Chinese President Xi Jinping has been reaching out to Western investors and has repeatedly warned against attempts of ‘de-coupling’ by the US.

Apple CEO Tim Cook during his recent visit to Indonesia said that Apple would expand its presence in Indonesia. Cook, who met with Indonesian President Joko Widodo, said: “I think the investment ability in Indonesia is endless. I think that there are a lot of great places to invest. And we’re investing. We believe in the country.”

In recent years -- in the aftermath of trade wars between both countries and then the covid 19 pandemic -- Apple, like several other US companies, has sought to relocate from China. South-East Asian nations – Vietnam, and Malaysia – have been top preferences for these companies, with India also beginning to emerge as a potential destination.

The Biden Administration introduced the Chips and Science Act, in 2022, to give a boost to semiconductor manufacturing in the US and in October 2022 it introduced laws restricting the export of certain semiconductors to China (Biden’s economic policies vis-à-vis China, especially in the area of tech have been quite tough). During a recent trilateral summit of leaders from the US, Japan and the Philippines, the US along with Japan said that it would invest in the semiconductor industry in the Philippines. The joint statement issued after the meeting also referred to a training program for Philippines students, with the aim of expanding the semiconductor workforce in the ASEAN nation.

“We intend to pursue a new semiconductor workforce development initiative, through which students from the Philippines will receive world-class training at leading American and Japanese universities, to help secure our nations’ semiconductor supply chains,” the statement read.

China trying to attract Western investors

Significantly, the Apple CEO had met with Chinese President Xi Jinping in November 2023 – Cook was one of the invitees for a dinner hosted by Xi on the sidelines of the APEC Forum in San Fransisco. He also visited China in March 2024.

Xi on his part has been reaching out to Western investors and has repeatedly warned against attempts of ‘de-coupling’ by the US. During his meeting, last month, with US CEO’s -- who had come to attend the China Development Forum – the Chinese President highlighted the reforms undertaken by China to attract foreign investors. He also said that there was great potential for cooperation between US and China in several areas including climate change and artificial intelligence.

Reforms being undertaken by China were also highlighted at the Boao Forum (China’s version of the World Economic Forum). While addressing the Forum, Zhao Leiji the Chairman of the National People's Congress Standing Committee of China said: “We sincerely welcome all countries to board the express train of China’s development and join hands to realize world modernization featuring peaceful development, mutually beneficial cooperation and common prosperity,”

Why China needs to draw more FDI

Recent growth figures may have come as a reprieve for China, China’s GDP was 5.3% year on year in the first quarter of 2024 well above the estimated 4.9%. Drawing more FDI is imperative for China, and Beijing’s overtures and outreach vis-à-vis US CEOs need to be viewed in this context.

It would be pertinent that foreign investment in China has witnessed a slump in the beginning of 2024 and a survey conducted by the American Chamber of Commerce in China (AmCham) – released in February 2024 highlighted the fact that while the profitability of Western countries was up in 2023, there was uncertainty with regard to expansion/fresh investments.

Can US-China relations be de-hyphenated from the bilateral relations?

US CEOs realize that economics cannot be de-hyphenated from the broader geopolitical relationship. According to the AmCham survey, one of the concerns of Western firms was the current state of US-China bilateral relations. It would be pertinent to point out that while engagement between Washington and Beijing is being viewed as a welcome step, by US businesses, key differences on economic and strategic issues persist. During her Beijing visit, US Secretary of Treasury Yellen highlighted several US concerns. Apart from possible US sanctions if China continued to provide assistance to Russia in the Russia-Ukraine conflict, the US Treasury Secretary also urged Beijing to consider revision of its unfair trade practices.

A possible Trump Presidency could further escalate tensions between Beijing and Washington. Trump has already warned that he would impose tariffs on China if he were to win the 2024 election. Earlier this week, US President Joe Biden called for tripling of tariffs on steel and aluminium from China.

In conclusion, it is highly unlikely that US CEOs are likely to ‘de-couple’ from Beijing as advocated by many US commentators and policymakers. At the same time, they will tap opportunities in other markets in South-East Asian nations and India. US CEOs would be closely following how US domestic politics pans out over the next few months in the run-up to the US Presidential elections in 2024.

Disclaimer: The views expressed in the article belong solely to the author.

![submenu-img]() Mukesh Ambani’s daughter Isha Ambani’s firm launches new brand, Reliance’s Rs 8200000000000 company to…

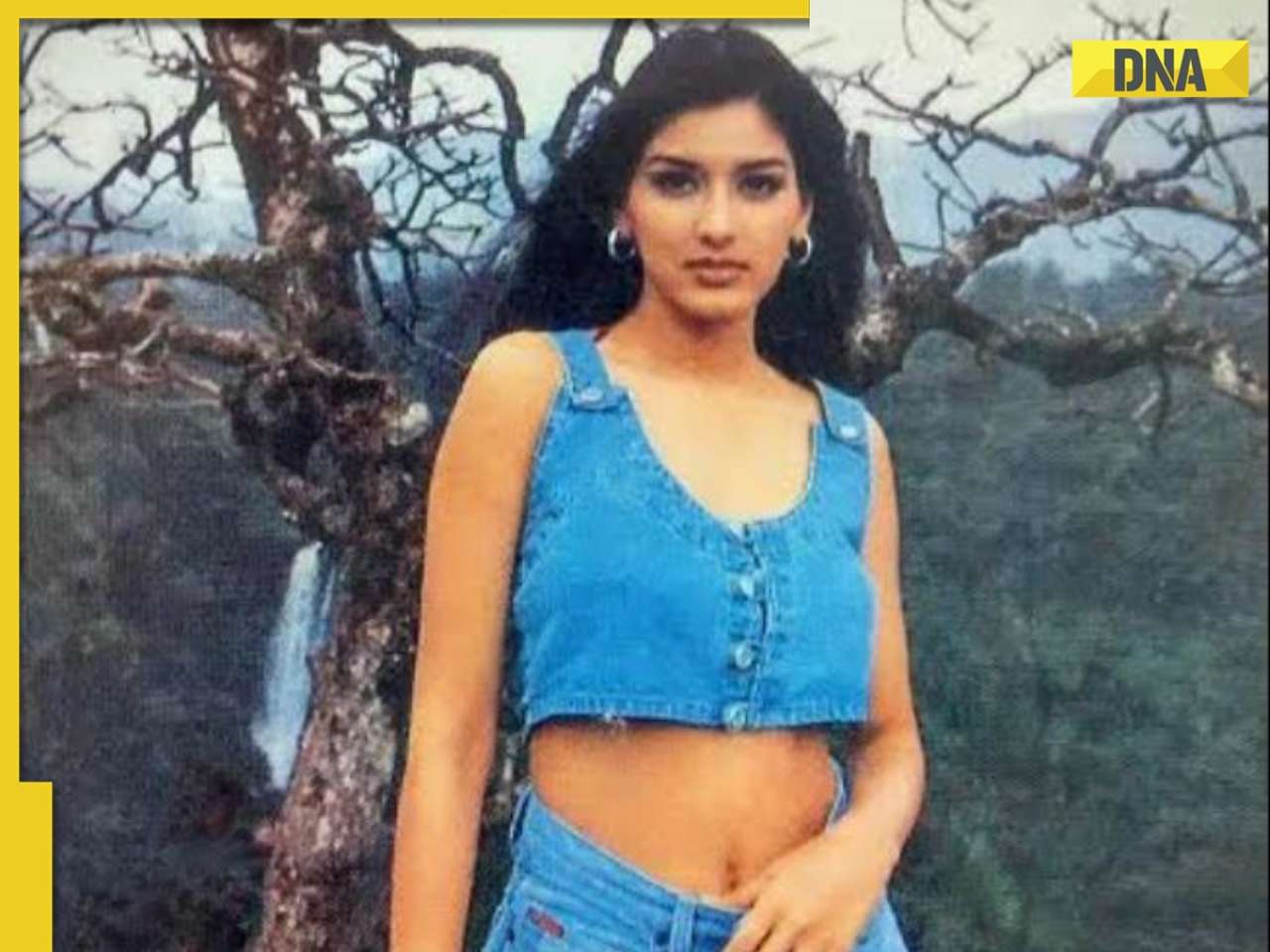

Mukesh Ambani’s daughter Isha Ambani’s firm launches new brand, Reliance’s Rs 8200000000000 company to…![submenu-img]() Sonali Bendre says producers called her 'too thin', tried to ‘fatten her up' during the 90s: ‘They'd just tell me...'

Sonali Bendre says producers called her 'too thin', tried to ‘fatten her up' during the 90s: ‘They'd just tell me...'![submenu-img]() Heavy rains in UAE again: Dubai flights cancelled, schools and offices shut

Heavy rains in UAE again: Dubai flights cancelled, schools and offices shut![submenu-img]() When 3 Bollywood films with same story released together, two even had same hero, all were hits, one launched star kid

When 3 Bollywood films with same story released together, two even had same hero, all were hits, one launched star kid![submenu-img]() Gautam Adani’s firm gets Rs 33350000000 from five banks, to use money for…

Gautam Adani’s firm gets Rs 33350000000 from five banks, to use money for…![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

Actors who died due to cosmetic surgeries![submenu-img]() See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol

See inside pics: Malayalam star Aparna Das' dreamy wedding with Manjummel Boys actor Deepak Parambol ![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() Sonali Bendre says producers called her 'too thin', tried to ‘fatten her up' during the 90s: ‘They'd just tell me...'

Sonali Bendre says producers called her 'too thin', tried to ‘fatten her up' during the 90s: ‘They'd just tell me...'![submenu-img]() When 3 Bollywood films with same story released together, two even had same hero, all were hits, one launched star kid

When 3 Bollywood films with same story released together, two even had same hero, all were hits, one launched star kid![submenu-img]() Salman Khan house firing case: Family of deceased accused claims police 'murdered' him, says ‘He was not the kind…’

Salman Khan house firing case: Family of deceased accused claims police 'murdered' him, says ‘He was not the kind…’![submenu-img]() Meet actor banned by entire Bollywood, was sent to jail for years, fought cancer, earned Rs 3000 crore on comeback

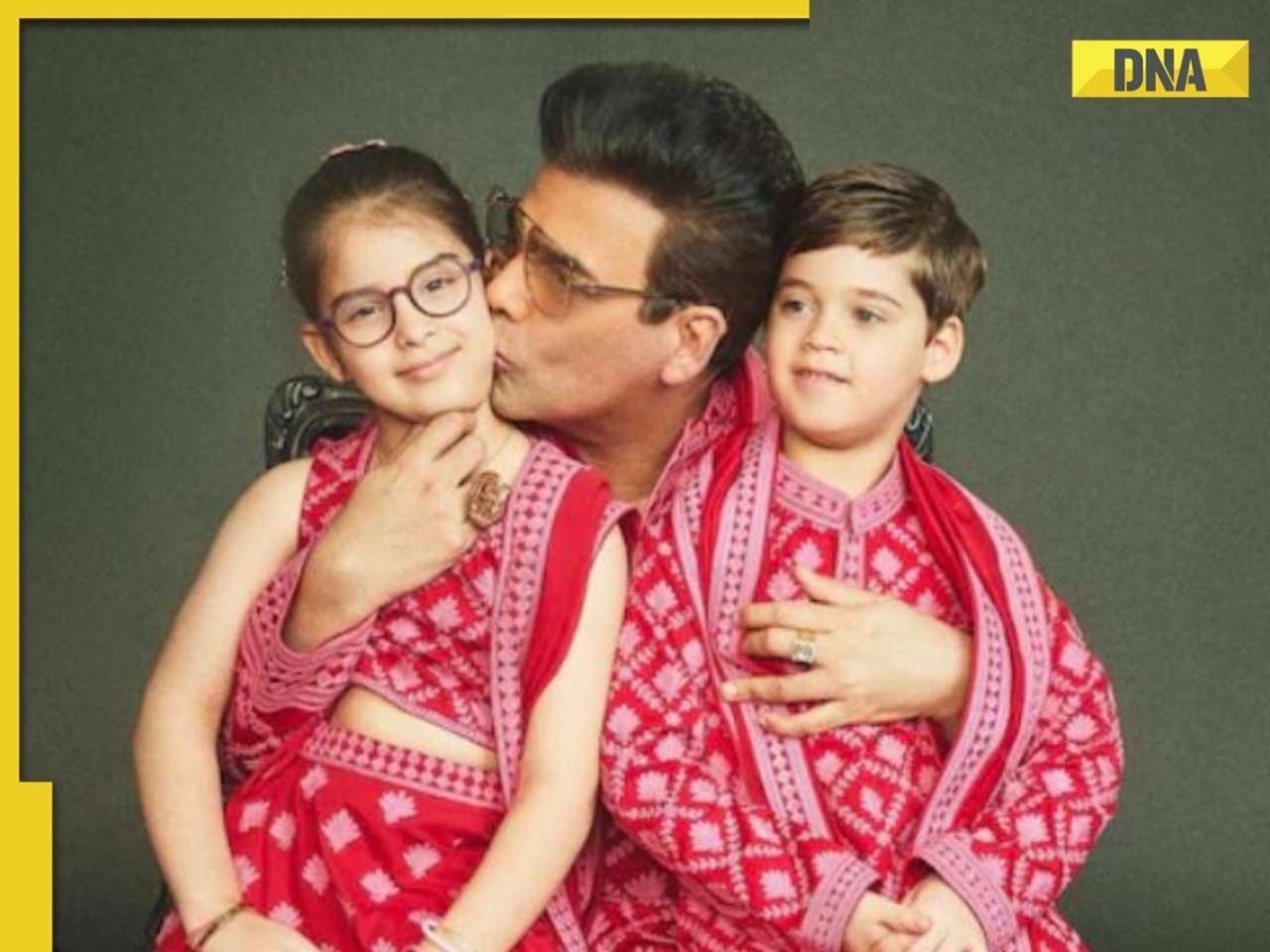

Meet actor banned by entire Bollywood, was sent to jail for years, fought cancer, earned Rs 3000 crore on comeback ![submenu-img]() Karan Johar wants to ‘disinherit’ son Yash after his ‘you don’t deserve anything’ remark: ‘Roohi will…’

Karan Johar wants to ‘disinherit’ son Yash after his ‘you don’t deserve anything’ remark: ‘Roohi will…’![submenu-img]() IPL 2024: Bhuvneshwar Kumar's last ball wicket power SRH to 1-run win against RR

IPL 2024: Bhuvneshwar Kumar's last ball wicket power SRH to 1-run win against RR![submenu-img]() BCCI reacts to Rinku Singh’s exclusion from India T20 World Cup 2024 squad, says ‘he has done…’

BCCI reacts to Rinku Singh’s exclusion from India T20 World Cup 2024 squad, says ‘he has done…’![submenu-img]() MI vs KKR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

MI vs KKR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() IPL 2024: How can RCB and MI still qualify for playoffs?

IPL 2024: How can RCB and MI still qualify for playoffs?![submenu-img]() MI vs KKR IPL 2024 Dream11 prediction: Fantasy cricket tips for Mumbai Indians vs Kolkata Knight Riders

MI vs KKR IPL 2024 Dream11 prediction: Fantasy cricket tips for Mumbai Indians vs Kolkata Knight Riders ![submenu-img]() '25 virgin girls' are part of Kim Jong un's 'pleasure squad', some for sex, some for dancing, some for...

'25 virgin girls' are part of Kim Jong un's 'pleasure squad', some for sex, some for dancing, some for...![submenu-img]() Man dances with horse carrying groom in viral video, internet loves it

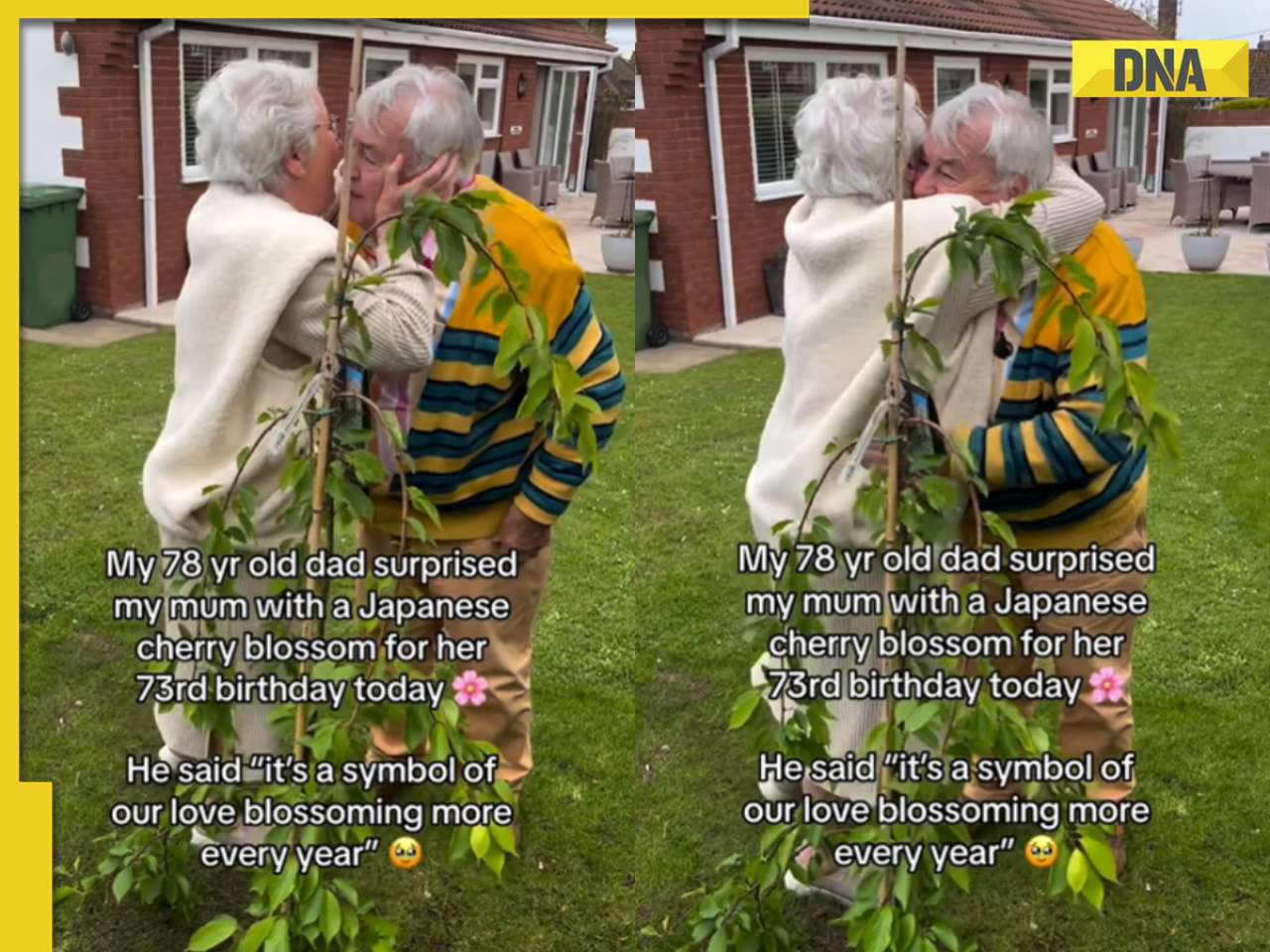

Man dances with horse carrying groom in viral video, internet loves it ![submenu-img]() Viral video: 78-year-old man's heartwarming surprise for wife sparks tears of joy

Viral video: 78-year-old man's heartwarming surprise for wife sparks tears of joy![submenu-img]() Man offers water to thirsty camel in scorching desert, viral video wins hearts

Man offers water to thirsty camel in scorching desert, viral video wins hearts![submenu-img]() Pakistani groom gifts framed picture of former PM Imran Khan to bride, her reaction is now a viral video

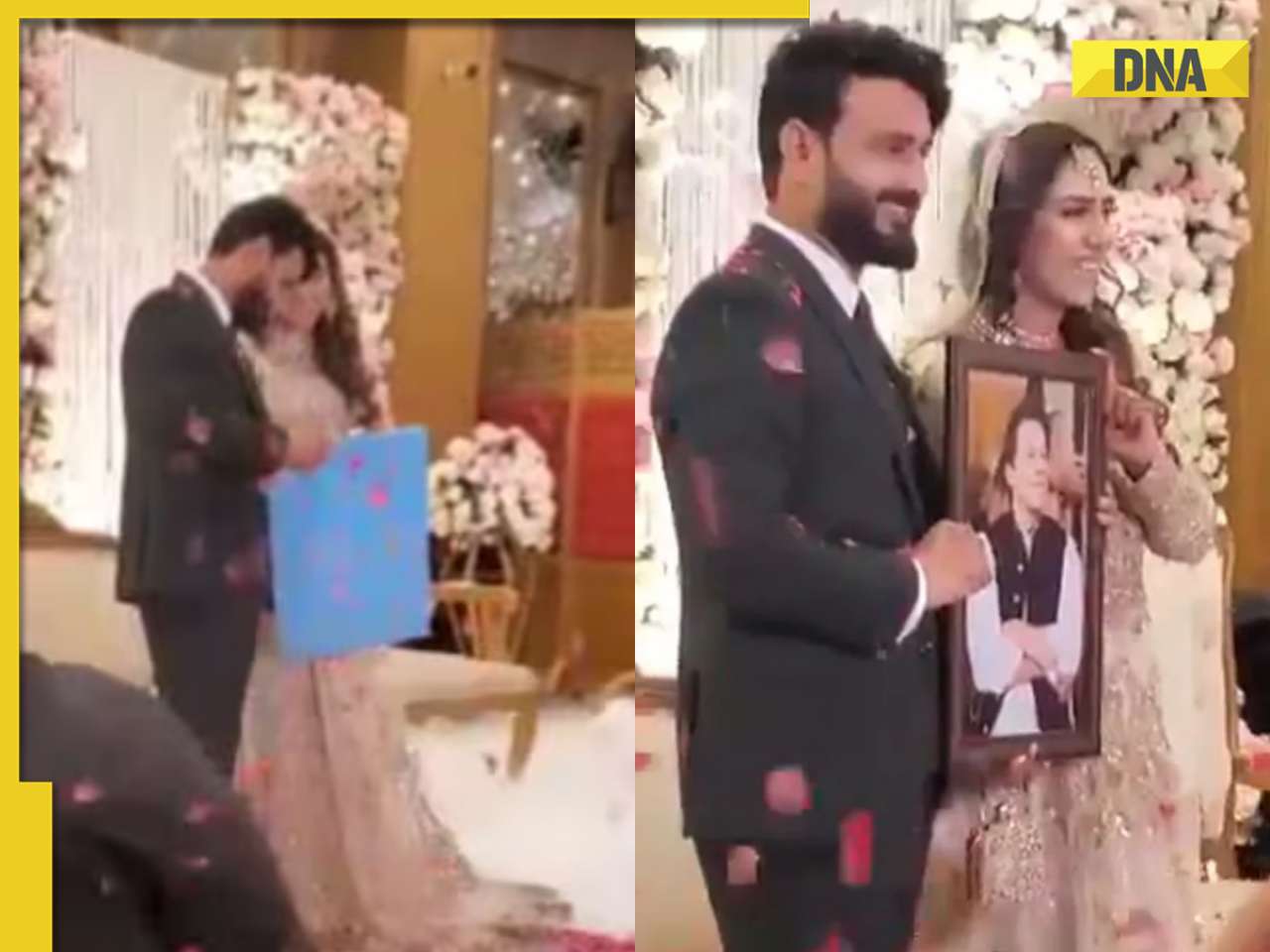

Pakistani groom gifts framed picture of former PM Imran Khan to bride, her reaction is now a viral video

)

)

)

)

)

)

)