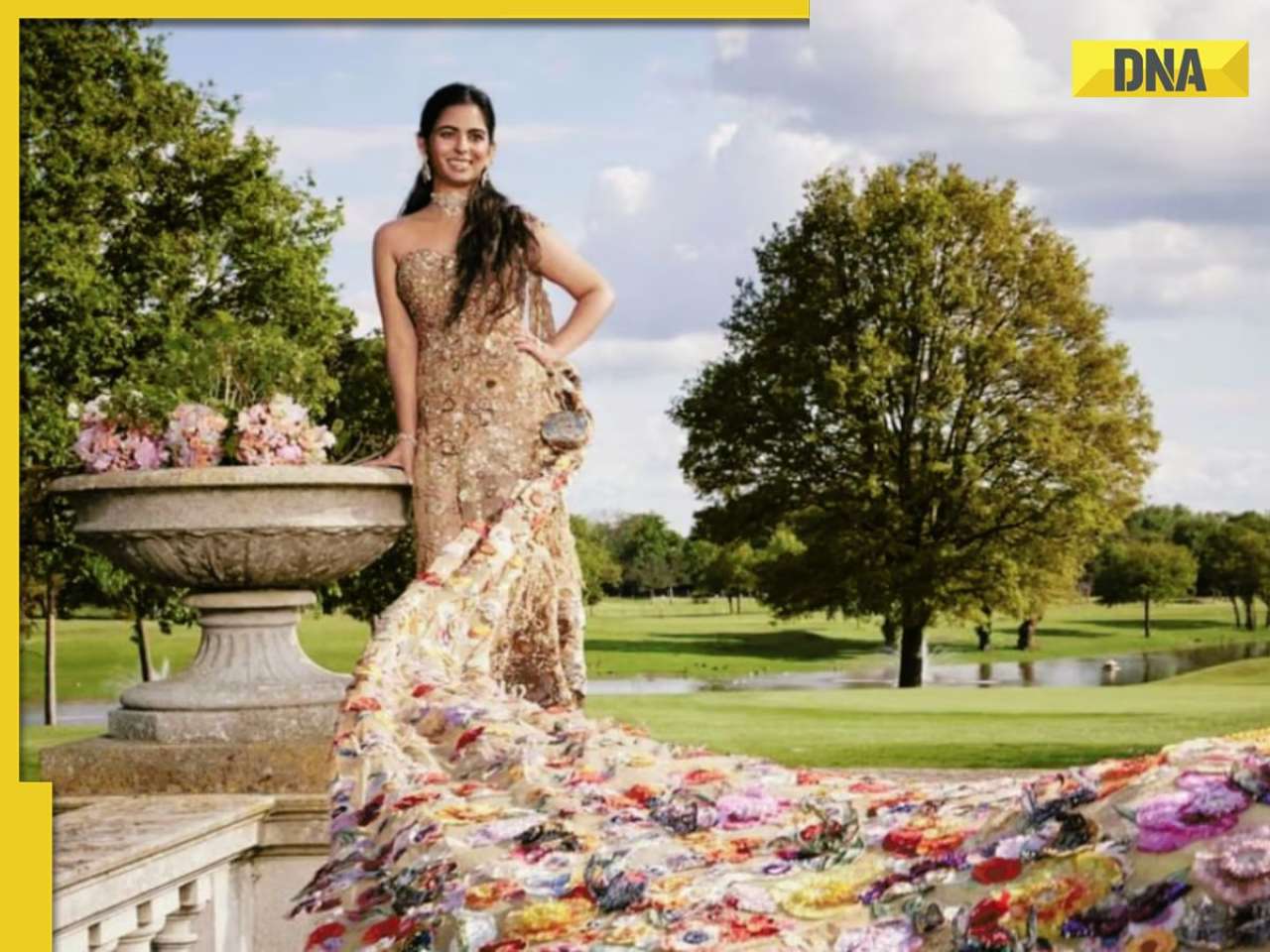

Here's why Isha Ambani was not present during Met Gala 2024 red carpet

)

)

)

)

)

)

)

)

)

)

)

)

)