Here's a look at some of the implications of GST in your daily life.

As most of our readers are already aware, the GST council has finalised the GST rates across different goods & service categories. The tax range is divided into the different slabs i.e. 0%, 5%, 12%, 18% & 28%.

Let's see how your life changes with the introduction of GST and how much more or less you need to shell out from your pocket.

Footwear: Be ready to shell out more for footwear which costs more than Rs 500 as the GST rate is kept at 18% as compared to the earlier 14.41%. However, the rate for footwear costing below Rs 500 is reduced to 5%.

Garments: Buying your next shirt or trouser will cost you a little less as the GST rate for ready-made garments is reduced to 12% from the existing 18.16%.

Cab & taxi rides: Even booking your cab is slightly cheaper now as the tax rate is reduced to 5% from 6% for any taxi booked online like on Ola, Uber or Meru.

Airline ticket: There is no change for an economy flight ticket price but GST for a business class ticket will attract 12% rate.

Train tickets: There is hardly any change as far as your railway ticket price is concerned because the rate has increased to 5% from the existing 4.5%. There is a benefit given to the passengers traveling for business as now they would be able to claim the Input Tax Credit for their rail ticket expenses. Your local or sleeper class ticket will remain the same, but the first class/AC ticket price has risen.

Movie tickets: Watching a movie with a ticket price of less than Rs 100 will attract 18% GST but the higher ticket i.e. more than Rs 100 will attract 28% GST. In fact your ticket price will also depend on the state where you are watching a movie.

Premium on your Life Insurance policy: Due to the rise of 3% rate i.e. GST rate of 18% from an existing service tax rate of 15%, you will end up paying more premium for your insurance policies. The same has been kept for all the insurance categories i.e. life, health and general insurance.

Jewellery: Gold investment will be slightly more expensive due to a higher GST rate.

Buying real estate: If you are planning to buy an under construction real estate property, then you will stand to get more benefit than a ready to move in property. Your builder will get input tax credit and can pass on the same to you in terms or reduced prices.

Hotel stay: For a room rent of less than Rs 1,000, there wont be any GST, but in case it is more than Rs 5,000 then it will have a GST rate of 28%.

Buying a car: Most of the cars across different segments will become cheaper but the same will not be applicable for hybrid cars as the GST rate is 28% on all the vehicles irrespective of its make, model or engine capacity and also depends on a particular car segment.

Mobile bills: Your phone bill is set to rise by 3% because GST on telecom services is 18% than an earlier 15%.

Restaurant bills/ Eating out: It depends on the type of restaurant you are dining in, i.e. whether it is an AC or Non-AC restaurant and whether it serves alcohol or not. Dining at a five-star hotel is kept at 18% GST rate. The Non-AC restaurant is kept at 12% rate & a 5% GST for a small hotel, dhaaba and restaurant whose yearly turnover is less than Rs 50 lakh.

IPL ticket price & other events: Your IPL ticket or ticket for any other sports event will be charged 28% GST from an existing 20%. rate. But for theatre, circus, classical music program or even a folk dance function is kept at 18% GST which is lesser than the earlier rate.

DTH/cable services: The charges for your Tata Sky/ Dish TV or your cable operator will reduce slightly as the entertainment tax is also done away with.

Amusement park: The price for your amusement park ticket say Imagica or any theme park similar to that is set to rise due to 28% GST rate.

![submenu-img]() This classic was made by director in frustration, was rejected by Amitabh, Naseer, inspired many filmmakers, earned...

This classic was made by director in frustration, was rejected by Amitabh, Naseer, inspired many filmmakers, earned...![submenu-img]() Panchayat's Durgesh Kumar says viral 'Dekh raha hai Binod' line is not his anymore, reacts to memes | Exclusive

Panchayat's Durgesh Kumar says viral 'Dekh raha hai Binod' line is not his anymore, reacts to memes | Exclusive![submenu-img]() 'Against Gambhir becoming the coach...': Sourav Ganguly gets slammed by fans for indirect tweet towards BCCI

'Against Gambhir becoming the coach...': Sourav Ganguly gets slammed by fans for indirect tweet towards BCCI![submenu-img]() 'The Indian Sarcasm': From Humble Beginnings to Conquering Social Media

'The Indian Sarcasm': From Humble Beginnings to Conquering Social Media ![submenu-img]() As rumours of divorce with Natasa Stankovic get stronger, fans wonder where is Hardik Pandya?

As rumours of divorce with Natasa Stankovic get stronger, fans wonder where is Hardik Pandya?![submenu-img]() Meet IAS officer who was victim of domestic violence, mother of two, cracked UPSC exam in first attempt, she's posted in

Meet IAS officer who was victim of domestic violence, mother of two, cracked UPSC exam in first attempt, she's posted in![submenu-img]() RBSE Class 5th, 8th Result 2024 Date, Time: Rajasthan board to announce results today, get direct link here

RBSE Class 5th, 8th Result 2024 Date, Time: Rajasthan board to announce results today, get direct link here![submenu-img]() RBSE Rajasthan Class 10 board results out, check direct link here to know results

RBSE Rajasthan Class 10 board results out, check direct link here to know results![submenu-img]() RBSE 10th Result 2024: Rajasthan Board Class 10 results to be out today; check time, direct link here

RBSE 10th Result 2024: Rajasthan Board Class 10 results to be out today; check time, direct link here![submenu-img]() Meet Indian genius who founded India's first pharma company, he is called 'Father of...

Meet Indian genius who founded India's first pharma company, he is called 'Father of...![submenu-img]() DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo

DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo![submenu-img]() DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here

DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() Streaming This Week: Panchayat season 3, Swatantrya Veer Savarkar, Illegal season 3, latest OTT releases to binge-watch

Streaming This Week: Panchayat season 3, Swatantrya Veer Savarkar, Illegal season 3, latest OTT releases to binge-watch![submenu-img]() Avneet Kaur shines in navy blue gown with shimmery trail at Cannes 2024, fans say 'she is unstoppable now'

Avneet Kaur shines in navy blue gown with shimmery trail at Cannes 2024, fans say 'she is unstoppable now'![submenu-img]() Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes

Assamese actress Aimee Baruah wins hearts as she represents her culture in saree with 200-year-old motif at Cannes ![submenu-img]() Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'

Aditi Rao Hydari's monochrome gown at Cannes Film Festival divides social media: 'We love her but not the dress'![submenu-img]() AI models play volley ball on beach in bikini

AI models play volley ball on beach in bikini![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?

DNA Explainer: Why was Iranian president Ebrahim Raisi, killed in helicopter crash, regarded as ‘Butcher of Tehran’?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() This classic was made by director in frustration, was rejected by Amitabh, Naseer, inspired many filmmakers, earned...

This classic was made by director in frustration, was rejected by Amitabh, Naseer, inspired many filmmakers, earned...![submenu-img]() Panchayat's Durgesh Kumar says viral 'Dekh raha hai Binod' line is not his anymore, reacts to memes | Exclusive

Panchayat's Durgesh Kumar says viral 'Dekh raha hai Binod' line is not his anymore, reacts to memes | Exclusive![submenu-img]() Dalljiet Kaur's husband Nikhil Patel reveals why their relationship ended, breaks silence on extra-marital allegations

Dalljiet Kaur's husband Nikhil Patel reveals why their relationship ended, breaks silence on extra-marital allegations![submenu-img]() This small-budget blockbuster was rejected by Amitabh Bachchan, attained cult status, made director star; film earned...

This small-budget blockbuster was rejected by Amitabh Bachchan, attained cult status, made director star; film earned...![submenu-img]() ‘They never make it better’: Game of Thrones creator George RR Martin slams film, TV adaptations of books

‘They never make it better’: Game of Thrones creator George RR Martin slams film, TV adaptations of books![submenu-img]() 'No one wanted to...': Billionaire Anil Agarwal’s daughter makes shocking revelation

'No one wanted to...': Billionaire Anil Agarwal’s daughter makes shocking revelation![submenu-img]() 'Humko nahi rahna is gola pe': Heatwave triggers meme fest on social media

'Humko nahi rahna is gola pe': Heatwave triggers meme fest on social media![submenu-img]() 'Ridiculous': Woman claims Swiggy charged Rs 115 for Rs 45 bun butter jam, shares bill

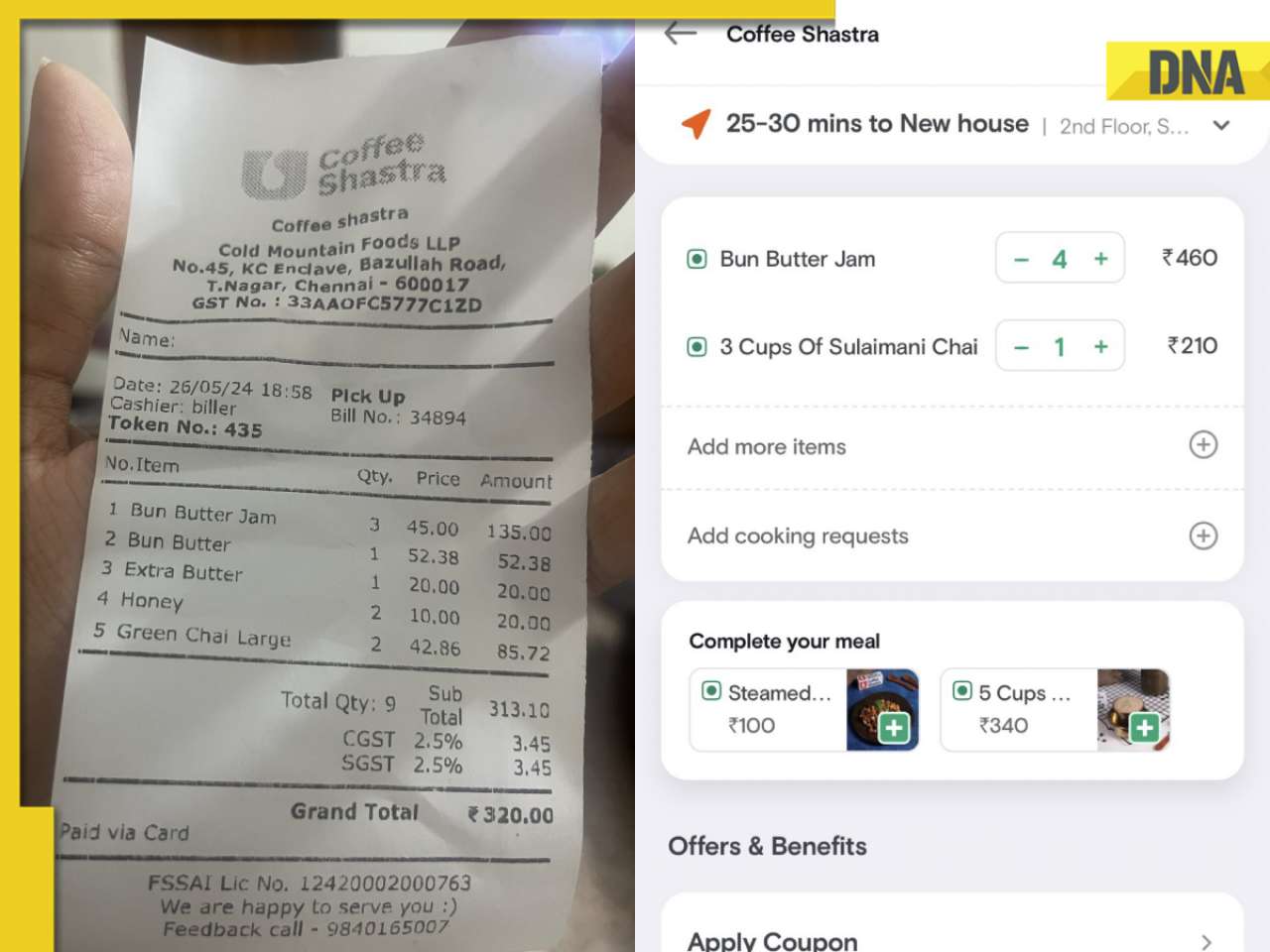

'Ridiculous': Woman claims Swiggy charged Rs 115 for Rs 45 bun butter jam, shares bill![submenu-img]() Man sells replicas of Nita Ambani's necklace for Rs 178, Harsh Goenka reacts

Man sells replicas of Nita Ambani's necklace for Rs 178, Harsh Goenka reacts![submenu-img]() Man dies after being sucked into plane engine in front of passengers at airport

Man dies after being sucked into plane engine in front of passengers at airport

)

)

)

)

)

)

)